Just like that, summer is over. It’s time to get back to school and I can already see the effect around. My colleagues are complaining that the traffic is getting worse and they need to prepare kids for school/kindergarten. Luckily, our baby-daughter is still too young to go to kindergarten and I am walking to work on foot, so I am not sharing those troubles yet.

Summer was great and it was very different to what it used to be when we were baby-free. There were less parties but we visited seaside and nearby lakes much more often than we used to. Unfortunately, August also included first illness of our daughter and an overnight stay in a hospital. Luckily, it was not serious and we are all feeling well now.

Enough with the summer overview. Let’s get to passive income my portfolio generated during the month of August.

Dividend Income

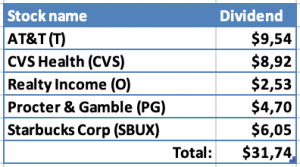

This month I received dividend from 5 companies:

That’s not too bad for an August.

As always, let’s see what part of expenses, related to the companies, the dividends could cover if I decided to spend them:

- $9.54 from AT&T would cover 40% of what we spent on Cellphone bill during the last 3 months;

- $8.92 from CVS Health would cover 8.1% of our expenses on Barber for the last 3 months. Since it is my second Healthcare company (after PFE), I decided to assign it to another category of our budget

- $2.54 from Realty Income would cover 0.4% of our monthly Rent;

- $4.70 from Procter & Gamble would cover 3.1% of our Cosmetics & Hygiene expenses for the last 3 months;

- $6.05 from Starbucks would cover 2.3% of what we spent on Eating Out during the last 3 months.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

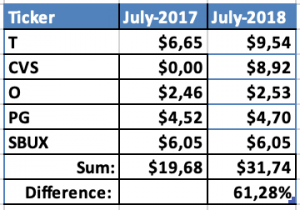

Let’s compare dividend income to August of last year:

I can’t complain about the increase of 61%. This is what caused it:

- New addition of CVS Health to my portfolio this Spring;

- AT&T position was moved from my old broker and I added a few shares in the process. In addition, AT&T raised their dividend slightly;

- Dividend increases from Realty Income and Procter & Gamble also helped slightly.

There is no increase from Starbucks compared to last year. I expect them to raise their dividend in Autumn, so I shouldn’t worry about this. Actually, I am very happy with performance of SBUX, as its stock price increased by ~85% since I purchased them a year ago!

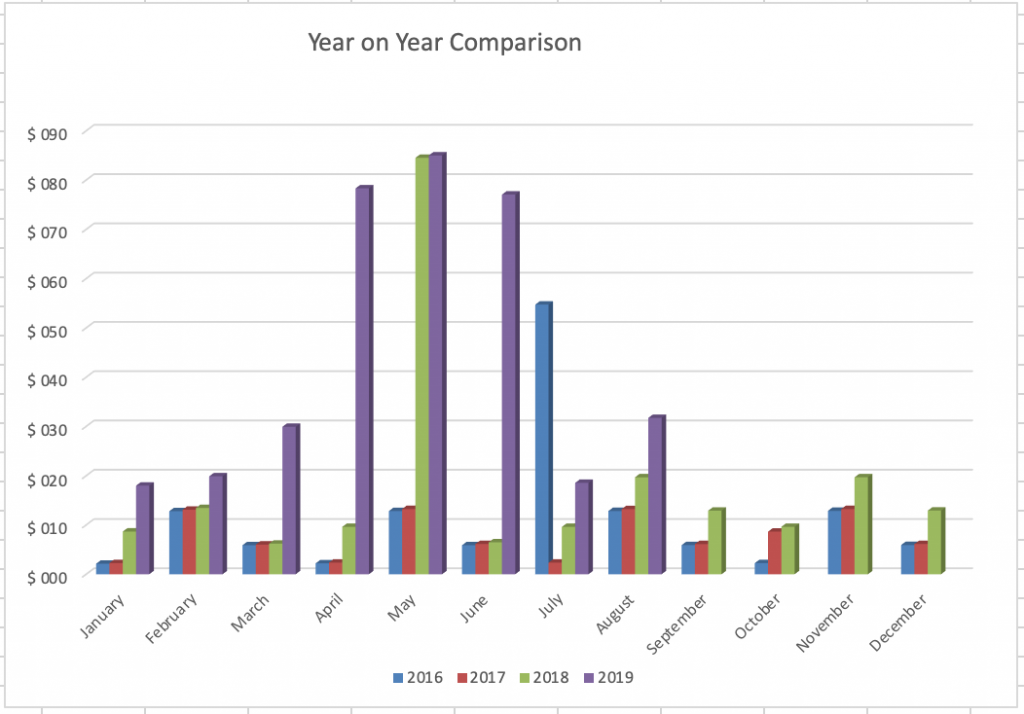

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €500 to my investment account which is slightly lower than usual.

