Welcome to another monthly review of our portfolio. I have to say that it was a great month. We had a short getaway to a local aqua-park at the beginning of the month. Also, I got promoted from IT Engineer to IT Architect at my work. It brings additional responsibilities and stress, but also some interesting challenges and constant development, so I am happy with the change.

Now let’s see how much passive income we received during the first month of Spring.

Dividend Income

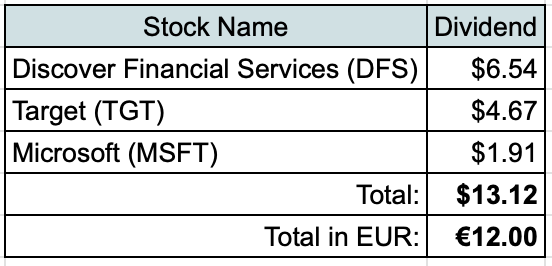

I had 3 companies paying dividend to me during March:

I am happy to see 3 payers in a month. It’s been a while since I had more than 2 dividend payments during a single month.

As always, I am comparing received dividends to actual expenses of our family:

- $6.54 from Discover Financial Services (DFS) would cover 40.1% of our expenses in Banking category for the last 3 months;

- $4.67 from Target (TGT) would cover 0.3% of our Food expenses in the first quarter;

- $1.91 from Microsoft (MSFT) could pay 0.5% of Subscriptions and Personal Development category for the last 3 months.

P2P Lending Income

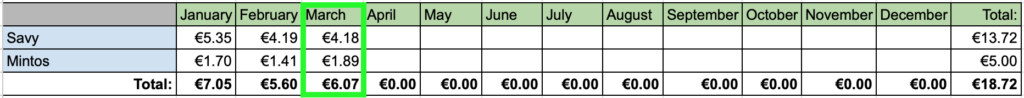

Next, I received some income from P2P lending:

Nothing new here, just average amount of interest payments from my investments in this category.

Money Market Funds

Finally, I received some interest from Money Market Funds from some savings accounts. This month, it added €2.90 to our passive income.

Passive Income Summary

After adding it all up, we received €20.97 in passive income during March.

I like to see that Passive Income surpassed €20 for 3 months in a row. Let’s see if we can continue the trend.

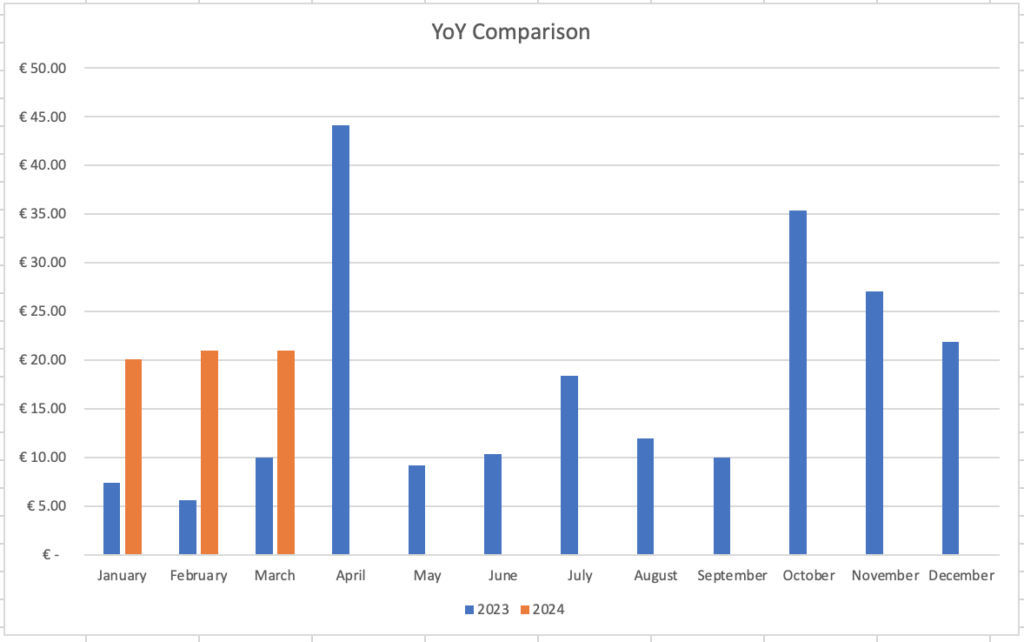

Here’s a comparison to passive income of last year:

Again, passive income more than doubled compared to the same month last year. I will not be able to continue this trend, however, as April’s income was pretty high last year and I no longer have the bond which generated most of the income in April 2023. The question is if I will be able to match the number of last year, but this could be hard to achieve.

