June was a fantastic month for us! My wife and I attended three music concerts, I competed in my first triathlon of the year, and we spent a relaxing week on the beautiful Greek island of Crete. It was definitely a busy month — but in the best possible way.

While we were out enjoying life, our investment portfolio was quietly working in the background, generating passive income. Let’s take a look at how it performed in June.

Dividend Income

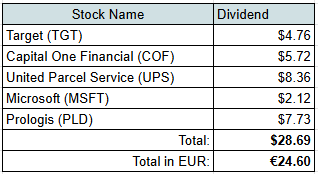

Let’s start with dividend income:

Just like three months ago, five companies paid us dividends. There was just one change: instead of a dividend from Discover Financial Services, we received one from Capital One Financial. That’s because the acquisition of Discover by Capital One was finally completed.

Luckily, I had bought shares of Discover before the acquisition news — and the stock price more than doubled following the announcement. As a result, I now own 11.2 shares of Capital One Financial.

Now, let’s see how these dividends compare to our actual spending:

- $4.76 from Target (TGT) — covered 0.3% of our Food expenses over the last 3 months

- $5.72 from Discover Financial Services (DFS) — covered 29.3% of our Banking expenses over the last 3 months

- $8.36 from United Parcel Service (UPS) — covered 1.2% of our Car & Transportation expenses over the last 3 months

- $2.12 from Microsoft (MSFT) — covered 1.6% of our Subscriptions & Personal Development costs over the last 3 months

- $7.73 from Prologis (PLD) — covered 0.3% of our Mortgage payments over the last 2 months

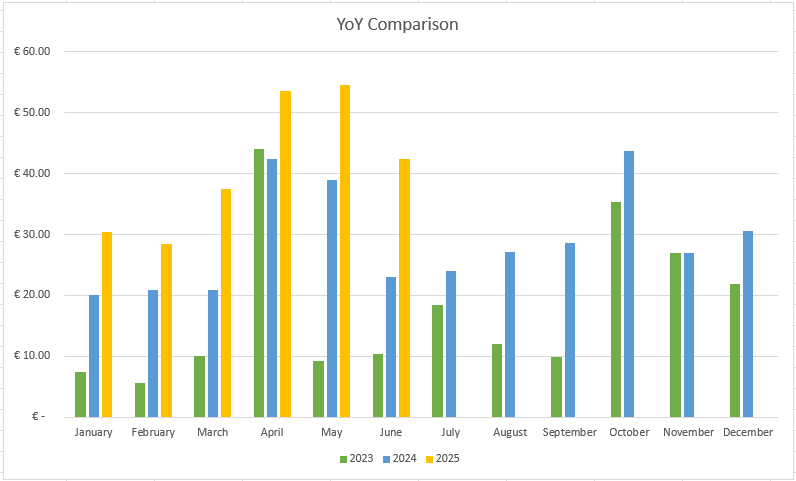

Dividend Year-on-Year Comparison

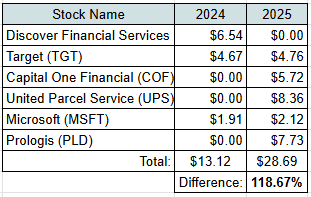

Let’s compare dividend to what we received June last year:

Compared to June last year, our dividend income more than doubled. This growth came mainly from two new holdings: UPS and Prologis. Additionally, both of our existing holdings raised their dividends. While Capital One’s payout was slightly lower than Discover’s, it didn’t offset the overall growth.

Other Passive Income Sources

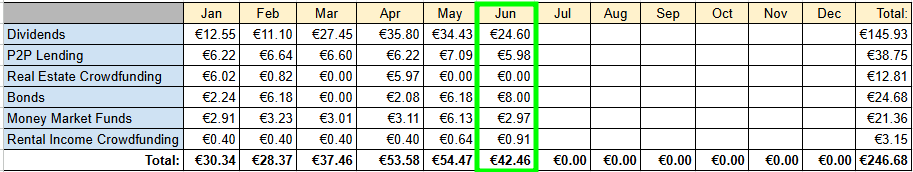

Beyond dividends, we also earned from other income streams:

- €5.98 – P2P lending

- €8 – Bond interest

- €2.97 – Money Market Funds

- €0.91 – Real Estate Crowdfunding (Rental Income)

Passive Income Summary

Altogether, our portfolio generated €42.46 in passive income this month:

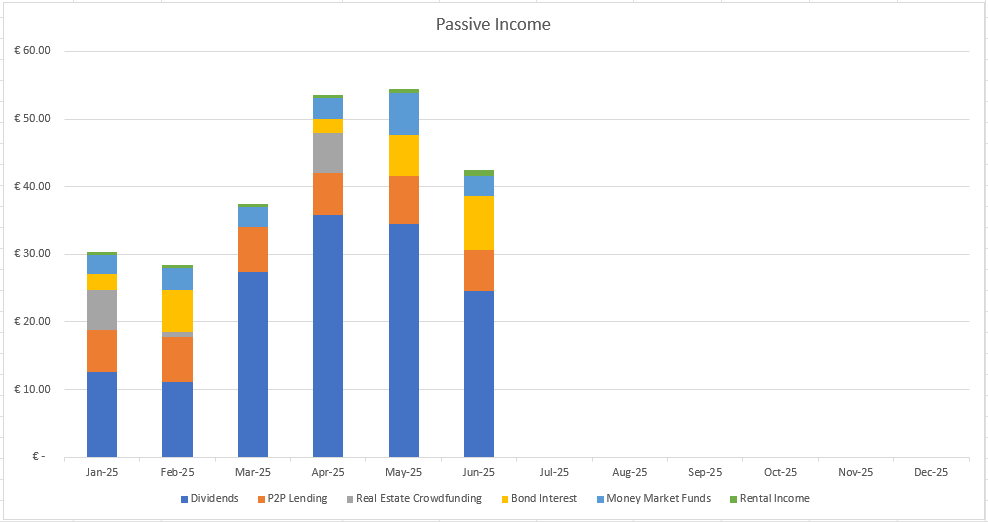

Here’s a quick look at how that compares to last year:

I love seeing those yellow bars on the chart climbing higher each month!

Investments and Portfolio Contributions

We contributed €600 to our investment portfolio in June.

- €100 was invested in another Real Estate Crowdfunding project:

- 12-month term

- 6.5% expected yield

- Estimated return: €6.55 if all goes as planned

- The remaining €500 was added to my Interactive Brokers account and is waiting for the right opportunity. More updates to come in my July summary!

Summary

With June behind us, we’re officially halfway through the year!

My goal for 2025 is to earn €500 in passive income. So far, we’ve collected €246.68, or 49% of that target. That puts us almost exactly on track — and I’m confident the second half of the year will push us past the finish line.

Thanks for reading! If you’ve had any wins, updates, or just want to say hi — feel free to drop a comment. I’d love to hear from you!