I will be honest that I didn’t spend much time researching the market or following the news lately. Summer is full of other activities, so I spent less time on this blog as well. I also didn’t have enough capital for a normal-size purchase.

That doesn’t mean that I am not investing, though. In fact, I took advantage of free trades in my Revolut account and made three small purchases last month.

Let’s see what I bought this time.

1. Johnson & Johnson (JNJ)

If I don’t have much time for researching new companies, I have some safe choices. One of them is the healthcare giant – Johnson & Johnson. Shortly about the company from Morningstar:

Johnson & Johnson is the world’s largest and most diverse healthcare company. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women’s health. Geographically, just over half of total revenue is generated in the United States.

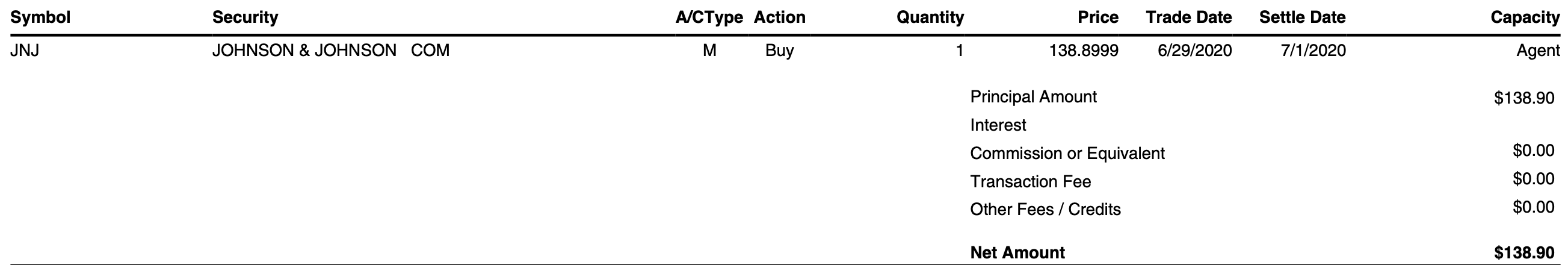

On the 29th of June, I bought 1 share of JNJ for $139.90:

These are the company fundamentals based on my purchase price:

- P/E (TTM): 18.65

- Forward P/E: 18.36

- Dividend Yield: 2.88%

- Payout Ratio: 53.4%

- Net Debt/EBITDA: 0.33

This purchase adds $3.43 to my net forward annual dividend income. I now own 5 shares of Johnson & Johnson and am planning to add more in the future.

This is how my purchase history of JNJ looks like so far:

2. Altria Group (MO)

Next up is a sin stock – Altria Group (MO). It’s also an existing company in my portfolio. Shortly about the business from Morningstar:

Altria comprises Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, Ste. Michelle Wine Estates, Nu Mark, and Philip Morris Capital. It holds a 10.2% interest in the world’s largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company’s Marlboro brand is the leading cigarette brand in the U.S. with a 40% share.

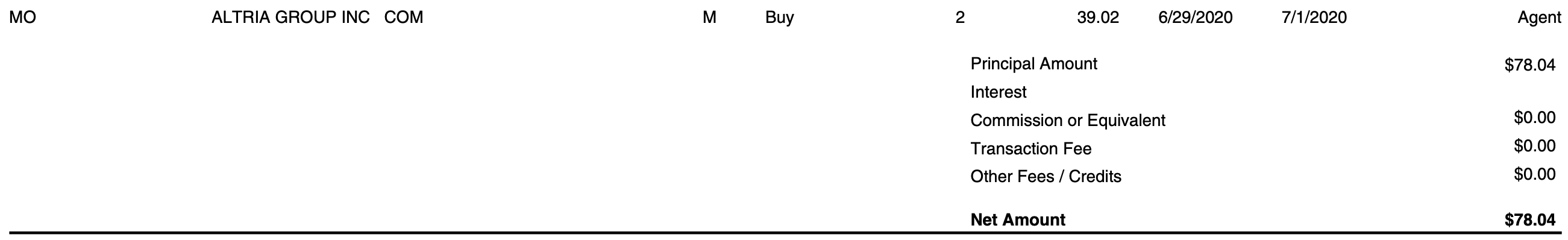

On the 29th of June, I bought 2 shares of Altria Group at $39.02/share for a total of $78.02:

