One of the most interesting things for me during free time is looking for companies that I would like to add to my portfolio. I know that it’s probably a more clever thing to invest to an index fund and don’t spend time on researching individual companies but that’s something I love doing so I don’t consider it as a waste of time 🙂

Probably, I will not have enough savings to purchase anything in the upcoming month but I figured it would still be useful to have a look at what the market has to offer. I came up with 3 companies that look attractive to me at the moment. Let’s start with the list.

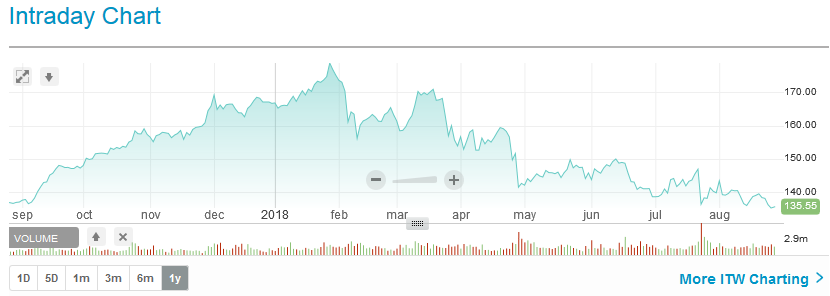

- Illinois Tool Works (ITW). This is a company that I wasn’t familiar with until recently when I started seeing it popping up in posts of fellow dividend investors – recent buy from Engineering Dividends and Dividend Diplomats (who made several purchases of ITW during August) to name a few. The Company is a global manufacturer of a diversified range of industrial products and equipment with 85 divisions in 56 countries. When looking at the share price, I can see that it decreased quite significantly since the start of this year:

I started to look into why its price decreased recently and it looks like this happened because the company had to revise down their profit forecast for the year and it generated less profit then anticipated by market analysts in the latest earnings review. However, the company is still profitable and profits are higher year-over-year. On a side note, it still surprises me how much the price of shares is affected by forecasts and future expectations. Of course, this dip in price is good news for us, dividend growth investors. Being a dividend aristocrat (they have raised their dividend for 54 years each and every year), it’s a company I would love to have in my portfolio. With their current price of $138.56, they have a lot of things that look attractive to me: they recently announced a huge 28% dividend increase, their payout ratio is just 52%. Added bonus is that ITW pays their dividend on the first month of the quarter, which is the weakest in my current portfolio. On the cons side, their dividend yield of 2.25% is quite low. P/E ratio of the company is quite high at 24.75 for the last 12 months (Forward P/E is set to 17.69) but I think it’s justifiable for a dividend aristocrat. The price has already started increasing (it was only ~$135 last week) so I have a feeling that this opportunity may not look so attractive when I have enough funds for a purchase. We’ll see how it looks after a month or so.

I started to look into why its price decreased recently and it looks like this happened because the company had to revise down their profit forecast for the year and it generated less profit then anticipated by market analysts in the latest earnings review. However, the company is still profitable and profits are higher year-over-year. On a side note, it still surprises me how much the price of shares is affected by forecasts and future expectations. Of course, this dip in price is good news for us, dividend growth investors. Being a dividend aristocrat (they have raised their dividend for 54 years each and every year), it’s a company I would love to have in my portfolio. With their current price of $138.56, they have a lot of things that look attractive to me: they recently announced a huge 28% dividend increase, their payout ratio is just 52%. Added bonus is that ITW pays their dividend on the first month of the quarter, which is the weakest in my current portfolio. On the cons side, their dividend yield of 2.25% is quite low. P/E ratio of the company is quite high at 24.75 for the last 12 months (Forward P/E is set to 17.69) but I think it’s justifiable for a dividend aristocrat. The price has already started increasing (it was only ~$135 last week) so I have a feeling that this opportunity may not look so attractive when I have enough funds for a purchase. We’ll see how it looks after a month or so. - Albemarle Corp. (ALB). This idea was presented by a guy who is probably known to most of the dividend growth investors who started looking into this area at least a few years ago – Jason Fieber. Here is a link to his article and analysis of the company. Information about company from their latest annual report: We are a leading global developer, manufacturer and marketer of highly-engineered specialty chemicals that are designed to meet our customers’ needs across a diverse range of end markets. The end markets we serve include energy storage, petroleum refining, consumer electronics, construction, automotive, lubricants, pharmaceuticals, crop protection and custom chemistry services. Company operates in 3 segments: Lithium and Advanced Materials, Bromine Specialties and Refining Solutions. With all the hype about electric cars and renewable energy, you don’t have to be a genius to notice that the energy is usually stored in lithium batteries. Being lithium developer and manufacturer, Albemarle should benefit in the rise of lithium usage going forward. When it comes to dividends, their current yield is quite low at 1.40% but they have been increasing their dividends for 24 years and their 10-year average annual dividend growth rate stands at 11.7%. Their payout ratio is just 21% so it definitely has some room to grow. Their P/E ratio (TTM) is currently at 32.1 which is much higher than of any company in my current portfolio but this is also quite normal for a company which tends to increase their earnings more quickly in the future. I am currently reading their annual report and am considering this as one of the choices.

