Another month has passed and we are into the last month of 2020. November was another tough month for me, mainly due to continuing health problems of my mother. Covid-19 situation makes it tougher when you cannot visit patients and the medical staff is busy, so it’s sometimes hard to get information on what is going on. We’ll just need to live it through.

However, there were some bright spots as well. Our little daughter is growing well and improving everyday. She keeps talking more and more. It would help if we understood all of it, as she sometimes gets frustrated if we don’t get what she’s trying to say. I continued doing sports everyday and I feel that it really helps both physically and psychologically.

In the meanwhile, our portfolio kept working in the background and delivered some income we didn’t need to work for. Let’s review the numbers for November.

Dividend Income

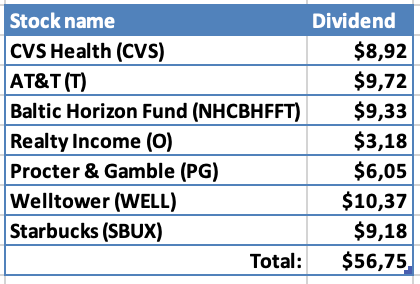

7 companies paid dividend this month:

I am happy to see another month above $50 mark. The first payout from Baltic Horizon Fund helped to reach it on the second month of a quarter.

Biggest payout came from the REIT – Welltower. It was the only company which delivered double-digit dividend this month.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $8.92 from CVS Health would cover 5.7% of our Barber expenses for the last 3 months;

- $9.72 from AT&T would cover 30.97% of our TV+Internet bill for the last month;

- $9.33 from Baltic Horizon Fund, $3.18 from Realty Income & $10.37 from Welltower would cover 3.5% of our monthly Rent;

- $6.05 from Procter & Gamble would cover 3.48% of what we spent on Cosmetics & Hygiene items during the last 3 months;

- Finally, $9.18 from Starbucks would cover 7.99% of our Eating Out expenses for the last 3 months.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

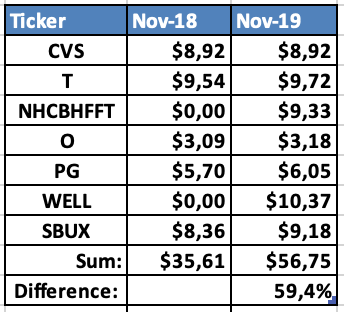

Let’s see how dividend income this month compares to November 2019:

I really can’t complain about growth of almost 60%. Most of the growth came from two new payers – Baltic Horizon Fund and Welltower. However, other companies, with exception of CVS Health, raised their dividend compared to last year and contributed to the growth rate.

