Life has been busy lately, so I am a little bit late with my passive income reports. It’s already December and I haven’t posted my passive income for October yet. Without further delay, here’s what happened with my portfolio during the month.

Dividend Income

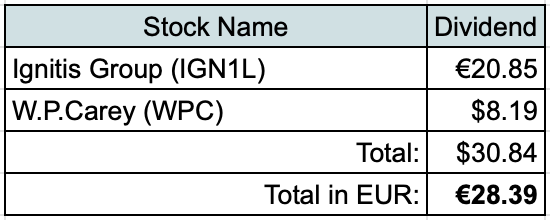

Let’s start with dividend income. During October 2 companies paid dividend to me:

Bi-annual dividend from Ignitis is getting bigger and bigger each time. I am glad to see that now I can already purchase a single share of Ignitis Group just from the received dividend.

As usual, let’s compare received dividend to our actual monthly expenses:

- €20.85 from Ignitis Group (IGN1L) would cover 2.4% of our expenses on Utilities for the last 6 months;

- $8.19 from W.P.Carey (WPC) could cover 0.2% of our Mortgage payments for the last 3 months.

P2P Lending Income

Next, some income was generated from P2P lending:

P2P Lending portfolio is not touched for several years now, so it’s just generating a similar amount of income each month.

Other Passive Income

Finally, some additional passive income was received from these sources:

- €3.93 from Real Estate Crowdfunding;

- €2.30 interest from a partial bond I own;

- €2.77 from Money Market Funds;

- €0.40 from Rental Income Crowdfunding.

Passive Income Summary

After adding it all up, I received €43.69 from passive income during October:

Here’s a better visualization of the income with different categories:

As you can see, October was the best month so far in terms of passive income. I like to see that it’s going to the right direction and that’s the result of those small contributions to portfolio each month.

Here’s a comparison year-over-year:

Investments and Portfolio Contributions

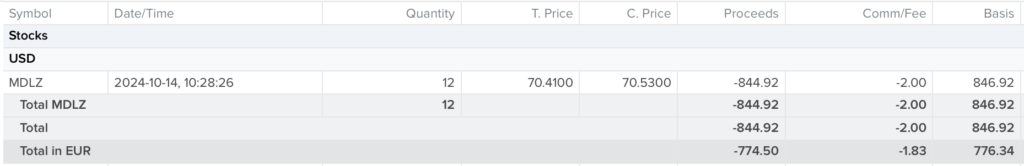

During the month of October I added €300 to my brokerage account.

With previous savings and this new investment, I was able to initiate a new position in my portfolio.

I was looking to add to Consumer Staples sector and that’s exactly what I did. On the 14th of October, I bought 12 shares of Mondelez for a total of $846.92 (including commissions):

Shortly about the company from Morningstar:

Mondelez has operated as an independent organization since its split from the former Kraft Foods North American grocery business in October 2012. The firm is a leading player in the global snack enclave with a presence in the biscuit (49% of sales), chocolate (30%), gum/candy (12%), beverage (3%), and cheese and grocery (6%) aisles, as of the end of fiscal 2023. Mondelez’s portfolio includes well-known brands like Oreo, Chips Ahoy, Halls, and Cadbury, among others. The firm derives around one third of revenue from developing markets, just more than one third from Europe, and the remainder from North America.

You may recognize a few products of Mondelez from this picture:

Some details about the company at my purchase price:

- P/E – 19.45

- Dividend Yield – 2.2%

- Payout ratio – 50%

This purchase adds $19.17 to our forward net annual dividend income.

Summary

October was a great month in terms of passive income. Our portfolio generated the biggest amount of income per month and I am sure that it will only grow higher going forward.

Looking at the year so far, we received €289.82 from passive income so far. This represents 79% of my goal to receive €365 during 2024. With only two months left in the year, I now know that I will not be able to reach the goal this year, unfortunately. On the bright side, I already received more passive income compared to the whole 2023, so it is moving to the right direction. I’m already thinking about the target for next year.

Thanks for reading! 🙂