Just like that the summer is gone. I am still trying to catch up with my passive income monthly summaries. August is already over, but first of all let me show you what my portfolio delivered during July.

Dividend Income

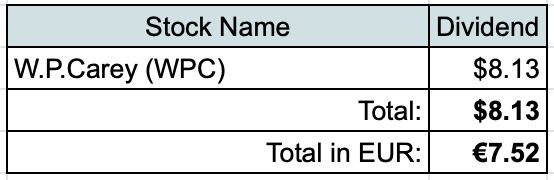

As always, let’s start with dividend income. A single company paid dividend during July:

I got used to at least 3 companies paying dividend in a month but there are not a lot of companies that pay on the first month of the quarter.

As usual, let’s compare received dividend to our actual monthly expenses:

- $8.13 from W.P.Carey (WPC) would cover 0.2% of our Mortgage payments for the last 3 months.

P2P Lending Income

As always, some income was generated from P2P lending:

€7.10 in interest is pretty similar to previous months, but it’s actually the biggest amount so far this year by a small margin. My P2P lending portfolio is still on autopilot and I am not contributing any new funds to it for some time now.

Other Passive Income

Finally, some additional passive income was received from a few more categories:

- €4.46 from Real Estate Crowdfunding;

- €2.37 interest from a partial bond I own;

- €2.61 from Money market funds.

Passive Income Summary

After adding it all up, I received €24.06 from passive income during July:

Here’s a better visualization with comparison of different categories of income:

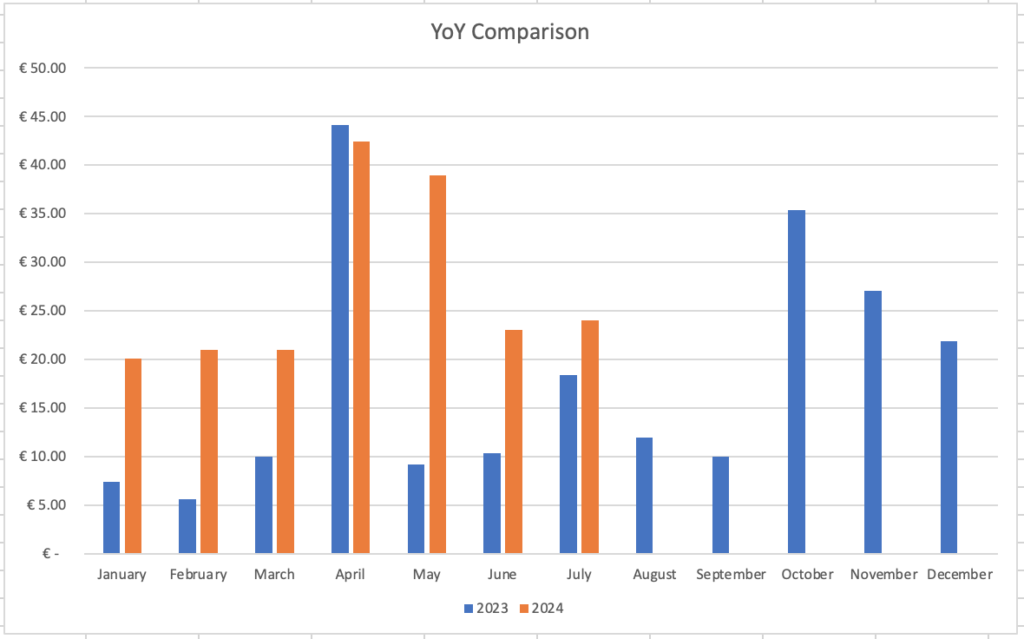

Finally, here’s a comparison year-over-year:

Not such a big difference compared to previous couple of months, but it’s still ~31% higher compared to July 2023 when I received €18.37.

Investments and Portfolio Contributions

During the month of July I added €300 to investment accounts.

I initiated one purchase during the month. On the 24th of July, I bought 6 shares of United Parcel Service (UPS) at $125.40/share (+$2 commissions) for a total of $754.43.

I was looking to purchase some company from the Industrials sector and UPS looked like an attractive opportunity. The price of UPS shares dropped by ~11% after they reported earnings and I couldn’t resist to try and catch the falling knife. They are down by ~19% so far this year and I hope that the trend is going to reverse at some point. We’ll see if this plays out in the long run.

Some details about the company at my purchase price:

- P/E – 20.5

- Forward P/E – 17.79

- Dividend yield – 5.2%

- Payout ratio – 106%

With their latest earnings, they payout ratio doesn’t seem safe, as they are paying out more than their net profit per share for the last 12 months. So I am hoping that their earnings will recover.

This purchase increases our forward net annual passive income by $33.25.

Summary

July was not a bad month, with passive income surpassing €20 again. It’s also nice to see that passive income is growing year over year. Furthermore, another stock was added to our portfolio which will generate additional income going forward.

Looking at the year so far, we received €190.43 from passive income. This represents 52% of my goal to receive €365 from passive income during 2024. With 58% of the year gone, I am falling behind schedule even more and the goal will probably be too optimistic to accomplish. However, the hope is not lost yet and we will see what the next months bring.

Thanks for reading! 🙂