October was a tough month to me. Towards the end of the month, my parents and brother got sick with COVID-19. Unfortunately, it coincided with some additional health problems for my mother and it’s hard to get proper treatment when you’re infected. It’s quite stressful at the moment but I’m trying to stay positive.

On the bright side, I completed a “Sober October” challenge I created with a few colleagues. During the month, I didn’t consume any alcohol, didn’t eat any sugar treats, did some sports every day, read a book each day for at least 30min and learned something related to my career in IT sector.

Also, I received my first interest payment from a bond I purchased in Spring. Dividends have also grown well compared to last year. Let’s see how much passive income I received this month.

Dividend Income

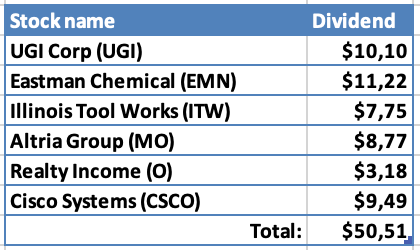

6 companies paid dividend to me this month:

Receiving $50 in the first month of a quarter is not too bad, so I can’t complain. I received my first dividend from UGI Corp and it was already in double-digits. It was surpassed only by Eastman Chemical which was the biggest dividend payer this month with $11.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $10.10 from UGI Corp could pay for 10% of our Utilities bills this month;

- $11.22 from Eastman Chemical would cover 3.9% of our expenses on Clothes for the last 3 months;

- $8.77 from Altria Group could pay for 5.2% of what we spent on Alcohol during the last 3 months;

- $7.75 from Illinois Tool Work would cover 5.2% of our expenses in Home category for the last 3 months;

- $3.18 from Realty Income would cover 0.5% of our monthly Rent;

- Finally, $9.49 from Cisco Systems would cover 15.4% of our TV + Internet subscription for the last 2 months.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

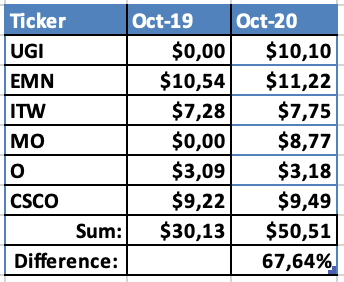

Let’s see how dividend income this month compares to October 2019:

I can’t complain about the growth of 67%, compared to previous year. I had two new companies paying me dividend (UGI Corp & Altria Group) and all other companies also raised their dividend throughout the year.

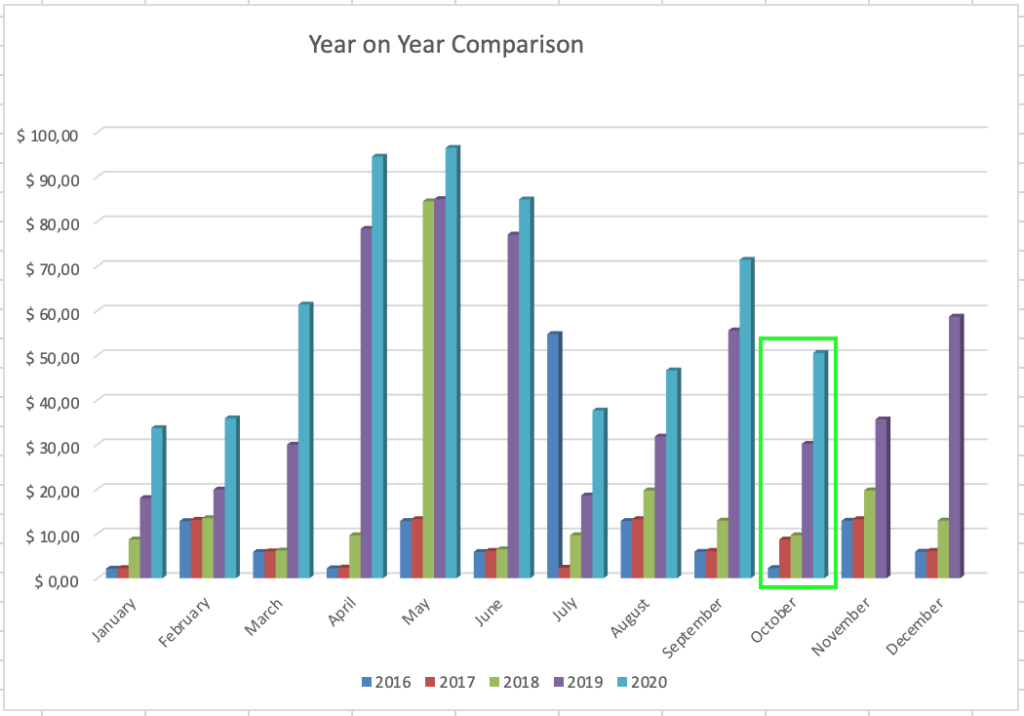

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €900 to my investment accounts.

