I am continuing my attempt to catch up with monthly updates of passive income before 2025 runs out. Let’s take a look at how my portfolio performed in the month of October.

Overall, October turned out to be a strong month and almost matched my best passive income month of the year so far.

Dividend Income

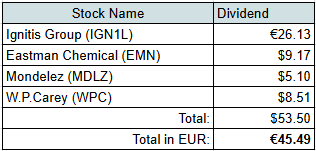

In October, I received dividends from 4 companies:

I love Octobers because it’s one of only two months in the year when I receive dividends from Ignitis Group. This company alone generated more than half of my total dividend income in October. Still, I’m also happy to see the regular quarterly dividends from other companies—every little bit counts.

Here’s how those dividends compare to our real-life expenses:

- €26.13 – Ignitis Group (IGN1L): Covers 2.9% of our Utilities expenses for the last 6 months.

- $9.17 – Eastman Chemical (EMN): Covers 10.6% of our Home expenses over the past 3 months.

- $5.10 – Mondelez (MDLZ): Covers 2.4% of our Sweets expenses over the last 3 months.

- $8.51 – W.P.Carey (WPC): Covers 0.8% of last month’s Mortgage payment.

It feels good to see dividends covering at least part of our expenses. As our portfolio continues to grow, I expect these percentages to increase over time.

Dividend Year-on-Year Comparison

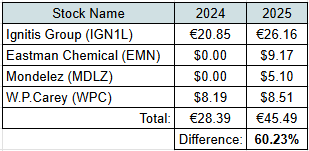

Let’s compare October dividends to what we received in October 2024:

There are two new dividend payers compared to last year. The remaining two companies also paid higher dividends. This is mainly due to:

- Additional shares added to my Ignitis Group position

- A dividend increase from W. P. Carey

As a result, dividend income in October grew by 60% year over year.

Other Passive Income Sources

In addition to dividends, we earned some income from several other passive income sources in October:

- €7.06 – P2P lending

- €16.61 – Real Estate Crowdfunding

- €1.90 – Bonds

- €3.06 – Money Market Funds

- €0.91 – Real Estate Crowdfunding (Rental Income)

These smaller streams continue to add up and help diversify my passive income beyond dividends alone.

Passive Income Summary

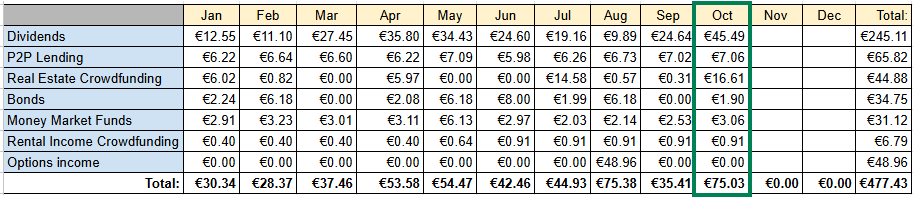

When I add everything up, our portfolio generated €75.03 of passive income in October:

This is very close to my record month of August, when I received my first income from selling options. What I really like about October is that almost the same amount came from more traditional and predictable sources of passive income.

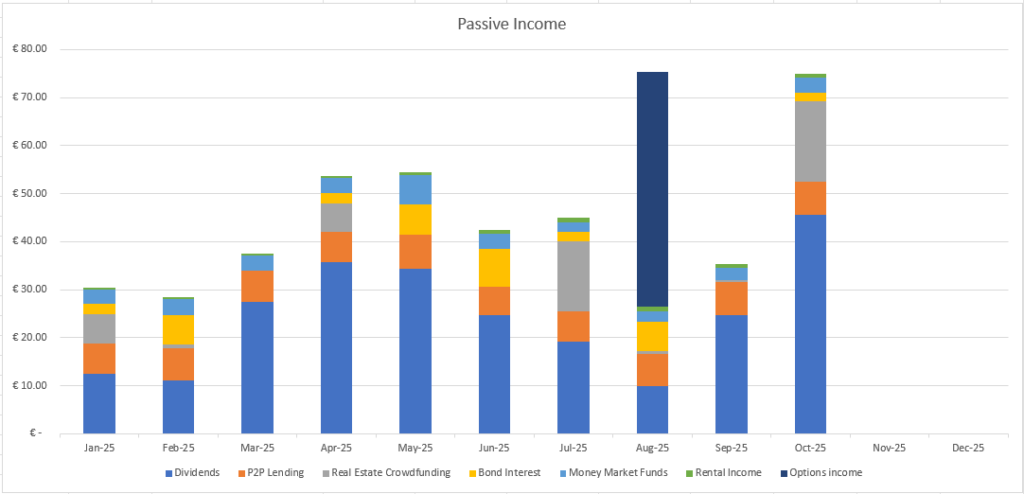

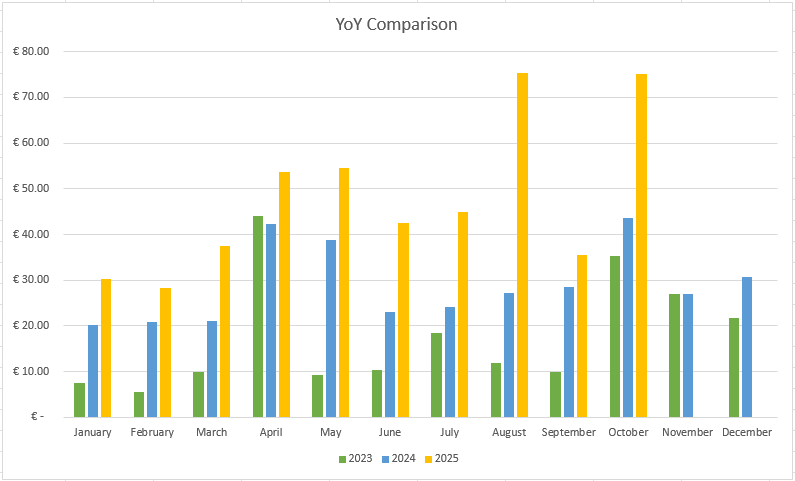

This chart below shows comparison of passive income over years:

October delivered a 71% increase in total passive income versus October last year.

Portfolio Contributions and New Investments

During October, I contributed €400 to my investment accounts:

- €300 went to my stock investment account and is currently waiting for a new opportunity.

- €100 was invested in a new real estate crowdfunding project.

This real estate investment has a duration of 12 months with an interest rate of 6.5%. If everything goes according to plan, it should generate €6.57 in interest.

Summary

October was one of the strongest months of the year in terms of passive income. It came just slightly behind August, which remains my best month so far.

Year to date, my total passive income stands at €477, which is 95% of my €500 annual goal. I’m confident that I’ll reach this goal in November—and I’m curious to see how far beyond it I can go before the end of the year.

Thanks for reading! 😊