Everybody knows that diversification is one of the key concepts when starting investing. You try not to put eggs in one basket if you don’t want to get burnt.

I was always trying to keep my portfolio diversified by looking at different companies. But I actually never had a clear overview in that perspective. Therefore, I decided to review my portfolio and see how much exposure I have in each sector.

Sectors and Industries

Let’s start by explaining the difference between sector and industry. They always sounded as synonyms to me but it turns out that they are different things.

Economy and stock market is divided into several tiers. Sector is the highest tier of companies that have similar economic characteristics. It then breaks down to Industry Groups. Industry Groups are further broken down to Industries that, in turn, are broken down to Sub-industries.

You may read more and see the whole breakdown in a table from this Wikipedia page of Global Industry Classification Standard.

There are 11 major sectors most investors use to break down the market. However, even if two companies are from the same sector, they can be very different. For example, both Blackrock and Uniqa Insurance Group from my portfolio are from Financials sector. However, the first one is from Capital Markets industry (Asset Management sub-industry) while the latter one is from Insurance industry.

This is the list of commonly used sectors:

- Energy

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financials

- Information Technology

- Communication Services

- Utilities

- Real Estate

- Materials

Let’s review each one of them and see if I have exposure to them in my portfolio.

Energy

The energy sector consists of companies that source, drill, extract, and refine the raw commodities, such as oil and gas. At present, the energy sector contains two industries:

- Energy Equipment & Services Industry

- Oil, Gas & Consumable Fuels Industry

In some sources, this sector is part of “Basic Materials” sector but I will stick to Global Industry Classification Standards (GICS) classification.

Biggest companies from this sector are Schlumberger Limited (SLB), Exxon Mobil (XOM), Royal Dutch Shell (RDS) etc.

Currently, I have one company from this sector – Exxon Mobil (XOM). It is 3.7% of my portfolio.

Industrials

The sector includes companies that provide industrial and commercial equipment and services, transportation, and distribution operations. From construction and farming machinery to airlines, railroads, and waste management, the industrials sector has a broad range of end markets and beneficiaries. This sector contains 14 industries:

- Aerospace & Defense Industry

- Air Freight & Logistics Industry

- Airlines Industry

- Building Products Industry

- Commercial Services & Supplies Industry

- Construction & Engineering Industry

- Electrical Equipment Industry

- Industrial Conglomerates Industry

- Machinery Industry

- Marine Industry

- Professional Services Industry

- Road & Rail Industry

- Trading Companies & Distributors Industry

- Transportation Infrastructure Industry

As we can see from the number of industries, Industrials sector includes a wide range of fields. Biggest names in this sector are Boeing (BA), Lockheed Martin (LMT), Caterpillar (CAT) etc.

My portfolio has two companies from Industrials sector – Illinois Tool Works (ITW) & 3M (MMM). It’s currently 13.4% of my portfolio.

Consumer Discretionary

Consumer discretionary (also called Consumer Cyclical) is the term given to goods and services that are considered non-essential by consumers, but desirable if their available income is sufficient to purchase them. It consists of 11 industries:

- Automobile Components Industry

- Automobiles Industry

- Distributors Industry

- Diversified Consumer Services Industry

- Hotels, Restaurants & Leisure Industry

- Household Durables Industry

- Leisure Products Industry

- Multiline Retail Industry

- Specialty Retail Industry

- Textile, Apparel & Luxury Goods Industry

- Internet & Direct Marketing

It’s also a wide sector, ranging from cars to jewellery. Top players in this industry are Apple (AAPL) (although it’s in Technology sector in some sources), Disney (DIS), General Motors (GM) etc.

My portfolio currently has two companies from this sector – Starbucks (SBUX) & Tallina Kaubamaja Grupp (TKM1T). It adds up to 15.9% of my portfolio.

