The market was pretty wild lately. It presented some nice opportunities but I didn’t have available funds, unfortunately. I could tap to an emergency fund I am slowly building but I think it’s not worth the risk. It’s better to stick to the plan and only invest money you saved for investing, not for emergency situations.

However, I should have enough savings for a new purchase at the beginning of next month. In the meanwhile, I am creating a short list of companies I am watching at the moment to be ready for action when the funds are available.

1. Caterpillar (CAT)

First in the list is an Industrials giant which is well known in the world. Shortly about the company:

With 2018 sales and revenues of $54.7 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company principally operates through its three primary segments – Construction Industries, Resource Industries and Energy & Transportation – and also provides financing and related services through its Financial Products segment.

Founded almost 100 years ago, I don’t think it is going anywhere soon. This company always looked interesting to me but it became especially attractive after recent turbulence in the market, related to slowing economies and trade wars.

Let’s have a look at some of the main numbers/ratios that I usually check when looking for investment opportunities:

- Current price – $114.42;

- P/E ratio (TTM) – 10.65;

- Dividend Yield – 3.60%;

- Payout ratio – 38%;

- 26-year dividend growth streak;

- Net Debt/EBITDA – 2.76;

- Market Cap – $66.82B.

Fundamentals of the company are looking pretty nice. Low P/E ratio, low payout ratio, respective dividend yield (especially for CAT) – all of those seem attractive at current price.

Of course, there are risks. Caterpillar is a cyclical company and is dependent on business cycles. If economy goes to a recession, company’s results would definitely be affected. Fear of a nearing recession, together with trade wars between US and China triggered a sell-off in company shares recently. However, company shows history of surviving those recessions.

After the latest 20% dividend increase, company is yielding more than 3.5%. It is definitely tempting to initiate a position if this price holds until I have enough capital for a purchase.

2. Eastman Chemical (EMN)

Next up is a company I was keeping an eye on for the last couple of months. I am especially interested in this one because the company represents the only sector I don’t have any exposure to yet – Materials (Related – Portfolio Review).

Eastman Chemical Company, is an American company primarily involved in the chemical industry. Once a subsidiary of Kodak, it today is an independent global specialty chemical company that produces a broad range of advanced materials, chemicals and fibers for everyday purposes. Founded in 1920 and based in Kingsport, Tennessee, the company now has more than 40 manufacturing sites worldwide and employs approximately 15,000 people.

Company is creating a wide range of products that are used in many industries. The main end-use markets are transportation, consumables, building & construction, Industrial chemicals & processing etc.

Let’s see how its numbers/ratios are looking at the moment:

- Current price – $62.25;

- P/E ratio (TTM) – 9.60;

- Dividend Yield – 3.98%;

- Payout ratio – 38%;

- 7-year dividend growth streak;

- Net Debt/EBITDA – 3.21;

- Market Cap – $9.04B.

Company’s share price is currently at it’s 52-week low. It’s similar to aforementioned Caterpillar, as it’s also a cyclical company and investors are worried about slowing economies in the world. Actually, even the ratios are pretty similar to those of CAT at the moment.

It would also be a risky investment since we are not certain about future of economies in the world. On the other hand, now may be a nice time to lock that attractive dividend yield. I may initiate a position, if the price stays below $66.

