After a miserable May, June was a terrific month for markets. The same goes for my portfolio. It had probably the best month and gained ~€1100 (or ~8%) in a single month. Of course, the value of portfolio is not that important. The focus is constant stream of dividends. On the contrary, such market upswings present less opportunities, as companies tend to become overvalued. Nevertheless, I am still trying to find some candidates to be added to my stocks portfolio.

Truth be told, I was planning to write a short watchlist of a few companies that caught my attention recently. But I got interested in one particular company and decided to write down my thoughts about it alone.

Company Description

Leggett & Platt (NYSE: LEG) is a diversified manufacturer (and member of the S&P 500) that conceives, designs, and produces a broad variety of engineered components and products that can be found in most homes and automobiles. The 136-year-old company (founded in 1883) is comprised of 15 business units, 23,000 employee-partners and 145 facilities located in 18 countries. Leggett & Platt is the leading U.S.-based manufacturer of:

- components for bedding;

- automotive seat support and lumbar systems;

- specialty bedding foams and private-label compressed mattresses;

- components for home furniture and work furniture;

- flooring underlayment;

- adjustable beds;

- high-carbon drawn steel wire;

- bedding industry machinery.

I like how diversified the company is. It mainly produces components to various manufacturers, so maybe that’s why the company is not well-known by end-customers (at least I wasn’t aware of it).

Company’s market and products overview:

At the start of this year, Leggett & Platt acquired ECS (Elite Comfort Solutions) which was by far the biggest acquisition in company’s history. Management claims that ECS will provide capabilities in proprietary foam technology, along with scale in the production of private-label finished mattresses. This acquisition has also increased company’s debt, which I will cover later in the post.

