I have been pretty busy lately, so I am lagging with my blog articles. Nevertheless, it’s time to report results and actions in my portfolio for the second month of the year. Let’s see what happened during February.

Portfolio News

Let me start with some portfolio news that happened during February. In the middle of the month Capital One announced that it will attempt to acquire Discover Financial Services (DFS) in an all-stock transaction valued at $35.3 billion.

Under the terms of the agreement, Discover shareholders will receive 1.0192 Capital One shares for each Discover share. This is a premium of 26.6% based on Discover’s closing price of $110.49 on February 16. Since I own 11 shares of Discover, I should receive 11 shares of Capital One and some cash, unless I sell the shares before merger.

Discover has been the best performer of my portfolio recently, up by almost 50% since November.

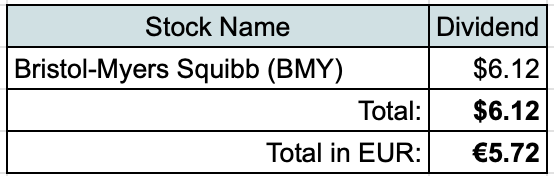

Dividend Income

Just like in previous month, one company paid a dividend to me during February. Bristol-Myers Squibb(BMY) delivered $6.12 after taxes to my investment account. This is an increase of ~5% compared to the previous time they paid out their dividend (in November).

As always, I am comparing received dividends to actual expenses our family incurred:

- €5.72 from Bristol-Myers Squibb would cover 15.2% of our expenses in Health category for the last 3 months.

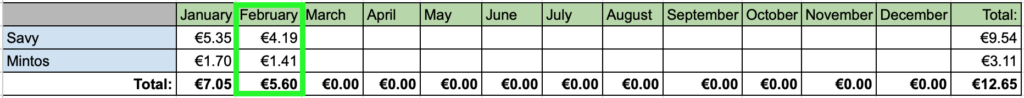

P2P Lending Income

I also received some income from P2P Lending:

€5.60 in interest from P2P lending is smaller than usual because Savy started charging a monthly €1 fee for their service. Even though it’s not much, it’s not a pleasant feeling to get an additional fee added for investments that are not liquid.

Bond Income

Next, I received my first payment from the fractional bond holding I have in Eleving Group. I was paid €6.17 after deduction of taxes this quarter.

Other Passive Income

Finally, I received some small amounts from two additional categories:

- €0.89 interest from Real Estate Crowdfunding;

- €2.55 interest from Money Market Funds.

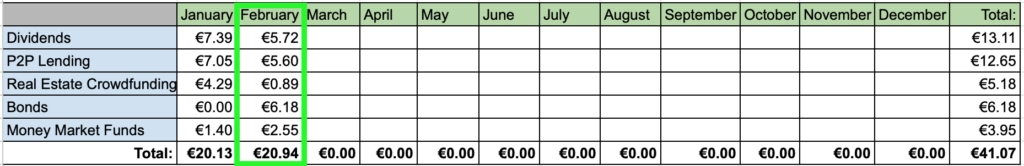

Passive Income Summary

After adding it all up, I received €20.94 from passive income during February:

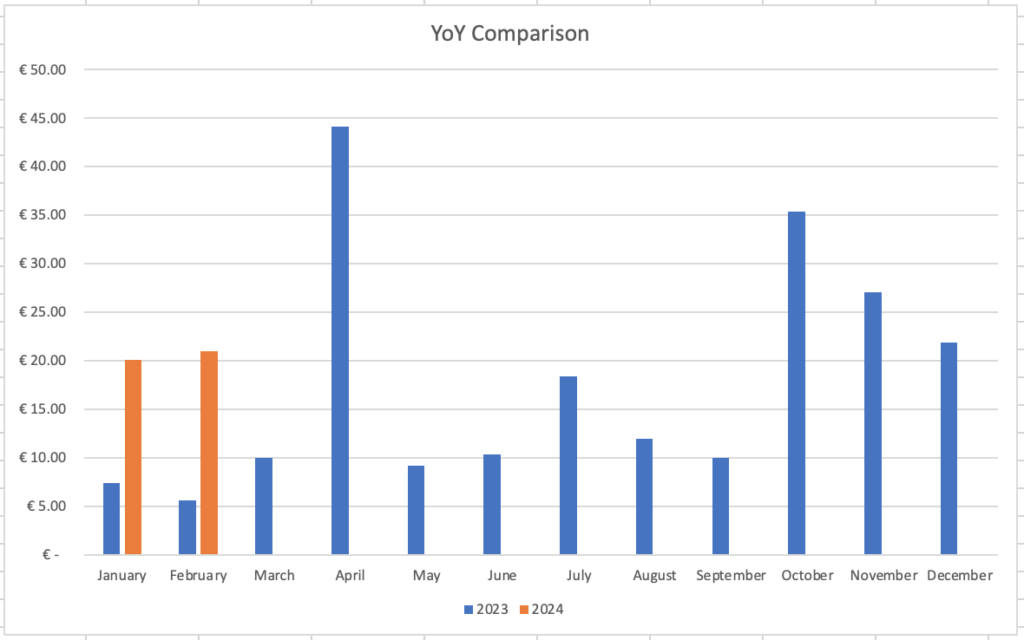

And here’s the comparison to last year. I like to see that the passive income is going to the right direction:

Investments and Portfolio Contributions

During February, I added €400 to my investment account. I used this money and previous savings to add an additional company to our portfolio.

