It’s been a while since I posted an analysis of a stock in my blog. This time it is going to be about a company in a sector which was the worst performing sector in 2019 and a laggard in general for the last 5-10 years. That sector is Energy. ESG investing got very popular lately and oil companies are beaten down. However, I don’t think it is the end for oil companies yet and they may still come back, for at least the next 10 years. So I decided to look more deeply into a name which was especially discussed in media this year.

That company is Occidental Petroleum (OXY).

Company Profile

Sector: Energy

Industry: Oil & Gas E&P

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally. The company operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. Occidental Petroleum Corporation was founded in 1920 and is headquartered in Houston, Texas.

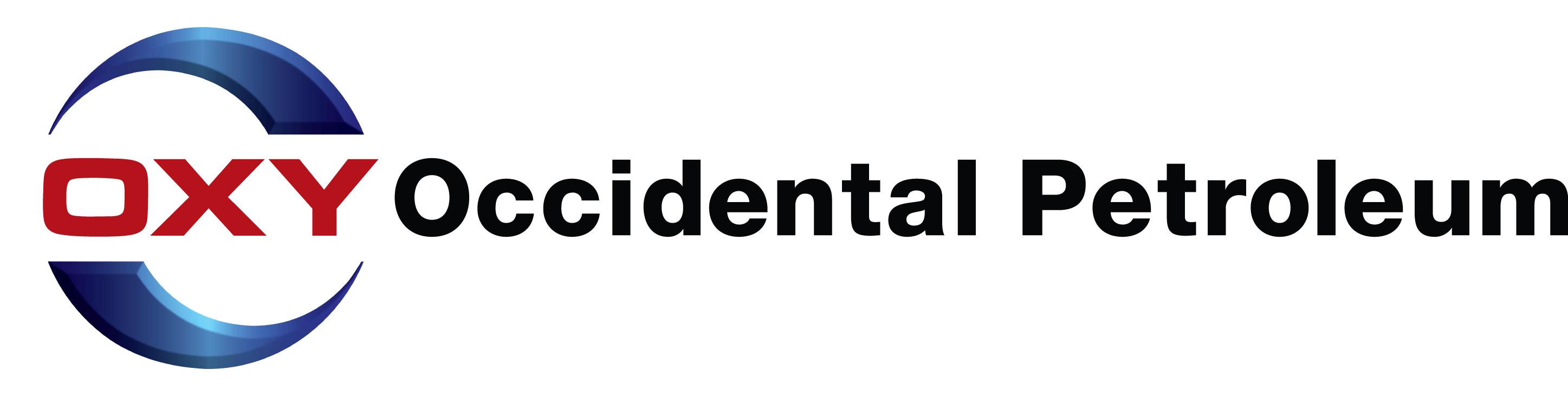

This is a nice representation of main assets Occidental currently holds:

Acquisition of Anadarko Petroleum

The biggest news about the company during the last year was its acquisition of Anadarko Petroleum. Back in April 2019 Occidental Petroleum made a hostile bid of $56B (or $38B excluding debt of Anadarko) and won the bidding war against Chevron. This move was not greeted well by analysts and investors. Stock price of OXY declined by more than 40% since then:

The bidding process was quite interesting. Two initial offers by Occidental Petroleum were rejected by Anadarko. They have already accepted Chevron’s offer worth about $63.50/share. But then Occidental made another offer of around $76/share.

Interestingly, this was not the end. At first, the offer was 50/50 cash and shares which would leave Anadarko shareholders with 29% of the combined company. However, then Warren Buffett’s Berkshire Hathaway came in with some additional cash to back the deal. Berkshire invested $10bn in new preferred shares that would pay 8% dividends. That sounds like a good deal for Mr Buffett but not that great for shareholders of common shares of OXY at the time of the deal. Occidental raised the proportion of cash to 80% of the deal with these additional funds. This made sure that existing shareholders of Occidental would not be able to block the deal. It made the deal sweeter for Anadarko as well, as getting more cash instead of Occidental shares is less risky.

