After a dreadful March for markets, April was very different. The stock market kept climbing, even with multiple worrying headlines, like record unemployment in US and historic declines of GDP in multiple countries. It just shows that it’s hard to predict what is going to happen next. Even if you know that the economy is going to take a big hit, markets are forward-looking and it’s hard to wrap your head around it. That’s one of the reasons why I decided not to change anything in my strategy and keep investing when I can, even in these turbulent times.

Starting from this year, I am reviewing my portfolio once a month. It’s mainly for fun and entertainment but it may also show what direction I am going to take next. Let’s see what happened with my portfolio during April.

Portfolio Overview

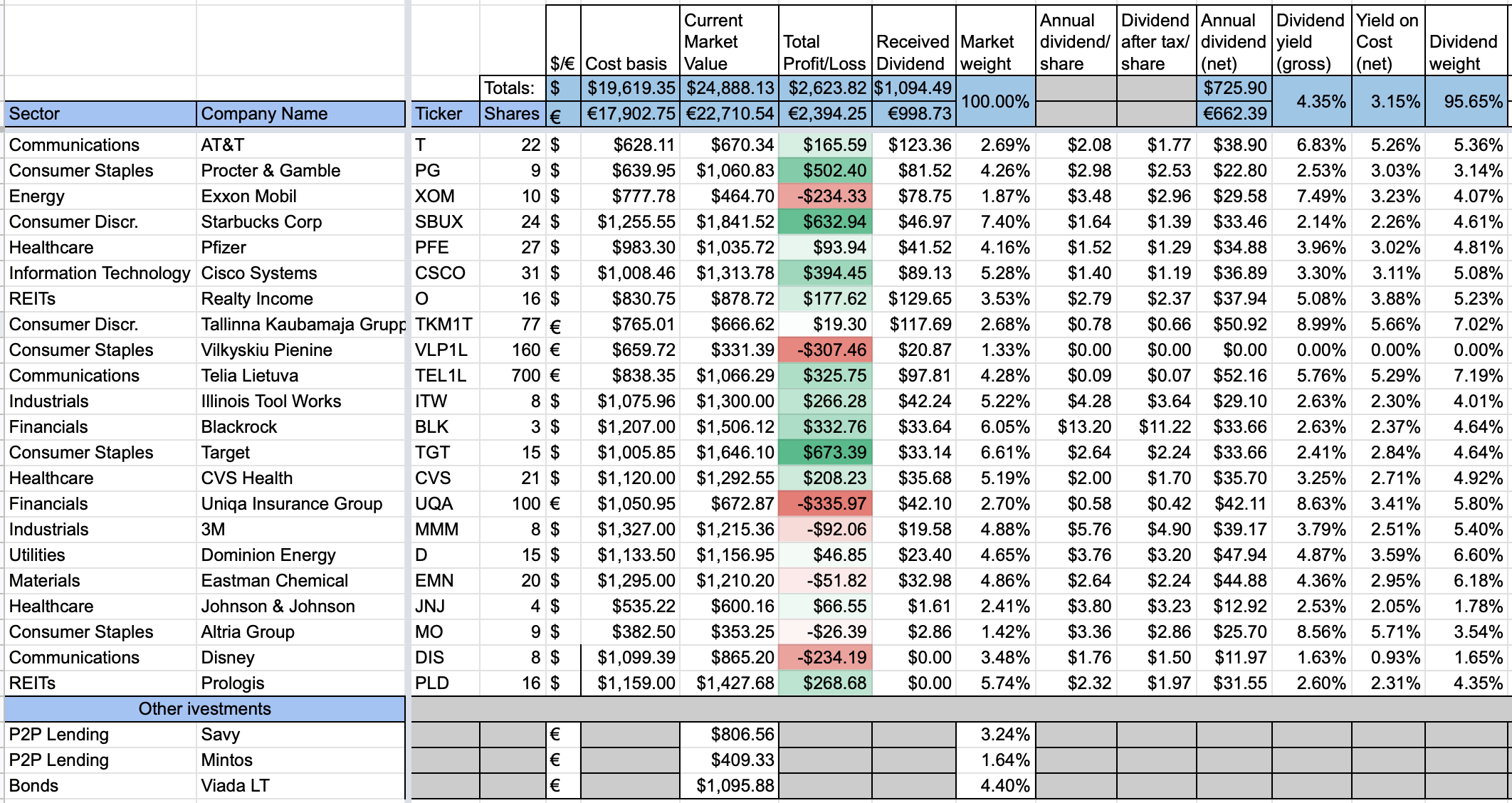

Let’s start with an overview of my portfolio, as it stood on the 30th April:

I think my portfolio saw the biggest increase in value during the last month. It rose from €18.4k to €22.7k during April. Most of the gain came from my recent investments to Prologis and a bond of Viada LT but market appreciation also played a part.

