Just like that, the first month of the new year is already behind us.

January was a solid month overall. My wife and I managed to squeeze in a couple of dates – a tour of a local prison (surprisingly interesting!) and a stand-up comedy show. Otherwise, it was a quiet month, but in a good, calm way.

Let’s take a look at how much passive income our portfolio generated.

Dividend Income

As always, let’s start with dividends.

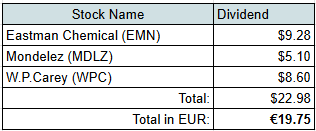

In October, I received dividends from three companies:

These are the same U.S. dividend payers that showed up three months ago, with very similar amounts. No surprises here – we’ll look at the year-over-year comparison later.

Here’s how those dividends compare to our real-life expenses:

- $9.28 – Eastman Chemical (EMN): Covered 1.1% of our Home expenses over the past 3 months.

- $5.10 – Mondelez (MDLZ): Covers 2.0% of our Sweets expenses over the last 3 months.

- $8.60 – W.P.Carey (WPC): Covers 0.8% of last month’s Mortgage payment.

The percentages are still small. For now, this is mostly a game – but I fully expect dividends to cover a much larger portion of our family’s expenses in the future.

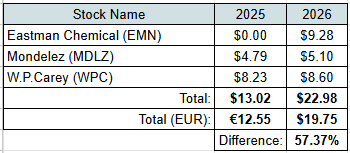

Dividend Year-on-Year Comparison

Here’s how January 2026 dividends compare with January 2025:

- One new dividend payer (Eastman Chemical) was added compared to last year.

- The remaining two companies increased their dividends.

As a result, total dividend income in January grew by 57% year over year.

Other Passive Income Sources

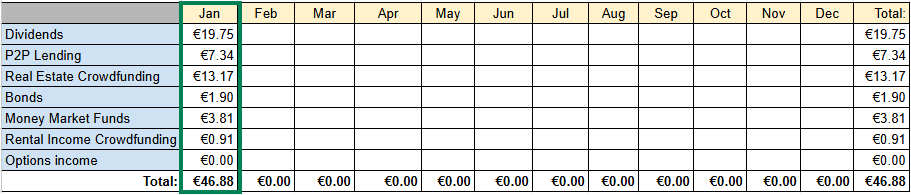

In addition to dividends, we earned income from several other passive income sources:

- €7.34 – P2P lending

- €13.17 – Real Estate Crowdfunding

- €1.90 – Bonds

- €3.81 – Money Market Funds

- €0.91 – Real Estate Crowdfunding (Rental Income)

This is exactly why diversification matters – if one income stream slows down or disappears, the others keep working.

Passive Income Summary

Altogether, the portfolio generated €46.88 of passive income in January:

I really can’t complain, especially considering the diversification: income came from six different sources.