This was all to acquire highly-priced US shale oil assets in Permian Basin. Anadarko has drilling rights on around 250,000 acres of the Permian. It is one of the cheapest places to drill oil in the world. Drillers are still profitable if the price of oil does not drop below $50/barrel. Vicky Hollum, Occidental Petroleum’s CEO, claims that the company is best suited to take advantage of costs savings when combining Anadarko’s assets with Occidental’s knowhow.

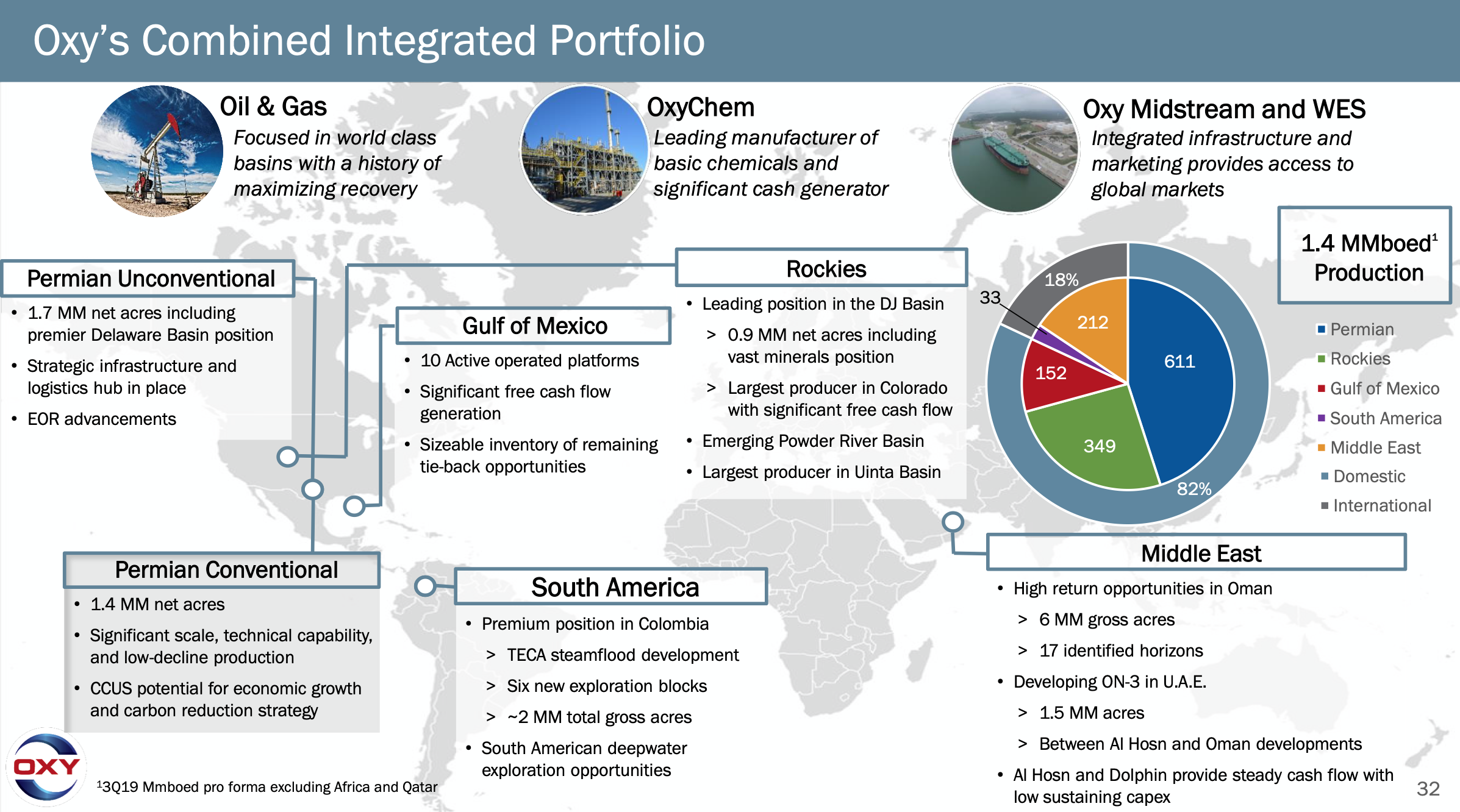

I have to say that Ms Hollum is not bragging without a reason. When presenting results of the last quarter of previous year, Occidental showed their operating expenses per barrel of extracted oil in Permian Basin. The costs were reduced drastically throughout the years:

