This year, I started reviewing my portfolio once a month. It’s mainly for fun and entertainment, but it may also reveal if I should do some changes to the portfolio.

I am continuing the tradition this month. As always, it will show the biggest moves, top/bottom positions, any portfolio changes and something extra.

Portfolio Overview

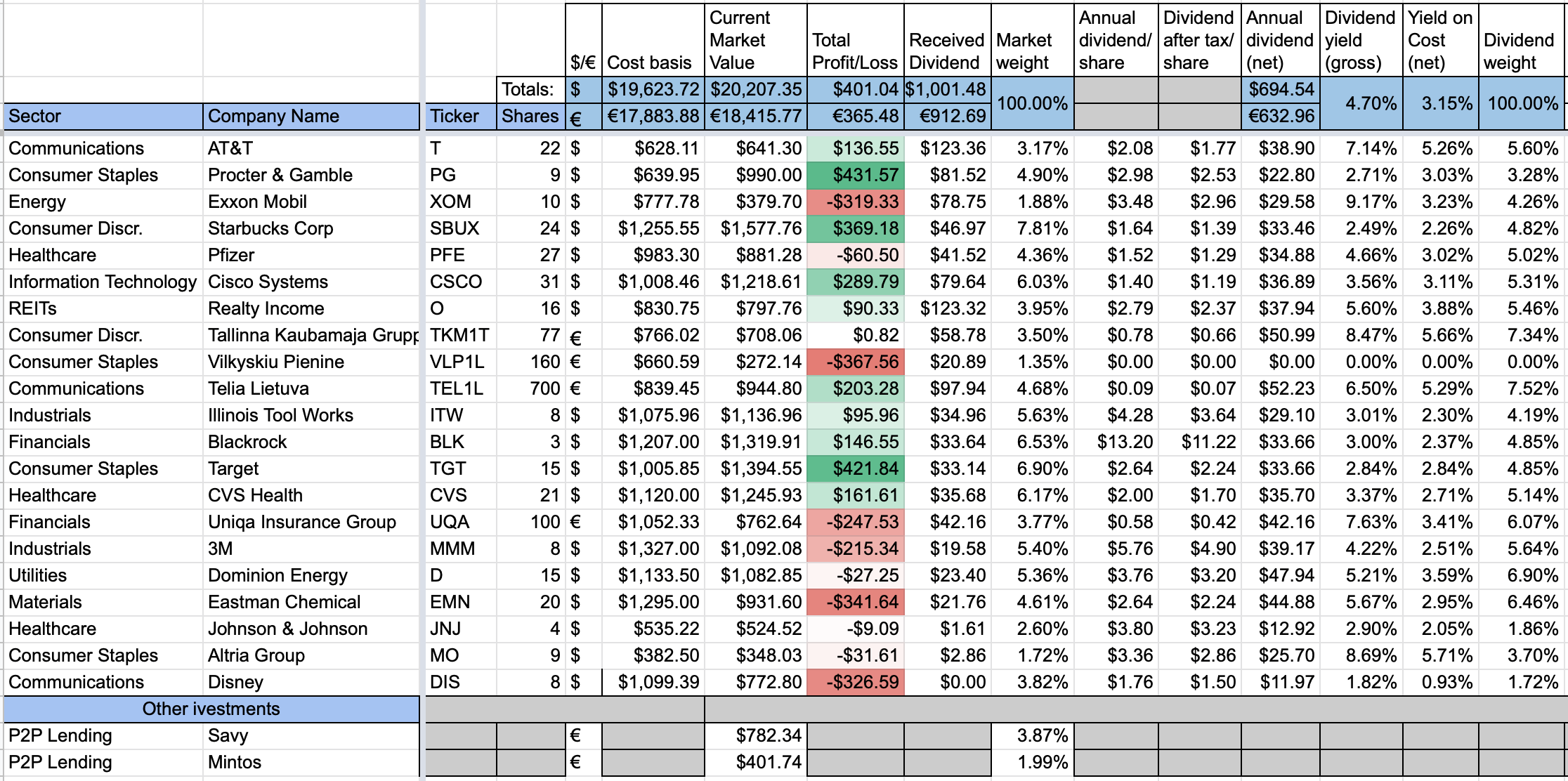

Let’s start with an overview of the portfolio, as it stood on the 31st of March:

Once again, there’s a decrease in the overall value (it was €19202 last month). And that’s including small additions to the portfolio and some changes in how I show it. In reality, the stocks portfolio decreased by almost €2000.

I decided to add a section of “Other investments” to show P2P Lending portfolio. Next month, it will also show the new bond I own.

