November is over, which means that it’s time to review passive income for the month.

Let’s see what the last month of Autumn brought.

Portfolio News

I will start with some interesting news from one of my companies.

W.P.Carey completed a spin-off of 59 office properties into Net Lease Office Properties (“NLOP”), a separate, publicly-traded real estate investment trust that will be listed on the New York Stock Exchange under the symbol “NLOP”.

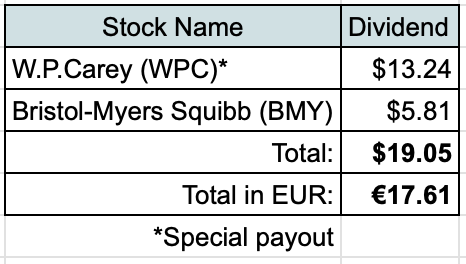

Under the terms of the Spin-Off, W. P. Carey stockholders received one NLOP common share for every 15 shares of W. P. Carey common stock held as of the record date of October 19, 2023. Since I only owned 11 shares of WPC, I received $13.24 in cash instead. I will treat this as a special dividend in this month’s report.

As a result of this spin-off, W.P.Carey is reducing its dividend. A few days ago, it announced a new dividend of $0.86/share per quarter, which is a decrease of 19.7% from previous dividend. This means that my annual dividend income decreases by $7.89 as a result. I am planning to keep the company in my portfolio despite this news.

Dividend Income

One company of our portfolio paid their regular dividend during November. Bristol-Myers Squibb (BMY) delivered $5.81 after taxes to my investment account. After adding it up, this is how November looks like:

As always, I am comparing dividend income to actual expenses our family experienced:

- $13.24 from W.P.Carey would cover 1.0% of our Mortgage payment for the last month;

- $5.81 from Bristol-Myers Squibb would cover 1.7% of our expenses in Health category for the last 3 months.

P2P Lending Income

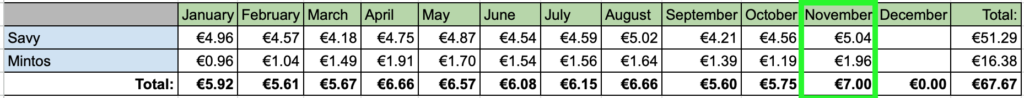

Next, we received some interest from Peer-to-peer lending:

€7 received from P2P lending marks the best month for the year so far.

However, there are some news in this front and the news isn’t good. One of the platforms I am using (Savy) announced that starting from February 2024 they will start charging an additional fee of €1/month for investors. I am only earning ~€4.6/month from Savy platform monthly. It means that my income from Savy will decrease by more than 20%. Since there is no quick way to withdraw funds from P2P platforms, it doesn’t feel good to get charged additionally.

My investing style is quite conservative and most of the loans come with some kind of “insurance”, so my average interest is ~9%. I would need to add ~€130 additionally to this platform if I wanted to keep the current rate of profit after the fee is introduced. I could stop reinvesting returned loans, but most probably I will just swallow the pill and continue investing with Savy.

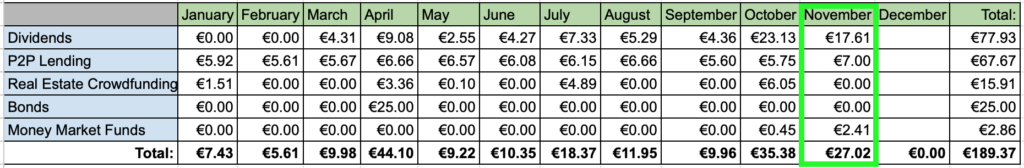

Money Market Funds

We are currently saving for some furniture for our apartment and I decided to keep this money in a flexible money market fund account. During November, we received €2.41 in interest from this source.

Passive Income Summary

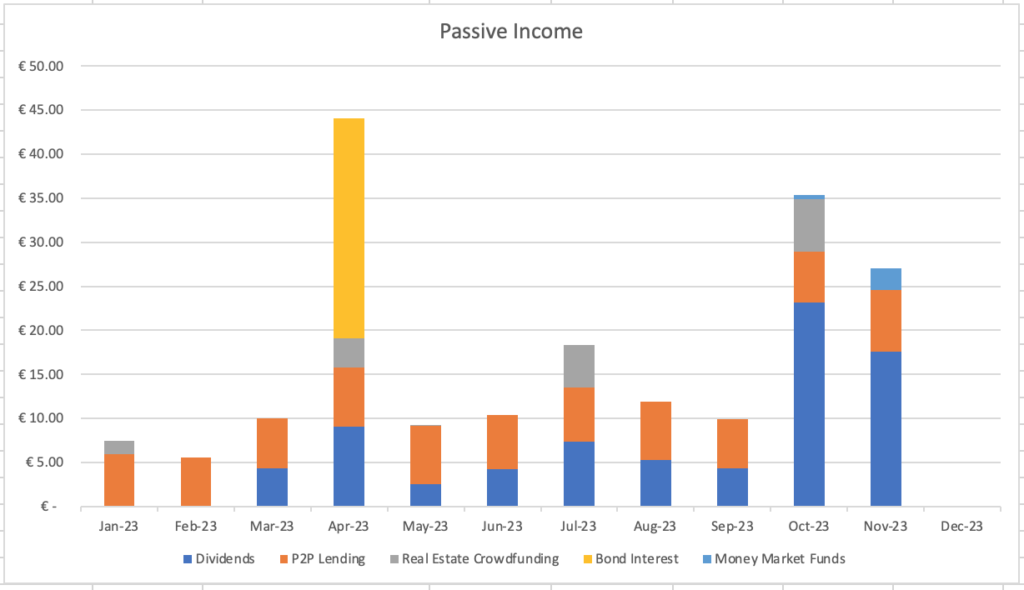

After adding it all up, November brought €27.02 in passive income:

November ended up being the third best month of the year and it will most probably stay this way.

Here’s a graphical representation of passive income in 2023:

Investments and Portfolio Contributions

During the month of November, I set aside €300 to my investment accounts. Again, the amount is smaller than average this year, due to savings for new furniture for our apartment.

€200 from this amount went to my Interactive Brokers account, waiting for a bigger purchase.

The rest went to some small additions for my Lithuanian company holdings.

On the 21st of November, I bought 4 shares of Ignitis (IGN1L) at €19.58/share for a total of €78.32. This purchase adds €4.37 to my annual dividend income. I now own 33 shares of Ignitis in my portfolio.

On the same day, I bought 20 shares of Telia Lietuva (TEL1L) at €1.63/share for a total of €32.60. This adds €1.02 to my annual dividend income. After this purchase, my portfolio holds 170 shares of Telia Lietuva.

Summary

Even though November was one of the biggest months in terms of passive income so far this year, it wasn’t a great month. I would have preferred not to receive the payout from W.P.Carey but keep the same dividend from the company. Additionally, the news from Savy means that my passive income from P2P Lending will be impacted by €12/year.

On the bright side, bigger than expected month means that I have actually surpassed my goal to receive €183 from passive income during 2023. The amount at the moment stands at €189.37, which means that we achieved the goal with a month to go! It seems that I will be able to cross the €200 mark, which is pretty nice to see for my small portfolio.

Thanks for reading! 🙂