Merry Christmas to everyone!

I found some time between the festivities to sit down and write my monthly passive income update for November

November was a great month for our family. We visited London for the second time this year – this time with our daughter as well. We saw The Lion King musical and visited Warner Bros studio where the Harry Potter movies were filmed, so it was a real blast.

Unfortunately, passive income didn’t perform nearly as well this month – but keep reading to see just how bad it was.

Dividend Income

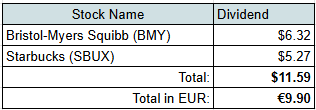

In November, I received dividends from just two companies:

The second month of the quarter is consistently my weakest month for dividend income. Just like last year, dividends came only from Bristol-Myers Squibb and Starbucks.

Here’s how those dividends compare to our real-life expenses:

- $6.32 – Bristol-Myers Squibb (BMY): Covers 2.3% of our Health expenses over the past 3 months. That monthly AG1 subscription is definitely adding up to our expenses, but health is something worth prioritizing.

- $5.27 – Starbucks (SBUX): Covers 0.8% of our Eating Out expenses over the last 3 months.

Dividend Year-on-Year Comparison

Let’s compare dividend to what I received in November 2024:

Similar to what happened in August this year, dividend income is lower than last year once everything is converted into euros. While both Bristol-Myers Squibb and Starbucks slightly increased their dividends in USD terms, the weaker US dollar meant that I actually received less in euros.

To reduce the impact of this in the future, I clearly need to add another company that pays dividends in the second month of the quarter.

Other Passive Income Sources

In addition to dividends, we received some income from alternative investments:

- €6.52 – P2P lending

- €6.18 – Bond interest

- €3.00 – Money Market Funds

- €0.91 – Rental Income Crowdfunding

Passive Income Summary

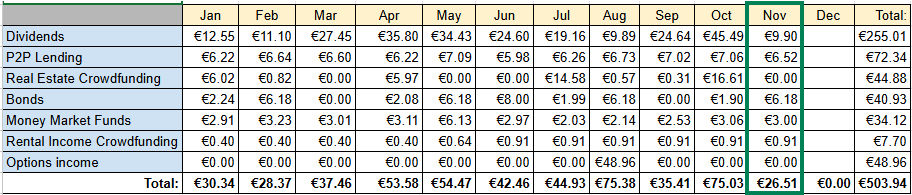

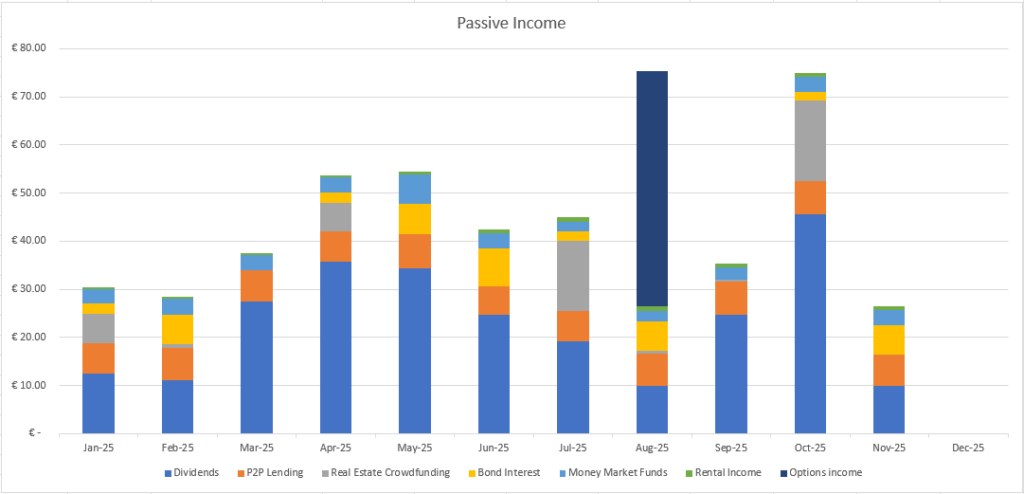

After adding everything up, our portfolio generated €26.51 in passive income during November:

This was the worst month of the year in terms of passive income. The main reason was the decline of the US dollar against the euro, combined with relatively low payouts from other investments during the month.

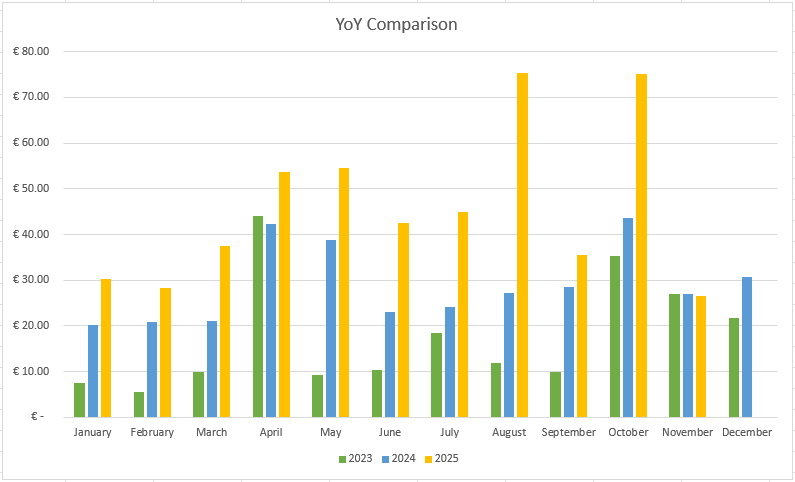

Here’s a comparison to previous years:

When compared to previous years, passive income once again slightly decreased year over year after currency conversion. This is the only month in the year where that happened. It doesn’t feel great—but it is what it is.

Portfolio Contributions and Investments

I only managed to add €300 to our investment accounts during November.

Together with some previously uninvested cash, I used this amount to add to existing portfolio positions:

- Ignitis Group (IGN1L):

Bought 2 shares at €21.00 each for a total of €42.00.

This increases forward annual dividend income by €2.25. - Vilkyskiu Pienine (VLP1L):

Bought 30 shares at €10.70 each for a total of €321.00.

This adds €13.77 to forward annual dividend income, assuming the dividend remains the same as this year.

Summary

November wasn’t a great month for passive income, but fluctuations like this are normal. Dividend timing, exchange rates, and payout schedules can easily make one month look worse than another. What matters most is that the portfolio keeps growing and forward income continues to increase.

Year to date, our passive income stands at €503.94, which means I officially reached my €500 annual goal with one month still to go. Now let’s see how much higher that number will be once December is counted.

Thanks for reading! 🙂