I decided to start a new series of posts in my blog – monthly Portfolio Overview. While my regular monthly reviews cover Passive Income, this one will unveil what happened with my portfolio during the month in terms of market value.

I noticed that I am often not aware of what is happening with the holdings in my portfolio. It’s not necessarily a bad thing, as I am of opinion that it’s better to leave your investments and don’t touch them too often. But it may be nice to see how the portfolio changes, what holdings have the most weight in my portfolio and which positions could be increased to keep them up with others.

There are not that many bloggers who track their portfolio changes each month but I am inspired by Engineering Dividends who is doing this. You may find his latest Portfolio Thoughts post here.

Portfolio Overview and Top/Bottom Positions

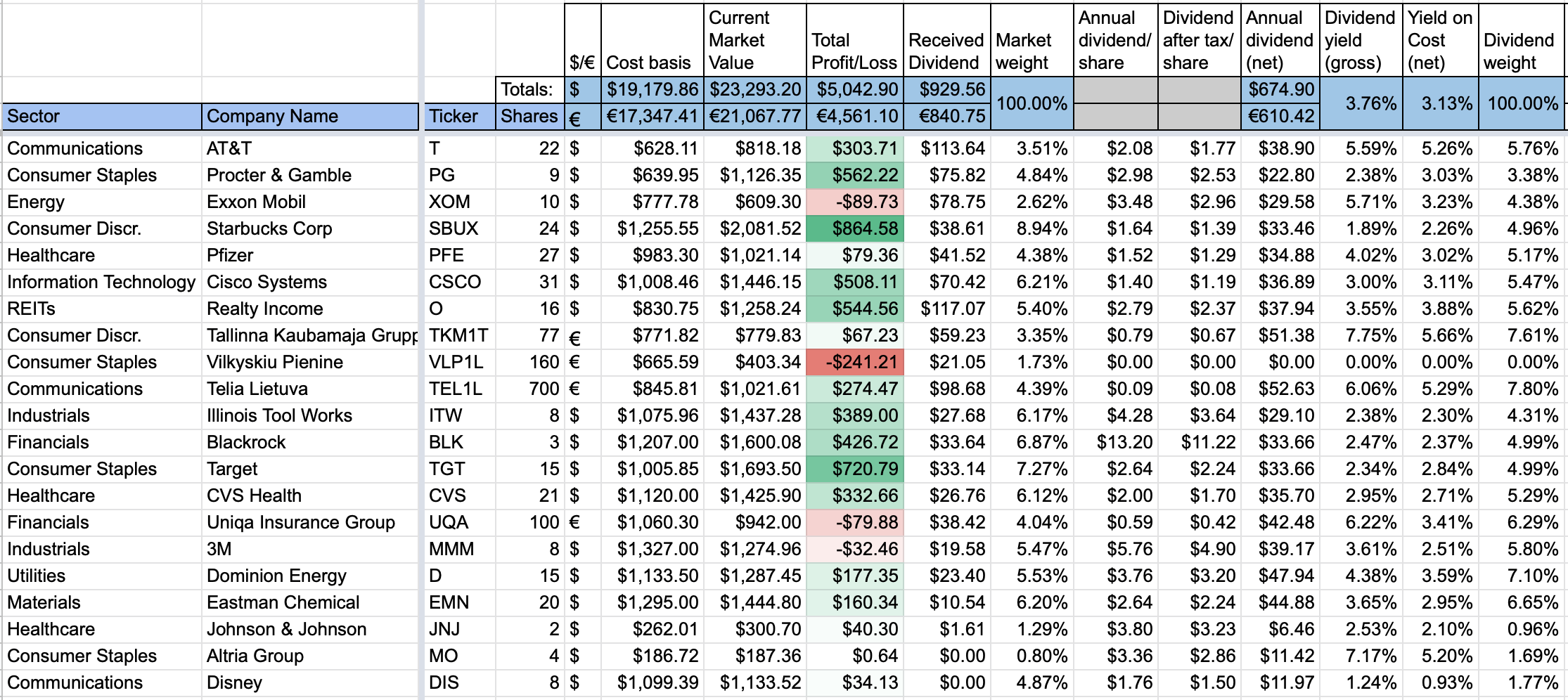

First of all, this is how my portfolio looked like on the 3rd of February:

Starbucks (SBUX) is currently the most profitable company in my portfolio (up $864, including dividends). Of course, most of those gains are unrealised, so it’s just profit on paper, as I am not planning to sell them yet.