This is how the main ratios of the company looked on my purchase price:

- P/E (TTM): N/A (Earnings per Share were negative due to a writedown)

- Earnings per Share (EPS): $-0.49

- Forward P/E: 9.29

- Dividend Yield: 8.61%

- Payout Ratio: N/A (Earnings per Share were negative)

- Net Debt/EBITDA: 2.11

This purchase adds $5.71 to my net forward annual dividend income.

I now hold 11 shares of Altria Group. I’m planning to increase the position to put it up to line with my other investments as well.

This is how my purchase history of MO looks like so far:

3. Slack Technologies (WORK)

Finally, I decided to purchase a different kind of stock to my portfolio. Some time ago, I decided to dedicate a small portion of my portfolio to speculative kind of stocks. I decided to go for a company which had its IPO last year and was not performing too well, while outperforming the market during the recent pandemic.

Shortly about the company from Morningstar:

Slack Technologies operates Slack, a software-as-a-service platform that brings together people, applications, and data. The platform is appropriate for all business types, from small and medium-size businesses to enterprise customers. The company was founded in 2009 as a game developer but later changed its focus and released its internally developed toolset, Slack, in 2013. It is headquartered in San Francisco.

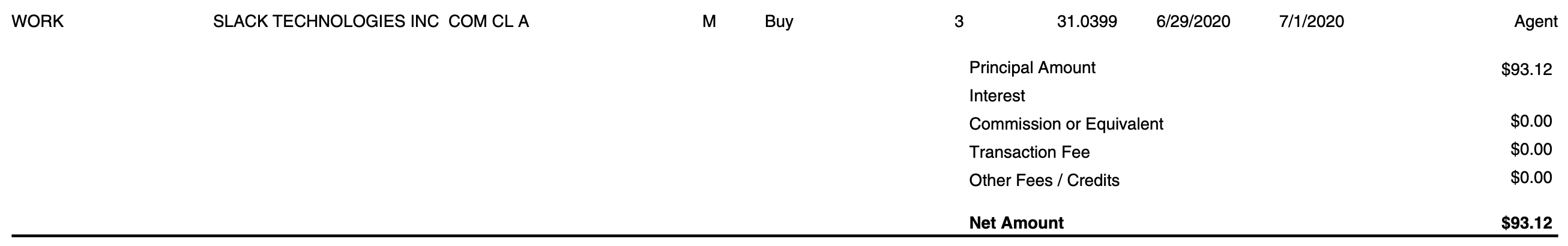

On the 29th of June, I bought 3 shares of Slack Technologies at $33.04/share for a total of $93.12:

This is how the main ratios of the company looked on my purchase price:

- P/E (TTM): N/A (Earnings per Share were negative)

- Earnings per Share (EPS): -$1.43

- Forward P/E: -52.26

- Dividend Yield: N/A

- Net Debt/EBITDA: N/A (EBITDA is negative)

- Net Debt: $684.7M

- Market Cap: $17B

This is not a typical company for my portfolio. Even though it does not pay dividend and does not generate a profit, I would like to have some exposure to such companies as well. At least I will be obliged to follow the stock more when I have some shares in my portfolio.

Summary

In total, I invested $310 and added $9.14 to my net forward annual dividend income. It’s not much but every little bit counts. Next month I should be able to initiate a bigger purchase if I find a suitable target.

Have you been buying anything lately? What do you think about my purchases? I would love to hear your thoughts! 🙂

Solid titles and I like the gradual building of a position in JNJ.

In June, I added BMY and T and I’m thinking about MRK and GD.

Thanks LoI!

I like your buys as well. GD is also a solid choice but I have enough Industrials in my portfolio already for now. Haven’t looked into MRK yet, so cannot comment on that.

Thanks for visiting!

Well BI, every small step is still one step in the right direction! Keep up the grind my friend and stay safe.

Thanks for the encouragement Mr. Robot! The same to you 🙂