Let me start by saying that this is my 100th post in the blog. I started logging my journey 2,5 years ago and have no intention to stop.

Back to the main topic of this post. I didn’t have enough funds for a regular-size purchase of at least $1k in February, so this time I added a little to my smallest positions of the portfolio. I initiated those positions in October and November of last year. When I look back now, it turns out I was lucky that I didn’t invest more, as the bloodbath in the market started shortly after my purchases.

JOHNSON & JOHNSON (JNJ)

First up is a healthcare giant which is one of the foundation stocks in many portfolios of dividend growth investors.

Shortly about the company from Morningstar:

Johnson & Johnson is the world’s largest and most diverse healthcare company. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women’s health. Geographically, just over half of total revenue is generated in the United States.

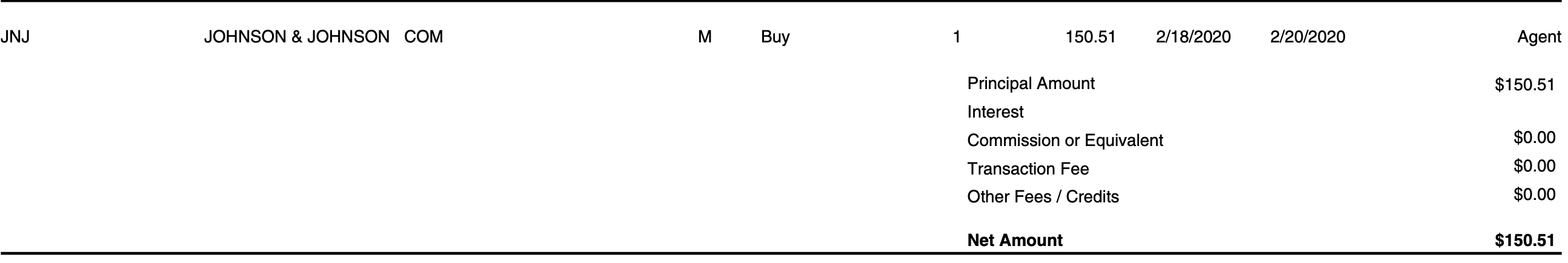

On the 18th of February, I bought 1 share of Johnson & Johnson for $150.51:

These are the company fundamentals based on my purchase price:

- P/E (TTM): 22.20

- Forward P/E: 15.41

- Dividend Yield: 2.52%

- Payout Ratio: 56%

- Net Debt/EBITDA: 0.31

This purchase added $3.23 to net forward annual dividend income. I now own 3 shares of Johnson & Johnson and am planning to add more in the future.

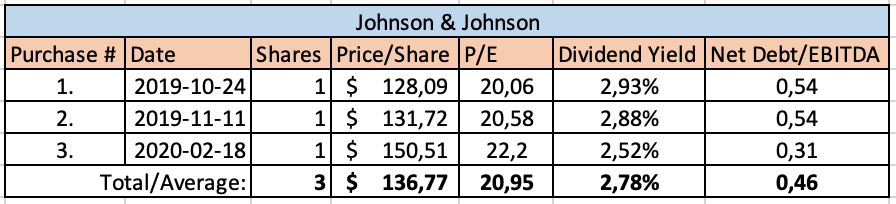

This is how my purchase history of JNJ looks like so far:

Altria Group (MO)

Once again, I added a couple of shares of Altria to my portfolio.

Shortly about the company from Morningstar:

Altria comprises Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, Ste. Michelle Wine Estates, Nu Mark, and Philip Morris Capital. It holds a 10.2% interest in the world’s largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company’s Marlboro brand is the leading cigarette brand in the U.S. with a 40% share.

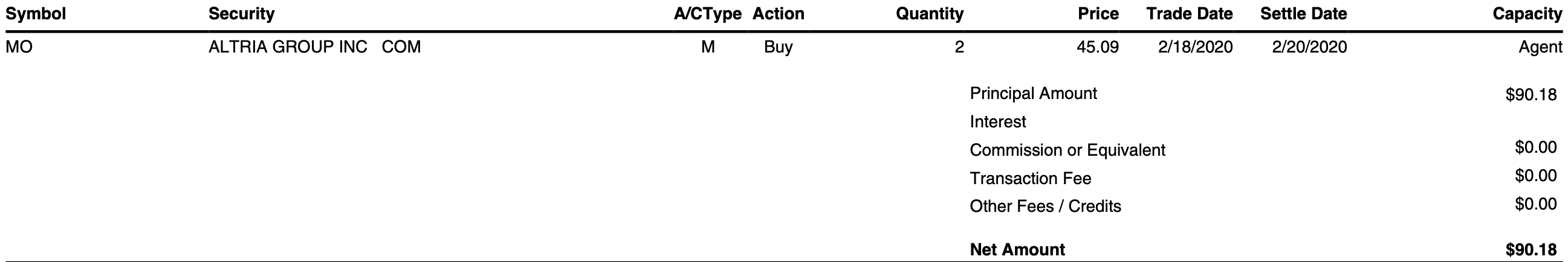

On the 18th of February, I bought 2 share of Altria Group at $45.09/share for a total of $90.18:

This is how the main ratios of the company looked on my purchase price:

- P/E (TTM): N/A (Earnings per Share were negative)

- Forward P/E: 9.12

- Dividend Yield: 7.45%

- Payout Ratio: N/A (Earnings per Share were negative)

- Net Debt/EBITDA: 2.35

This purchase adds $5.71 to my net forward annual dividend income.

I now hold 6 shares of Altria Group. I’m planning to increase the position to put it up to line with my other investments.

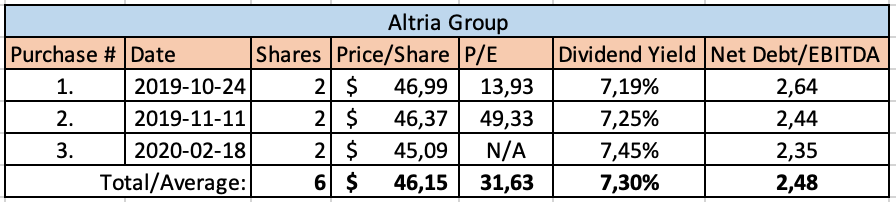

This is how my purchase history of MO looks like so far:

Summary

To sum up, those small buys added $8.94 to my forward annual dividend income. I slightly increased my smallest positions of the portfolio but they are still at the bottom. I think I will add to both of the companies in the future if nothing changes dramatically.

Have you been buying anything lately? Are you waiting for the situation to clear? Thanks for reading and feel free to leave your comments!

Good buys. Both in my portfolio. Only regreat that jumped on oil companies and MO to fast 🙂

Thanks P2035. Unfortunately, we don’t have a crystal ball to see what will happen in the future, so it’s too hard to predict 🙂

The main thing is to keep investing and it will definitely pay off in the long run.

Well funnyest thing is that I accumulated cash for past year and prediscted such even sooner or later, but then got feling of missing out and trigered buy. Lesson learned – stick to your strategy 😀

I remember you predicting that Brexit will cause the market meltdown. It turns out that it’s something completely different that caused the downturn.

Your case seems like a classic scenario – selling out before a big climb in the market (~30% in 2019) and buying back before the fall. That’s why I don’t like trying to time the market – you just never know what is going to happen, so I just invest when I can constantly.

I have altria, but not yet a position in JNJ. I bought 50 units of MPLX on friday 28 february at 18.46$ a piece. They have a massive yield, but they cover their dividend nicely and there is also some future growth potential when new pipeline projects come online. A risky stock, but they seem to be a great value play.

Thanks for the comment Norwegian! I am not familiar with MPLX, so cannot say much but dividend yield of 13.5% shows some red flags. I had a quick look and found out the following:

As of Dec 31, 2019, the partnership’s cash and cash equivalents were $15 million. Its total debt amounted to $20.3 billion.

So, as you say, it’s a really risky investment but if they pull it off, it will be rewarding. But the risk sounds too big to me. Anyway, hopefully it will play out for you well!

I bought shares of Altria around their current level awhile back. I still like their long-term outlook. JNJ is also an interesting buy. The dividend is very safe but the valuation is still high based on many metrics when compared to its history. One company I bought recently was XOM. Investors have beaten it down. There’s risk, no doubt, but the potential reward will hopefully justify the risk.

Thanks for the comment Brian! I guess the future is somewhat reflected in the price. There is a lot of uncertainty with Altria but it seems to have a lot of potential if they make it work. On the other hand, JNJ is a safer bet but I agree that their valuation is not that great. We have to pay for that safety 🙂

Brave move with XOM. It’s the only energy company I have in my portfolio and I was thinking to add to it. But I am a little bit worried about their dividend safety. I was also looking at CVX and RDS.A, as I would like to have some more exposure to energy but I have not decided yet which one to add. Most of them are really beaten down lately.

Good luck with your investments!

Congratulations on the 100th post, BI. Glad to hear you have no plans to stop, as I want to see where you can take your portfolio.

I like both companies, but favor JNJ much more. Even small buys are good. They all add up!

Thanks a lot ED!

The same here with regards to the relative liking of the two companies. I only like the dividend yield of MO 🙂