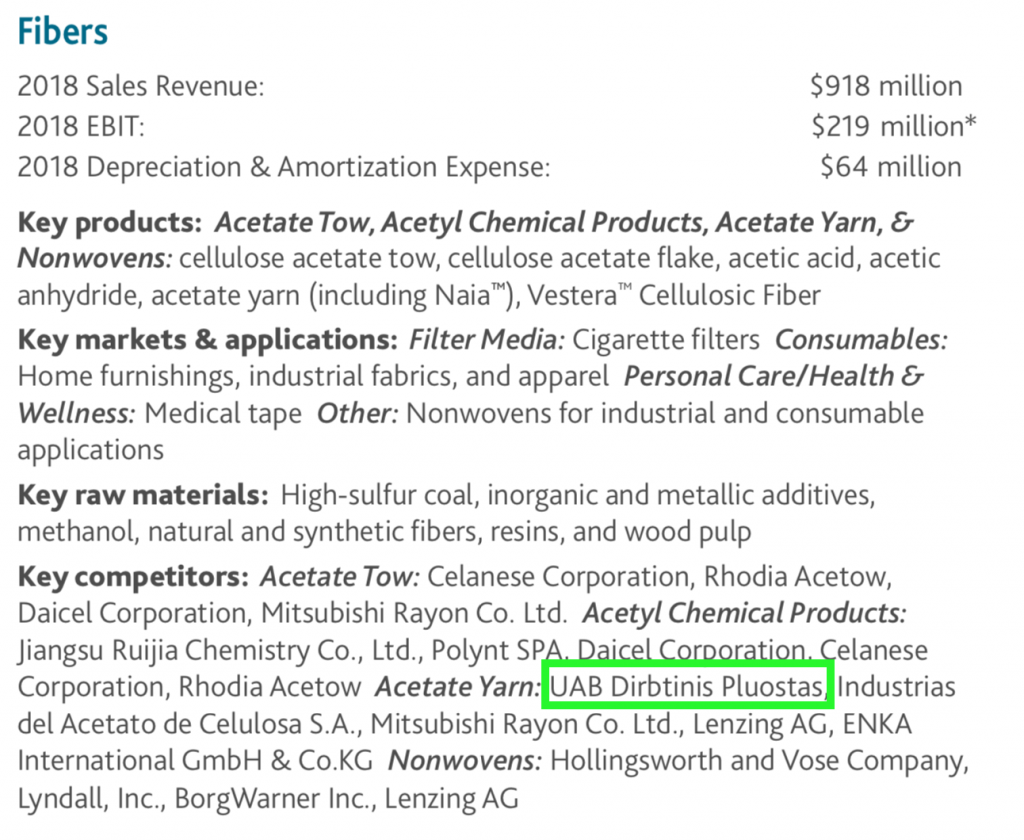

Fun fact: While reading about Eastman Chemical, I found a Lithuanian company in the list of main competitors for one of its products. It’s not often I see competitors from our little country considered in presentations of big US companies 🙂

3. Albemarle Corporation (ALB)

Third in the list is a company which was in my watchlist almost a year ago. Information about company from their latest annual report:

We are a leading global developer, manufacturer and marketer of highly-engineered specialty chemicals that are designed to meet our customers’ needs across a diverse range of end markets. The end markets we serve include energy storage, petroleum refining, consumer electronics, construction, automotive, lubricants, pharmaceuticals, crop protection and custom chemistry services.

Company operates in 3 segments: Lithium and Advanced Materials, Bromine Specialties and Refining Solutions. You may think that companies involved in lithium production would perform well now, when electric cars and other uses of lithium batteries are becoming more popular. However, the opposite is happening. Share prices of businesses in this field are actually declining quite heavily recently. Lithium prices are falling due to oversupply from new mines in Australia. Furthermore, electric car demand is actually lower due to a cut to subsidies in China this year.

There is some uncertainty and it is not clear how long this situation will persist or if it will get even worse. However, now may be a nice time to enter into this position, with hope that situation will get better in the future.

Let’s see how various ratios of ALB are looking at the moment:

- Current price – $61.22;

- P/E ratio (TTM) – 11.96;

- Dividend Yield – 2.40%;

- Payout ratio – 29%;

- 15-year dividend growth streak;

- Net Debt/EBITDA – 1.7;

- Market Cap – $6.49B.

Company’s valuation seems much better than it did a year ago. Even though the dividend yield is quite low, it’s actually not bad for this company. In September last year it was standing at 1.4%. Also, company has a lot of room to grow, since the payout ratio is low.

If I decide to purchase some shares of ALB, it would be one of the lowest-yielding companies in my portfolio. On the other hand, I believe that it would represent big growth opportunities. I think it’s good to have a balance of high initial yield and growth companies.

4. WestRock Company (WRK)

Finally, I am looking at a company which was featured in my watchlist of April 2019.

Let’s remember what this company is about:

WestRock Company manufactures and sells paper and packaging solutions for the consumer and corrugated markets in North America, South America, Europe, Australia, and Asia. The company operates through three segments: Corrugated Packaging, Consumer Packaging, and Land and Development.

The company was created as a result of a merge between RockTenn and MeadWestvaco in 2015. It also acquired KapStone Paper and Packaging Corporation for $4.8B last November.

It’s another business from Materials sector. However, it’s very different to EMN & ALB I covered earlier, as it belongs to a different industry.

Let’s see how the company’s ratios changed since April when I last reviewed it:

- Current price – $32.47 (was $35.49);

- P/E ratio (TTM) – 10.12 (was 10.11);

- Dividend Yield – 5.61% (was 5.13%);

- Payout ratio – 57% (was 52%);

- 3-year dividend growth streak;

- Net Debt/EBITDA – 3.55;

- Market Cap – $8.64B.

The price of the company is lower compared to where it was when I reviewed it in April. Unfortunately, the fundamentals are also looking poorer since then. P/E and Payout ratios are slightly higher, the debt levels are pretty high as well. On the bright side, its dividend yield is also higher at the moment.