Target came back to the top position as the biggest winner of my portfolio overall. It is closely followed by Starbucks, and then Procter & Gamble.

Talking about biggest losers, insurer Uniqa Insurance Group took the top position (I will discuss their recent news later in the post). It is followed by a long-time laggard Vilkyskiu Pienine, and then Exxon Mobil with Disney.

Price Movement

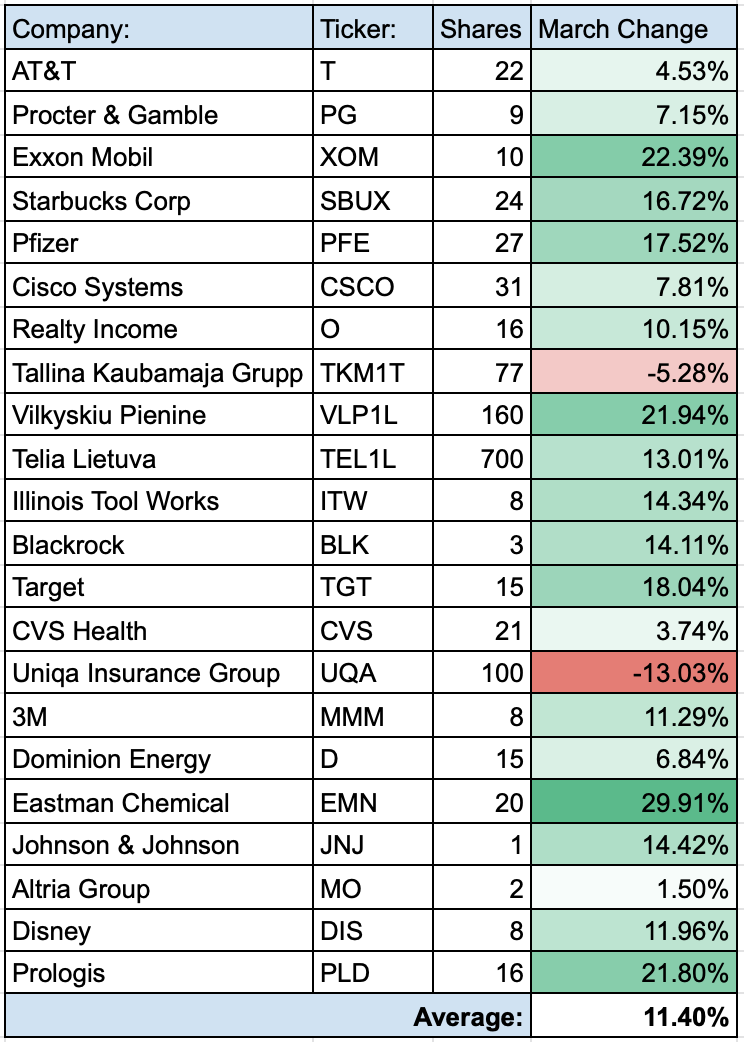

This time, most of the positions were showing green colours in my spreadsheet:

Let’s start with the bad news. Uniqa Insurance Group was the worst performer of the month with a decline of 13%. This company recently announced some negative news – a reduction of the planned dividend of 54c per share to 18c per share for the 2019 financial year. Furthermore, they are planning not to pay a dividend for the 2020 financial year (which would be have been paid out next year). I guess it’s not surprising from a European financial institution – most of them cut/reduced their dividends recently. I haven’t decided yet if I am going to do anything with this position.

