It’s been a while since I wrote a separate post for something I bought recently. Usually I just mention it in my monthly reviews.

Now, I have some time while I wait for my daughter in her friend’s birthday. So I decided to use this time to cover my latest purchase.

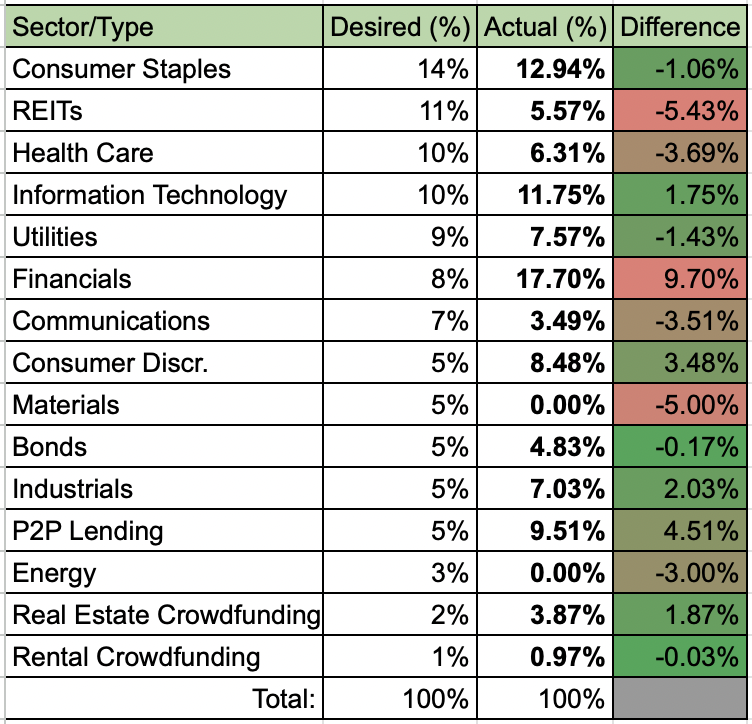

I am using my desired allocation to different sectors to decide which sector to look into next. During my most recent review of current portfolio allocation, it was clear that I should look into REITs or Materials sector.

I decided to go with the former and initiated a position in a company which was in my portfolio previously – Prologis (PLD).

Company Overview

Prologis (PLD) is the biggest industrial Real Estate Investment Trust (REIT) in the world.

This is how company’s business outlook is described by Morningstar in their latest report for the company:

Prologis acquires, develops, owns, and operates industrial properties that are strategically located in markets characterized by large population densities, growing consumption, and high barriers to entry, typically near large labor pools and extensive transportation infrastructure. The company’s strategy is to leverage the organizational scale of its 1.2 billion square foot portfolio to provide a single point of contact to address the logistical needs of its multimarket clientele. The firm’s strategically located global land bank has the potential to support the lucrative development of approximately $37 billion of new industrial projects in upcoming years.

As is shown in their investor relations fact sheet, company operates in 20 countries (mainly North America, Europe and Asia:

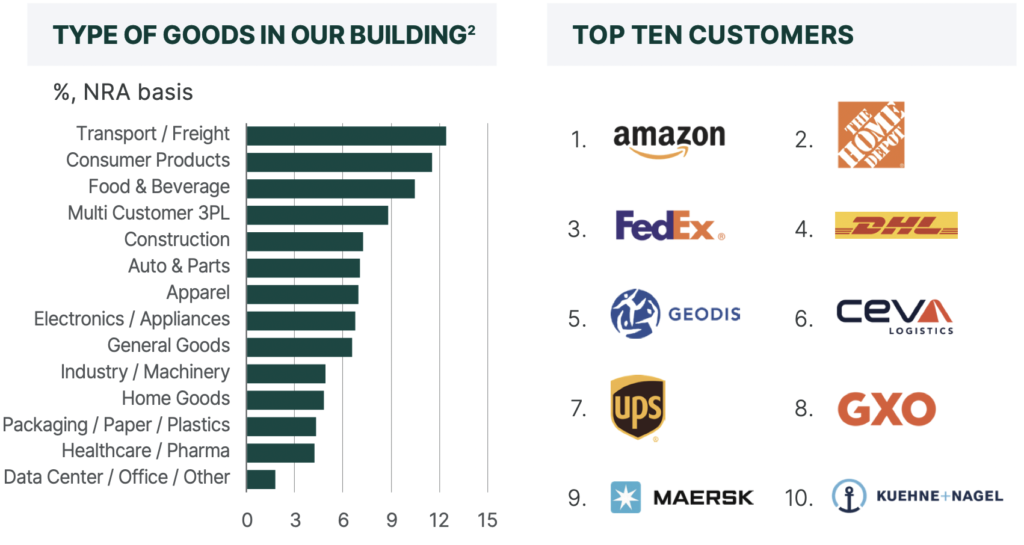

This is a list of what types of goods are in their buildings and their biggest 10 customers (as of 31st December 2024):

It’s not a surprise that the list is dominated by companies delivering goods to customers.

