It’s almost the middle of July and I haven’t found time to report my passive income for May. It’s better late than never, so I sat down to report what happened during May.

On a personal front, we had an emergency because our daughter broke her hand. She spent a night in the hospital, got a cast and it was a stressful period for us. Fortunately, it healed well, and it is all behind us already.

Now let’s see what the month brought in financial terms.

Dividend Income

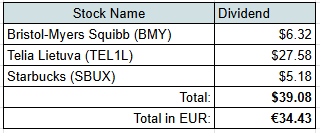

During May, just like in April, three companies in my portfolio paid out dividend:

As always, let’s compare received dividends with our actual expenses:

- $6.32 from Bristol-Myers Squibb (BMY) – covers 18.1% of our Health expenses over the past 3 months.

- €24.31 from Telia Lietuva (TEL1L) – covers 5.6% of our Internet & TV bill over the last 12 months. It’s nice to receive some money back from the same company I am paying to for services.

- $5.18 from Starbucks (SBUX) = covers 0.7% of our Eating Out expenses over the last 3 months.

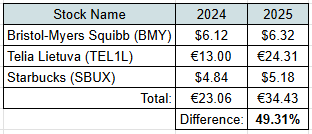

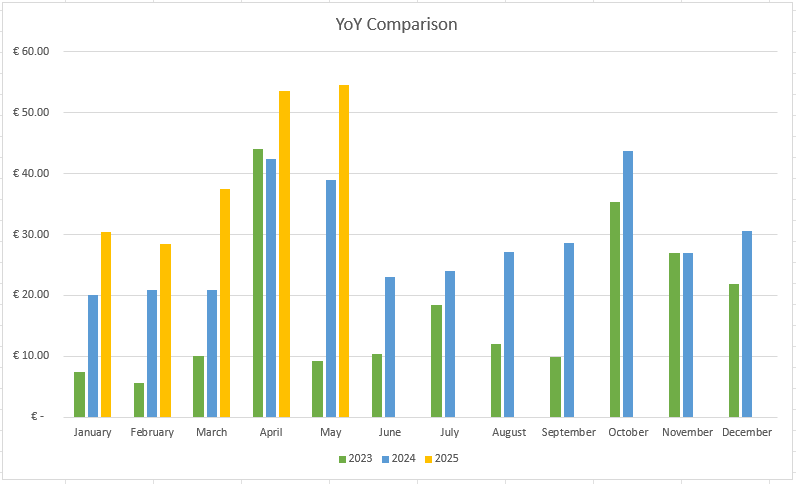

Dividend Year-on-Year Comparison

Compared to May last year, our dividend income grew by whopping 49%!

This jump is mainly thanks to:

- Purchasing more shares and increased dividend from Telia Lietuva

- Small dividend increases from Bristol-Myers Squibb and Starbucks

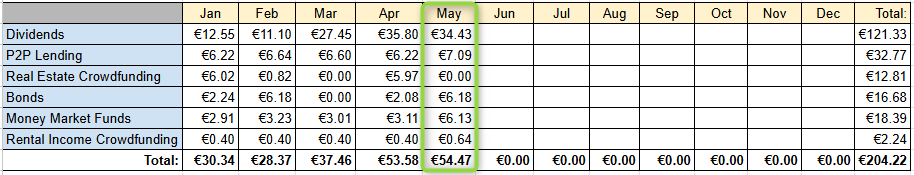

Other Passive Income Sources

We also received some income from a few alternative investments:

- €7.09 – P2P lending

- €6.18 – Bond interest

- €6.13 – Money Market Funds

- €0.64 – Rental Income Crowdfunding

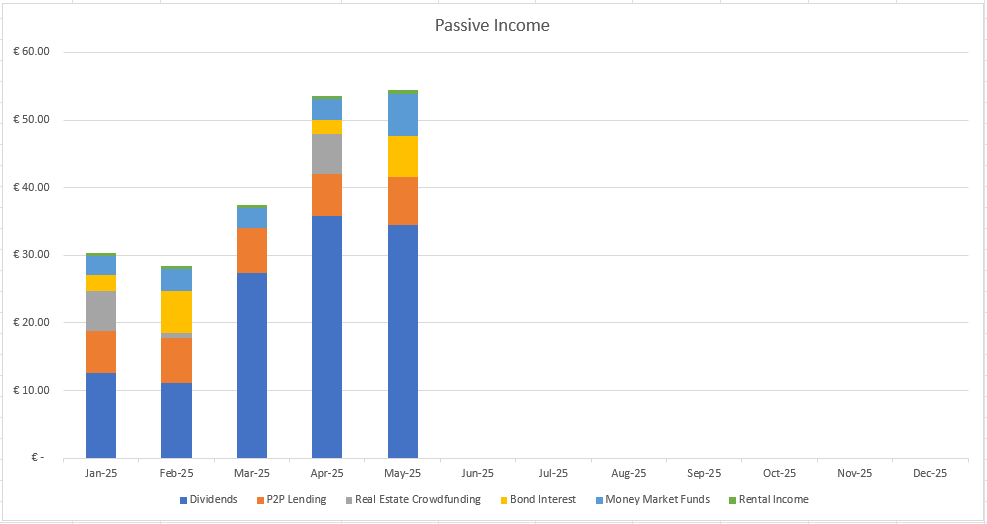

Passive Income Summary

After adding it up, our portfolio generated €54.47 in passive income during the month:

Here’s a comparison to previous years:

That’s a 40% increase compared to May 2024. It’s great to see such a growth year over year.

Portfolio Contributions & Investments

We contributed €600 to our investment portfolio in May.

I made a few small investments using part of the above contributions.

Stocks

- 2 shares of Ignitis Group (IGN1L) at €21.25 each for a total of €42.50. This adds €2.25 to forward annual dividend income.

- 50 shares of Telia Lietuva (TEL1L) at €1.635 each for a total of €81.75. This adds €4.67 to forward annual dividend income if the dividend stays the same as paid out this year.

Real Estate Crowdfunding

I invested €100 to a real estate crowdfunding project:

- 12-month term

- 6.5% yield

- Expected return: €6.43 if all goes well

Summary

May marked another record for passive income by slightly surpassing the previous one set in May.

Our passive income for the year stands at €204.22, which is 40.8% of our €500 goal for 2025. With May marking 42% of the year completed, I am slightly behind schedule but I am catching up.

How was your month? Are you on track to reach your financial goals for the year? I would love to hear from you in the comments!