Consumer Staples

Consumer Staples (also called Consumer Defensive) are essential products that include typical products such as food, beverage, household goods, and feminine hygiene products, but the category also includes such items as alcohol and tobacco. These goods are those products that people are unable—or unwilling—to cut out of their budgets regardless of their financial situation. This sector contains 6 industries:

- Beverages Industry

- Food & Staples Retailing Industry

- Food Products Industry

- Household Products Industry

- Personal Products Industry

- Tobacco Industry

Consumer Staples is a backbone of many dividend stock portfolios. They tend to perform well during recessions and are more stable than Consumer Discretionary companies. However, they usually lag general market when economy is having good times. Biggest names in this sector are Procter & Gamble (PG), Coca-Cola (KO), Phillip Morris (PM) etc.

My portfolio currently has 3 companies from this sector – Procter & Gamble (PG), Vilkyskiu Pienine (VLP1L) & Target (TGT). In total, this is 14.4% of my portfolio.

Health Care

The healthcare sector consists of companies that provide medical services, manufacture medical equipment or drugs, provide medical insurance, or otherwise facilitate the provision of healthcare to patients. It consists of 6 industries:

- Biotechnology Industry

- Health Care Equipment & Supplies Industry

- Health Care Providers & Services Industry

- Health Care Technology Industry

- Life Sciences Tools & Services Industry

- Pharmaceuticals Industry

Examples of companies in this sector are Johnson & Johnson (JNJ), Abbott Laboratories (ABT), Abbvie (ABBV) etc.

I have two companies from Health Care sector – Pfizer (PFE) & CVS Health (CVS). They take 11.6% of my overall portfolio.

Financials

The financial sector is a section of the economy made up of firms and institutions that provide financial services to commercial and retail customers. This sector is made up of many different industries:

- Banking Industry

- Capital Markets Industry

- Consumer Finance Industry

- Diversified Financial Services Industry

- Insurance Industry

- Mortgage Real Estate Investment Trusts (REITs) Industry

- Thrifts & Mortgage Finance Industry

Biggest names in this industry are Visa (V), JPMorgan Chase (JPM), Wells Fargo (WFC) etc.

My portfolio has two companies from this sector – BlackRock (BLK) & Uniqa Insurance Group (UQA). It’s currently 10.5% of my portfolio.

Information Technology

The technology sector is the category of stocks relating to the research, development and/or distribution of technologically based goods and services. This sector contains businesses revolving around the manufacturing of electronics, creation of software, computers or products and services relating to information technology. This sector contains 6 industries:

- Communications Equipment Industry

- Electronic Equipment, Instruments & Components Industry

- IT Services Industry

- Semiconductors & Semiconductor Equipment Industry

- Software Industry

- Technology Hardware, Storage & Peripherals Industry

Some examples of companies in Information Technology sector include Microsoft (MSFT), Alphabet (GOOGL, GOOG), Facebook (FB).

My portfolio has one company from Information Technology sector – Cisco Systems (CSCO) which takes 8.6% of the portfolio.

Communication Services

The telecommunication sector is made up of companies that make communication possible on a global scale, whether it is through the phone or the Internet, through airwaves or cables, through wires or wirelessly. These companies created the infrastructure that allows data in words, voice, audio or video to be sent anywhere in the world. The largest companies in the sector are telephone (both wired and wireless) operators, satellite companies, cable companies, and internet service providers. It contains 5 industries:

- Diversified Telecommunication Services

- Wireless Telecommunication Services

- Entertainment

- Media

- Interactive Media & Services

In 2018, the telecommunication services sector was renamed communication services. The sector was expanded to include media and entertainment companies previously in the consumer discretionary sector, as well as interactive media and services companies from the information technology sector.

Biggest names of this sector are AT&T (T), Verizon Communications (VZ) etc.

I have two companies from this sector – AT&T (T) & Telia Company (TEL1L) which comprise 8.6% of my portfolio at the moment.

