It’s already the middle of February and I haven’t reported my passive income for January yet. It’s getting harder to find time to blog these days, so I am a little late to write this post. However, I would never miss it, as looking back at what my portfolio did during last month is a satisfying thing to do.

Without further ado, let’s see what January brought.

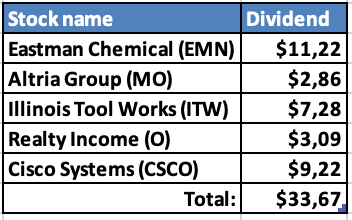

Dividend Income

This month 5 companies paid dividend to me:

That’s not too bad for the first month of the quarter, which is one of the slower months in terms of dividend income. It seems that the sub-$30 months are already in the past. Last year, I was happy that sub-$10 months were a history, so it’s nice to reach another small milestone.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $11.22 from Eastman Chemical would cover 4.3% of our expenses on Clothes in the last 3 months;

- $2.86 from Altria Group could pay for 70.5% of what I spent on Alcohol in the last 3 months;

- $7.28 from Illinois Tool Work would cover 14% of our expenses in Home category;

- $3.09 from Realty Income would cover 0.5% of our monthly Rent;

- Finally, $9.22 from Cisco Systems would cover 11% of our TV + Internet subscription for the last 3 months.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

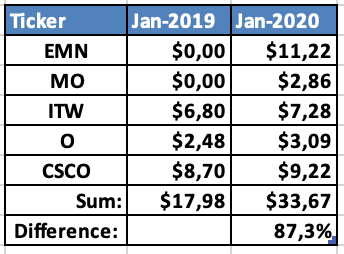

Year-on-Year Comparison

Let’s see how dividend income compares to January of last year:

I was not able to double the dividend income compared to last year but 87% growth is not too bad. The biggest contributor to the change was the new position of Eastman Chemical acquired last year.

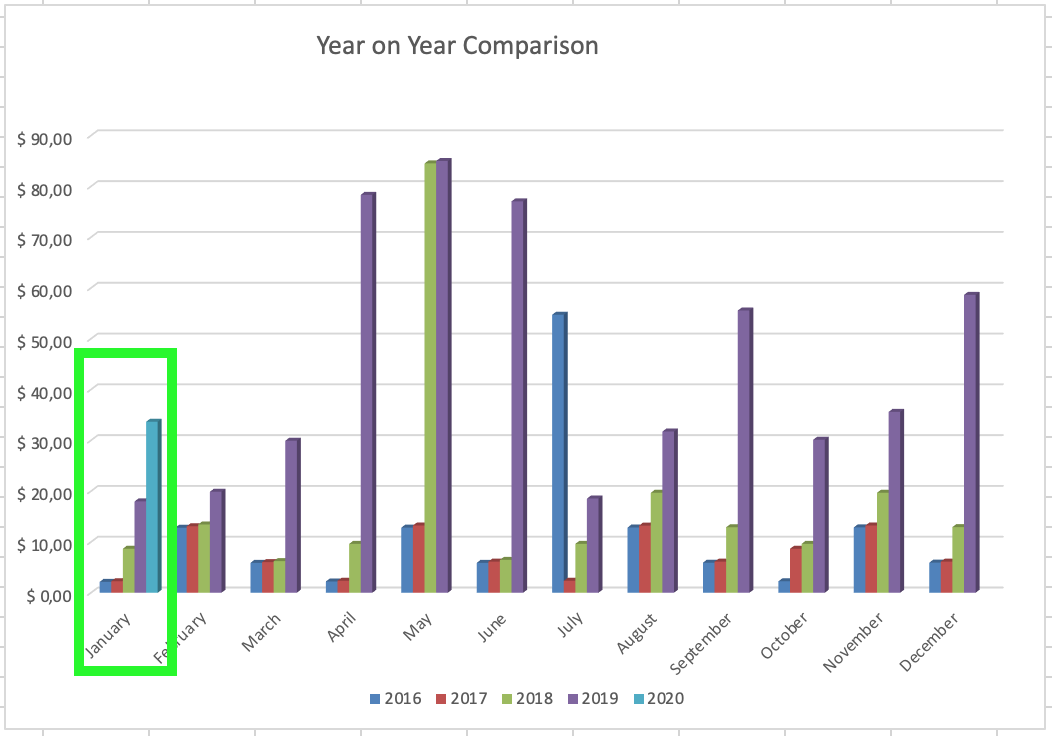

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €500 to my investment account.