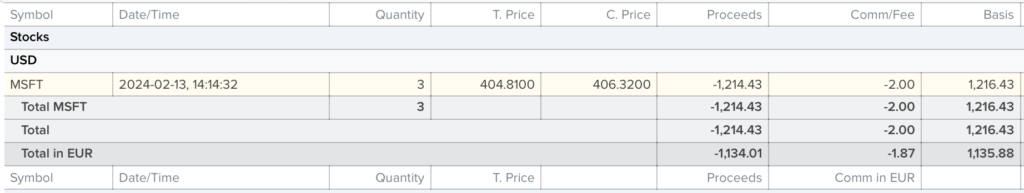

On the 13th of February I bought 3 shares of Microsoft (MSFT) at $404.81/share + $2 in commissions for a total of $1216.43:

Looking at my desired sector allocation, Technology sector was the next one to invest to. I chose to go with the biggest publicly listed company in the world by market capitalization.

Here’s a nice representation of Microsoft’s Income statement, based on its latest earnings report:

Some facts and ratios about the company at the purchase price:

- EPS – $11.06

- P/E – 36.6

- Forward P/E – 35.72

- Dividend Yield – 0.74%

- Dividend Payout Ratio – 25.86%

- Dividend Growth – 19 years

- 5-yr. Dividend Growth Rate – 10.20%

- Net Debt/EBITDA – 0.26

It’s not the cheapest company by any means and it could be overvalued but I think there is some margin of safety as well. I don’t think that Microsoft is going to face any existential threats anytime soon.

The purchase adds $7.65 to my forward annual net dividend income. By coincidence, I purchased the shares one day before their ex-dividend date, so I have already received the first dividend payment a couple days ago.

Portfolio Overview

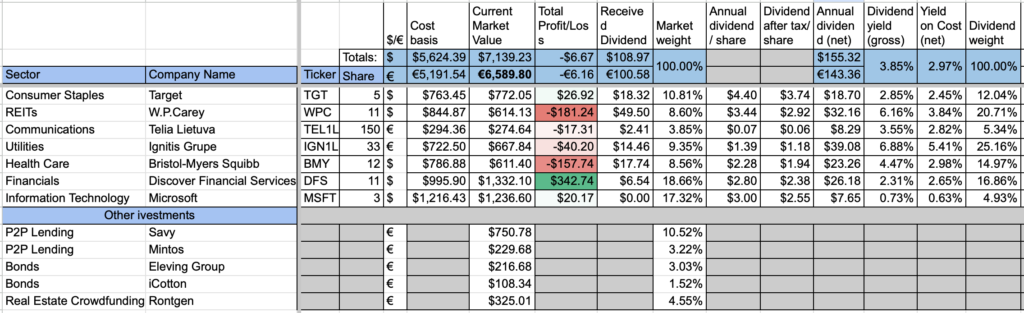

This is how my portfolio was looking at the beginning of March:

After the purchase of some Microsoft shares, I have a representative from yet another sector in my portfolio.

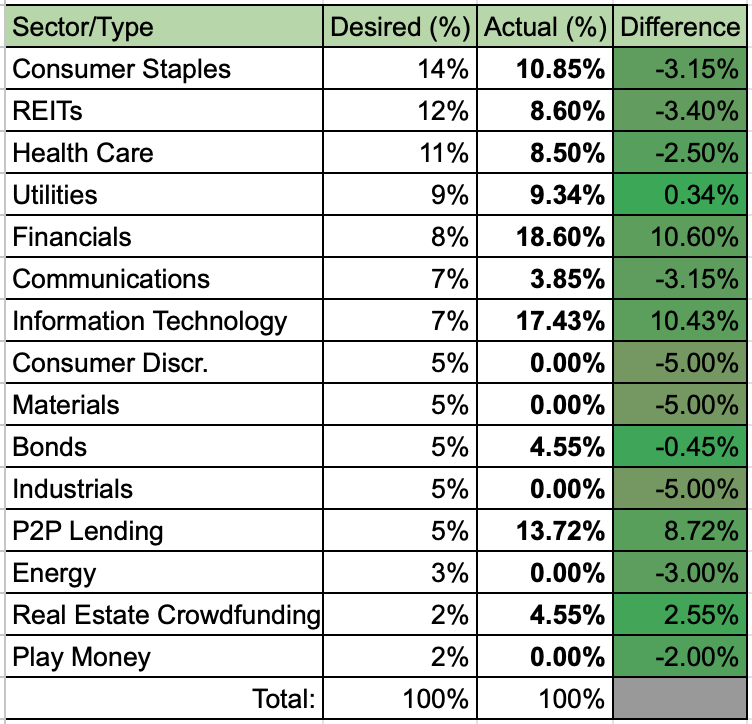

This is how current sector/category allocation is looking compared to desired allocation:

Looking at the above table, my next purchase should go to some company in Consumer Discretionary, Materials or Industrials sector. I am planning to initiate my next buy in April.

Summary

February was quite a nice month. We received north of $20 in passive income again. The year-on-year comparison is looking very nicely, as it more than doubled, compared to the same month in 2023.

I was a little bit hesitant but decided to set a goal to receive €365 from passive income during 2024. With two months gone, I have so far received €41.07, which is 11.2% of my goal and it means that I am behind schedule. I will need to make some moves and increase savings if I plan to achieve this goal.

Let’s see what the next months bring. Thanks for reading! 🙂