Another decliner of the month was another European company – Tallinna Kaubamaja Grupp from Estonia. However, this decline was led by a completely different reason – they simply had ex-dividend date in April and paid annual dividend with a yield of ~10%. The price of the stock dropped by a similar amount next day which is quite natural.

Talking about biggest gainers of the month, I had 4 companies that increased by more than 20% during the month. The pack is led by Eastman Chemical with an increase of almost 30%. Other notable gains came from Exxon Mobil, Vilkyskiu Pienine & the newcomer of the portfolio – Prologis.

Top/Bottom Portfolio Positions

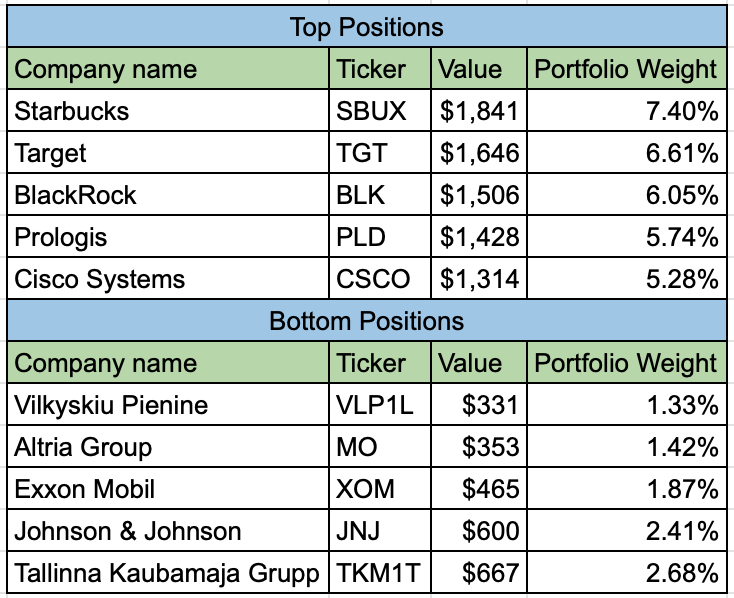

These were my Top and Bottom portfolio holdings in terms of portfolio value at the end of April:

There are not too many changes compared to last month. Regarding Top positions, the newcomer Prologis came straight to the Top4 position of the portfolio. It replaced CVS Health which is out of Top5 for now.

The only change in Bottom Positions is the Bottom5 place – Talinna Kaubamaja Grupp replaced AT&T. However, they are pretty close, so it may easily change in the future.

I still haven’t managed to close the smallest position of my portfolio – Vilkyskiu Pienine. Perhaps it’s a good thing, as it was one of the biggest climbers last month. However, the position is very small, so it didn’t make much difference.

Purchases/Sales

On the 1st of April, I purchased 16 shares of Prologis at $72.00/share for a total of $1159.00 (including commissions). It adds $31.55 to my net forward annual dividend income. You may read more about the purchase here.