Investments and Portfolio Contributions

During March I haven’t done any new investments. I contributed €400 to my investment accounts and should be able to buy something in April.

Portfolio Overview

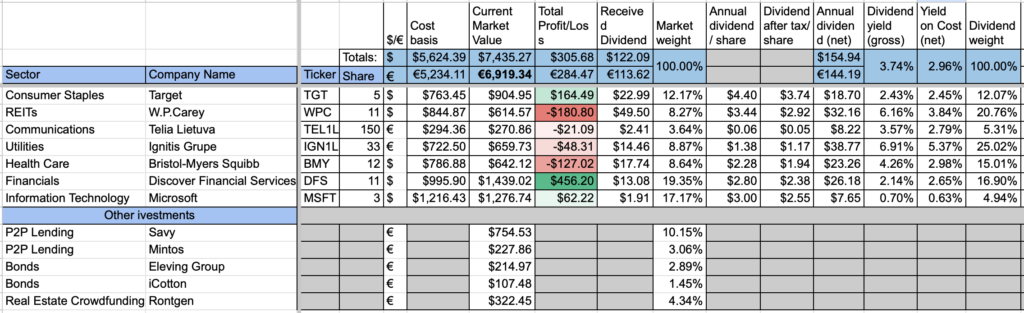

This is how my portfolio looked like on the 1st of April:

Compared to the beginning of March, portfolio grew by ~€300 as a result of market movement. It is approaching €7k mark and it should be crossed during April if everything goes according to plan and I buy something new to be added to our portfolio.

Also, for the first time since I restarted our investing journey in December 2022, the stock portfolio result is in green and profit on paper shows almost €300. This shows the power of patience and continuous investing.

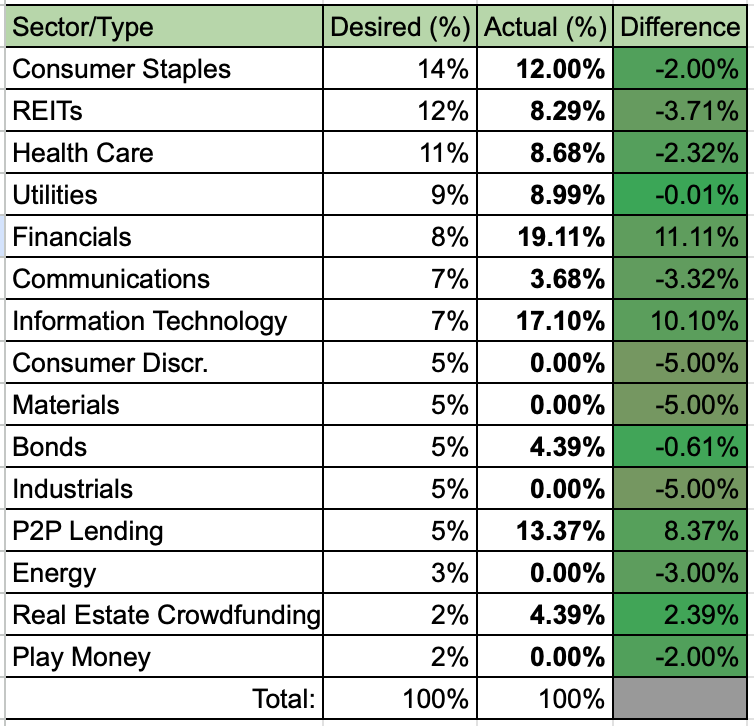

This is how current sector/category allocation is looking, compared to desired allocation:

My next purchase should go to some company in Consumer Discretionary, Materials or Industrials sector.

Summary

Another month flew by and I am pretty happy with the results. Even though the numbers are still pretty low, the progress from last year is undeniable.

So far in 2024, we received €62.04 in passive income. Looking at my goal to earn €365 in passive income, I am falling further behind. With 25% of the year gone, we have only reached 17% of the goal so far. I will need to make some moves to get closer to the target. We will see how it goes when the year progresses.

Thanks for reading! 🙂