- Tallina Kaubamaja Grupp (TKM1T). OK, most of you will not be familiar with this company. I wasn’t familiar with this company myself before looking for new investing opportunities while writing this post. I decided that it’s been a while since I invested in the local Baltic market so I took some time to investigate what is happening in the local Baltic Equity list. I was checking which companies were paying dividends this year and Tallina Kaubamaja Grupp caught my eye. Tallinna Kaubamaja Grupp AS is an Estonia-based company engaged in retail trade and provision of related services. The main areas of activity are department stores, supermarkets, footwear trade and car trade. I read their half-year report and liked what I see. Their revenues/net profit rose by ~6%/8% respectively year-on-year so far. In the meanwhile, their share price is flat since beginning of the year (-1%) with a spike during their dividend paying time (they are paying dividends once a year). Speaking of dividends, they paid €0.69/share. With the current price of €9.1, this converts to a huge yield of 7.6%. Of course, this comes with a cost. I calculated that their payout ratio was 94.5% this year, as their EPS (Earnings per share) was €0.73 for year 2017. Back in 2017, their payout ratio was 100%, when they paid out €0.63/share and their EPS was €0.63. They didn’t pay dividends during 2016 but during that year their price increased by 22%. Current P/E ratio for the company stands at 12.15 which looks attractive. So it’s a company which is not very consistent with their dividend and would be a riskier play than my current investments but on the other side it has some attractive things as well. I recently purchased SBUX with a low dividend yield so maybe I should adjust the balance with a company which has a higher yield and payout ratio. The added bonus is that I would need to pay only ~15% tax on their dividend, compared to 30% for US stocks with my broker. If the price stays at current levels, I am seriously considering purchasing some shares of TKM.

What do you think about the companies I mentioned? Do you have any of them in your portfolio? What are you watching at the moment? Please don’t hesitate to leave your comments below.

Photo by Daniel Hjalmarsson on Unsplash

Interesting watchlist BI. ITW is indeed popping up everywhere at the moment. I’m interested to see what you are going to buy!

Hi Mr. Robot,

Thanks for the comment. I am not sure yet what my next buy will be, it could be that it won’t be from this list 🙂

Go for TKM. Its my best investment with div yield on cost >10% 🙂 But as you said dividends might be gone one day as it happined with lots of Baltic companies – TEO, OEG, TVEA. All of them were my largest holdings and failed as dividend investments. On the other hand US stocks looks overvalued. P/E >30 is a sale triger for me personaly. Im looking for share price correction some time soon as FED is estimated to increase interest rates to 3% in 2019 then it makes no sence to invest in companies with div yield 1-2% and their share prices should go down by 1/3 or something.

Hi P2035,

Yes, I am leaning towards TKM out of above companies. If the US stocks fall that much, they will present a higher yield and great buy opportunities 😀