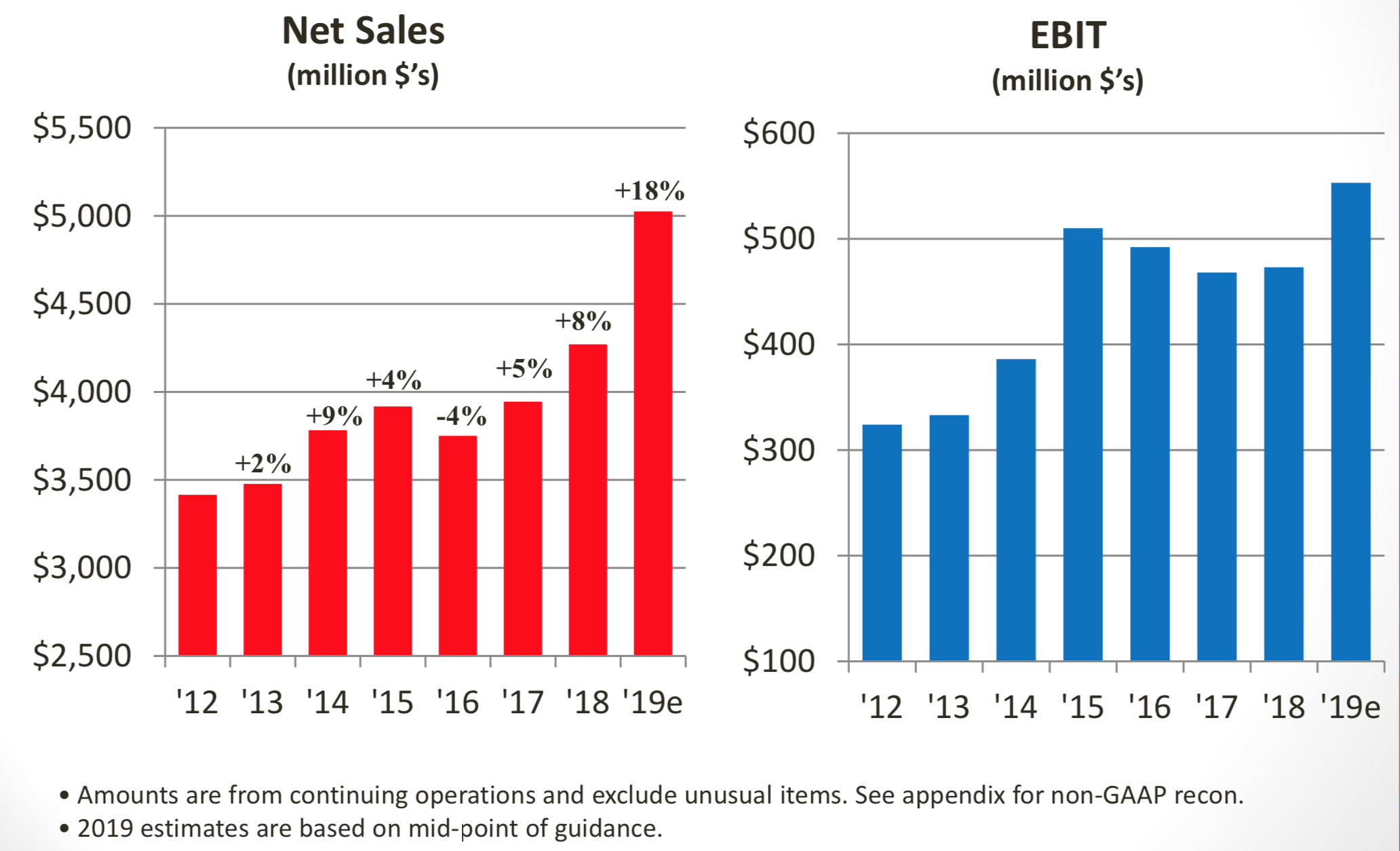

Revenue and Earnings Growth

Let’s have a look at company’s earnings for the past 8 years:

Net Sales are looking pretty good but we can see that Earnings Before Interest and Tax were declining for the last few years. A similar situation is with Net Earnings and Earnings Per Share:

Net earnings are pretty flat for the last 5 years. Looking forward, acquisition of ECS should increase revenue but organic sales are declining.

During 1Q 2019, sales were up 12% to $1.16B but it was mainly due to acquisitions:

- ECS and other small acquisitions added 13% to sales growth;

- Organic sales were down 1%.

Of course, this is all historical data and it doesn’t guarantee future results. It will be interesting to see if company is able to turn around and increase their earnings by a bigger rate going forward.

Other factors, like cost of raw materials (mainly steel) have big impact as well. E.g. if price of steel decreases, this should improve results of LEG, and vice versa. Also, the business is quite cyclical and would be hit hard during a recession. Sales are dependent on home sales, employment levels, consumer discretionary spending etc. All of those would decrease during a recession and impact sales of Leggett & Platt.