Utilities

The utilities sector refers to a category of companies that provide basic amenities, such as water, sewage services, electricity, dams, and natural gas. It is divided to five industries:

- Electric Utilities Industry

- Gas Utilities Industry

- Independent Power and Renewable Electricity Producers Industry

- Multi-Utilities Industry

- Water Utilities Industry

Some examples of Utilities sector are NextEra Energy (NEE), Southern Company (SO), Aqua America (WTR) etc.

My portfolio has a single company from this sector. It’s Dominion Energy (D) and it takes 6.2% of my portfolio. In fact, this was my latest purchase and I didn’t have any Utilities companies before last month.

Real Estate

The real estate sector includes all Real Estate Investment Trusts (REITs) with the exception of Mortgage REITs, which is housed under the financial sector. The sector also includes companies that manage and develop properties. At present, the Real Estate sector is made up of two industries:

- Equity Real Estate Investment Trusts

- Real Estate Management & Development

Real Estate sector was previously classified within Financials sector. However, in 2016 the real estate industry group (except Mortgage REITs) was moved out of Financials sector to a newly created real estate sector.

Biggest names in this sector include American Tower Corporation (AMT), Simon Property Group (SPG), Welltower (WELL) etc.

I have one company from this sector – Realty Income (O). It is currently 6.3% of my portfolio.

Materials

Material sector manufactures, logs, and mines everything from precious metals, paper, and chemicals to shipping containers, wood pulp, and industrial ore. This sector is broken down to 5 industries:

- Chemicals Industry

- Construction Materials Industry

- Containers & Packaging Industry

- Metals & Mining Industry

- Paper & Forest Products Industry

Examples of companies from this sector are Air Products & Chemicals (APD), Lyondell Basell Industries (LYB), Alcoa (AA).

This is the only sector I don’t have any companies from, so it’s 0% of my portfolio.

