December is not looking good for markets so far. We hear the news everyday that the stock prices are falling due to various reasons: FED raising interest rates, trade wars between U.S. and China, uncertainty about Brexit, slowing economy growth in the world, U.S. Government shutdown etc. My own portfolio decreased by ~5% recently but it doesn’t bother me as long as my companies keep paying dividends. On the other hand, the recent pullback is presenting quite a few opportunities. It may be risky to try catching the falling knife as we don’t know if it’s only a start or a temporary dip but I think it is important to keep investing, especially in times of massive sell-offs.

Since pretty much all the sectors were affected by the turmoil, I came up with a few ideas of candidates to my portfolio.

1. Williams-Sonoma (WSM)

Williams-Sonoma has never been in my watchlist. That’s mainly because I was not familiar with the name as it doesn’t operate in my country. Shortly about the company:

Williams-Sonoma, Inc., incorporated in 1973, is a multi-channel specialty retailer of high quality products for the home. Today, Williams-Sonoma, Inc. is one of the United States’ largest e-commerce retailers with some of the best known and most beloved brands in home furnishings. They operate in the U.S., Puerto Rico, Canada, Australia and the United Kingdom and offer international shipping to customers worldwide. Their unaffiliated franchisees operate stores in the Middle East, the Philippines, Mexico and South Korea, as well as e-commerce websites in certain locations. Company owns the following brands: Williams Sonoma, Pottery Barn, Pottery Barns Kids, West Elm, PBTeen, Rejuvenation, Mark & Graham, Outward.

I saw this name a few times in portfolios of other dividend investors but it caught my eye around a month ago when I noticed its price decrease by 11% in a single day due to missed earnings forecast. Earnings still grew but analysts expected more from the company. Shares have lost even more since then and currently stands at $47.00.

It could be that the market have over-reacted and there a few things that I like about the company at their current price:

- Dividend yield stands at 3.49% and is on the higher end compared to other companies in my portfolio;

- Dividend Payout ratio equals to 49% which is right in the middle of my preferred window of 40-60%;

- Company has raised their dividend for 13 years in a row and the 5-year growth rate stands at ~10%;

- Debt to equity ratio is currently 0.33 and I like that the company doesn’t have loads of debt in this environment of rising interest rates;

- Company generates 52.5% of their sales from e-commerce which is good competing with competitors like Amazon.

There are of course risks associated with the company and here are some of them:

- Company sales are cyclical and correlated to housing market. It would probably be hit hard during a recession;

- Williams-Sonoma reported cash and cash equivalents of $164.4 million as of Oct 28, 2018 compared with $390.1 million on Jan 28, 2018. They spent a lot re-purchasing their shares and the pile of cash depleted by quite a bit as a result;

- Approximately 65% of merchandise purchases in fiscal 2017 were sourced from foreign vendors in 43 countries, predominantly in Europe and Asia (information from company’s 2017 annual report). The trade war between America and China may result in higher tariffs for the merchandise company is purchasing. It also presents a foreign exchange risk.

2. Bed Bath & Beyond (BBBY)

This is also a new name in my watchlist. Firstly, short introduction about the company:

Bed Bath & Beyond Inc., incorporated on October 5, 1971, is a retailer, which operates under the names Bed Bath & Beyond (BBB), Christmas Tree Shops, Christmas Tree Shops andThat! or andThat! (collectively, CTS), Harmon or Harmon Face Values (collectively, Harmon), buybuy BABY (Baby) and World Market, Cost Plus World Market or Cost Plus (collectively, Cost Plus World Market). The Company operates in two segments: North American Retail and Institutional Sales.

The Company sells a range of domestics merchandise and home furnishings. Domestics merchandise includes categories, such as bed linens and related items, bath items and kitchen textiles. Home furnishings include categories, such as kitchen and tabletop items, fine tabletop, basic housewares, general home furnishings, consumables and juvenile products.

The Company operates approximately 1,530 stores plus its various Websites, other interactive platforms and distribution facilities.

