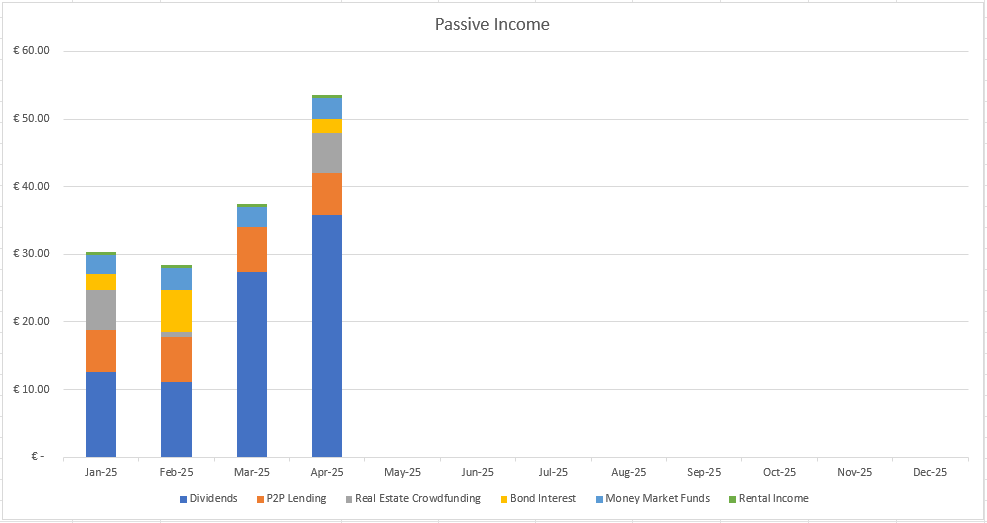

April has come to a close, which means it’s time to share how much passive income our portfolio generated this month.

But first – big news from our family. We welcomed a new member! Please meet Karis!

While we’re getting a bit less sleep lately, the added joy more than makes up for it. 😊

Now, on to the numbers!

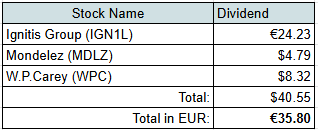

Dividend Income

April was a strong month for dividends—even though only three companies paid out, it marked our highest monthly dividend so far this year thanks to a semi-annual payment from Ignitis Group.

As always, let’s compare received dividends with our actual expenses:

- €24.23 from Ignitis Group (IGN1L) – covers 1.7% of our Utilities expenses over the past 6 months.

- $4.79 from Mondelez (MDLZ) – covers 2.1% of our Sweets expenses over the last 3 months.

- $8.32 from W.P.Carey (WPC) – covers 0.8% of last month’s Mortgage payment.

The absolute numbers are still small, but every euro counts—and the percentages will grow as we keep investing.

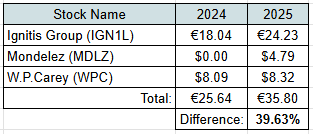

Dividend Year-on-Year Comparison

Compared to April last year, our dividend income grew by 40%! 🎉

This jump is mainly thanks to:

- Purchasing more shares of Ignitis Group

- Adding Mondelez to the portfolio

- A dividend increase from W.P. Carey

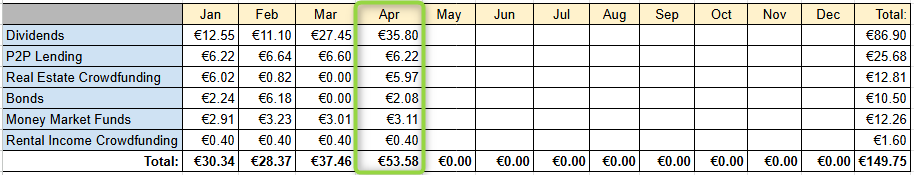

Other Passive Income Sources

We also received income from a few alternative investments:

- €6.22 – P2P lending

- €5.97 – Real Estate Crowdfunding

- €2.08 – Bond interest

- €3.11 – Money Market Funds

- €0.40 – Rental Income Crowdfunding

Passive Income Summary

After adding it up, our portfolio generated €53.58 in passive income during the month:

Here’s a comparison to previous years:

That’s a 26% increase compared to April 2024.

