I managed to save up some funds and am looking for ways to employ my money. I think it’s a good idea to set up a list of a few stocks that look interesting and try to find the best choice. This is my second watchlist and I received some comments with suggestions to my previous one. I decided to include a couple of companies that were suggested by fellow investors this time. So these are the stocks I am considering to add to my portfolio at the moment:

- Kraft Heinz Company (KHC). Who doesn’t like Heinz ketchup? I bet that some of Kraft Heinz products are in refrigerators of most of my readers at the moment. Even with the strong products they own, the price of KHC declined by ~37% during the last 12 months. It happened due to decreasing sales of its main products. However, with KHC being the second biggest holding in Warren Buffett’s Berkshire Hathaway portfolio, I trust that the business is not going to fade away and necessary steps will be taken to put it back on track. This is what Warren Buffett had to say about the current performance of the stock:

“The short term doesn’t make much difference to us, because we will be in this stock forever. This is a business with us. It’s not really a stock…It’s where the new Kraft Heinz Co. is 10, 20, 50 years from now that counts to Berkshire. These are brands I liked 30-plus years ago, and I like them today. And I think I’ll like them 30 years from now.”

I fully agree with this kind of thinking, as this is exactly what we need as dividend growth investors. I like investing to a company and staying with it for a long time, without worrying about short-term fluctuations.

- Apple (AAPL). If you asked me two years ago, I would not have thought of Apple as a possible addition to my portfolio. It just didn’t look like a suitable stock for dividend growth investors. However, it is more and more appealing to me. Even with investors being worried about slowing sales of iPhones, the company is sitting on loads of cash, and is constantly increasing its dividend. Even though the yield is still pretty low at 1.57%, its 5-year dividend growth rate stands at 33.8%. I recently read a short article that investors cut their Apple holdings by most since 2008 but guess who is buying the stock? You guessed it right – it’s Warren Buffett who is now company’s third largest investor! It’s one more reason to seriously look into the company and consider adding it to my portfolio.

- Pfizer (PFE). This was one of the companies that fellow investor P2035 bought recently. I guess most of the people are familiar with the company but just in case, the company describes itself as “a research-based, global biopharmaceutical company.” It owns a lot of well-known products, From Robitussin cough syrup to Viagra for erectile dysfunction. Due to its moat and constant dividend payouts, it is liked by dividend growth investors as well. With current yield of 3.82% and payout ratio of 35.60%, I wouldn’t mind having the company in my portfolio. I will need to investigate it more to see how it may look in the future.

- Brookfield Renewable Partners (BEP). This was one of the suggestions by Mr. Robot in comments of my previous watchlist. I decided to investigate the company a little as I wasn’t familiar with it. Brookfield Renewable operates renewable power generation facilities around the world. This is a business I like and it would feel good to own a company that only invests to green energy. Current dividend yield is amazing (6.23%). However, with a negative Earnings per Share (EPS), I am afraid that it may not be sustainable in the long run. The company is also considered as a bond proxy stock, so when the treasury bonds yield is rising, the company’s price suffers. Currently, the interest rate is rising, so I guess it does not look good for BEP. So it’s definitely a company I would like to track but I think that now is not the best time to enter into this position.

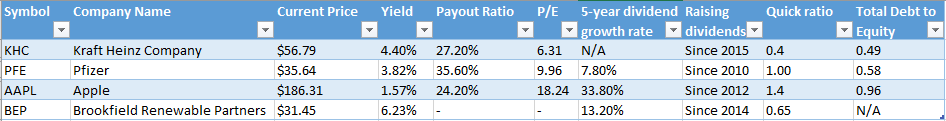

This is a short summary about key indicators I was able to find about above companies:

What do you think about my selected companies? What would be your first choice at the moment? Please leave a comment below and thanks for reading! 🙂

Hey BI, thanks for the mention! I discussed BEP over at Mr. ATM’s blog and he had the following to say regarding BEP:

“I don’t follow BEP but a quick glance tells me it is a Limited Partnership and not a corporation. It is not a regulated utility either and therefore dividends are not dividends but rather distributions. It buys and sells energy assets taking advantage of up and down cycles.

Also, because it is a LP, you need to look at FFO and not earnings. Company is based in Bermuda (a negative for me).

It does have a decent credit rating of BBB+ with a 38% debt/cap. FFO has been negative for past several years and finally positive growth in 2017.

Because BEP is a LP, its dividend is actually called a distribution which has a pass-through tax implication. Shareholders or partners are responsible for paying all the taxes, the US shareholders get K-1 form instead of 1099. I hate K-1 forms.

I can only pull up history going back to 2012 and it shows annl. ROR of 7% which seems pretty good. But the history is not long enough for me to compare it to blue chip utilities.

The yield is around 6.3% which is very high and likely full of risks.

I personally don’t like LPs or MLPs, especially if they are based off Bermuda, Bahamas, or Cayman Islands and stay clear of them. I got my reasons based on having experienced investing with them in the past. Maybe I watch too much American Greed on CNBC, ha 😉

To feed your green side, why not invest in utilities like NEE? It has a annual Total ROR double the size of S&P return for the past 19 years. Of course, the dividend yield is much lower but that’s because it is one of the highest quality utilities out there.

For long-term investing, quality matters the most because you want the company and its dividend to not only sustain but grow over that long period. A risky company tends to cut its dividend or may even go bankrupt during economic or industry downturns and thus not a good long-term investment, in my opinion.”

Hi Mr. Robot,

Thanks for the share, I also noticed that the company is based in Bermuda when looking at their financial reports. I believe I would not even be able to invest into it even if I wanted with my current broker, so I will need to cross this one out of my list 🙂

-BI

Nice list bought KHS and PFE latly. Also sufest looking at PG, JNJ they are on my WL 🙂

Thanks P2035,

PG and JNJ are good buys anytime, I would say. I already own some of PG, would love to have JNJ as well 🙂