I haven’t invested to any new companies. However, I finally moved 4 remaining US positions from my old broker to my new broker. Now I will need to pay 15% withholding tax on dividends, compared to 30% at my old broker. This transfer cost me €51 but it resulted in $21.56 increase in projected annual dividend income.

I haven’t added any funds to P2P lending platforms.

Dividend Increases

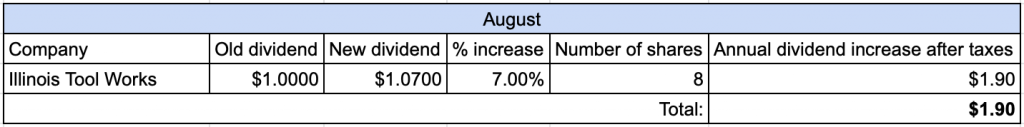

This month one company in my portfolio announced a dividend increase:

With dividend increases being much smaller compared to last year, I really can’t complain about the news from ITW. It’s actually the biggest increase in percentage terms so far this year for my portfolio.

Changes in Projected Annual Dividend Income

As I mentioned in previous posts, I have a goal to increase my PADI to $450 from US companies this year. At the start of the year it was standing at $236. This means that I should add additional $214 (or $18/month in average) if I want to achieve the target.

To track the progress, I monitor PADI increase/decrease from two sources – dividend increases and capital contribution.

Let’s see how forward dividend income changed during July:

Even though I haven’t added any additional stocks, PADI increased because I moved my remaining US stocks to the new broker.

I am very close to my target now (only $6 missing), so I am very optimistic to reach this goal, maybe even next month.

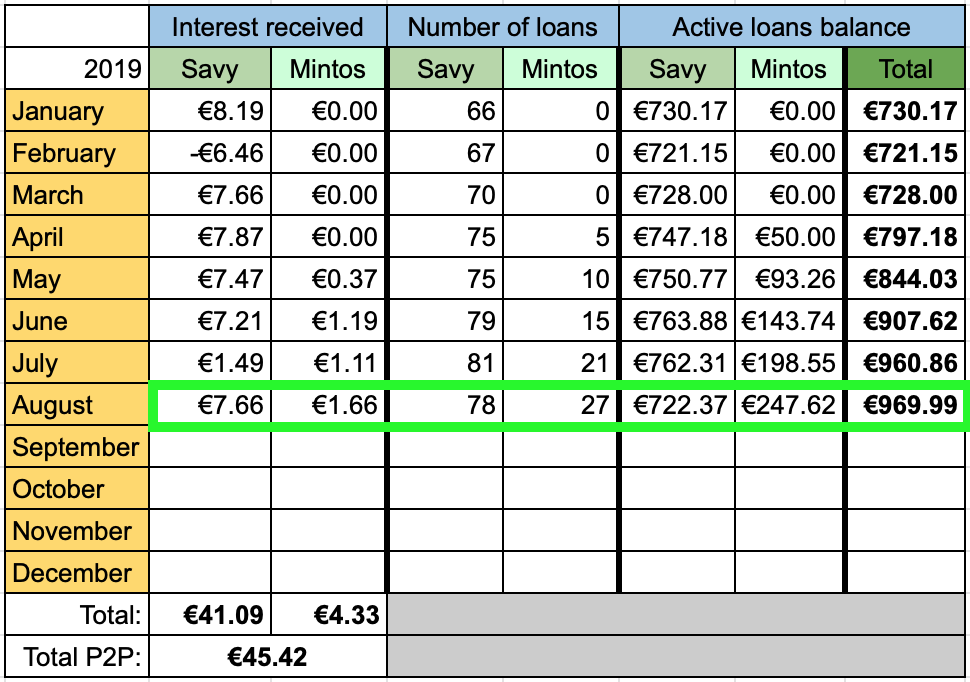

P2P Lending Income

This is how my income from P2P lending looked like in August:

Interest from P2P lending added €9.32 to passive income this month.

I am no longer adding any funds to Savy platform and actually transferred €50 of returned back loans to Mintos this month.

In general, I would like to keep P2P lending portfolio at ~5% of my overall portfolio. Currently it stands at 5.2% of my overall portfolio.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR) I received €38.15 in passive income during August. This brings the total for 2019 to €373.67 which is ~77% of my goal to receive €480 this year. I am on track to reach the goal, as we still have 4 months left.