I used all of this amount to participate in an IPO of a Lithuanian company – Ignitis Grupe (IGN1L).

I bought 40 shares at €22.5/share for a total of €900.

This purchase adds €38.42 to my net forward dividend income, if company sticks to its target of dividend payments.

You may read more about the purchase here.

Dividend Increases/Cuts

This month none of my companies increased or cut their dividend.

However, I found out that Dominion Energy (D) is planning to “re-base” their dividend after they sold some of their business. They only announced it officially a few days ago but it was clear to happen back in July.

On the bright side, it turns out that I missed an announced increase from Starbucks (SBUX) on the last day of September. They raised their dividend by 9.76% which results in a net annual dividend income increase of $4.22 for my portfolio.

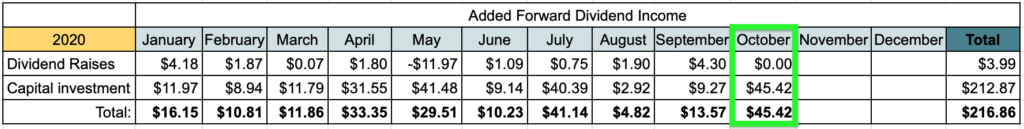

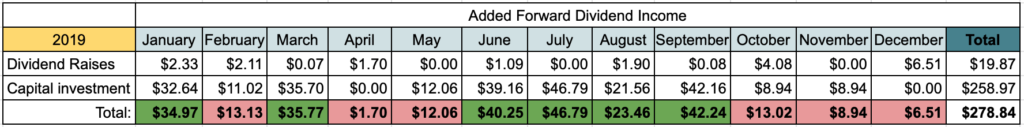

Changes in Projected Annual Dividend Income

am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income changed during October:

I decided to start including Dividend raises/cuts and Capital investment to European companies as well going forward. In the end, my portfolio has quite a few companies here in Europe so it will better reflect the situation. I expect to see more negative numbers in “Dividend Raises” part of the table as a result, as European companies don’t have traditions to keep raising dividends each year.

For comparison, I am also adding the table from previous year:

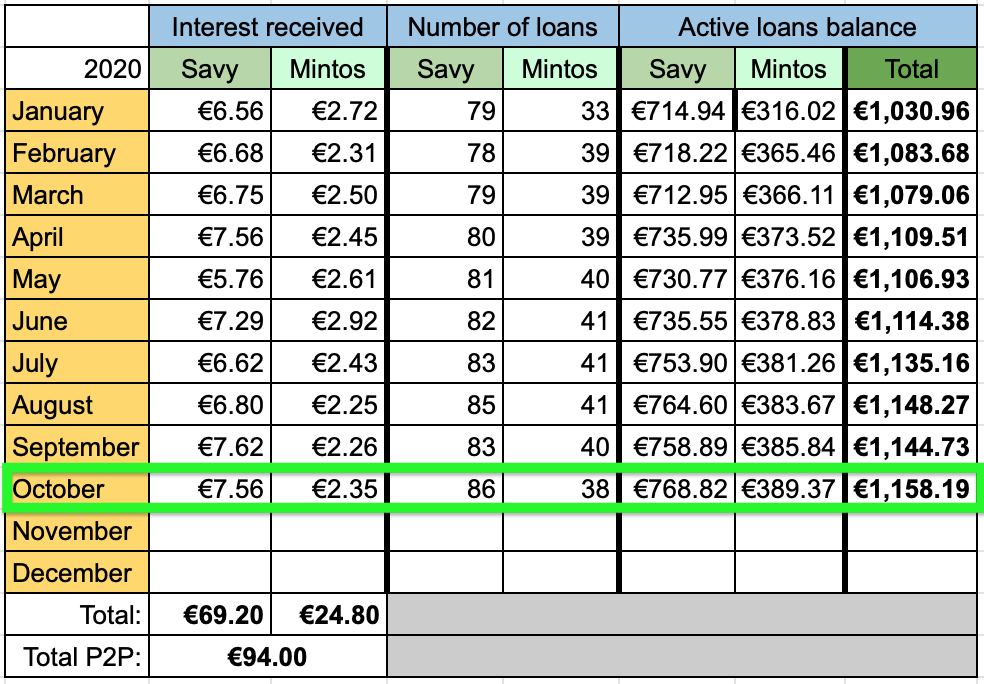

P2P Lending Income

Let’s see how much income was added from interest in P2P lending:

Interest from P2P lending added up to €9.91 which is very similar to last months.

P2P lending portfolio currently takes 4.07% of my portfolio which is close to my target of 4%.

This part of my portfolio is pretty much on auto-pilot, as I only keep reinvesting the interest and don’t add any additional funds, at least for now.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Bond Interest

I am including a new section to my passive income review this month, since I received the first interest payment from a bond I bought this Spring. I received €25 in interest, just as planned.

It’s nice to receive some passive income from another type of investment.

Summary

In total (after converting to EUR) I received €77.61 from passive income during October. This brings the total for the year so far to €659.66. It’s only 66% of my goal to receive €1000 from passive income this year but I realised that the goal was too ambitious awhile ago.

Passive income is still growing and going to the right direction, so I am grateful for that.

How was your month? Have you reached any records? Are you sharing any payers with me? As always, thanks for reading and I would love to hear from you! 🙂

Ouch, all the best luck with yout family. Nasty times to get sick 🙁 I had a great october, as it was not empty as in 2019, now I can do monthly dividend reviews 🙂 Bought some more Ignitis as price is just going down. Need to use that hedge funds that needs to sell their positions. Also suprised from good side with bounce back of Baltic horizon dividends. Waiting for my first bond interest at Dec from Auga. Looks like we starting to have some sort of bond market here in LT 🙂

Thanks a lot for the comment, P2035!

Nice to see that you are taking opportunity to grab Ignitis at a lower price. I could do the same, but I feel that I have enough Utilities already.

Having opportunity to participate in the bond market as a retail investor in Lithuania is definitely a nice sign and I am happy that we have more options for different kind of investments. Auga seems like nice choice.

Hey BI, sorry to hear about your families sickness. I hope that they recover soon!

Almost 70% growth it just amazing, great to see you achieving these results. As I said on your buy post, interesting to see you participating in an IPO. I hope it works out for you.

I think its also nice to see your diversification in local/European companies as well as P2P. Keep going!

Thanks a lot for the comment, Mr. Robot!

Seeing the growth is really encouraging and I hope to keep it going. It may slow down for some time but I will do my best to keep it rolling 🙂

Likewise, I’m sorry to hear about your family and I wish them well.

Congrats on a good report despite the fact that we are in a global pandemic. That’s a healthy YoY growth from last year. We only share MO and O as I sold out of my CSCO stocks some time ago (might get back in later).

It’s always good that you are receiving income from multiple sources. I almost tried P2P lending but never decided to pull the trigger. I hope next month’s report is good news, both for your portfolio and also for your family.

Hi DP,

Many thanks for your kind words!

I am happy to be a fellow shareholder of those companies! As time goes by, I am sure that we will have many more names to share 🙂

Ouch. Three family members?! I’m definitely wishing them all a speedy recovery. Hopefully, the situation isn’t too stressful on you either, BI.

On a brighter note, you triumphed with that stellar 67% YoY growth. Your two new dividend payers paid off, for sure. You’ve notched positive YoY income growth every month this year… not easy considering all the market drama in 2020.

Keep up the terrific progress.

Thanks a lot for the kind words, ED!

I definitely cannot complain about the growth this month. Those new payers and bond interest played its part 🙂

Take care

Hopefully your family members are doing better by now. That’s all that matters during this time. Dividends are dividends. Its just money.

However, I’m pumped to read about your increase compared to last week. Fantastic job increasing your income and receiving two new dividends from companies. Yes, that Dominion cut was brutal. No doubt about that. But you have more than made up for it with your gains.

Bert

Thanks for your kind words, Bert. I really appreciate it.

Hopefully, the passive income will keep growing, as the times goes by.

Take care!