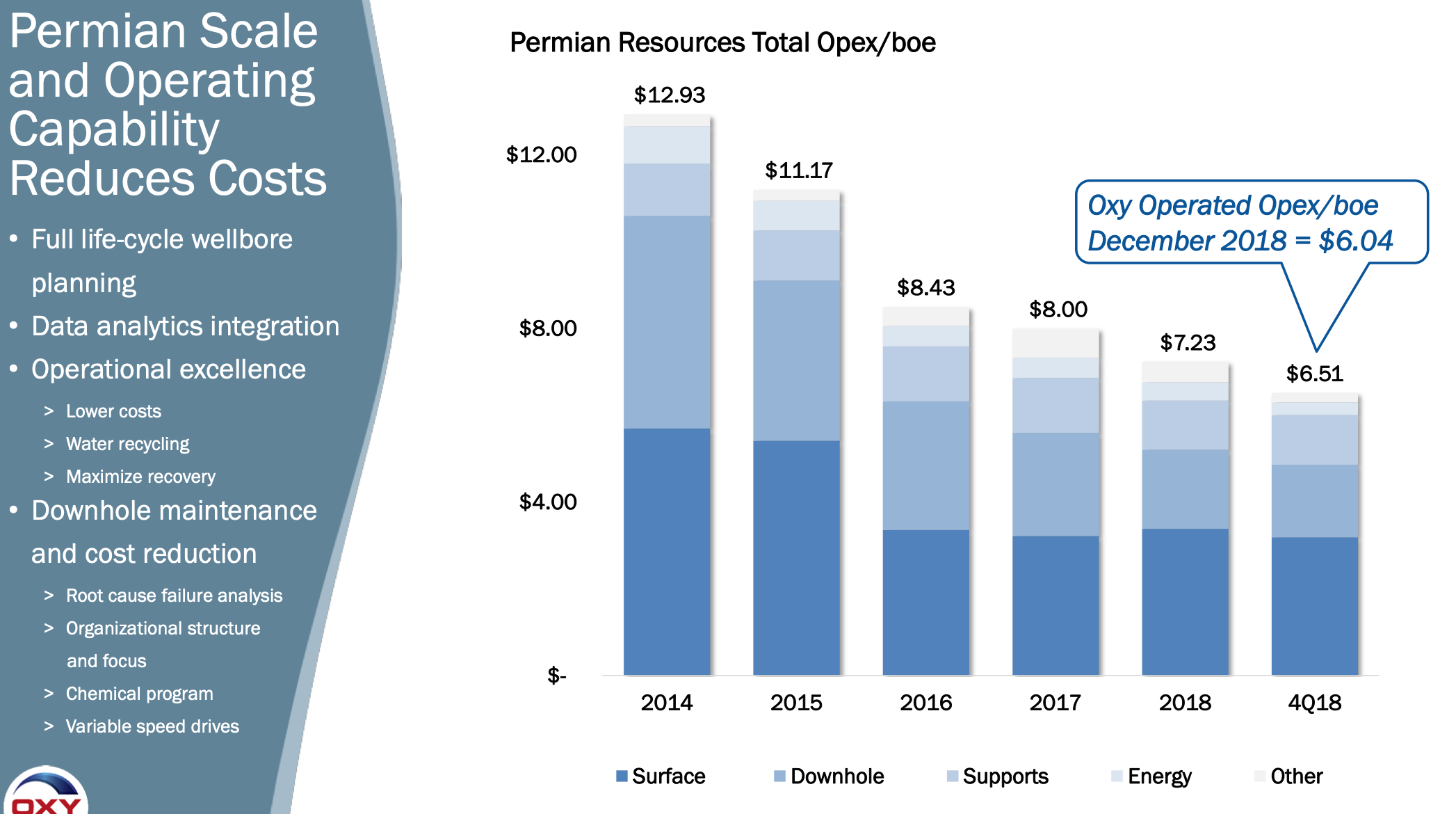

This purchase made Occidental the third largest US oil production company (after Exxon Mobil and Chevron). Also, company expects the merge to decrease Capital expenses going forward:

I have to highlight that it assumes to moderate production growth from 10% to 5% and asset divestitures. It clearly shows the target to offload debt, even if it slows down growth of the company.

