Another month has passed and just like that the winter is over. I already had an outside ride with my bike a few days ago to mark the beginning of spring. It’s still quite cold but the days are getting longer and brighter which is a good thing. Our baby-daughter is growing well, learning new things and giving us a lot of joy. There is just some uncertainty everyday if we will have a good night sleep. One thing is certain, though: companies will pay some dividends to our account. Let’s see how much we received for doing nothing this month.

Dividend Income

This month 4 companies paid dividend to me:

I am getting closer and closer to receive $20 during the second month of the quarter, so I can’t complain.

As always, let’s try to see what part of our family’s expenses in related categories these dividends could cover if we decided to spend them:

- $6.78 from AT&T would cover 19.5% of what we spent for cellphone bill for the last 3 months;

- $4.52 from Procter & Gamble would cover 3.5% of our cosmetics & hygiene expenses for the last 3 months;

- $6.05 from Starbucks would cover 2.3% of our Eating out expenses for the last 3 months;

- $2.53 form Realty Income would cover 0.4% of our monthly rent.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

Let’s compare dividend income to what I received this time last year:

Increase of ~48% is not bad. Having an ambitious goal to double my passive income compared to last year will not be achieved at this pace, though. Hopefully, I will be able to pick up the pace as the year progresses.

Looking at the source of increase, the purchase of Starbucks last year was the main driver. However, I shouldn’t disregard that all other payers increased their dividend compared to last year. That’s one of the reasons why I love dividend growth investing. The income keeps growing without doing anything additional.

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I contributed €600 to my investment account. I haven’t initiated any purchases but moved AT&T from the old broker to the new one and purchased a few more shares in the new broker. Now I own 22 shares of AT&T instead of 19. The increase of shares and lower tax on dividend income at my new broker resulted in $11.02 increase in Projected Annual Dividend Income.

I haven’t added any funds to P2P lending platform this month.

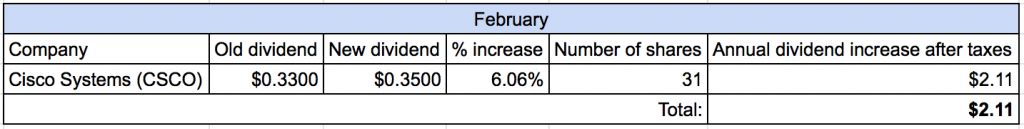

Dividend Increases

This month one company increased their dividend:

The growth of dividends is slower so far compared to 2018. I guess this was bound to happen as companies were really generous last year due to the tax reform in U.S. Every little bit helps in our journey to financial independence, so I will take the 6% raise.

Changes in Projected Annual Dividend Income (PADI)

As I mentioned in previous post, I created a goal for myself to increase PADI to $450 before year ends. To achieve that, I would need to increase PADI by $18/month in average. I will track the increase/decrease from two sources – dividend raises and capital investment.

Let’s see how projected annual dividend income changed during February:

February saw an increase of $13.13 in PADI which is lower than my target of $18/month. However, I am still ahead of schedule for the year so far, and I should be able to increase the number by more during March.

P2P Lending Income

This month I received €7.28 in interest from P2P lending. However, this month also marked the first loan to default in my portfolio. A loan with value of €13.74 was handed over to court, so I don’t expect to receive it back anytime soon. I decided to exclude this amount from my overall passive income calculation this year.

My loans portfolio currently consists of 67 loans for a total value of €721.15.

Summary

In total (after converting to EUR) I received €24.83 from passive income during February. If I exclude the defaulted loan (€13.74), my current income for the year stands at €34.97. This is behind target to receive €480 from passive income during 2019 but I am staying positive. I think I still have enough time to improve and the next few months should increase the pace.

How was your February? Are you sharing any of the companies that paid dividends to me? Are you on track to reach your goals? Thanks for reading and feel free to leave a comment below!

It is definitely not spring here yet, because last night it was – 15 degrees Celsius! Fortunately that was maybe the last cold night before spring.

Really impressive year-over-year growth and I think it was a good move to add more AT&T shares. Loan defaults are never fun and I hope you don’t have more of those in the future. Have you though about purchasing loans with buyback guarantee? These loans usually have a slightly lower interest rate, but you don’t have the default risk.

Wow, that’s cold! We only have -2 degrees Celsius at night now and I hope it won’t get any colder until next winter.