Summary

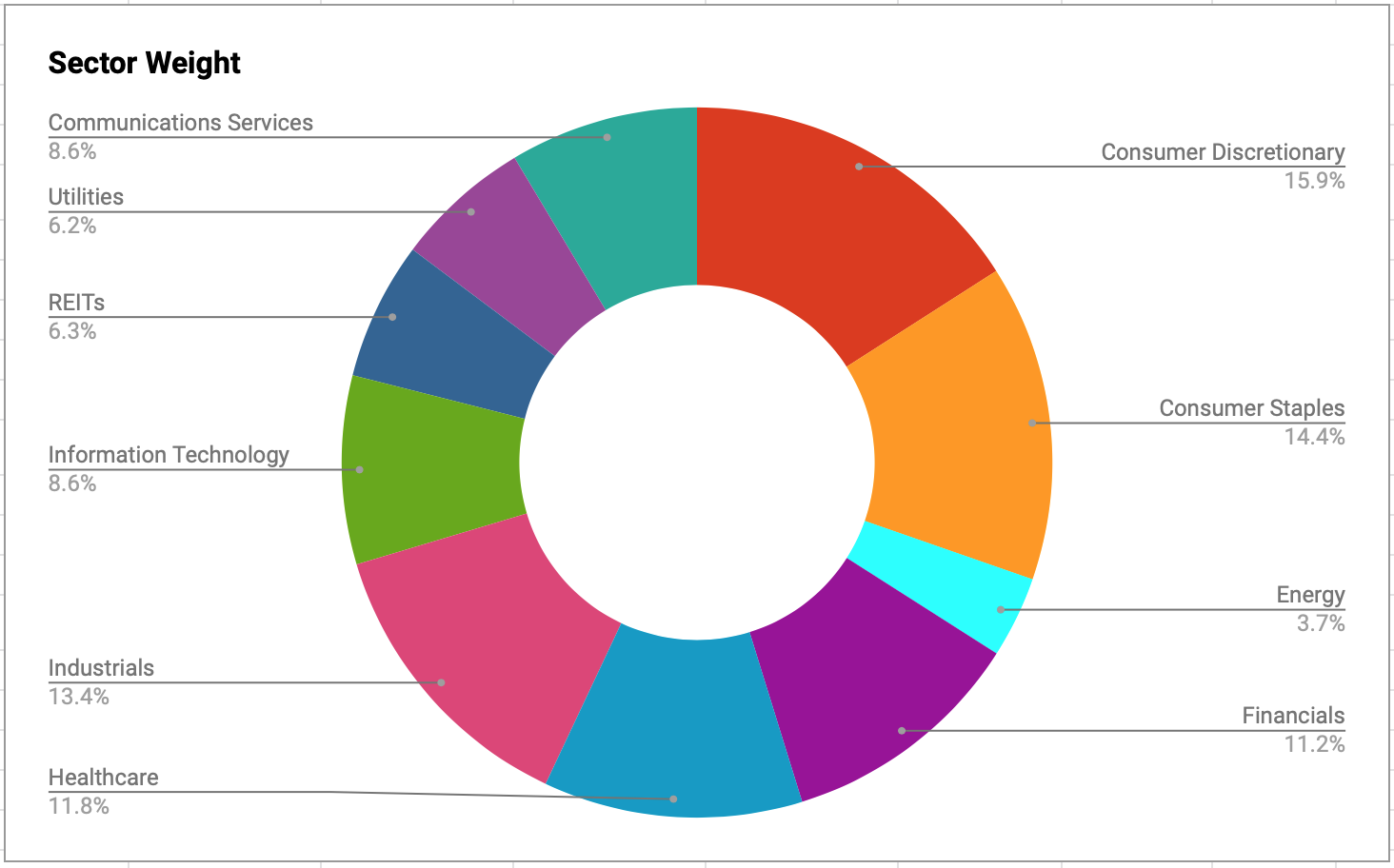

My portfolio now seems to be well represented in most of the sectors:

I have exposure to each sector except Materials. I guess this may be target of my next purchase, especially after the latest stock market turmoil where some Materials companies took especially hard beating.

What about your portfolios? Do you have them diversified? Do you own companies from each sector? Are you trying to avoid any sectors at the moment? Thanks for reading and I would love to see your comments!

Sources:

That’s a good article. Thanks for the detailed description.

Thanks D for Dividends!

Hi BI,

Just like you, I don’t have any holdings in one sector. That sector is Utilities for me. I think the main reason is the low overall growth in that sector. I like the yields, but haven’t been enamored enough with the growth to commit. NEE is a possibility if the price comes down, as it seems to have some growth. My last utility stock was SCANA, which I sold right before it merged with Dominion, as you know. I’m sure utilities will on my shopping list when I get closer to retirement, as the income they offer will be more in focus for me.

We seem to have some differences in the sector we put some stocks in… hmmm. I find it strange because I believe I’m using the GICS classification as well. For instance, I see you had TGT in Consumer Staples, but I have it in Consumer Discretionary. You also listed Visa in Financials, but I have it in Information Technology. Finally, you listed Facebook in Information Technology, but I have it in Communication Services. Not a big deal at all, just found it curious.

I think it’s a great idea to know how your stocks are allocated into the various sectors so that you can stay diversified. Well done on performing the examination.

Thanks for your thoughts!

Yes, it’s a little bit confusing with those sectors. I think it’s especially true nowadays when it’s hard to assign company strictly to one category (e.g. Visa or Facebook).

Regarding Utilities, I think it’s quite good to have some more stable stocks to avoid big losses. But then again, in the long run, more growing sectors usually outperform them. So it really makes sense that you should load up with more stable stocks closer to retirement.

Great read! Thanks BI.

You’re pretty well diversified across all the sectors…I absolutely am not.

You avoided the pain with the Materials sector this year. Hopefully it will come back. There’s some good yield out there…WRK and LYB come to mind.

Thanks for the comment Passive Cash! Actually, I already closed this gap and purchased a Materials company. Next blog post will reveal what I chose 🙂