Happy New Year, everyone!

2024 is behind us, so it’s time to see how it ended. Let’s see what happened during the last month of the year.

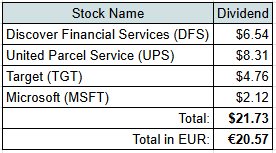

Dividend Income

Let’s start with dividend income. Just like 3 months ago, 4 companies paid a dividend during the month:

Even though it’s the same 4 companies, the dividend amount is slightly higher due to increased dividend from Microsoft. It’s just $0.21 more, but every little bit helps.

As always, let’s compare received dividends with our actual expenses:

- $6.54 from Discover Financial Services (DFS) would cover 42.5% of our Banking expenses for the last 3 months;

- $8.31 from United Parcel Service (UPS) would cover 1.2% of our Car & Transportation expenses during the last quarter (it was very high due to our roadtrip);

- $4.76 from Target (TGT) could cover 0.4% of our Food expenses for the last 3 months;

- $2.12 from Microsoft (MSFT) could pay 0.4% of Subscriptions and Personal Development category for the last 3 months.

P2P Lending Income

P2P lending also generated some passive income:

€6.50 was earned in interest which is similar to the usual amount from P2P lending category.

My goal is to keep ~5% of my portfolio in P2P lending. Currently, it accounts for 9.5%, so I am not investing any additional money until the rest of portfolio catches up.

Other Passive Income

Finally, I received some small amounts from 2 other sources of income:

- €3.13 in interest from Money Market Funds;

- €0.40 from Rental Income in Mintos platform.

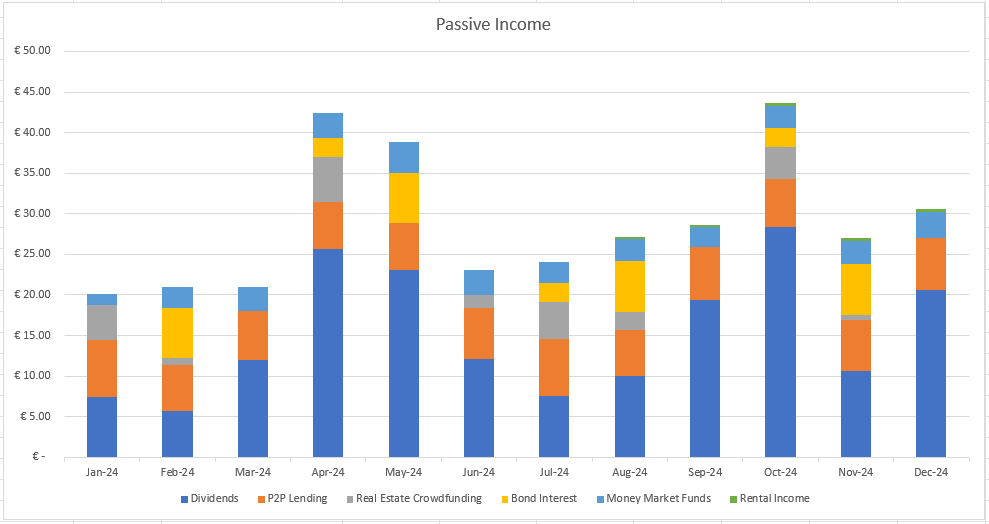

Passive Income Summary

After adding it up, our portfolio generated €30.60 of passive income during December:

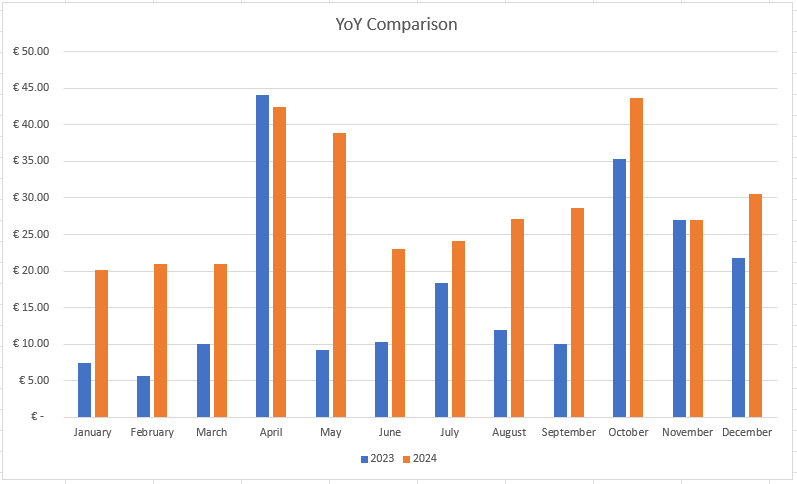

Let’s see how it compares to last year:

I am glad to see that almost every month (with exception of 2 months) saw some significant increase in passive income compared to last year. December was not an exception when we saw a 40% increase compared to 2023.

Investments and Portfolio Contributions

During December, I only managed to allocate €200 for investments.

All this amount went to a local bond investment. The funds are going to be used to finance the constructions of a new Office Centre called “Sąvaržėlė”, located in Vilnius Central Business District. Some details about the offering:

- Interest rate – 8%

- Duration – 2 years

Based on this, I am planning to earn €16 annually, or €32 for the whole period of 2 years, unless the issuer decides to buy out the bonds earlier.

I like the fact that the building is developed by a known company with experience (“Lords LB Asset Management”). Also, there is a collateral offered for bond holders (The 1st rank mortgage over the land plot and the building). So I am not expecting any issues with getting back my investment on this one.

My plan is to have ~5% of my portfolio invested in Bonds and at the beginning of January it stands at 4.83% of the portfolio, so I am happy with my current allocation to this category of investments.

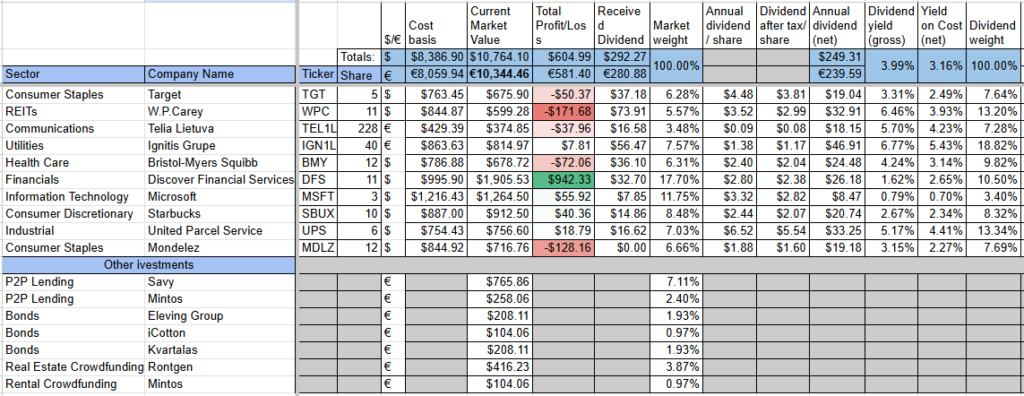

Portfolio Overview

This is how my portfolio looked like on the 1st of January:

I am happy to see that portfolio crossed the €10k mark.

Here’s how it looks like in terms of portfolio composition, compared to desired allocation:

Recently, I removed the “Play Money” category (it had 2% target), as it’s hard to distinguish what would go to this category if it’s some company stock.

My next purchase should go to some REIT or a company from Materials sector.

Summary

Just like that, the year is gone and it’s time to see how it went overall.

I had a goal to earn €365 from passive income during 2024. Unfortunately, I was unable to reach the target and ended the year with €347.42 received, which is 95% of the goal. I am still happy with the result, though, as this is an increase of 64% compared to 2023. It was also a great year for our family and we had a lot of nice moments. As the time goes, I am more and more happy to invest to experiences with family, even if this means that there is less money left for investments.

Let’s see how it goes in the New Year and I wish you a great 2025! Thanks for reading! 🙂

Good luck for the next year! And keep going forward!

Thank you very much EP! Have a great year too! 🙂