The biggest laggard of the portfolio is a Lithuanian dairy producer – Vilkyskiu Pienine (VLP1L). The things were looking bright when I purchased them at the end of 2017 but it turned south pretty much straight away. I am thinking if I should just liquidate the position and allocate funds to a company which is paying dividends instead. On the other side, I don’t think there is much downside from here either. They are going to report their annual results next week, so I will think then if I should keep the position.

Purchases/Sells

During January, I initiated a new position in my portfolio.

On the 29th of January, I bought 8 shares of DIS for $136.55/share for a total of $1099 (including commissions). You may read more about the purchase here.

This brings the number of companies in my portfolio to 21.

Price Movement

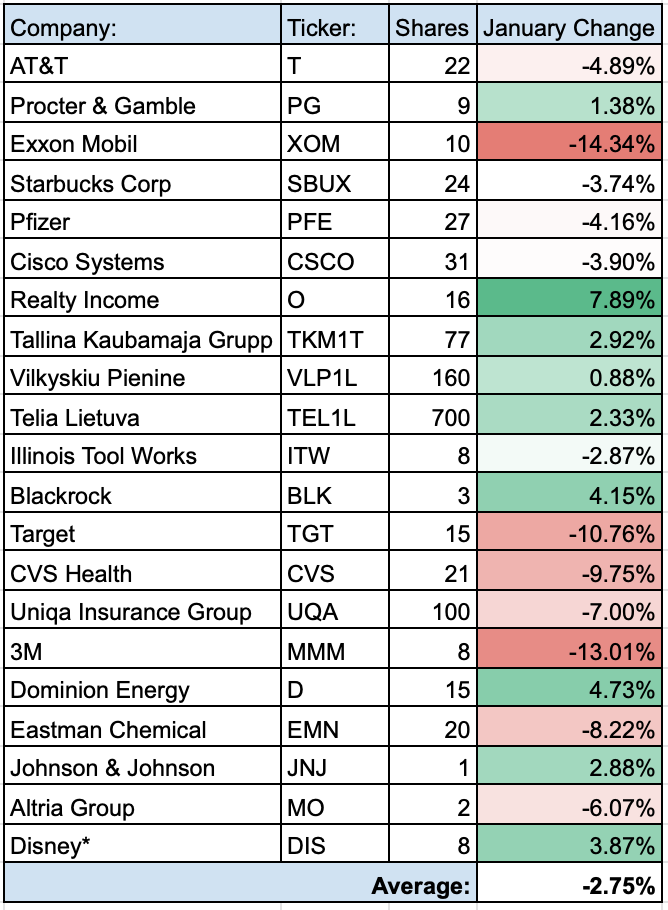

While most of the 2019 was very profitable to stock markets, January of 2020 brought some correction. It was well reflected in my portfolio as well:

There is quite a lot of red colour in the above table. I had three companies that dropped by more than 10%. The biggest laggards were Exxon Mobil (-14%), 3M (-13%) & Target (-11%). CVS Health almost made it to the list but haven’t reached the 10% threshold. The biggest influencers of this drop were the outbreak of coronavirus, falling oil prices and fears of a slowing global economy due to the aforementioned virus outbreak.

I had no companies climbing more than 10% this month. The biggest gainer was a REIT – Realty Income ( up 7.89%).

Top/Bottom Portfolio Positions

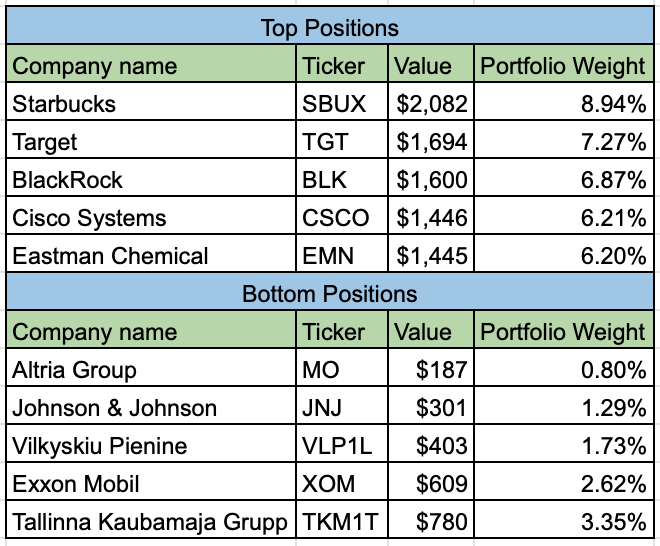

These were my Top and Bottom portfolio holdings in terms of portfolio value at the beginning of February:

This was actually revealing to me as I was composing the table. I wasn’t aware that Starbucks is back as my top position of the portfolio. Also, I wasn’t aware that BlackRock and Eastman Chemical are among my Top 5 holdings. I guess I should review my portfolio more often 🙂

As with regards to my bottom holdings, I am planning to increase my positions in Altria Group and Johnson & Johnson to get them closer to my other holdings. Who knows, maybe I already did this during February.