The portfolio is still in profit, since I started investing But it wouldn’t take much for it to dip into the red. Biggest gainers of the portfolio at the moment are Procter & Gamble, Target & Starbucks. The biggest losers so far are Vilkyskiu Pienine, Eastman Chemical & Disney.

Price Movement

For the second month in a row, all of my positions were in red:

March was pretty dreadful with average drop of 14.71%. The biggest losers this month were Realty Income (O), followed by Exxon Mobil (XOM). This is quite understandable, with retail places closing and the crazy month for oil.

Top/Bottom Portfolio Positions

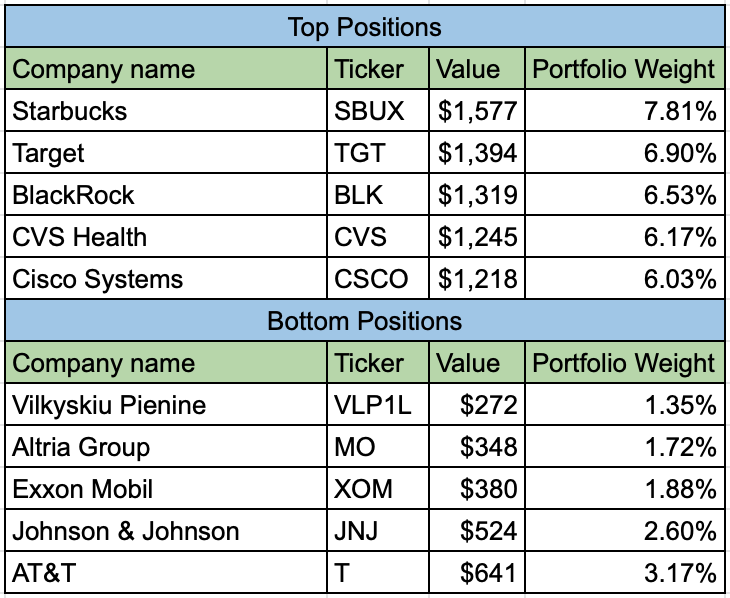

These were my Top and Bottom portfolio holdings in terms of portfolio value at the end of March:

Surprisingly, after such a volatile month there are not many changes in Top positions. Top 3 positions stayed the same. Illinois Tool Works is no longer among the top positions and it was replaced by CVS Health which climbed one position (it was 5th last month). The TOP 5 is completed by Cisco Systems which came back to the list. Healthcare and Technology sectors sustained smaller losses this month and it can be seen at my portfolio as well.

Regarding my smallest positions, Vilkyskiu Pienine switched places with Altria Group. The same happened with Exxon Mobil and Johnson & Johnson. I slightly increased Altria and JNJ positions last month, so it’s quite natural. The Bottom Positions list has a new name – AT&T. It’s a result of their share price falling by more than 20% last month. Tallinna Kaubamaja Grupp fared much better so it’s no longer among the smallest positions in my portfolio, at least for now.

The more I think about it, the more I am leaning to cut the losses and sell my smallest position of the portfolio – Vilkyskiu Pienine. It’s the only company in my portfolio which doesn’t pay dividends and it suffered Net Loss for two years in a row. I guess I should have done it much earlier but it doesn’t feel good psychologically to sell a stock and realise a loss.

Purchases/Sells

During March, I made a few purchases:

- 1 share of Johnson & Johnson for $122.70;

- 3 shares of Altria Group at $35.20/share for a total of $105.50;

- 1 bond of “Viada LT” for €1000.

You may read more about these purchases here and here.

The bond is not shown in my portfolio overview, as I didn’t have it yet on the 31st of March.

Sector Allocation

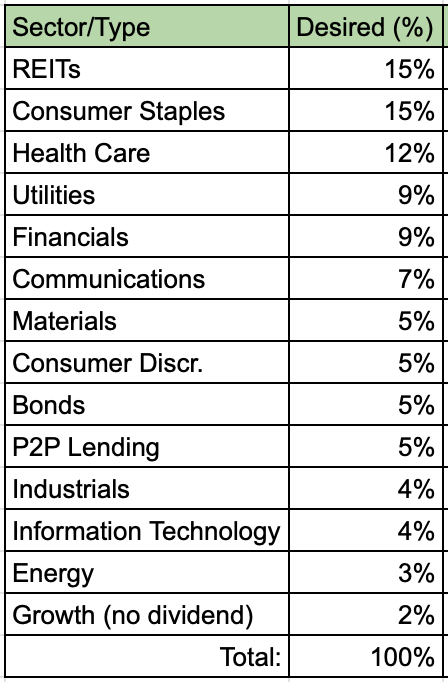

In my previous portfolio overview, I reviewed my portfolio in terms of Sectors. It got me thinking and I decided to create a target allocation for each sector/asset class. This is what I came up with:

I would like to have more exposure to REITs because of their usually higher dividend yield and to Consumer Staples for their stability. On the other hand, I don’t want to have too much exposure to more volatile sectors, like Energy, Information Technology and Industrials.

