I can’t believe that 2019 is officially over. It’s time to look back and see what happened throughout the year. For me, the year was really great. It was very different compared to previous years due to our baby-girl. Life changes when you have kids and it is hard to explain how much joy it can bring to life, even though you feel tired more often than before 🙂

Anyway, let’s see how much passive income was generated during the last month of the year.

Dividend Income

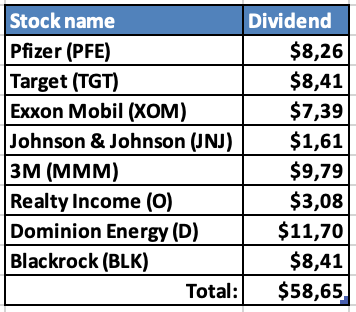

This month 8 companies paid dividend to me:

The list keeps getting longer and I love it. Biggest payer this month was Dominion Energy (D) which delivered $11.7. It’s rare that my quarterly payers would pay more than $10 with a single payout. It should get the new normal going forward, though. The smallest amount came from Johnson & Johnson (JNJ) which is one of the most recent additions to my portfolio. It’s a tiny position and I am planning to increase it in the future.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $8.26 from Pfizer and $1.61 from Johnson & Johnson would cover 5.0% of our expenses in Health category for the last 3 months;

- $8.41 from Target could pay for 0.8% of what we spent on Food during the last 3 months;

- $7.39 from Exxon Mobil would cover 3.2% of our Car & Transportation expenses for the last 3 months;

- $9.79 from 3M would cover 1.2% of what we spent on Baby related expenses (mainly Daycare) during the last 3 months;

- $3.09 from Realty Income would cover 0.5% of our monthly Rent;

- $11.70 from Dominion Energy would cover 3.2% of our Utilities bills for the last 3 months;

- Finally, $8.41 from Blackrock could cover 28.1% of our expenses in Banking category for the last quarter.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

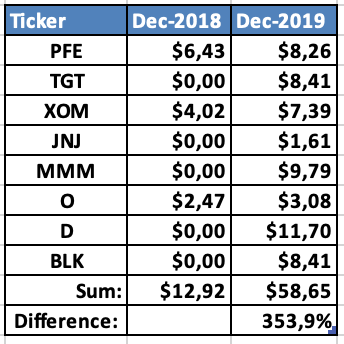

Let’s see how dividend income compares to December of last year:

That’s what I’m talking about! Dividend income this December is more than 4x bigger than what I received last year. It just shows that consistent investing is paying off and it should only get better in the future.

The main reason for this growth was addition of 5 new companies to my portfolio that all pay their dividend in December.