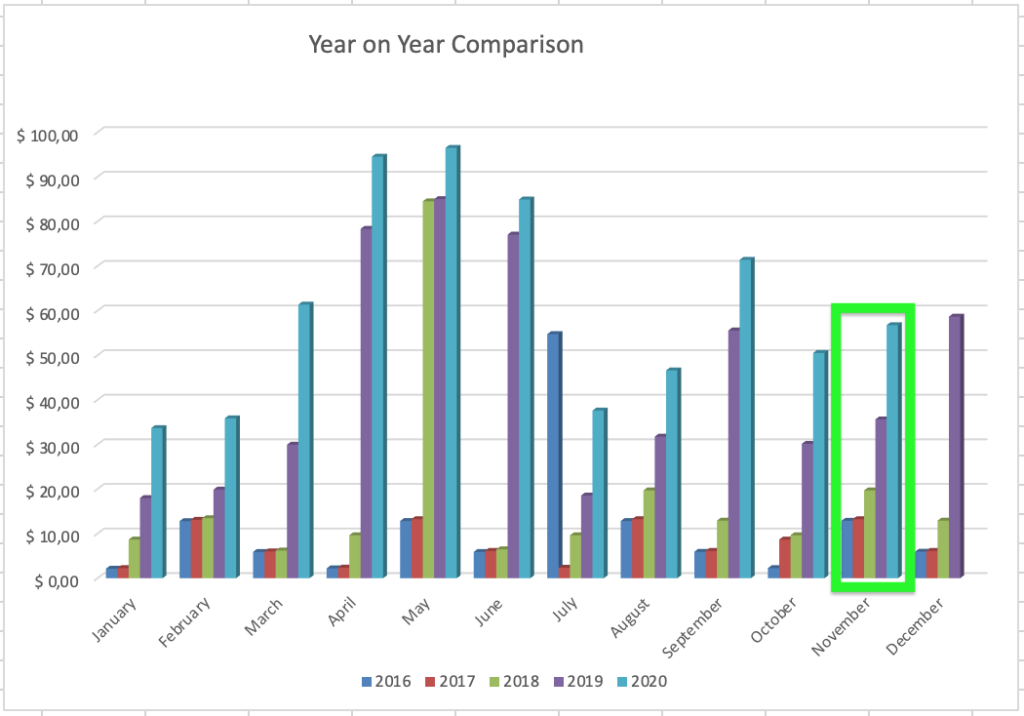

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

Unfortunately, I didn’t have any available funds to add to my portfolio this month. I’m afraid this will be the same for the nearest future. It sucks not to be able to grow the portfolio but I have to prioritise other areas of life at the moment. I’m sure that I will come back stronger after that, so it’s just a temporary setback.

I still had some money laying around in my Revolut account and purchased a single share of Altria Group (MO) for $40.04. This adds $2.92 to my forward annual dividend income.

Dividend Increases/Cuts

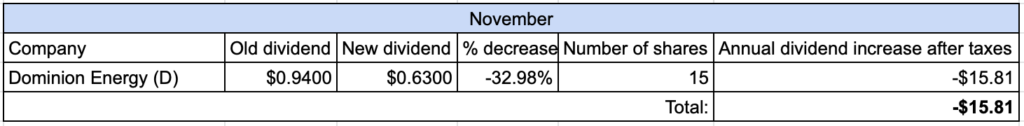

Dominion Energy officially announced their dividend cut during November. It was known in summer already, so this is not something new. Still, it’s not fun to experience a decrease in dividend income.

The cut of 33% results in a decrease of $15.81 to my annual dividend income.

Changes in Projected Annual Dividend Income

I am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income changed during November:

It turns out that November was the worst month in terms of changes in projected annual dividend income. That dividend cut from Dominion Energy and lack of new investments slowed down the growth of dividend income in the portfolio.

For comparison, I am also adding the table from previous year:

P2P Lending Income

Let’s see how much income was added from interest in P2P lending:

Interest from P2P lending added up to €10.09 which is very similar to last months.

P2P lending portfolio currently takes 4.02% of my portfolio which is close to my target of 4%.

This part of my portfolio is pretty much on auto-pilot, as I only keep reinvesting the interest and don’t add any additional funds, at least for now.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR), I received €56.88 from passive income during November. This brings the total for 2020 so far to €716.54. I am going to end up much lower than my target of €1000 for the year but it’s still a step in the right direction, compared to last year 🙂

There were some good and bad things during November but I am happy to have found dividend growth investing a few years ago. Passive income is slowly growing and it shows that consistency is paying off. I am also fond of relationships with other dividend growth investors and it helps to keep the motivation.

How was your month? Are you sharing any dividend payers with me? Were you hit by any dividend cuts? Are you planning to finish the year strong? I would love to hear from you, so don’t hesitate to leave a comment! 🙂

Congrata BI. Also sharing BH, love the fund after it recovered its dividends. Also bough some more MO myself 🙂 Another dividend monster. 748€ in my account after 11mo. Lets see who will end the year better. 60€ should be paid by Auga bonds. Looks like its going to be close to 1k€ mark 🙂

Thanks for the comment P2035!

I think you will easily beat me this year, I am not expecting a huge December payout 🙂

Still going strong BI, nice!

Sorry to hear about your mother, I hope everything turns for the better soon!

It sucks not having dry powder to invest. But as you said I’m sure it’s only temporary. Have a great holiday BI + family!

Thanks a lot, Mr. Robot!

Yes, I am still motivated to keep going on this path, even though I need to make a break now.

I wish you and your family a great holiday, too!

Hi BI,

Glad I’m able to comment on this one before your Dec. dividend report is posted. I’m running behind!

Congrats on passing $50 in a non-quarter-ending month. Your dividend payments were nicely distributed amongst the payers, too. I like seeing the new dividend payers – a couple of new ones looks good. Also, good to see your continued YoY growth each month this year… that’s your proof that you’ve got things moving in the right direction. I look forward to your Dec. report. Until then…

Hi ED,

Thanks for visiting. I am also running behind with reading other blogs, unfortunately, so I fully understand you 🙂

Thanks for the encouragement as well! It’s motivating to see the growth but I have some plans for 2021 that will probably take a hit for my portfolio and dividend income. However, even if I need to start over, I am sure that dividend growth investing will be part of our journey 🙂

Heading over to see how it’s going on for you now 🙂