I find it interesting to compare the above graph with what the company had almost 5 years ago when I previously bought some shares of the company:

We can no longer see XPO Logistics, DSV and BMW in the list in 2025.

After doing some quick research I found out that GXO Logistics was spun off XPO Logistics, so that explains the removal of XPO Logistics from the list.

DSV is no longer in the list because it started acquiring and developing its own logistics infrastructure. It shows the risk of losing customers by Prologis, as more companies could expand their logistics infrastructure instead of relying on services by Prologis.

Instead, we can see CEVA Logistics joining the list. The need of distribution centres made Prologis a good partner for CEVA Logistics.

Finally, we can also see that BMW is no longer among the biggest 10 customers of Prologis. It was already at the bottom of Top10, so I didn’t investigate what could have led to this exclusion.

Pros and Cons

Let’s review some pros and cons of the company (from Morningstar report).

Starting with the pros:

- Prologis has the biggest portfolio of well-located industrial properties and is in the best position to capitalize on e-commerce demand.

- Prologis’ recent acquisition of Duke Realty has given it an unrivaled scale in the industry.

- The strategic capital segment of the company is capital-light and is a consistent cash flow generator.

- The high mark-to-market will ensure strong same-store NOI (Net Operating Income) growth in the upcoming years even if market rents do not grow.

There are also some cons identified by Morningstar analyst:

- Industrial facilities are largely commoditized and easily replicable. New construction is quick to negate any imbalances in supply and demand in the long run.

- A slowdown in consumer spending could expose the asset class, increasing vacancies, as seen in the global financial crisis.

- We have seen a record amount of new supply being added in the industrial sector in recent years, which could significantly affect management’s ability to pass along further rent increases.

So, even though the company is the biggest industrial REIT in the world, it doesn’t have a strong moat, as the industrial sector REITs is not something very special. However, the size of the company gives advantages, as it is considered safer when applying for loans (which means smaller interest rates) and company is able to use some economy of scale.

Financial Indicators

Finally, here’s some financial indicators of the company (as of 26th January 2025):

- Price – $118.93

- FFO Payout Ratio (forward) – 87%

- Net Debt/EBITDA – 4.91

- EBITDA/Net Interest Expenses – 6.96

- Net Interest Expenses/Net Operating Income – 25.04%

- Debt/Total Real Estate Assets – 42.05%

- Dividend Yield – 3.23%

- Average 4-yr yield – 2.51%

- Consecutive years of dividend growth – 11 years

I like to see that their current dividend yield is higher than their 4-year average. Even though the yield is not the biggest in the industry, I feel that this is one of the safer bets in the industry due to company’s size and history.

Purchase Summary

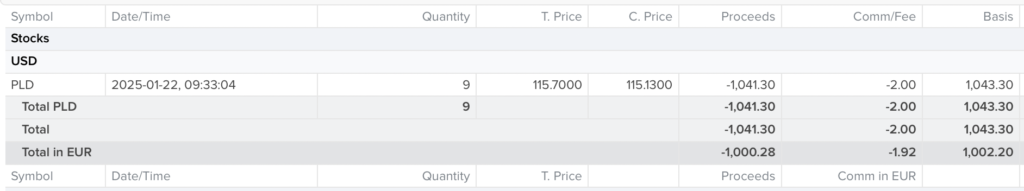

On the 22nd of January, I bought 9 shares or Prologis at $115.7/share for a total of $1043.30 (including commissions):

This purchase adds $29.37 to my net annual dividend income.

I was waiting for their financial report before initiating the company and I could have gotten the company for 6-7% less if I purchased it before the latest report, but you never know which direction it is going to move following earnings release.

As a result, I now have a second REIT in my portfolio. W.P.Carey (WPC) is one of the worst performing stocks in my portfolio, so I hope that Prologis will not repeat the history.

Have you been buying anything lately? Do you have Prologis in your portfolio? What do you think about the company? I would love to read your comments! 🙂