Sector Allocation

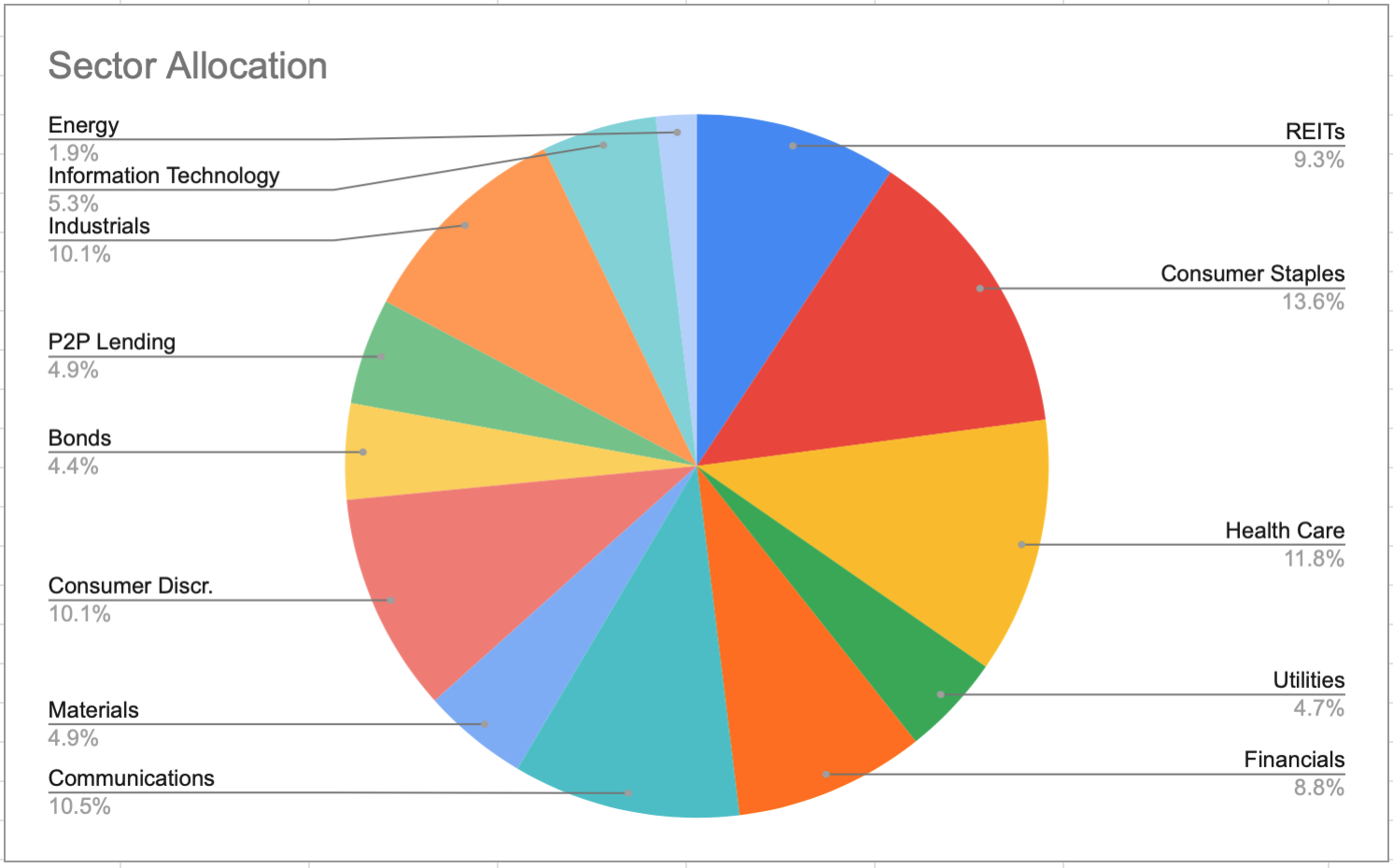

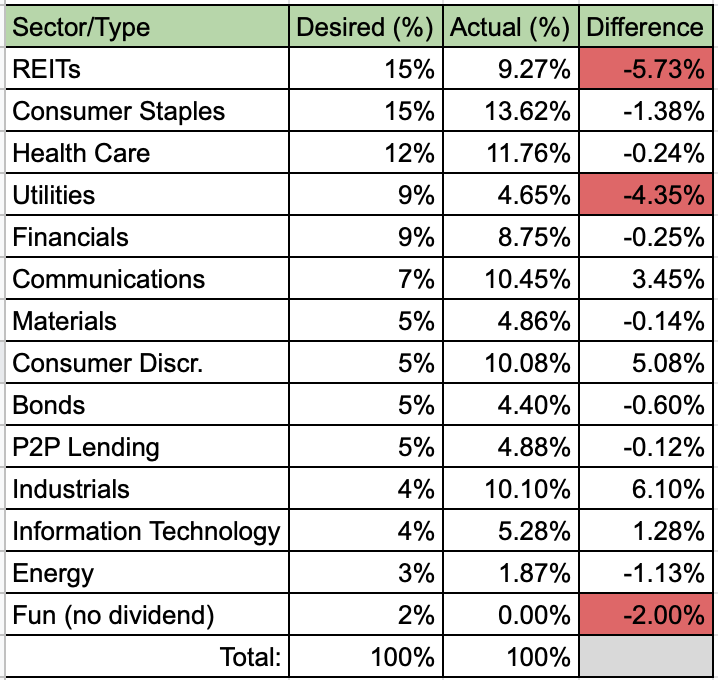

This is how Sector/Type of Investment allocation was standing at the end of April:

During my portfolio review last month, I shared a desired sector allocation for my portfolio. This is how it looks at the moment:

Looking at the table above, I am thinking about adding to one or two of the highlighted areas. Priority sectors currently would be REITs and Utilities. I haven’t looked much into individual companies lately but a few names from REITs come to mind for further investigation. It’s Welltower, Simon Property Group, Ventas and Baltic Horizon Fund. From Utilities, I am thinking about Nextera Energy, Southern Company, Duke Energy. Finally, in the Fun category, I have a few ideas in my head – Advanced Micro Devices, Slack, Match Group, Ubisoft Entertainment.

However, these are just initial thoughts and I didn’t dig deeper to any of the companies yet.

Summary

I didn’t have much time to look into stocks lately. However, now that I reviewed my portfolio and found out which areas I would like to increase, I will try to find some time to investigate possible candidates to my portfolio.

How is your portfolio doing? Have you been buying anything lately? What’s on your watchlist at the moment? I would love to hear your thoughts in the comments!

Hi,

New to the blog. Nice post!

How did you come up with your desired weightings?

J

Thanks J!

I just sat down and played with the percentages until it equaled 100% 🙂 Since I am mainly dividend investor, I gave REITs big weighting due to their relatively higher dividend yield. Similarly, Consumer Staples & Healthcare sectors get high ratings due to their stability and ability to withhold crises. Going down the list, I am giving less percentage to sectors I consider volatile/cyclical.

I also gave 5% to P2P lending and Bonds each, to diversify into different investment classes a little bit.