I used this and previous savings to add a new company to my portfolio. On the 29th of January, I bought 8 shares of The Walt Disney Company (DIS) for $136.55/share for a total of $1099 (including commissions).

This purchase adds $11.97 to my forward annual dividend income. You may read more about the purchase here.

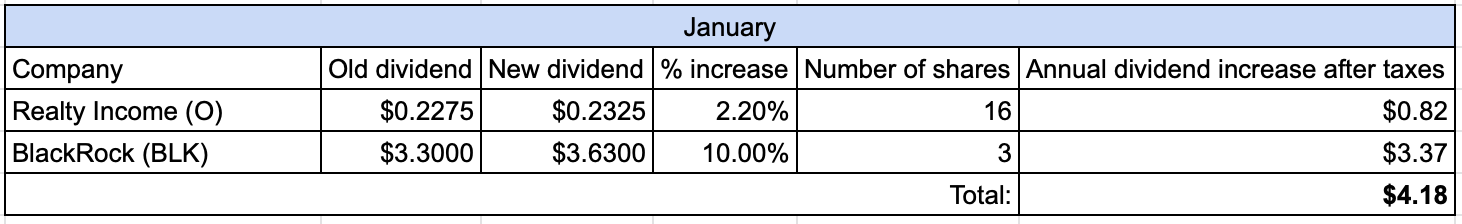

Dividend Increases

During January, a couple of companies declared dividend increases:

Realty Income declared their regular dividend increase of January of ~2%, so nothing new here. I am pretty happy for a heftier increase from BlackRock, though.

With the average dividend yield of my portfolio, I would need to invest ~$133 to reach this amount. It clearly shows the power of dividend increases.

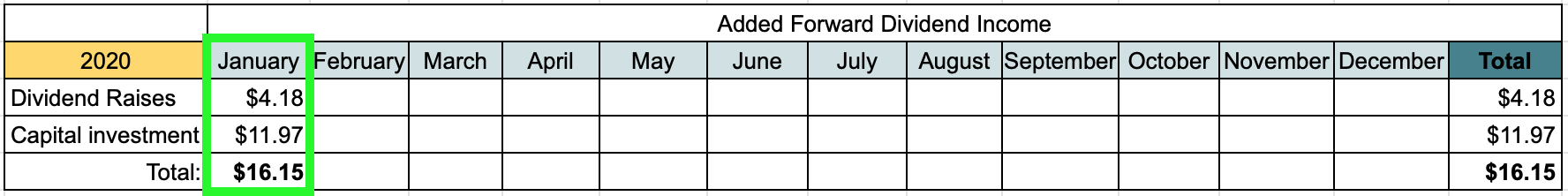

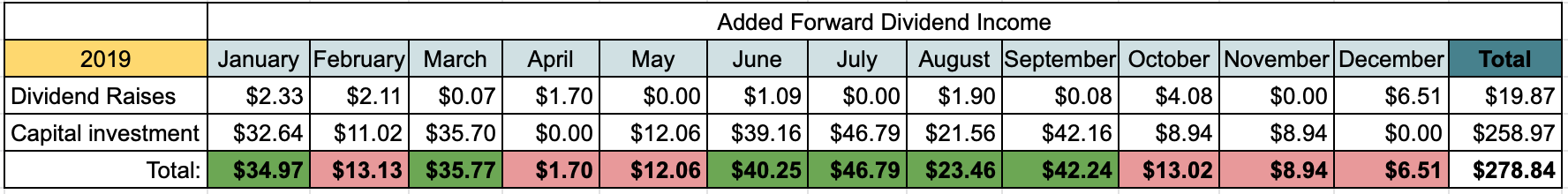

Changes in Projected Annual Dividend Income

I am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income changed during January:

For comparison, I am also adding the table from previous year:

I am lagging behind compared to last year, as my purchase this January was of a low-yielding company. However, there is an increase in the Dividend Raises category. I expect this trend to continue during the year, as my portfolio gets bigger and it should experience more dividend raises.