To be honest, this is the least likely company to be added to my portfolio, as it seems to be the riskiest out of the four.

Summary

There you have it – 4 companies that are actually quite similar to each other. They are all cyclical companies that would probably perform badly during a recession. However, I feel that a lot of the risk is already included in the price, as it was declining for all covered companies recently. Of course, we never know where the bottom is but it is tempting to lock in the dividend yield they are currently providing.

What are you watching at the moment? What was your most recent purchase? Do you like any of the companies I mentioned? Thanks for visiting and I would love to read your opinions!

Photo by Javier Allegue Barros on Unsplash

I own WRK in my portfolio, but instead of increasing my position there i would be tempted to initiate a position i CAT. This months new stock for me was Equinor, the biggest Norwegian oil company. We will see next month what i end up deploying new money towards.

Thanks for the comment Norwegian!

I like CAT more than WRK as well. But I am tempted more towards EMN or ALB at the moment.

I am not familiar with Equinor. Having a quick look, I can see that it’s also trading near 52-week lows at the moment and now may be a nice opportunity. I will need to look more into this 🙂

It just so happens I made purchases of CAT and EMN this week, BI.

CAT is a new position, and EMN is one I started in June and added to this week.

Obviously, I like both. Yet, I agree that there could be more downside with these two given the slowing world economies and U.S./China trade issues. That said, it still wasn’t enough for me to not make an investment. You never know which way things are going to go. Historically, the levels I purchased these two at seem to offer good value. Time will tell, of course.

I haven’t researched ALB or WRK so can’t comment much on those two.

Hi ED, I rember you purchasing EMN recently. Nice to see that you were able to get them at even lower price.

It’s pretty hard to catch the bottom, so we shouldn’t worry too much. If the company seems attractive at certain levels, go for it! If the price goes further down, you should average down, just like you did with EMN. Value should look even better with lower price, of course if there are no new issues with the business. I often see prices going down just for some future predictions that don’t get realized.

The same goes with growing stocks. It’s common to see a stock perform really well and earnings keep growing. But it suddenly stops and you find out that you purchased at the top when the expectations were too high.

So far in my short experience, it often pays off to purchase a company when expectations from general public is low, like it happened with TGT or SBUX.

BI-

Looks like your planning to build positions in Materials. The sector has taken a beating, not sure the pain is over. I have positions in CAT and WRK. I think we’re at the mercy of a trade war for now….and fears of a recession.

You are right Passive Cash! The situation is uncertain but the companies seem to be at attractive enough levels for me. In case they drop further down, it will be opportunity to average down 🙂

WRK and CAT are the two that caught my eye on this list. It isn’t surprising how far CAT has fallen given their international exposure and this trade war with China. I expect this stock to ride with the emotions of the trade war announcements, which should present some buying opportunities for long-term investors like ourselves. If you can’t stomach the short-term, I’d suggest looking elsewhere. I’m excited to see what stock you end up purchasing.

Bert

Thanks for the insights Bert, I totally agree. We are of course focusing on the long term and should instead take those opportunities when they present themselves.

Sveikas, stebiu irgi visas sias akcijas, WRK paskutinis mano pirkinys, nes labai geras fundamentalas. Pasirinkau ja nes Basic Materials gerai laikosi per recesijas. Del UAB “dirbtinis pluostas” tai nustebino 😀 Dabar protingiausia butu orientuotis i Basic materials, healthcare ir consumer staples sektorius tikint kad tuoj recesija…Ka manai apie CMI (Cummins) ir GPC (Genuine parts)?

Be to, buk atsargus su licio imonem, nes tai tikrai nera ateities techonologija. Licio isgavimas labai blogina ekologija ir ateities akumuliatoriai bus tikrai ne is licio (kiek zinau bus is aliuminio, nes jau daromi eksperimentai). Jau geriau investuoti i vario kasyklas, nes varis naudojamas laiduose, o elekrtrifikavimas vis auga.

O, nežinojau šito, turėsiu omeny labiau pasidomėti, dėkui 🙂

Sveikas, dėkui už komentarą! Dėl consumer staples sutinku, mažiau nuvertėja per recesijas, bet basic materials manau nukenčia panašiai kaip ir kiti, visgi jie dažnai gamina kompanijoms/produktams, kurie būna stipriai paveikti nuosmukių

Apie CMI ir GPC girdėjęs, nes dažnai matau kitų investuotojų portfeliuose, bet labai nesidomėjau, reikės pažiūrėti įdėmiau, kai bus proga 🙂