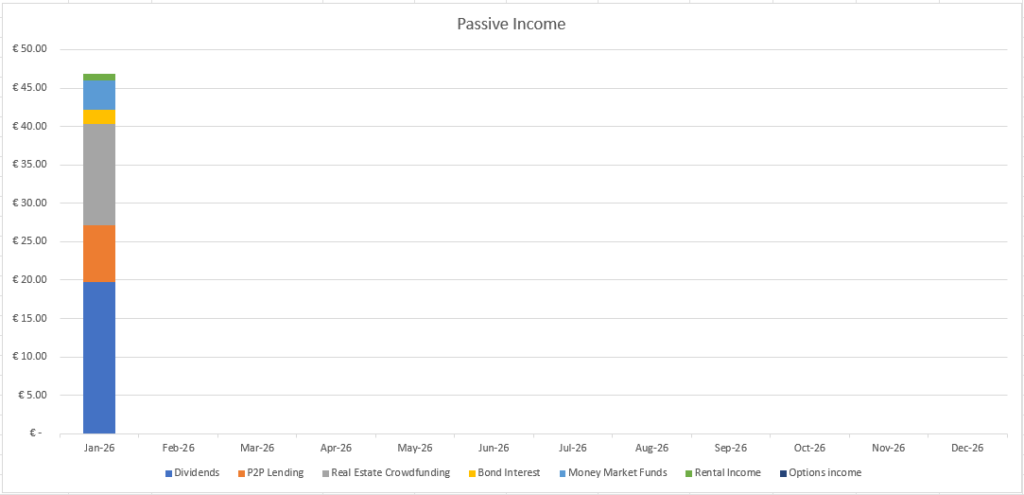

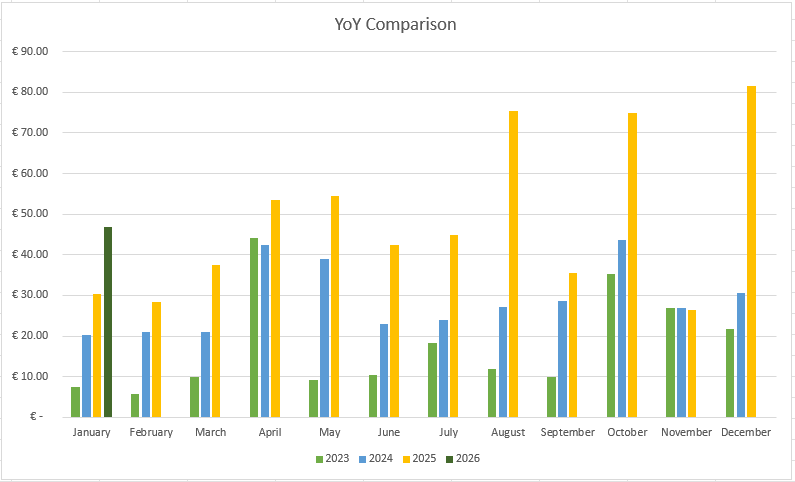

This chart below shows comparison of passive income over years:

Compared to January last year, total passive income increased by 54%. A great way to start the year – let’s keep the momentum going.

Portfolio Contributions and New Investments

During January, I contributed €600 to my investment accounts:

- €500 – Stock portfolio (Interactive Brokers)

- €100 – Real estate crowdfunding

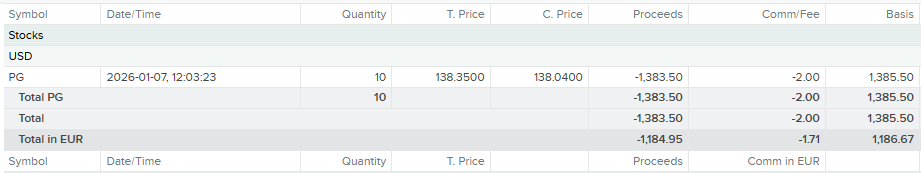

Using these contributions and some existing cash, I added a new company to my portfolio: Procter & Gamble (PG).

I wanted to increase my exposure to the Consumer Defensive sector and decided to go with a Dividend Aristocrat – companies that have increased their dividend for at least 25 consecutive years.

Why Procter & Gamble?

Procter & Gamble is a global consumer staples company behind everyday brands like Tide, Pampers, Gillette, and Crest. It sells essential household and personal care products in more than 180 countries, and its scale, brand strength, and steady cash flows make it a classic defensive, income‑focused holding.

On 7th of January, I bought 10 shares for a total of $1,385.50 (including commission):

Key stats at my purchase price:

- Dividend yield – 3.06%

- 4 Year avg. dividend yield – 2.48%

- Payout ratio – 60.62%

- Dividend Growth – 69 years!!

- 5 year dividend growth rate – 5.97%

- P/E (TTM) – 23.09

- Net Debt/EBITDA – 1.1

This is a very stable business, so I’m not expecting fireworks. Interestingly, the stock is already up about 15% since my purchase – a nice bonus – but I’m in this one for the long run, so short‑term price moves don’t matter much.

This purchase adds $35.95 to my net annual forward dividend income.

Real Estate Crowdfunding Activity

I also received about €300 back from real estate crowdfunding investments.

During the month, I invested €400 into three new projects, resulting in a net investment of €100. This should add approximately €6.98 to our annual passive income.

Summary

Overall, it was a great start to the year. I’m happy to see passive income growing year over year, and I’m continuing to add capital to keep that momentum going.

My goal for 2026 is to earn €750 in passive income. That means averaging €62.50 per month. After January, I’ve completed 6.2% of that goal – slightly behind schedule – but stronger months lie ahead, and additional investments should help close the gap.

How was your month? Did you get off to a strong start this year?

Thanks for reading 🙂