Finally, I decided to allocate 2% for “Play Money”. I haven’t added anything to this category yet, though 🙂

Nice set of companies. For REITs I would recomend looking at BPY and for utilites ED. The more I think SPG looks like a very risky buy now, pure retail and big boxes. Dividend cut very likely and sustainability in L/T qestionable. Would go for O better if to retail. Noce that your portdolio is still overwater. My is -10% due to REITs and Oils that im very exposed to. Need to decrease that.

Thanks for the suggestions P2035! I will have a look at BPY and ED.

Yes, SPG is not likely to end up in my portfolio. They will have to reduce their dividend, so I will only consider them when I see how they stand after they do the decrease. I have O in my portfolio already but I may consider adding to the position.

Yes, the portfolio was in loss for just a brief period for now. It may still get into loss but I think it should be good in the long term 🙂

I’m really impressed by your diversification based on sector, thats some awesome work right there. Keep it up my friend and keep watching the balance!

Thanks a lot, Mr. Robot! I am trying to diversify as I see it fit. The main thing is to make the strategy work for you 🙂

Good to see all the green, BI. Not only for the month, but overall, too.

That was quite an initial investment into PLD, as it moved right into the top 5!

On the Portfolio Overview table, I wanted to ask about the Yield on Cost (YoC). It would seem that in the cases where you are in the green on a stock that your YoC would be higher than than the current Yield, but that’s not the case for many of them. How are you calculating those?

Thanks for a kind comment, ED!

The reason why YoC yield is smaller is because I calculate it after withholding tax, while current yield is displayed as gross. It may sound confusing but I find it easier to track and it works for me. But as you are telling this, I will need to review my calculations, I may have made some mistakes in the formulas 🙂