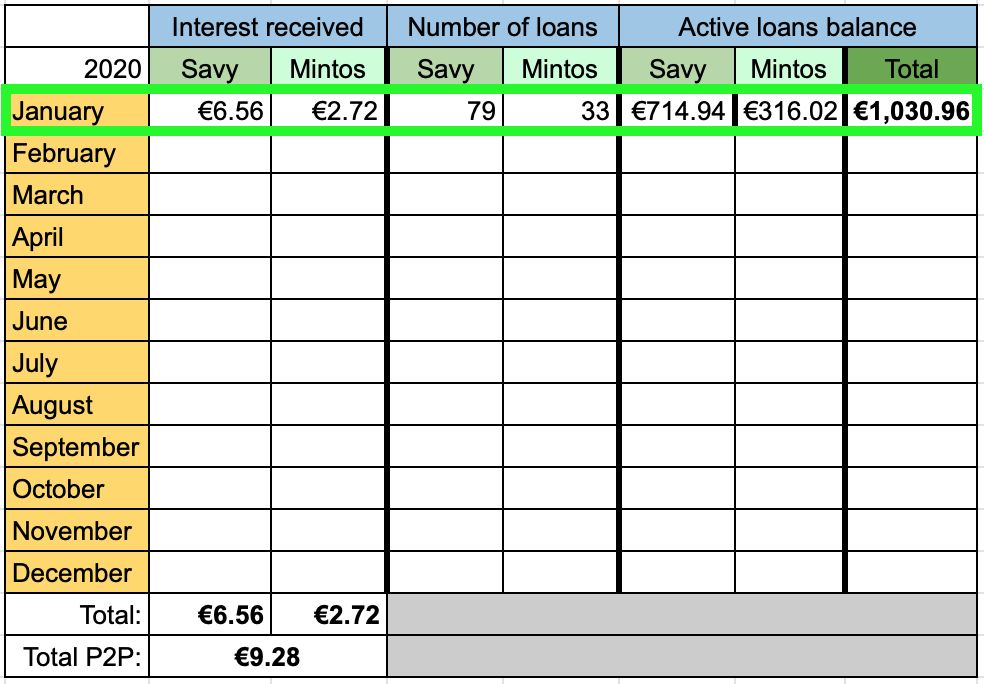

P2P Lending Income

This is how my income from P2P lending looked like in January:

Interest from P2P lending added €9.28 to passive income this month.

My P2P lending portfolio currently stands at 4.5% of my overall portfolio. I would like to keep it at around 5%, so I may add some funds to it to keep up with stocks portfolio.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR), I received €40.37 from passive income during January. I have an ambitious goal to reach €1000 throughout 2020. Slow start of the year means that I am behind the target – at 4% with 8% of the year behind us. I will have some bigger months in Spring but it will be hard to reach the target.

How was your month! Have you beaten any records? Are you sharing any dividend payers with me? Don’t hesitate to leave your comments and thanks for reading!

Why don’t you have EU/Baltic stocks in your portfolio?

If you visited my Portfolio page, you would see that I have some EU/Baltic stocks. None of them is paying dividends in January, though.

You’ve almost doubled your January dividend income year over year. Nice work! It’s also cool to see how dividends can cover specific parts of your expenses. This approach helps put things in perspective.

Thanks for the comment, Frugal Fortunes! It’s motivating to track the progress and comparing dividends to expenses is an additional motivation 🙂

Great progress, BI. I’m loving that YoY growth of over 87%.

Glad to see the PADI tables again this year. I find them very revealing. I’m hoping you have at least one raise every month in 2020 and can avoid any $0 amounts in the Dividend Raise row.

I know that will happen eventually, but maybe it will be this year.

I went 5 for 5 with you on common dividend payers in January. Perfect!

Thanks for the encouragement ED!

Let’s see if I get any dividend increase announcements in May. I am basing my buys to have dividend increases each month, but I think it should happen naturally at some point 🙂

Aš nustojau save apgaudinėti su dividendine strategija ir perėjau prie augimo/spekuliacijų strategijos. Skirtumas pelningume astronominis. Šitie dividendiniai centuku pakėlimai neturi jokios reikšmės. Jeigu pas žmogų jau yra didelis kapitalas tada palaikau tokia strategiją. Perki saugius elektros tinklus, Coca-Cola ir ramiai gyveni iš dividendų. Bet mums Lietuviams su Mūsų algomis ir infliacija prireiks viso gyvenimo kol surinksim sumą, kad gauti bent 2-3k dividendų per mėnesį. Plius mes kiekvieną kartą mokam mokesčius nuo dividendų kas dar labiau mažina pelną. Ir dauguma dividendinių kompanijų didina dividendus tik kad juos didinti ir išlikti visokiais aristokratais ir karaliais, bet kai ateis sunkumai bus labai blogai. Aš nenoriu būti negatyvas, tiesiog per metus laiko ir laaabai daug mokymosi ir skaičiavimų supratau, kad su mažu kapitalu šita strategija niekam tikusi.

