Another wonderful month has passed. We finally had our vacation abroad after a 5-year break. It was the first journey to another country for our daughter as well. Even though it took ~5 months of saving €500/month for the vacation, it was totally worth it and we are planning to have a similar vacation next year as well 🙂

While we were having fun, our portfolio was working in the background and generated some passive income. Let’s jump to the numbers for October.

Dividend Income

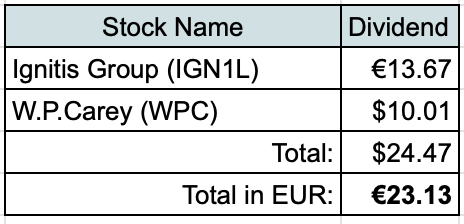

I received dividend from two companies during October:

Firstly, I received my first dividend from Ignitis Group (IGN1L). It’s nice to finally receive a payment from them, as I was buying a few shares of the company pretty much every month since May.

The second dividend for the month came from the only REIT I hold – W.P.Carey (WPC). This company is actually the worst performing holding of my portfolio so far. Even though I already received $28 from them in dividends, they generated -$210 in loss for me so far. I guess my stock picking skills are not that great 😀 The bright side is that this is only loss “on paper” and I am not planning to give up on this company yet.

As always, I am comparing dividends received to our family’s actual expenses:

- €13.67 from Ignitis would cover 1.4% of our expenses on Utilities for the last 6 months;

- $10.01 from W.P.Carey could cover 0.26% of our Mortgage payments for the last 3 months.

P2P Lending Income

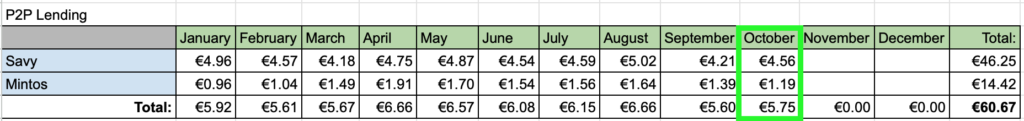

Another source of income is coming in the form of Interest from Peer to Peer Lending.

This month, it added €5.75 to my passive income. This is slightly higher than last month but still lower than average so far this year.

Real Estate Crowdfunding

Next, I received my quarterly interest payments for the Real Estate Crowdfunding projects in which I’ve invetsed. It added €6.05 to my passive income this month.

Money Market Funds

Finally, there is a new category of passive income. I started using a new feature of Money Market Funds investments in my Revolut account. It’s quite a nice service, which pays interest daily and it’s really flexible, as you may withdraw the funds at any time. Current interest rate at this account stands at 3.07%. During the month of October, some small savings I added to this account earned €0.45 in interest.

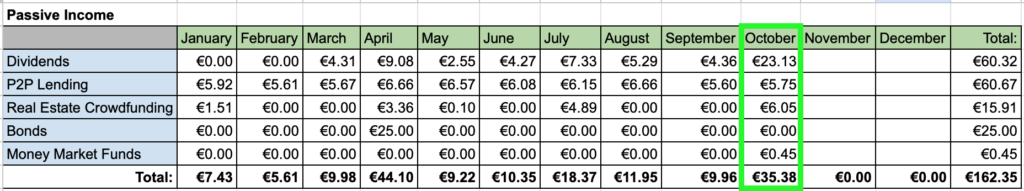

Passive Income Summary

After adding it all up, October brought €35.38 in passive income:

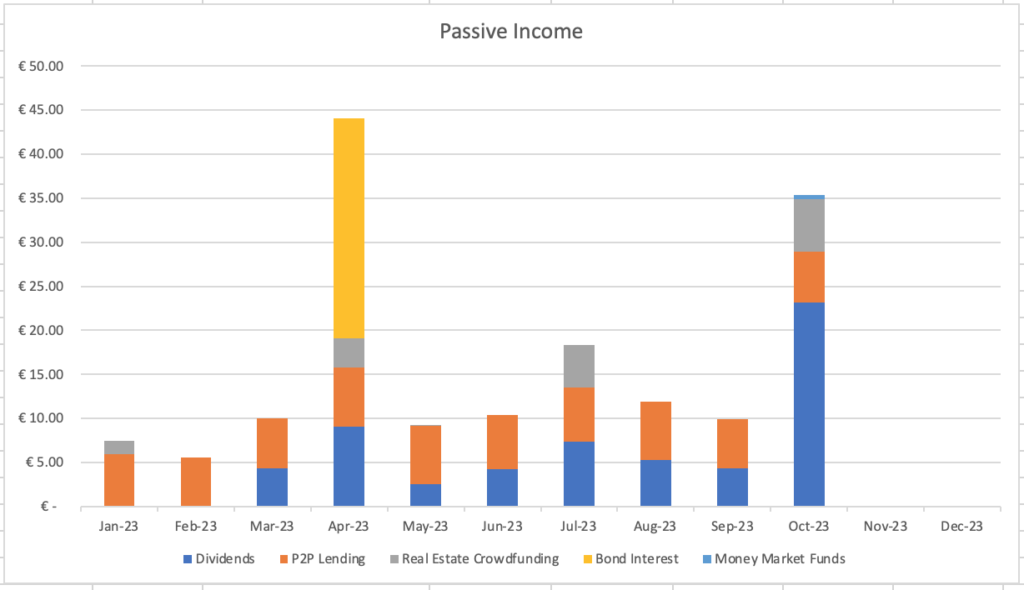

This is how it looks graphically so far this year:

Investments and Portfolio Contributions

In October we decided that it’s finally time to invest again to some furniture for our apartment. This means that our contributions to investments will suffer for the next few months and I will not reach the goal to invest at least €5000 of additional funds to our investment portfolio during 2023.

However, I still managed to set aside €300 for investments this month.

€200 from this amount went to some Fractional bonds. This is a new offering from one of my Peer to Peer lending platforms I am using – Mintos. The actual bonds are issued by Eleving Group. Some facts about the bond offering:

- Maturity date – 2028-10-31

- Interest – 13%

This means that the investment term is 5 years and with my investment of €200 I should earn €26/year if everything works out fine. Of course, I understand that this is quite a risky investment, as the interest rate suggests.

Another €100 went to my existing Lithuanian companies.

On the 26th of October, I bought 4 shares of Ignitis (IGN1L) at €20.05/share for a total of €80.20. This purchase adds €4.37 to my annual dividend income. I now own 29 shares of Ignitis in my portfolio.

On the same day, I also purchased 20 shares of Telia Lietuva (TEL1L) at €1.585/share for a total of €31.70. This adds €1.02 to my annual dividend income. After this purchase, my portfolio holds 150 shares of Telia Lietuva.

Summary

October was the second largest month in terms of passive income so far this year. Also, I added some bonds back to my portfolio, which adds an additional source of income for the future. Unfortunately, I am not sure if I will be able to contribute any additional savings to investments this year due to improvements for our apartment. But this was long time coming and thankfully we can see the finish line at this front as well.

Looking at our passive income throughout 2023, we received €162.35 in passive income so far, which is 88% of my goal to receive €183 during the year. Now I am pretty certain that the goal will be reached!

Thanks for reading! 🙂