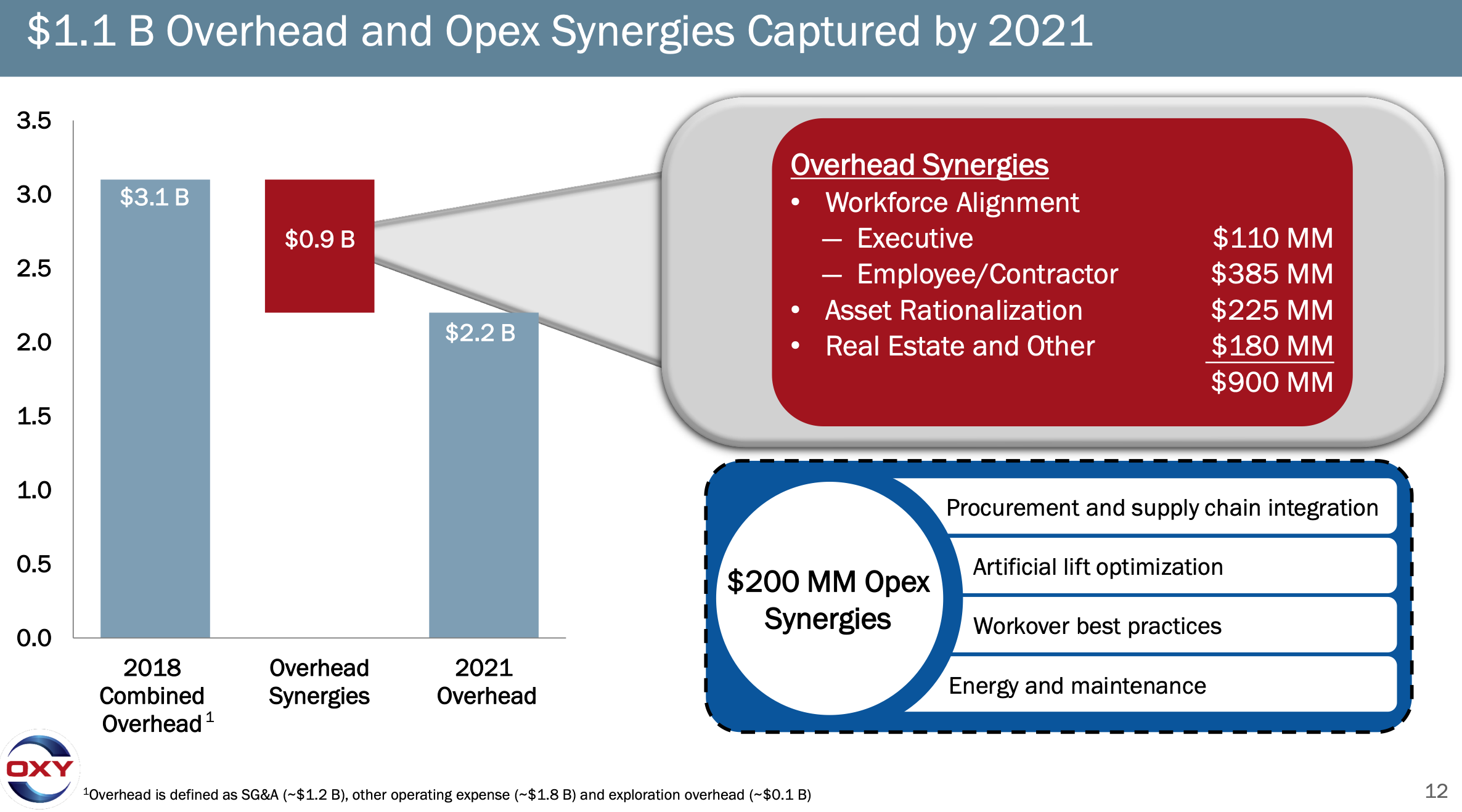

Furthermore, company also expects the merger to decrease their Overhead and Operating Expenses:

If the oil prices stay at these levels or increase, I believe the company can become a winner here. However, if the oil prices were to collapse again, the debt levels would become a real problem for the company.

