I’m a bit behind with monthly updates, but better late than never! Let’s take a look at how my portfolio performed in July.

Dividend Income

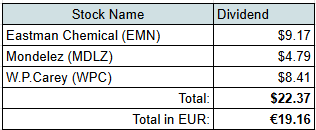

In July, three companies in my portfolio paid dividends:

It’s always nice to welcome a new payer (Eastman Chemical)!

As always, let’s compare received dividends with our actual expenses:

- $9.17 from Eastman Chemical (EMN) – covers 1.9% of our Home expenses over the past 3 months.

- $4.79 from Mondelez (MDLZ) – covers 1.7% of our Sweets expenses over the last 3 months.

- $8.41 from W.P.Carey (WPC) – covers 0.8% of last month’s Mortgage payment.

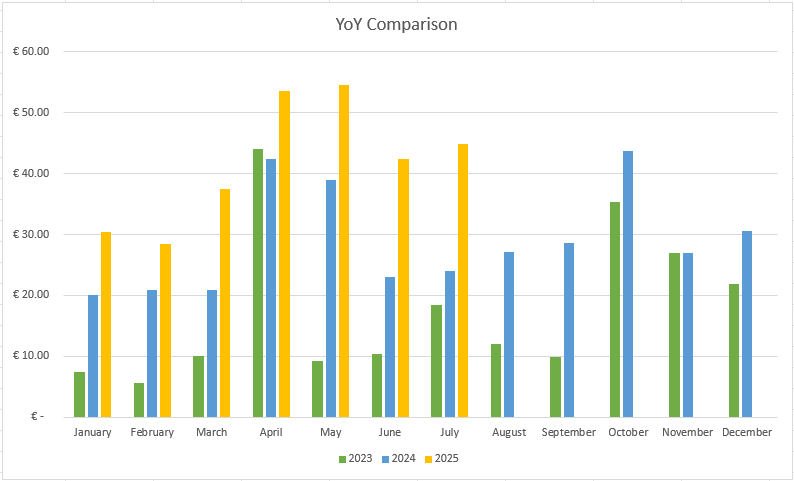

Dividend Year-on-Year Comparison

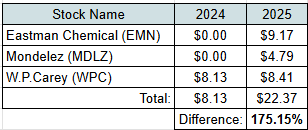

Let’s compare dividend to what we received July last year:

Compared to July 2024, dividend income more than doubled!

- Growth came mainly from new positions (Eastman Chemical and Mondelez).

- An increased payout from W.P.Carey also added to the boost.

Other Passive Income Sources

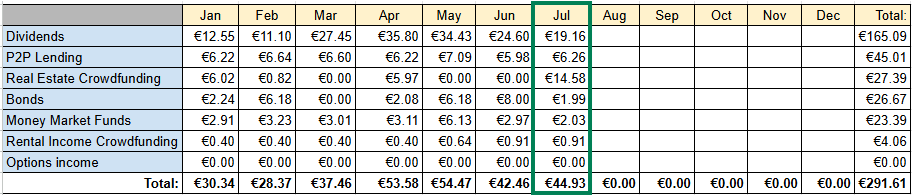

We also received some income from a few alternative investments:

- €6.26 – P2P lending

- €14.58 – Real Estate Crowdfunding

- €1.99 – Bond interest

- €2.03 – Money Market Funds

- €0.91 – Rental Income Crowdfunding

Passive Income Summary

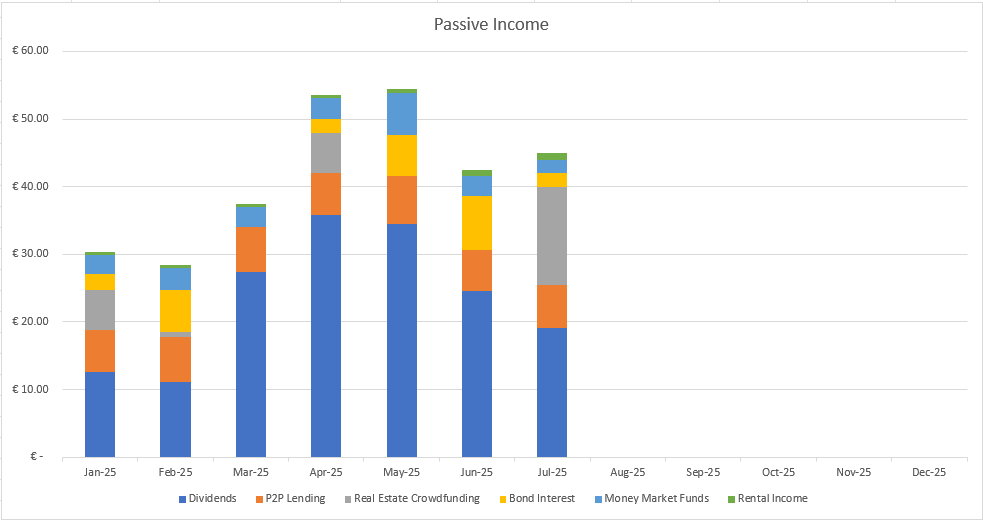

After adding it up, our portfolio generated €44.93 in passive income during the month:

Here’s a comparison to previous years:

That’s a 86% increase compared to July 2024. It’s great to see the growth as the time goes by.

Portfolio Contributions and New Investment Move

I contributed €600 to our portfolio this month. All of it went to my Interactive Brokers account which I use for international stocks investments.

But July was special: I tried options trading for the first time.

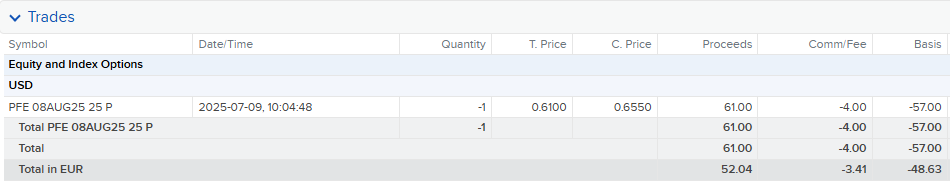

My First Put Option (Pfizer)

- Stock: Pfizer (PFE)

- Date sold: July 9, 2025

- Strike price: $25

- Expiration date: August 9, 2025

- Premium received: $61 ($57 after commission)

- Collateral required: $2500

What this means:

- If PFE closed below $25, I’d have to buy 100 shares at $25, but still keep the $57 premium.

- If PFE stayed above $25, the option would expire worthless, and I’d just keep the premium.

Why I did it:

I wanted to own Pfizer anyway, ideally at a lower price. Selling a put let me get paid while waiting.

The math: $57 on $2500 = 2.28% return in 30 days, or ~27.7% annualized.

When I am writing this, it’s already way passed the expiry date, so I think you can guess that I now own 100 shares of Pfizer in my portfolio 🙂

Summary

July was quite a nice month in terms of passive income. It was my third best month of the year so far.

I am also happy that I have tried a new way of investing/trading, as I was always curious how it works with options. I think it can improve my main strategy of buying dividend paying companies.

So far in 2025, my passive income totals $291.61, which is 58% of my €500 annual goal. Right on track – and I’m optimistic about hitting the target before year-end.

Thanks for reading, and here’s to more growth in the months ahead!