Summary

January brought some correction to stock market which is a healthy thing, in my opinion. It brought some opportunities to purchase companies at better valuations. On the other hand, there may definitely be some impact due to coronavirus which will be felt when companies report their results for Q1 of 2020.

I found it interesting to review my portfolio in this perspective as well. It highlighted some movements that I would have missed otherwise, since daily moves are usually minimal. It also made me think if I should keep some of my investments in my portfolio (Vilkyskiu Pienine) or allocate the funds elsewhere. I am planning to keep the tradition of reviewing my portfolio on the 2nd/3rd week of the month going forward.

As always, thanks for reading and let me know your thoughts in comments!

Nice to see you reviewing your portfolio. Its something I should do more often. Are you also looking at your diversification in different sectors, industries or countries?

Thanks for the comment Mr. Robot! I don’t think it adds much value to review your portfolio each month but it’s a fun thing to do 🙂

Regarding sectors diversification, I have all the sectors covered now. The last time I reviewed my portfolio in this regard was in August:

http://brokeinvestor.net/portfolio-review-august-2019-sectors/

Maybe I should revisit it next month.

And I have some diversification country-wise, although most of my companies are based in US. But I have some Lithuanian, Estonian and Austrian companies as well. Not to mention that most of my US holdings are multinationals 🙂

Hey,

i recently came up to your blog and started reading so i don’t know much about your strategy, but i saw something strange in your portfolio.

You have portfolio with 21 positions and i see that those positions weighs from less than 1% to almost 9% of portfolio as i understand from the portfolio overview. Have you thought any rules, how would you balance your portfolio? Or your main purpose from investing is to get sufficient money flow from dividends not looking at the size of every position and count of companys in your portfolio?

BTW, i’m Lithuanian too 😉

Hey, nice to see a Lithuanian visiting!

It’s pretty hard to keep the portfolio balanced and I am not trying to do that. For example, my initial purchase of Starbucks was smaller than Eastman Chemical or Dominion Energy but it is worth more now, as the share price appreciated quite a lot. It usually depends on how much money I have for investment. At the beginning, the purchases were quite slow but lately I am trying to invest at least $1000 on my main broker (Interactive Brokers) to avoid high percentage in commissions.

The only exception is the recent introduction of Trading by Revolut where you may make three trades a month free of charge. I gave it a try and initiated a couple of positions (Johnson & Johnson and Altria Group) that I am planning to build over time.

Anyway, when the number of positions grows, it should balance out more and I shouldn’t have positions that are more than 5% of the overall portfolio.

But you are right, the main goal of the portfolio is growing stream of dividends. Portfolio value is not that important but it of course correlates.

Are you investing already? It would be interesting to hear how it is going for another Lithuanian 🙂

Hi, BI. Awesome to see you kick off a new post series. Thanks much for the mention, too.

Interesting to see a couple of Consumer Discretionary names as your top 2 portfolio positions. Both stocks performed very well in 2019. Do you know how far these two moved up your rankings in 2019?

I owned both, but as you know recently parted ways with TGT after my covered call expired in the money. However, I view SBUX as a long-term keeper for me.

Looks like your non-US stocks held up best in January… all positive. The diversification paid off nicely.

MO and JNJ appear to be some solid positions to grow. It seems there’s more uncertainly surrounding MO at this point, but it does offer an intriguing price at which to add. The same could perhaps be said for XOM, one of your other smaller positions. JNJ has had a nice run up since October!

Thanks for the comment ED!

TGT advanced the most during 2019 (up 93%) while Starbucks climbed by ~37%. I added TGT at the very end of 2018 and I am not sure where it was when I added it in terms of a position in my portfolio. I think SBUX was my top position already, as it was already up since I purchased them in the middle of 2018.

Yes, geographical diversification gave me some cover. On the other hand, those holdings lagged US positions during 2019. But I guess that’s the point of diversification (to reduce risk of a single region).

You are right regarding my smallest holdings. I am planning to add to JNJ and MO. I am not sure about XOM, as their balance sheet is not looking too primising. But the dividend yield is getting hard to resist, so we’ll see 🙂