Debt

Needless to say, this acquisition added a load of debt to the balance of OXY. It raised net debt of the company to ~$50B, which is more than three times its annual cash flow from operations.

In the latest earnings release, Occidental presented the structure of debt it has after the Anadarko acquisition:

One additional ratio I am usually checking when evaluating a stock is its Net Debt/EBITDA ratio. Let’s see how it was changing throughout the years:

Above ratio usually gives warning signs to me if it’s above 3. Occidental Petroleum is definitely a risky company in this regard.

However, company is clearly showing that it is determined to offload the debt as soon as possible. During their latest earnings release, they announced that they already returned $4.9B of debt during quarter 3. There are no remaining debt maturities in 2020.

Company is planning to divest more of its assets that are not aligned with their long-term strategy to reduce debt levels further.

Dividend

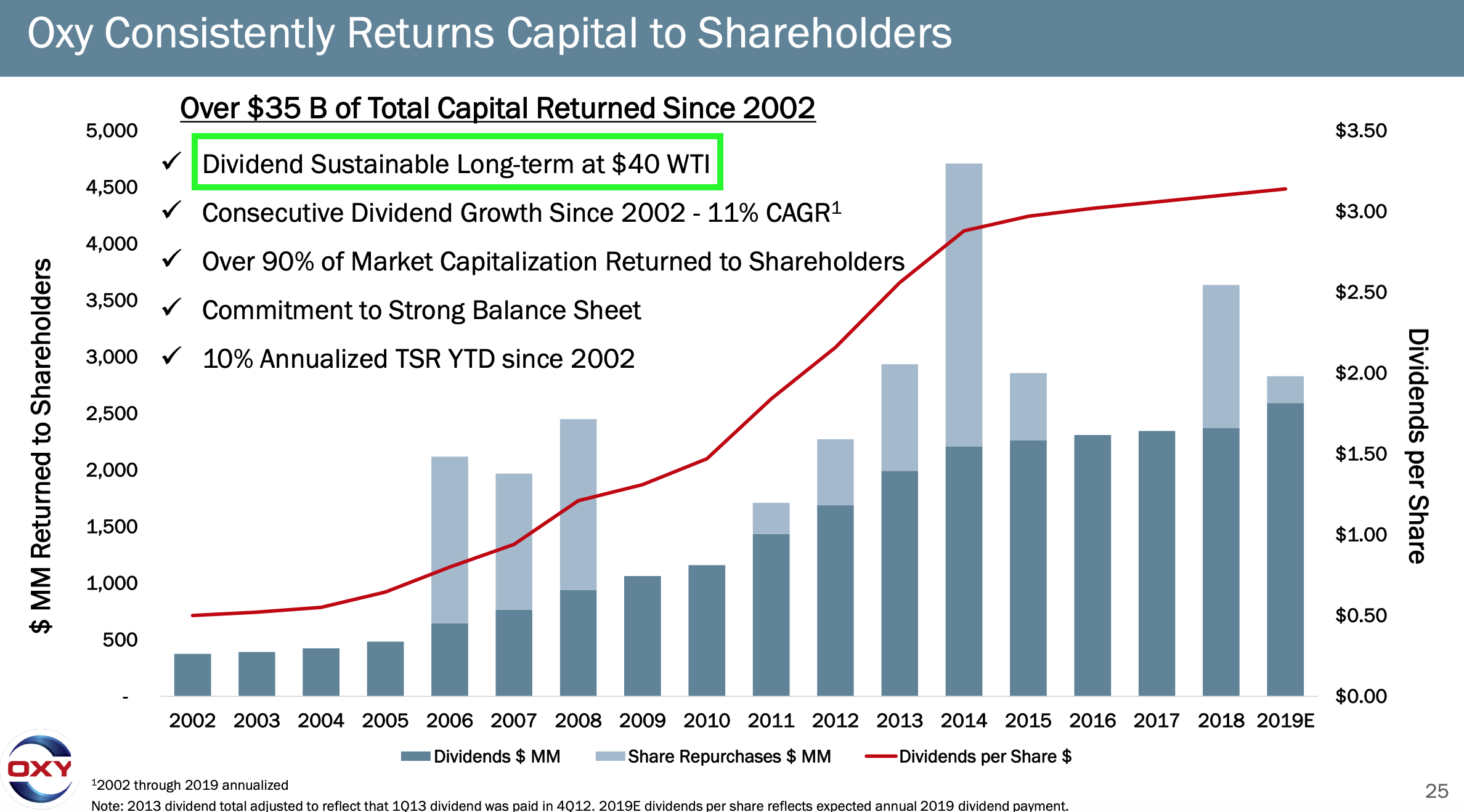

Occidental Petroleum currently pays $3.16/share annual dividend. This means a whopping 7.87% dividend yield at their current price of $40.16.

Of course, it comes with a risk. With EPS (TTM) of $1.53, the payout ratio stands at 206%. There are rumours that Occidental will cut its dividend at some point in the future.

On the other hand, the company states that the dividend is safe if the price of Crude oil (WTI) stays above $40/barrel:

The latest price of WTI crude oil stands at ~$61/barrel, so it would need to come down by quite a bit. It is not impossible, though, as it dipped below $40 not that long ago (in 2016). If we were to see such oil collapse again, Occidental would not be in a good situation and it may end in a dividend cut.

Another thing to like is that Occidental also raised their dividend for 17 years in a row. They kept the streak during the bad times as well, so it gives some confidence in company’s commitment to continue this kind of profit distribution to shareholders.