This company was really battered throughout the last few years. It’s down by 56% over the last year alone and ~83% down over the last 5 year period:

The reason for the fall is quite simple – it’s revenues are falling due to increasing competition from online retailers and weakness of its brick-and-mortar stores. The company’s earnings-per-share were $5.10/share back in 2016 and are estimated to fall down to as low as $1.64/share for the next year. Clearly, the company has issues but could it be that it can get out of the problems? With their price fall, there are still things to like about the company at their current price:

- P/E ratio stands at 4.27 for trailing twelve months and Forward P/E is estimated to be 5.68. This is clearly low but not good enough for analysts, as the revenues keep declining. It could however present potential if the company manages to sort their problems;

- Dividend yield stands at whopping 5.37%. It would be one of the highest yielding stocks in my portfolio if I were to add it;

- Even though the yield is very high, payout ratio is surprisingly low and stands at 24.10% at the moment. Even if the EPS falls to $1.64/share next year, its annual dividend of $0.64/share would still be very well covered;

- Company doesn’t have a lot of debt and its current Debt/Equity ratio stands at 0.51.

Looking at the above, I am thinking if the market could have over-reacted. It may be too early and I don’t want to risk catching this falling knife but I will be looking closely at this company.

3. Target Corporation (TGT)

Third in the list is another Retail company. This company is more known and it was in my radar for a longer time. Most probably everyone is familiar with the company but just in case this is a brief description about Target:

Target Corporation (Target), incorporated on February 11, 1902, is a general merchandise retailer selling products through its stores and digital channels. The Company’s general merchandise stores offer an edited food assortment, including perishables, dry grocery, dairy and frozen items. The Company’s digital channels include a range of general merchandise, including a range of items found in its stores, along with an assortment, such as additional sizes and colors sold only online. The Company’s owned brands include Archer Farms, Market Pantry, Sutton & Dodge, Art Class, Merona, Threshold, Ava & Viv, Pillowfort, up & up, Boots & Barkley, Room Essentials, Wine Cube, Cat & Jack, Simply Balanced, Wondershop, Embark, Smith & Hawken, Xhilaration, Gilligan & O’Malley, Sonia Kashuk, Knox Rose and Spritz.

The company caught my attention on the same day as Williams-Sonoma. Its price also decreased by double-digits (-11%) in one day due to disappointing quarterly results. It actually already fell by ~30% during the last quarter. It’s hard to say if it is going to fall even more but this may be a good time to initiate a position in this company:

- Dividend yield stands at 4.07% which is very respectable and one of the highest points in the company’s recent history;

- Payout ratio stands at 41.3% which leaves a lot of room for improvement;

- Company is known to increase their dividends for 50 years in a row so I see the likelihood to stop the dividend increases very low;

- P/E stands at 10.17 which is a level I like to see.

Let’s also look at some of the risks the company is facing:

- Debt/Equity ratio stands at 1.05 which is a little bit too high for my liking;

- Revenues have been pretty much flat for the last 5 years;

- As for the other two retailers in my watchlist, Amazon is a threat to Target as well.

Summary

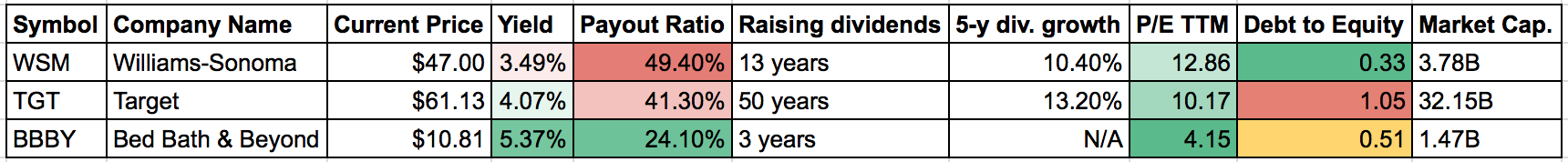

There you have it – 3 companies that are potential candidates to my portfolio. Here is a short table with comparison of ratios that look important to me when I am looking for potential buys:

I am not going to rush in and will probably wait for the year to end before I buy anything and it could be that the company will not even be from this list – there are so many attractive targets now.

What do you think about above companies? Do you own any of them in your portfolio? Do you think they look attractive at the moment?

Thanks for reading and have a nice Holidays season everyone!