I feel very fortunate to be in a position where I can save part of my salary and slowly build passive income. At the beginning it seems very slow but I believe that the numbers will only get better if we keep consistency. Seeing the income grow each month is very motivating and I don’t see any reason to stop.

How was your month? Are you sharing any dividend payers with me? Did you have a nice summer? Let me know in comments below and thanks for reading! 🙂

great YOY .you are getting there. keep at it some solid results

Thanks for the encouragement Doug!

Looking good, BI! You are well on your way to meeting your financial goals. 60%+ is terrific YoY growth. Keep that going as long as you can.

I share almost all stocks with you this month, with T being the lone exception. As for SBUX, let’s hope we see that dividend raise very soon.

Nice to see your Savy interest bounce back this month, too.

Thanks a lot ED!

Keeping up the growth rate will be higher with dividend income becoming higher. I don’t mind having this “problem”, though 😀

Definitely hoping to see a dividend increase from SBUX. They recently announced decreased expectations for earnings in 2020, so the increase may not be big, but I am still hoping for one 🙂

Savy returned some old loans this month. I don’t expect the increase to last though, as I am planning to slowly reduce my exposure to this platform.

Thanks again for the comment!

On Mintos, do you use Invest & Access?

If not, have you seen any increase in cash drag lately?

Imagine what that PI already pays for! You can eat for a week with that right? It’s a great start!

I don’t think I use it, just a simple Autoinvest. I noticed that there was some cash drag at one point but it’s invested promptly now. On the other hand, my amounts are very slow, so there is not much movement.

Raising passive income is definitely motivating. Hopefully, I will use it one day to cover our daily expenses 🙂

Thanks for the comment Eelis!

Apart from the illness it seems you have a great summer. For me it was the same, thankfully no hospital visit while on holiday this year. Three weeks of sun and we practically never left the camping site. For us it was also different having a baby again, especially with 35°+ temperatures.

We share all companies except SBUX, I really should have bought the dip last year. Oh well, maybe next time.

Awesome growth and nice results for this august. I also just posted my results and am pretty happy with them as well.

Congrats on the ITW raise!

Hey Mr. Robot,

It’s nice to hear that you also had a great summer! 35+ temperatures sounds too much but we had some days close to that this summer as well 🙂

Regarding SBUX, you can’t get them all. There are loads of companies I wish I invested to in the past 😀

Thanks for the encouragement! Heading over to your blog to see what your month looked like 🙂

Congratulations BI, solid names that delivered awsome YoY growth.

We share only SBUX and it looks you were right with CVS 🙂

Good luck.

Thanks Druss, the income is growing and it’s nice to see the progress!

CVS is looking pretty nice indeed so far. They climbed by ~17% since my purchase 🙂

Thanks for the comment!

Indeed there is nothing to complain about a 61% growth rate. Congrats, BI!

Like yourself, I’m curious to see SBUX dividend raise in autumn. They stock price appreciation has been phenomenal. I hope we can say the same about the divvy boost too:) I think SBUX is going to announce in September.

Keep it up!

-SF

Thanks SF!

Let’s see what Starbuc delivers, hopefully they won’t disappoint 🙂

Their yield is pretty low at the moment, it’s good that we managed to enter during the dip 🙂

Gražu žiūrėti į progresą! 🙂 o tu kai mokėsi mokesčius, tai reiks prikabinti kokia nors ataskaitą iš IB ar tiesiog skaičiukus surašysi?

Ačiū Crash!

Prikabinsiu ataskaitą. IB duoda statement už visus metus. Nors tiksliai nežinau, ar ir surašyti atskirai reikės. Gali būti, kad šiais metais deklaruodamas mokesčius sumokėjau daugiau nei reikėjo 🙂 po to sužinojau, kad šiaip reikia prisegti GPM308U priedą, kuris automatiškai neformuojamas.

O dėl pelno mokesčio, tai jeigu neviršijau 500eur, tai išvis nieko deklaruoti nereiks?

Manau, kad deklaruoti pajamas reikėtų bet kokiu atveju 🙂 bet čia jau gal VMI geriau pakonsultuotų 🙂

Congrats BI! That’s a great month right there. Love the CVS addition compared to last year. And that ITW dividend increase wasn’t too bad. I benefited from it as well (although I wish it were higher)! Keep moving, keep hustling, and keep pushing your dividend income forward.

Bert

Thanks a lot Bert! Got to love these increases and added income 🙂

Let’s keep moving!