Also, I added 2% to a category called “Growth (no dividend)”. That’s what I would call “Fun” investments. 2% of my portfolio could go to positions that I would not be afraid to lose but could provide some growth opportunities or at least fun experience. I may sell my “Vilkyskiu Pienine” position I mentioned earlier and re-allocate those funds to some growth stock. Most likely, it would be from Information Technology sector and that’s part of the reason why I only allocated 4% to Tech.

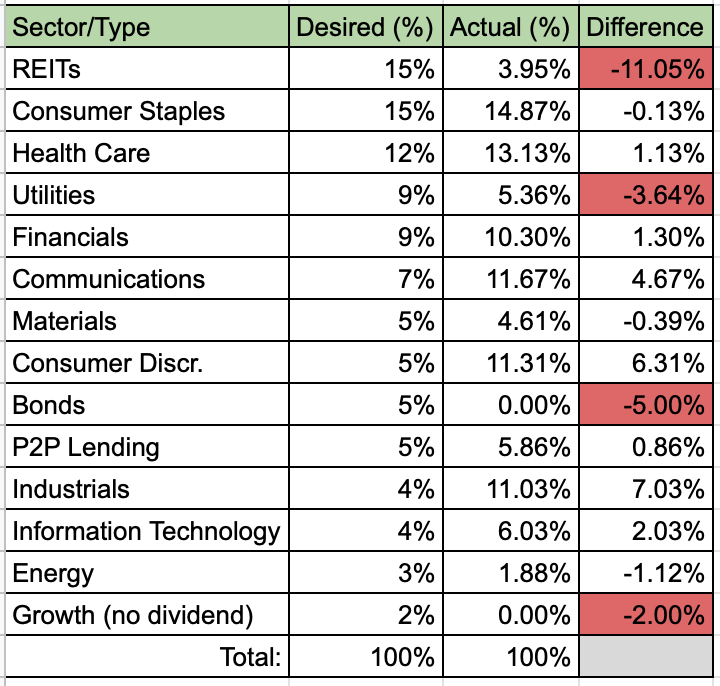

And this is how the actual portfolio was looking at the end of March in terms of sector allocation:

I highlighted in red the sectors/types of investments that I am planning to focus on next. In fact, I already purchased a new REIT and a bond, so it is looking slightly differently already. In the nearest future, I am planning to look more into REITs, Utilities and the Growth categories.

With regards to the positions that are above my target allocation, I am not planning to sell them. Instead, I will think twice before adding to a sector I already have too much exposure to, according to my plan.

This is just the first version, so the target allocation is likely to change in the future.

Summary

March was a dreadful month for stock market. It was even worse for my portfolio than February but I don’t feel too worried. The main thing is for the companies to keep paying their dividend. This overview is mainly for entertainment, as I like playing with numbers 🙂

How is your portfolio doing? Do you have a strategy for sector allocation? I would love to hear your thoughts in the comments!

Good time to add REITs. They are 50% or so cheaper. Look at BPY or SPG they have huge dividend yield, altough have to agree on more then probable dividend decrease.

Thanks for the comment P2035! The names you mentioned declined by 50% or more but they seem too risky to me. I recently looked into SPG but haven’t checked BPY. I’m trying not to fall to a value trap with huge initial dividend yields, as I already have some riskier assets 🙂

Well im doing just that, falling in valur trapd in oil and reit companies 😀

Good to hear your portfolio is still showing a profit despite all the red in March. Keep building that portfolio as you can. You should reap big rewards in the future.

Interestingly, we seem to be going opposite directions when it comes to REITs. I’ve been paring down my allocation while you are looking to build yours. I will say it possibly could be a good time to raise your allocation after REITs have pulled back a good amount recently. I’ve been trying to maintain a sector allocation that is close to that of the S&P 500.

Thanks ED!

Doing what I can to build the portfolio. I know that the earlier you start, the easier it gets later on.

Regarding REITs, I may change my target allocation in the future. It’s more related to the yield which is usually higher in REITs. Also, it’s like another asset class in a sense (Real Estate).

Now I see why you have quite a few tech names in your portfolio 🙂 Perhaps I should own more of them as well but they tend to have lower dividend yield. Also, the new category I added for Fun stocks will probably include some Tech names.