Photo by Javier Allegue Barros on Unsplash

Hi BI. Looked at your watch list and its quite interesting. Personaly I would not go for BBBY as its might be catching of falling knife. Thier decline is just too sharp and I doubt that they will manage to reverse the trend and there is a risk of dividend cut in 1-2y. WSM a new company to me but from what you mentioned looms like a good company. TGT I own few. Also looks like a good buy but they are weak at e-commerce and its a big thing for retailers. Exodus has already begun. Smaller and weaker retail chains already bankrupting.

Also I would like to note that Debt/Equity ratio is not that informative if you want to measure how much company is in debts. NetDebt/EBITDA is the best ratio. All fin debts – cash / EBITDA. Below 3 is goos, more then 4 is bit too much.

Hi P2035,

Thanks for the comment! I agree that BBBY would be a risky move and it’s hard to say if they will be able to recover. However, it looks like a lot of the future problems may be already reflected in the price, so I am just going to watch it closely and try to see if there is potential for reverse.

Thanks for the advice regarding the debt related ratios – that’s something I should check when trying to evaluate companies 🙂

Interesting here, interesting. I was not expecting to see a retail heavy dividend stock watch list here! From the list, I know Lanny is a huge fan of BBBY because of their balance sheet. There dividend may face some pressure, but they have a pretty clean balance sheet. Low interest expense should help the company weather a storm while they work on turn it around. At least management won’t have to pick between debt holders or shareholders at the moment . Of the list, I’m a fan of TGT. I have a large position, otherwise, I’d consider adding. They’ve had a really smooth holiday experience (at least from a shoppers perspective) and I like some of the investments the company is making to combat amazon.

Happy holiday shopping. I’m excited to see what you end up selecting!

Bert

Hey Bert,

Thanks for the comment! I also was surprised about the low debt level of BBBY. The company is really beaten down but at least debt is not a problem. TGT is actually the most probable choice I would go with. They seem to be the safest choice and I would love to add another dividend aristocrat to my portfolio at this valuation 🙂

Hello,

I want to ask you what broker you ar using like a Lithuania investor , that gives you to buy stocks of BBBY Company. I’m using SEB bank account and I can not buy these stocks (BBBY) on my account because I’m not a profesional invetor. Some other stocks I can not buy too like I’m not profesional investors. So I want to know how you can get BBBY or other American stocks whose I can not buy.

Hi EP,

Thanks for visiting!

I had the same problem and it was really annoying me. I was also using SEB (and still have most of my positions there) but approximately two months ago started using Interactive Brokers (via their Lithuanian partner Myriad Capital). You can either open account with them directly or via Myriad Capital in Lithuania. You get better commissions directly via Interactive Brokers ($1 instead of $7 for US stocks for example) but there is a minimum monthly fee of $10 if your portfolio is less than $100k. The fee doesn’t apply yet for Myriad Capital clients so it’s ok for me at the moment.

There was previously a requirement for minimal deposit of $10k for Interactive Brokers directly but it seems that since August of this year it’s no longer a requirement.

As you know, I’ve added two of the three on your list recently. Personally, I’m not a huge fan of BBBY and part of that is because their retail locations have not performed well in my area (and I know the one in our town closed down). I know that doesn’t necessarily mean a lot in the grand scheme of things, but those personal experiences do tend to color my perspective.

Look forward to seeing what you end up purchasing!

Hi DivvyDad,

Thanks for the comment! BBBY is the least likely to end up in my portfolio, at least in the short term. You made some good points and I think it’s helpful to see their stores in real world. I don’t have any exposure to their retail locations and that’s a minus when evaluating companies 🙂

Thanks againfor the insights!

Target has been a part of my portfolio for a few years now and I think it’s still a slightly undervalued dividend king (at least 50 years of consecutive increases). TGT has the best dividend record of these three companies and with my current information it would probably be my first choice. Also I’m not that familiar with WSM and BBBY stocks, so I’ll have to read more about them!

Hi Dividend Deluge,

Thanks for the comment and your opinion! I am also leaning mostly to TGT out of these three after some consideration 🙂

Thanks for your tips. At first glance Bed Bath & Beyond looks tempting but the price drop has its own reasons. I would rather look more closely at TGT.

Hi Druss,

I think you are right! It just doesn’t feel good to invest to a degrading company (BBBY), even though the yield looks attractive 🙂