Another month is in the books, which means that it’s time to review how much passive income was generated. Let’s see what happened during February.

Dividend Income

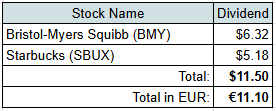

Let me start with dividend income. I got 2 companies pay me dividend during the month:

I love to see the dividends coming in every quarter. Dividend from Bristol-Myers Squibb is bigger compared to last quarter. It’s especially nice that the dividend is constantly increasing without needing to purchase additional shares in the company. That’s what the dividend growth investing is about.

As always, let’s compare received dividend to our family’s actual expenses:

- $6.32 from Bristol-Myers Squibb (BMY) would cover 3.4% of our expenses in Health category for the last 3 months;

- $5.18 from Starbucks (SBUX) could cover 3.0% of our Eating Out expenses for the last 3 months.

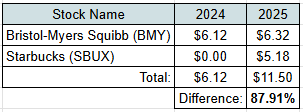

Dividend Year-on-Year Comparison

Next, let’s see the difference in dividend income compared to February of last year:

I like seeing the increase of almost 88%! Most of it was due to Starbucks being added to our portfolio last year. However, Bristol-Myers Squibb also slightly contributed to the growth by increasing their dividend by 3.2%. This is very similar to current inflation rate in Lithuania.

Other Passive Income

Other sources also added some passive income during the month:

- €6.64 in interest from P2P lending

- €0.82 from Real Estate Corwdfunding

- €6.18 interest from partial Bonds I own

- €2.91 from Money Market Funds

- €0.40 from Rental Income Crowdfunding

Passive Income Summary

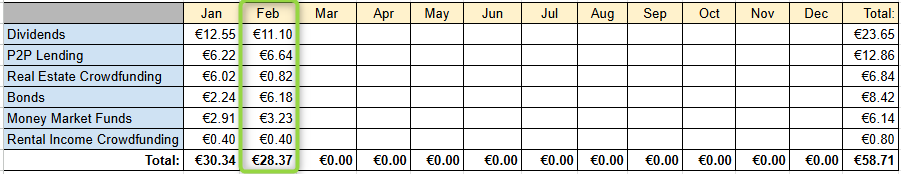

After adding it all up, I received €28.37 from passive income during February:

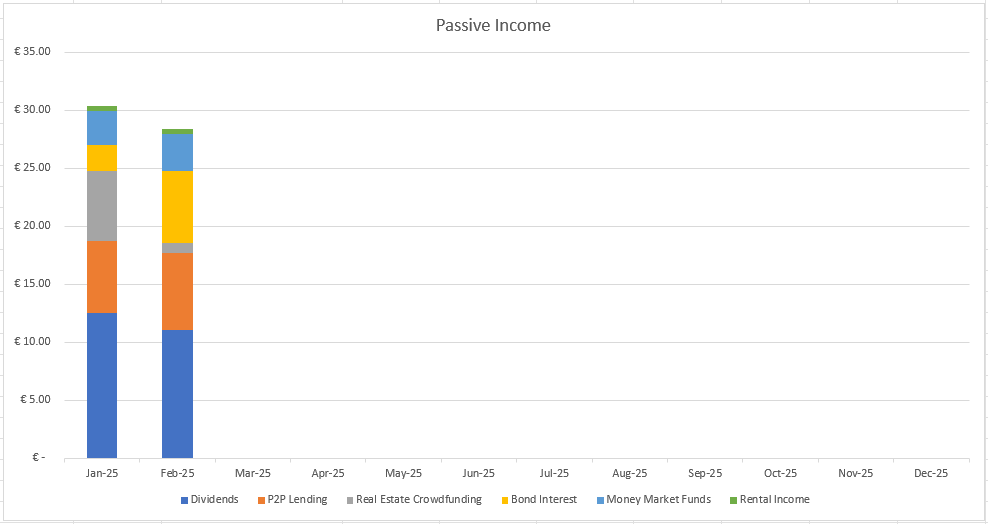

Here’s a better visualization with different categories of income:

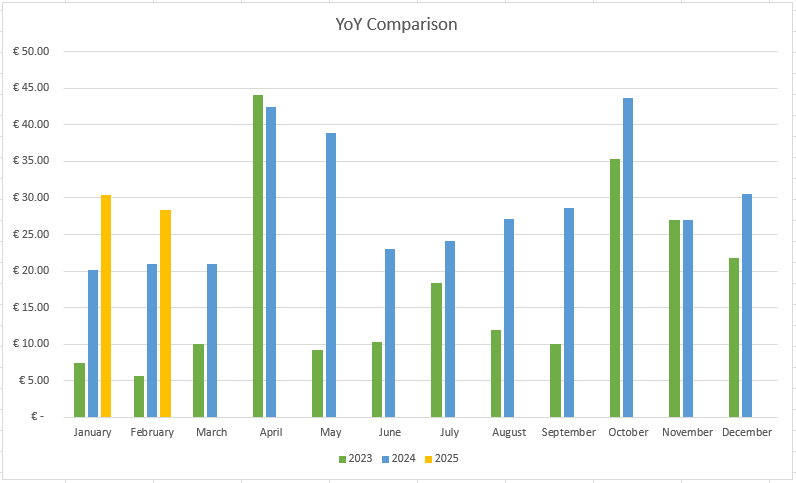

And here’s a comparison year-over-year:

This is an increase of 35% year over year. Hopefully, I can keep up the rate of growth during the year.

Investments and Portfolio Contributions

During February, I added €500 to my investment accounts.

€100 of this amount went to another Real Estate Crowdfunding project with 7% interest. It’s an investment for 12 months, so it should generate €7 in passive income if everything goes according to plan.

I also added small amounts to my Lithuanian companies.

On the 26th of February, I bought 3 shares of Ignitis Group (IGN1L) at €21.7/share for a total of €65.10. With their current dividend, this adds €3.27 to net projected annual dividend income. I now own 43 shares of Ignitis Group.

On the 26th of February, I bought 32 shares of Telia Lietuva (TEL1L) at €1.64/share for a total of €52.48. With their latest dividend, this adds €2.44 to net projected annual dividend income. This brings the count of my Telia Lietuva shares to 260.

After adding it all up, I invested additional €218, which should add €12.71 to my annual passive income.

Summary

Our passive income for February could be converted to €1 for every day of the month. The amounts are still small but I am sure it will keep growing as the time goes by.

During 2025, I have a goal to receive €500 in passive income. So far in 2025, we received €58.71 in passive income, which is 11.7% of the goal. With 16.6% of the year gone, I am behind schedule at the moment. However, we will have some bigger months shortly, which should bring me back on track. Therefore, I am pretty confident to achieve the goal if everything goes according to plan.

How was your month? Do you have Starbucks or Bristol-Myers Squibb in your portfolio? I would love to read your comments.

Thanks for reading! 🙂