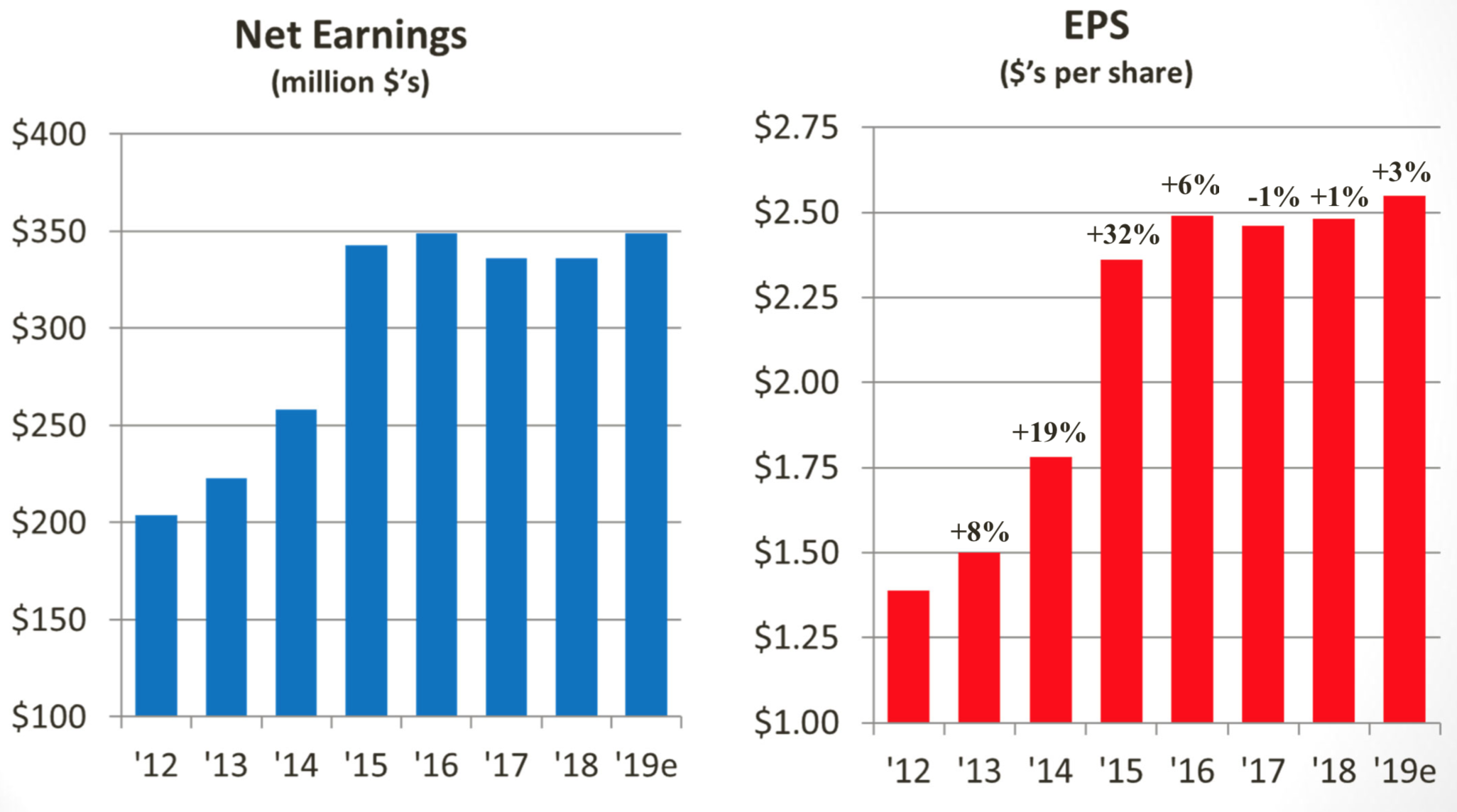

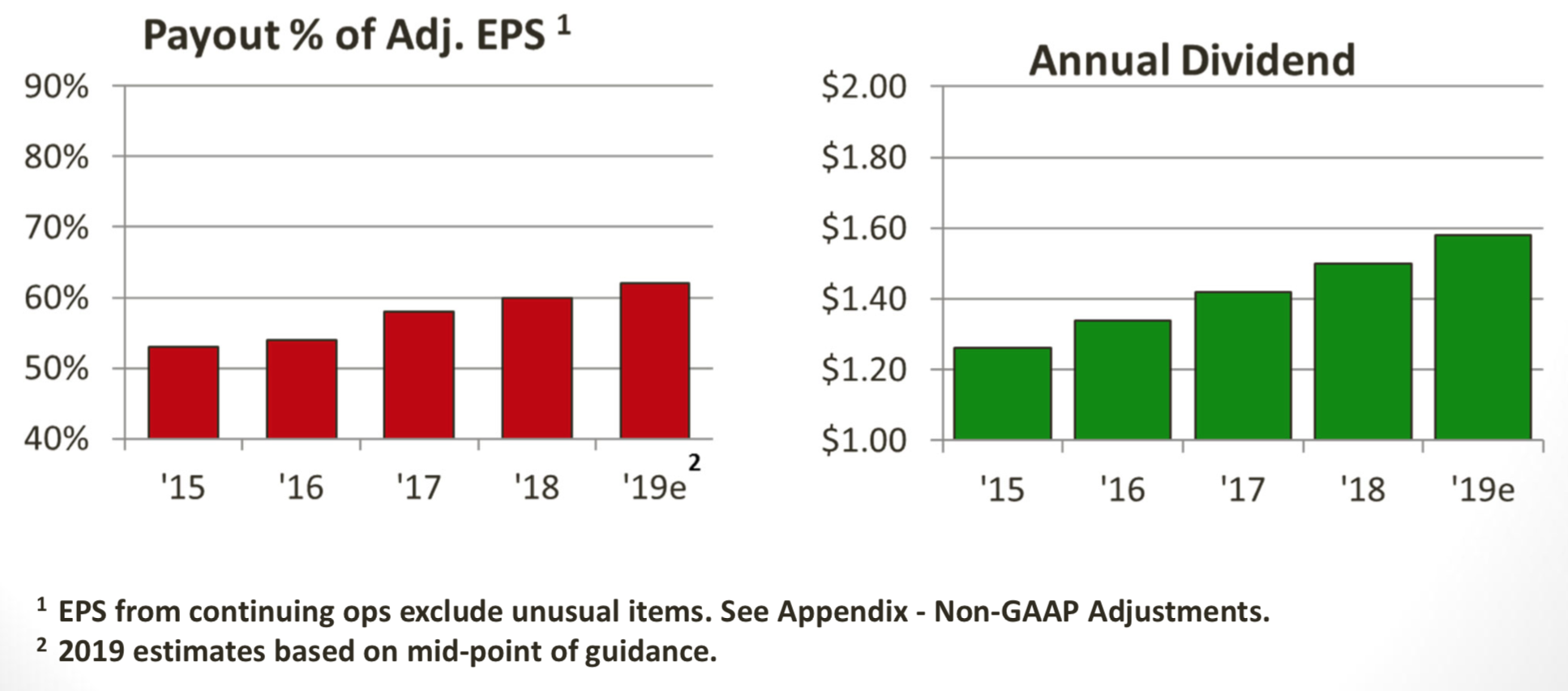

Dividend

Company raised its dividends for 48 years in a row which makes them a dividend aristocrat. It would be great to add another dividend aristocrat to my portfolio. However, there are some headwinds to their dividend growth at the moment. As seen in previous section, their net earnings are pretty flat for the last few years.

It seems that the recent dividend growth was mainly driven by increased payout ratio:

I assume that the company will raise their dividend in a slower rate for the next few years, as they will be prioritising debt repayment. However, company clearly states that dividend payments will be a priority of free cash flow use.

With all that said, dividend yield is very attractable at the moment (4.07% at their current price). In fact, we would need to look back to 2013 for the last time when company provided dividend yield of 4%:

Debt

Leggett & Platt acquired ECS (Elite Comfort Solutions) for $1.25B. They financed the deal with expanded commercial paper program (which is short-term debt in other words) and $500 million 5-year term loan. Naturally, the debt levels increased. In fact, the Debt/EBITDA ratio increased almost twice and is currently bigger than desired:

As visible from above graph, company maintained stable Debt/EBITDA level for the last 10 years before this big acquisition. Management is committed to bring the debt levels down, as LEG’s CEO mentioned after 1Q results earlier this year:

(…)we will prioritize debt repayment after funding organic growth and dividends. We expect to be back to our target level of debt to trailing 12-months adjusted EBITDA of approximately 2.5x by year-end 2020.

It’s good to know that the company is still prioritising dividends before debt repayment. It expects to reduce leverage by temporarily limiting share repurchases, reducing other acquisition spending, and using operating cash flow to repay debt.