Aš manau, kad strategija priklauso nuo to, ko tu sieki. Kaip suprantu, nori greito pelno, tad sėkmės su spekuliacijų strategija. Mano tikslas yra kitoks – gauti pastovų srautą pajamų, todėl neinvestuoju į kompanijas, kurios nemoka dividendų. Kartais kirba mintis įsigyti vienos ar kitos augimo kompanijos, bet laikausi savo strategijos užuot kaitaliojęs ją kas metus. Galėčiau tam skirti nebent labai mažą dalį portfelio, kurios negaila. Bet kol kas portfelis per mažas, kad leisčiau sau spekuliuoti.

Mokesčius reikėtų mokėti ir nuo kapitalo prieaugio pardavus akcijas. Priedo, dar turi žinoti, kada parduoti. Nelaikau savęs protingesniu už 90% investuotojų, tad short-term strategija man netinka.

O dėl skirtumo pelningume, tai kažkaip ir mano dividendinis portfelis aplenkė S&P 500 indeksą praeitais metais. Manau, kad čia labiau sėkmė negu mano nuopelnas, bet tai nepakeičia fakto, kad dividendinės akcijos nebūtinai atsiliks nuo augimo kompanijų.

Aš tiesiog pastebėjau, kad dividendinis investavimas man absoliučiai nuobodus dalykas, bet trading’as per rizikingas. Tai gerai apgalvotos ir išanalizuotos spekuliacijos (mid-term) man aukso viduriukas. Keisti strategijas nėra blogai, tai patirtis ir naujos žinios. Ir labai įdomu pasidaro kai pradedi domėtis kita strategija tada randi labai daug minusų buvusioj strategijoje. Dividend strategijoje radau labai daug minusų nors garbinau ją prieš tai… Dauguma kažkodėl galvoja, kad dividendinės kompanijos yra super saugios, bet taip tikrai nėra. Dar priėjau išvados, kad man netinka joks long-term investavimas 10-20 metų, nes tai tiesiog absurdas, juk pasaulis taip greit keičiasi ir konkurencija žvėriška. Man žymiai saugiau yra uždirbti iš spekuliacijų ir po truputi savo uždirbtus (darbe) pinigus traukti atgal ir kad suktųsi jau “ne” mano pinigai rinkoje. Geriau atiduoti tikrai daug darbo ir rasti tokį variantą kaip Tesla, nei rinktis centukus iš dividendų ir laukti algos, kad vėl padidinti centukus. Pagaliau mano tikslas nepriklauso nuo mano algos, man nereikia laukti jos kad vėl nusipirkti akcijų, kad gauti daugiau dividendų kurie nedaro jokios reikšmės, nes už juos net neišeis dar viena akcija kuri pridės dolerį prie metinių dividendų. Nu, bet čia turbūt labai individualu. Sėkmės Tau šiam nelengvam kelyje 🙂

Ačiū Crash, sėkmės ir Tau 🙂 Tikrai individualu investavimas, ir nemanau, kad yra kažkokia viena geriausia strategija. Labai priklauso ir nuo charakterio žmogaus. Aš pavyzdžiui mėgstu “grind’inti” ir kaip tik žiūriu į 15-20 metų ateitį. Aš kuo toliau, tuo labiau tikiu, kad apgalvotos ir išanalizuotos spekuliacijos yra bullshit, nes stock marketu’ui nerūpi, kaip stipriai tu stengiesi, tai nėra racionalus dalykas.

Bet kokiu atveju svarbiausia domėtis, investuoti, o jei ir nudegsi su savo spekuliacijomis, tai bus bent pamoka 🙂

Pagal mane tai ne spekuliacijos bullshit, o žiūrėjimas 15-20 metų į priekį…

Awesome to see that growth BI. I’m still triggered by your P2P adventures as a means of diversification, I still need to look into that as well.

Thanks a lot Mr. Robot! I like dividend stocks more but P2P lending has been pretty profitable so far 🙂