Speaking of loans, most of them are with buyback guarantee now. I decreased the risk level of uninsured loans, so hopefully I won’t see many of them to default 🙂

Hi BI nice month. Im sharing T and PG dividends. Got some as well 🙂 but im a bit against the waive and waiting for brexit. Sold few of my holdings that increased the most and siting on cash right now 😀

Hey P2035,

Thanks for the comment. Your strategy may play out pretty well if you are right. There is really a chance for downturn and now may be a good time to keep some cash.

But I think I am going to keep investing and try not to pay attention to the predictions from others. At the end of the day, my main point is to receive dividends and I don’t think that Brexit is going to change that 🙂

Good dont listen to others strategy. Stick to yours. In L/T I think both of us will do ok 😉

Nice growth this month. T really pulls some weight once the position is built up. I like the example of comparing your dividends to your expenses. That has to make you feel good and want to keep going toward financial freedom. Keep it up!

Thanks for the comment Daze! I saw that T is one of your biggest payers. My position is quite small but its yield is the biggest in my portfolio.

Yes, the comparison of dividends to expenses is a fun exercise that gives me more motivation 🙂

So close to the $20 mark! No worries you’ll cross it next time with your additional T shares.

We are also still in the uncertain sleep phase. Don’t forget to enjoy every moment, even the bad ones. They grow up so fast…

Thanks a lot Mr. Robot! I keep hearing this to enjoy every moment and we are doing that 🙂 when you think about it, it’s really a nice stage, even if there are some harder moments 🙂

Good companies you have there. It’s always nice to see your dividends increase almost double from the previous last year mark. Keep that ball rolling!

Thanks for the nice words 3P. It’s nice to see a new face here 🙂 are you also in dividends game or doing it differently?

100% dividends game. Just started my blog about a week so I haven’t quite updated my portfolio on my site yet. But it’s coming soon! With fellow companies we share and others as well.

That’s great! I will have a look at your blog and good luck on your journey! 🙂

Thank you! And good luck to you

Hey BI. We share all 4 companies that paid you dividends in February. Looks like you’re well on your way to achieving your yearly PADI goals. I like the way you break it down on a monthly basis.

Hey DP, happy to be a fellow shareholder of those great companies 🙂 Yeah, so far the PADI progress look good, so I should be able to achieve the target. I am worried about the passive income annual goal, though. It looks like the target may be over-optimistic 🙂

Nice growth this month BI – Doubling your income will be a tough, but easily doable challenge. You have to remember, this month there weren’t really that many great deals in the marketplace. So it was tough finding good value in high dividend yielding companies. Sure, you could buy plenty of REITS or companies that pay 10%+. But you have to focus on getting a quality dividend along the way and not just chasing dividend yield. Keep investing and keep on pushing. The dividend income will follow 🙂

Bert

Thanks Bert! I couldn’t agree more – it is pretty hard to find good deals these days. However, I think I found one a few days ago. I am going to write a quick post about my latest buy shortly 🙂

BI, I’m not sure whether I should be more impressed by your earnings or the fact that you only spend about $10 per month for your phone! That T dividend will be covering your bill before you know it.

Bummer to hear about the P2P loan default. I still like the idea of diversification into multiple streams of passive income though.

Haha, thanks for the comment DivvyDad! My company is actually paying for my bill (I am using company’s provided phone as well), so it’s only my wife’s bill that we are paying. And… she just got a better deal and starting from next month will pay €6 (~$6.77) instead of €10. Every dollar counts! 🙂

Regarding P2P, it was bound to happen at some point. I knew that some of the loans would default once they mature. When you have a loan for a few years, life happens and not everybody can keep paying it back. It’s good that it’s not that common so far and it is just a small fraction of my portfolio 🙂

I couldn’t help but notice that your $6.78 dividend from T could cover nearly 20% of a quarterly cell phone bill. That’s crazy to see your cell phone that cheap especially compared to here in the US. I think even the cheapest options available over here are still around $25 per month. And enjoy the time with the little one. I know it’s cliche to say but they grow up so fast. It seems like just a few months ago our daughter, now 2.5 years old, was just coming home from the hospital. But it’s amazing to see how much and how quick she learns.

Haha, thanks, it’s not the first time when somebody notices how cheap our mobile phone bills are in Lithuania 🙂

I like the continued progress, BI.

We share all of your payers except for T. The SBUX add provided a nice boost, almost surpassing T. SBUX has had a good run over the past year. You seem to have a knack for picking good entry points. Keep it rolling…

Thanks ED! SBUX definitely is paying off so far, I got lucky with that investment 🙂

Hey, silly question, but when I invest in euros in American companies are your dividends payed to you in American dollars or euros?

Hey Dividend Dude,

I actually invest in USD, so the dividends are also paid in dollars 🙂