I finally found some time to sit down and try to catch up with my monthly portfolio summaries. It’s already mid-December, but hopefully I can still get everything published before the year ends. Without further ado, here’s what happened with our portfolio back in September.

Dividend Income

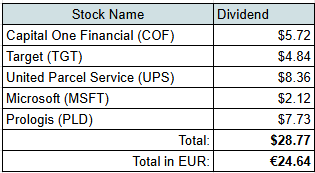

In September, I received dividends from five companies:

The third month of the quarter is usually the strongest for me in terms of the number of dividend payers. While the individual payouts are still quite small, they are slowly growing—which is exactly what I like to see.

Here’s how those dividends stacked up against our actual spending:

- $4.84 from Target (TGT) — covered 0.5% of our Food expenses over the last 3 months

- $5.72 from Capital One Financial (COF) — covered 15.3% of our Banking expenses over the last 3 months

- $8.36 from United Parcel Service (UPS) — covered 1.0% of our Car & Transportation expenses over the last 3 months

- $2.12 from Microsoft (MSFT) — covered 0.5% of our Subscriptions & Personal Development costs over the last 3 months

- $7.73 from Prologis (PLD) — covered 0.3% of our Mortgage payments over the last 2 months

Seeing dividends gradually cover small portions of real-life expenses is always motivating, even at this early stage.

Dividend Year-on-year Comparison

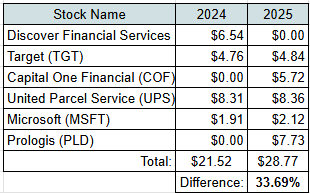

Let’s compare dividend to what we received in September 2024:

Compared to September last year, Discover Financial Services dividend was replaced by one from Capital One Financial, which was slightly smaller. Aside from that, all other companies increased their dividends, and I also added a new dividend payer: Prologis (PLD).

Overall, the year-on-year dividend growth came in at 33%, which is a very solid increase.

Other Passive Income Sources

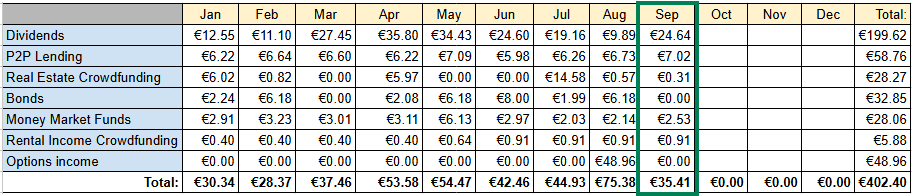

In addition to dividends, we earned income from several other passive sources:

- €7.02 – P2P lending

- €0.31 – Real Estate Crowdfunding

- €2.53 – Money Market Funds

- €0.91 – Real Estate Crowdfunding (Rental Income)

Passive Income Summary

After adding everything up, our portfolio generated €35.41 in passive income for September:

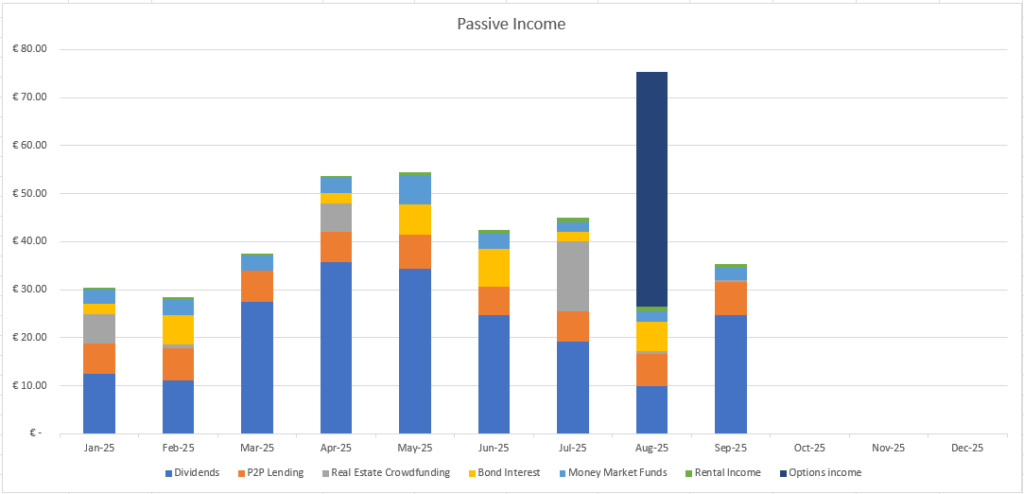

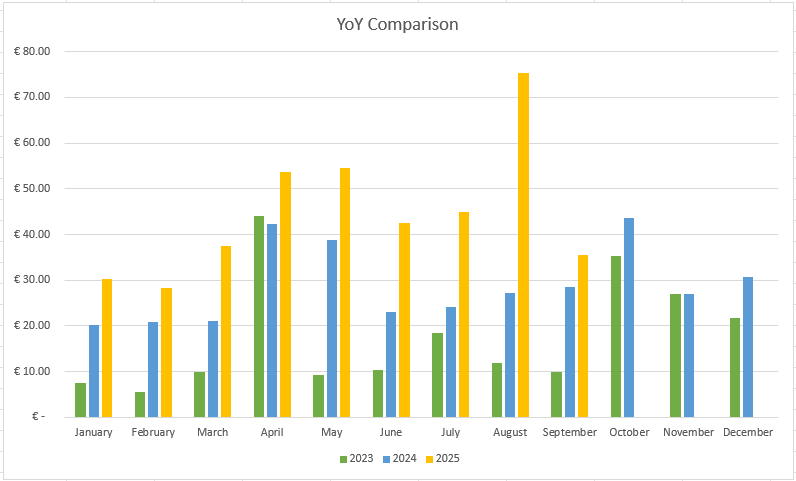

Here’s comparison to previous years:

When compared to previous years, I really like what I see: all of the yellow bars representing 2025 are higher than those from past years. Slow and steady progress is clearly paying off.

Portfolio Contributions and New Investments

In September, I contributed €300 to our investment accounts. Together with some previous savings, I used this capital to add a new position to the portfolio.

On September 24, I purchased 30 shares of Vilkyskiu Pienine (VLP1L) at €10.45 per share, for a total of €313.50.

I previously owned this company and decided to add it back to the portfolio after a few years.

A few things about the company:

- Core business: Milk procurement, processing and realization of dairy products.

- P/E (TTM): 7.15

- Dividend yield: ~5.1% (based on last year’s dividend at my purchase price)

Although the company operates in the Consumer Staples sector, it is quite cyclical. The current environment is very favorable, but that won’t last forever. Historically, the business has gone through ups and downs, but management has done a good job diversifying operations, and I believe in the long-term direction of the company.

I plan to continue adding to this position until it reaches my desired allocation.

Summary

September wasn’t one of the strongest months of the year, but every little bit helps.

So far in 2025, our passive income totals €402.40, which is already 80% of my €500 annual goal. Since I am well ahead of schedule, I’m confident that this goal will be reached.

Thanks for reading! 🙂