Main Facts/Ratios

- Current price: $38.9;

- P/E ratio (TTM): 18.18;

- Forward P/E (1yr): 15.96;

- Dividend Yield: 4.07%;

- Dividend Payout: 61.1%;

- 3-Yr Dividend Growth rate: 6%;

- 5-Yr Dividend Growth rate: 5%;

- Debt/EBITDA: 3.6;

- Debt/Equity: 2.06.

Other Notable Things

Costs of Leggett & Platt are roughly 75% variable and 25% fixed. Raw materials take approximately 60% of the cost, 25% of which is steel prices. Prices of raw materials tend to be volatile, so it may impact results of the company. E.g. steel price is around two times higher than it was back in 2016.

Company faces fierce competition from Chinese companies. As company’s CEO said after the latest earnings release, “(…)the U.S. bedding industry continues to be impacted by unfairly priced Chinese mattresses that are the subject of a pending antidumping matter. Since the filing of the case with the U.S. International Trade Commission and Department of Commerce in September 2018, we have seen a notable increase in imported mattresses from China which has impacted ECS’s sales growth. We expect a preliminary decision on the dumping allegations by the Department of Commerce in late May.” It turns out that U.S. government decided to increase tariffs for mattresses from China, as I was able to find in this article. However, it seems that the taxes imposed are not as significant as hoped, and Leggett & Platt’s share price decreased by 1% on the news.

Leggett & Platt has Baa1 credit rating from Moody’s. Due to ECS acquisition Moody’s changed company’s outlook from stable to negative. Similarly, following ECS acquisition, S&P downgraded LEG’s credit rating from “BBB+” to “BBB” with negative outlook. These downgrades may negatively affect company’s ability to borrow cheaply. Current rating of the company is still considered investment-grade, although of lower medium grade in this category. Company would need to decrease their debt leverage to ~2.0x Debt/EBITDA to increase their grade.

Summary

Main things I like about the company:

- Company raised its dividends for 48 years in a row. This would be another dividend aristocrat in my portfolio;

- Current dividend yield of 4.07% is quite high, especially for a dividend aristocrat;

- Recent acquisition of Elite Comfort Solutions (ECS) should help the company to create a new avenue of growth;

- Company is committed to keep raising their dividends, even though the focus will be to reduce debt in the nearest future.

Things that I don’t like:

- Organic revenue growth is flat for the last few years;

- Current debt level is high (Adjusted Debt/EBITDA of 3.6 as of March 2019);

- Dividend payout ratio currently stands at more than 60% and is growing;

To conclude, I like the company but there are quite few risks associated with it. I am thinking to stay on the sidelines for now but would probably initiate a position if the price falls to ~$35/share.

What do you think about Leggett & Platt? Do you have it in your portfolio? Did I miss to include something in my analysis? This is my first attempt to write a bigger analysis of a single company, so probably I made some mistakes here and there 🙂

Disclaimer: The information provided on this site is not financial advice and it is for informational and discussion purposes only.

I have had this company in the back of my head for a while and will probably make a position sometime in the future. In a future downturn like 2008 they will probably be on massive sale and could be a great buy. As you mention, 35$ could be a nice starting point. Nice to know that management is prioritizing their dividend payment.

Thanks for the comment Norwegian! In a downturn like 2018 there will be a lot of companies on sale, I guess, we just need to have some cash on hand 🙂 Let’s see if the price of LEG drops some more to become attractable enough. Currently it’s not a screaming buy but wouldn’t be a big mistake as well, in my opinion 🙂

Sveikas, gera analize, aciu. Siulau pastudijuot – Archer-Daniels-Midland Company (ADM). Nuobodus suprantamas biznis, manau long- term pats tas.

Ačiū Crash! Su ADM irgi pažįstamas, netgi planavau įsigyti prieš porą metų, bet nusipirkau kažko kito tuo metu. Reikės sugrįžti ir įdėmiau pažiūrėti vėl 🙂