Revenue and Earnings Growth

Everybody’s talking about debt but let’s also review company’s ability to earn money. This is how its Net Sales and Net Income (Loss) looks like for the last 5 years (we only have numbers up to Qtr3 for this year):

In above graph, I also added the price of WTI crude oil. It shows clear correlation between earnings and price of crude oil. Therefore, if you are willing to bet on a company, you are also betting on the oil prices in the future.

And this is how its Earnings per Share look like for the last 5 years, respectively (data of 3 quarters of this year is only available):

Such a low Earnings per Share ratio this year was due to net loss of $912 million, or $1.08 per diluted share in 3rd quarter. This was mainly due to Anadarko merger-related transactions costs and debt financing fees of $969 million. Adjusted income attributable to common stockholders (excluding one-off items) would have been $93 million, or $0.11 per diluted share. Adjusted EPS so far this year would go up to 1.85 instead which is still almost two times lower compared to the same ratio last year (adjusted EPS for the first nine months of 2018 stood at 3.79).

I also noticed that the number of basic shares increased, compared to last year, by ~20 million, from 761.7 to 781.1 million. This slightly contributed to the decline of EPS ratio.

Impact of Oil Prices

Naturally, results of Occidental Petroleum are highly influenced by oil prices. As per below slide, cash flow of Occidental is mostly affected by changes in WTI crude oil prices:

On the 1st of August, when presenting their 2nd quarter results, Occidental also shared a slide with a breakdown of free cash flow after dividend, depending on oil price:

Company once again states that the dividend and capital expenditure will be on track, if the price of WTI stay above $50. This is how the price of WTI fluctuated during the last 10 years:

It is quite hard to predict the prices of oil. But we can make some educated guesses.

