Happy New Year everyone!

Just like that, 2025 is over. It was a great year for me and my family. We traveled a lot, attended at least a dozen concerts, and—most importantly—didn’t face any major struggles or losses. That’s something we shouldn’t take for granted.

With the year behind us, it’s time to take a look at how our portfolio performed during the final month of 2025. Let’s get to it.

Dividend Income

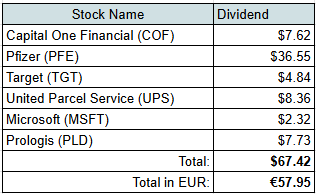

In December, I received dividends from six companies:

This is a record number of dividend payers in a single month for my portfolio. It also includes my first dividend from Pfizer, which alone generated more than half of all dividend income this month. Having a larger position (I own 100 shares of Pfizer) is finally starting to pay off.

Here’s how those dividends stacked up against our actual spending:

- $7.62 – Capital One Financial (COF): covered 13.6% of our Banking expenses over the last 3 months

- $36.55 – Pfizer (PFE): covered 20.5% of our Health expenses for the last month

- $4.84 – Target (TGT): covered 0.2% of our Food expenses over the last 3 months

- $8.36 – United Parcel Service (UPS): covered 0.9% of our Car & Transportation expenses over the last 3 months

- $2.32 – Microsoft (MSFT): covered 0.4% of our Subscriptions & Personal Development costs over the last 3 months

- $7.73 – Prologis (PLD): covered 0.4% of our Mortgage payments over the last 2 months

Seeing dividends gradually cover parts of our everyday expenses is always motivating, even at this early stage of the journey.

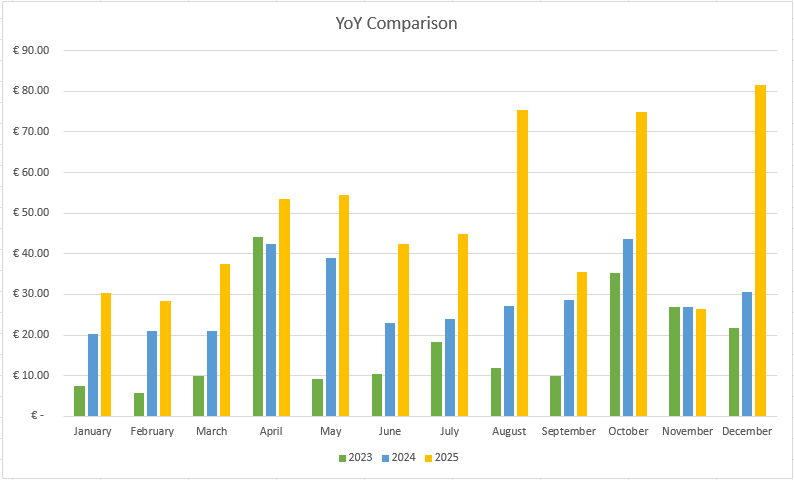

Dividend Year-on-Year Comparison

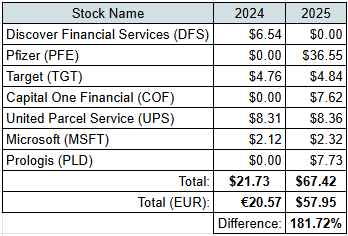

Let’s compare dividend to what we received in December 2024:

Last month was a bit disappointing, as dividend income declined year over year when converted to euros. December, however, delivered a huge rebound. Dividend income almost tripled, increasing from €20 to €58.

The main reasons for this growth were:

- New dividend payers: Pfizer and Prologis

- Capital One Financial: Discover Financial Services was acquired by Capital One, which initially reduced my dividend income. However, Capital One later increased its dividend by a massive 33% and also announced a share buyback program.

- Dividend increases: Target, United Parcel Service, and Microsoft all raised their dividends slightly year over year, further contributing to the growth.

Other Passive Income Sources

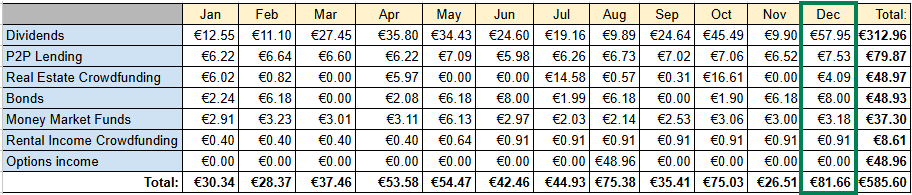

In addition to dividends, we also earned income from several other passive sources in December:

- €7.53 – P2P lending

- €4.09 – Real Estate Crowdfunding

- €8.00 – Bond interest

- €3.18 – Money Market Funds

- €0.91 – Real Estate Crowdfunding (rental income)

Passive Income Summary

After adding everything up, our portfolio generated €81.66 of passive income for December:

This was my best month of the year, and it feels great to end 2025 on such a high note.

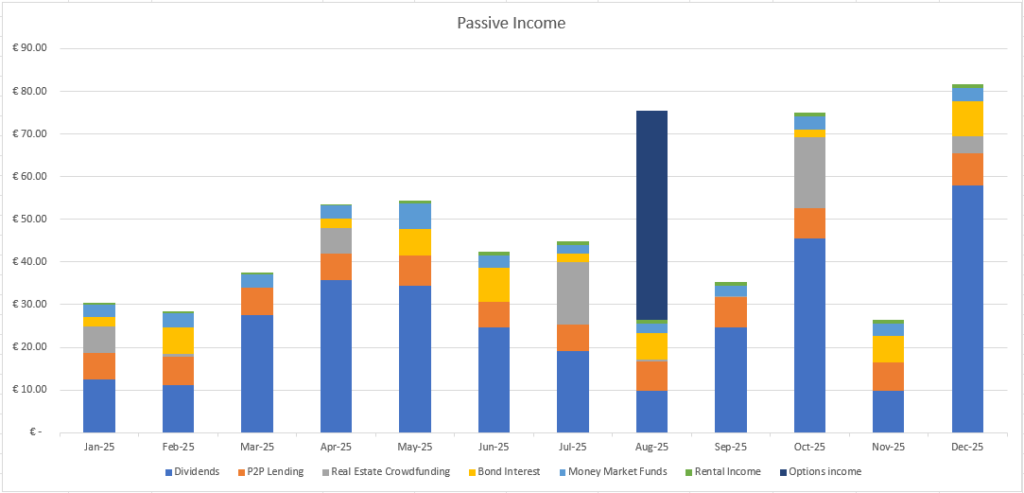

The chart below shows comparison of passive income over years:

We’re getting closer and closer to the €100 per month mark.

Portfolio Contributions and Investments

During December, I didn’t add any new money to my personal investment portfolio.

However, I was lagging behind with contributions to my daughter’s fund. To catch up and reach my annual goal, I invested €700 into her fund in December. For this, I’m using Swedbank’s Robur Access Global Edge fund.

Summary

I managed to finish the year with my strongest month ever in terms of passive income. My original goal for 2025 was to receive €500 in passive income. I ended up comfortably exceeding it, finishing the year with a total of €585.

Now the big question is where to set the target for 2026.

How was your year? Did you manage to reach your goals? I hope you have a fantastic 2026—and as always, thanks for reading! 😊