It’s great to see our passive income continue to grow year over year.

Portfolio Contributions & Investments

We contributed €1,000 to our investment portfolio in April and made a few notable investments:

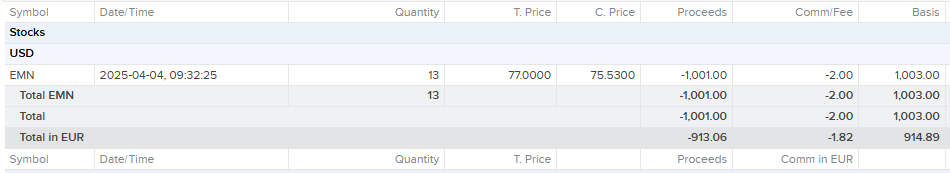

🧪 Eastman Chemical (EMN)

- Purchased 13 shares at $77/share for a total of $1,003

- Adds $36.68 to our annual dividend income

📊 Company Stats at Purchase:

- P/E: 9.7

- Forward P/E: 10.45

- Dividend Yield: 4.3%

- Payout Ratio: 40.05%

- Net Debt/EBITDA: 2.44

I’m happy to have Eastman back in the portfolio—it was a previous holding. I was looking to add something from Materials sector to our portfolio and that’s exactly what I did.

🏠 Real Estate Crowdfunding

- Invested €100 each into 2 projects (12-month terms, with 7% and 6.5% yields)

- Expected return: €13.32 if all goes well

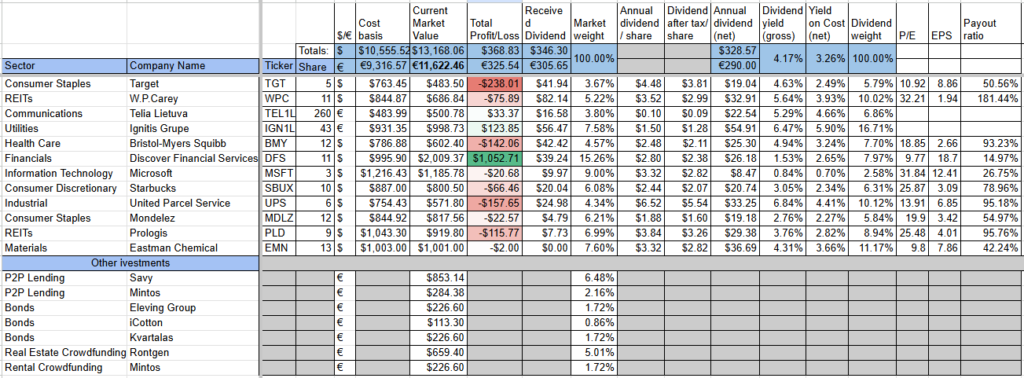

Portfolio Overview (as of May 1)

This is how my portfolio looked like on the 1st of May:

Despite adding €1,000 in April, our total portfolio value increased by just ~€200. This was mostly due to market fluctuations and a weaker dollar vs. euro.

No worries—I’m not trying to time the market. Consistency wins in the long run!

This is how the sector/category allocation is currently looking:

Looking at the current breakdown, Health Care might be next on my radar.

Got any favorite companies in that sector? I’d love your suggestions!

Summary

April brought joy on both personal and financial fronts.

Our passive income for the year stands at €149.75, which is 30% of our €500 goal for 2025. With 33% of the year behind us, we’re just a touch behind – but we’re catching up!

How did your April go? Did you reach any milestones? Drop a comment below – I’d love to hear form you!