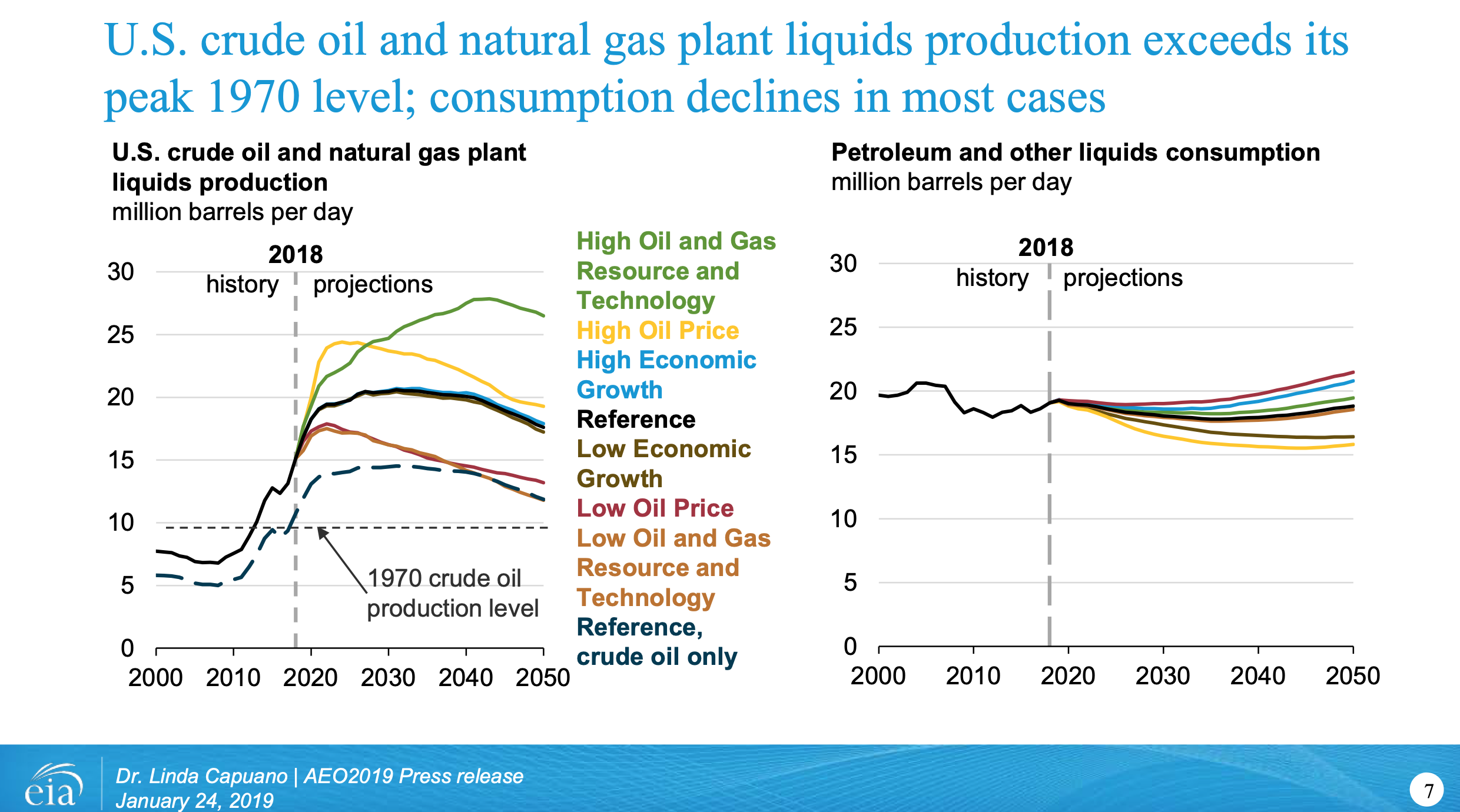

Energy Information Administration expects production of crude oil and natural gas in US to increase in most of the case scenarios, while consumption declines in most cases, due to more efficient usage:

This graph is a little bit concerning. If Oil production in US keeps increasing and consumption declines, it may lead to several outcomes. First option is that oil price will decline, which would negatively impact earnings of OXY. Another and most likely option is that the oil will be exported to other countries.

In their latest meeting on December 5th, OPEC (Organization of the Petroleum Exporting Countries) agreed to further cut collective production of oil, which is a good sign that the oil prices will stay stable.

Comparison with Competitors

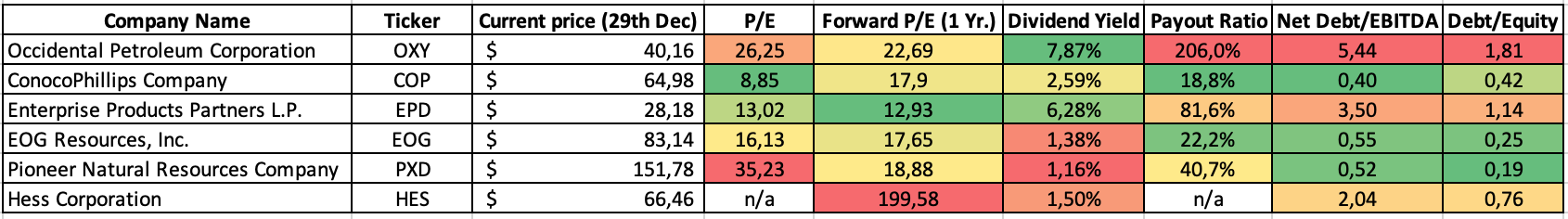

Let’s compare company’s fundamentals with competitors in Independent Oil & Gas industry. I chose 5 larger companies from the industry to compare the fundamentals to:

Truth be told, Occidental does not look good, compared to competitors. The only ratio where it shines is its current dividend yield. But high payout ratio and stretched balance sheet makes it look insecure.

However, most of the ratios are looking only a year into the future. Signs if Anadarko acquisition is working will mostly be seen after some more time. Company predicts the synergies to reduce costs will mainly emerge in 2021, so investors should have patience.

Summary

These are the things that I don’t like about the company:

- Very stretched balance sheet with loads of debt;

- High dividend payout ratio;

- Production of oil in US is predicted to grow while consumption to decline.

There are also some positive things:

- Huge dividend yield of almost 8%;

- 17 consecutive years of dividend increases;

- Synergies from Anadarko merger should improve company’s profitability if we trust the management’s hopes;

- Signs of commitment to pay off debt;

- Energy sector may be undervalued in general;

- Most of the negative news may already be priced in at current share price.

To conclude, I would say that it will take time for Occidental Petroleum to deliver results to shareholders. If you have a time horizon of at lest a few years and are betting that oil will come back from the recent lows, now may be a nice time to enter a position in OXY.

I would not jump in to Occidental Petroleum, even when its share price is at 10-year lows. Instead, I would suggest to look more deeply into EOG Resources and Pioneer Natural Resources who also operate in the same region and have much lower debt loads.

Good analysis. Debt/EBITDA ~5x is just too much. No wonder they borrow money from Bufer for 8%. In general this is junk bond interest. And it goes this way: 1) Dividend cut 2) Capex cut (if first then doomed for dividend cut and more likely leading to 3) and 3) Default on loan repayment (restructuring). Doubt that they will sustain present dividends. Also oil industry is on hedge and I would go for energy companies that are involved in gas as it is on a higher step of enviromental friendlyiness. Personaly I went for major energy companies XOM, BP and RDS that are more diversified and integrated – owning downstreem with refinary and retail fuel stations, which adds buffer to oil price volatility. Also investing in renewables and stuff like that and they have the capital and scale to remain on the top of energy demand changes. I would very not recoment investing in pure upstream companies as they are almost all goes underwater if oil hits <50$. You can see that on OXY EPS development and they even managet to be around zero in y2019 with oil price around 57$ (!)

Thanks for the insights P2035! I wouldn’t be so categorical, though. Warren Buffett also invested in regular shares and I don’t think he’s stupid 🙂 I understand that there is risk but I also think there is a lot of upside potential if everything goes according to plan. Having said that, I am not jumping in yet 🙂

Well Bufet also invested in Kraft Heinz and there was a dividend cut. Well I invested in KHC after that as I think they did the right thing. In this case dividend cut and deleverage of the company should be the way as well unless oil will hit 100$ again and I would not bet on that. US open their oil wells when oil price hit 60-70$ and flood the market with access supply and price goes down, then close them at 40-50$ and the story goes over again.

Buffet invested in preferred shares with 8% dividend yield. That’s a big difference.

I agree that it’s different and I mentioned it in the article. However, he is also buying common stock of OXY:

https://www.fool.com/investing/2019/11/16/heres-what-warren-buffetts-berkshire-hathaway-is-b.aspx