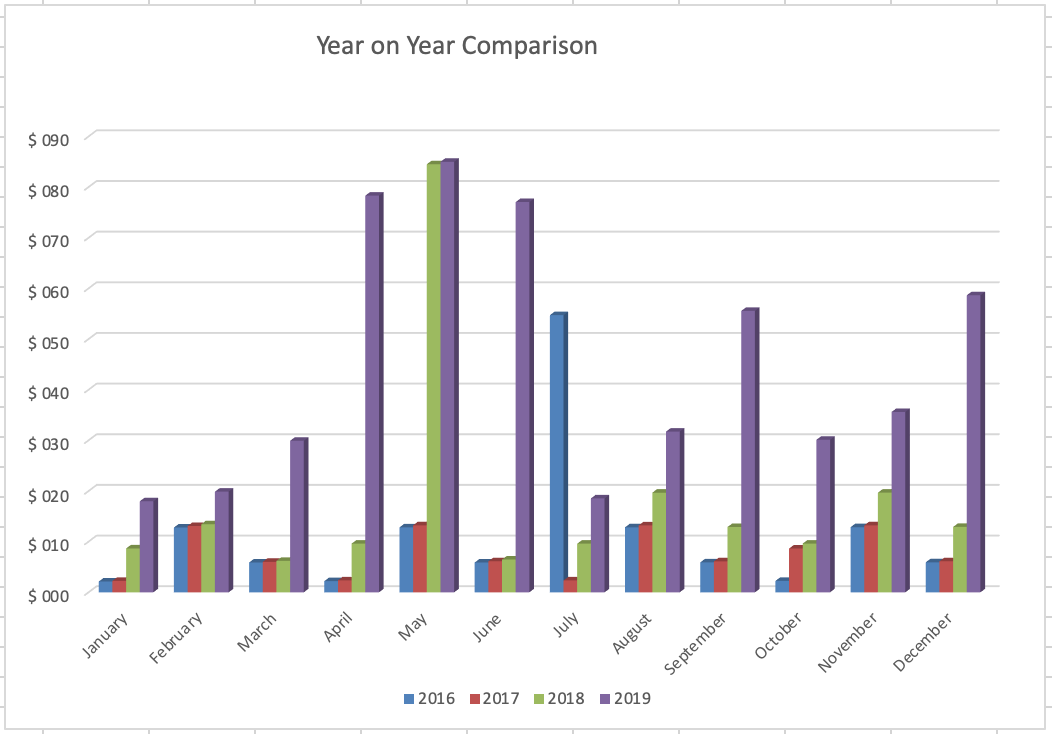

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €350 to my investment account. I haven’t purchased any shares, though.

I also haven’t added any funds to P2P lending platforms.

Dividend Increases

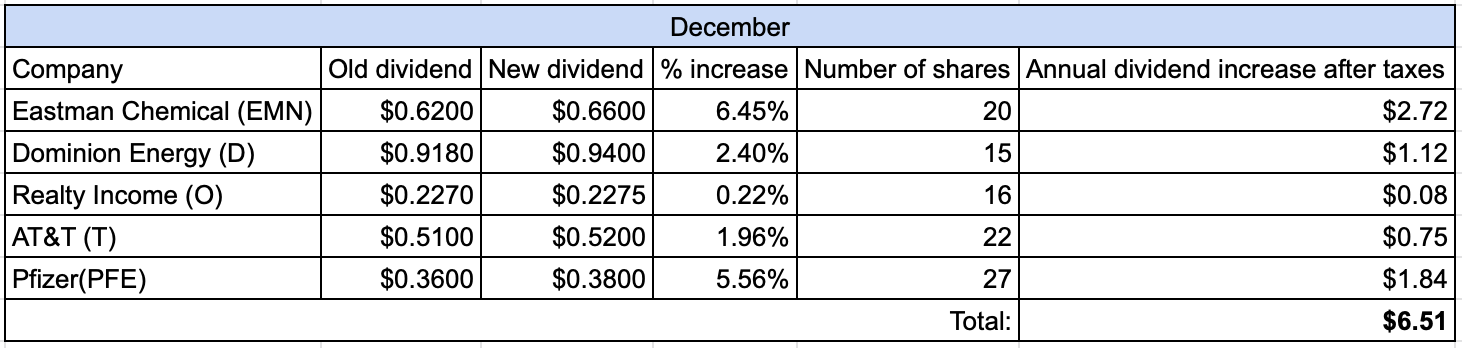

This month I had a number of companies declaring a dividend increase:

The biggest increases came in from Eastman Chemical and Pfizer. Other three companies also added a little. Every little bit counts, so I can’t complain. I would need to invest ~€210 with my average portfolio yield to get this amount of dividends!

CHANGES IN PROJECTED ANNUAL DIVIDEND INCOME

I had a goal to increase my PADI to $450 from US companies this year. At the start of the year it was standing at $236. This means that I should add additional $214 (or $18/month in average) if I want to achieve the target.

To track the progress, I monitor PADI increase/decrease from two sources – dividend raises/cuts and capital contribution.

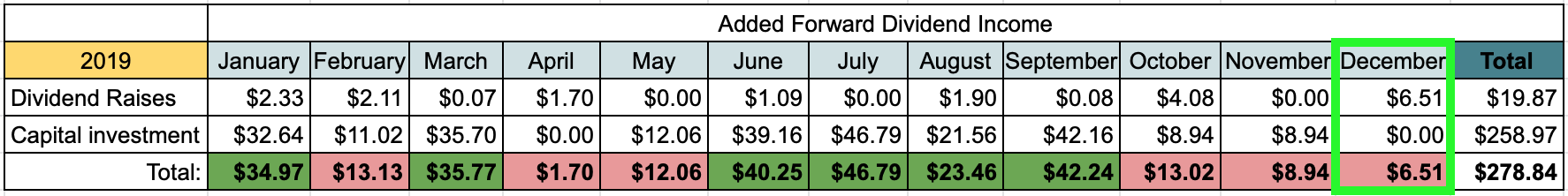

Let’s see how forward dividend income changed during December:

This time, the increases in forward annual dividend income only came in from dividend increases. It is nice to see that the dividend income increased every single month this year, one way or another. It’s especially great that $19.87 came from dividend increases, so I didn’t need to add any additional capital for this part.

P2P Lending Income

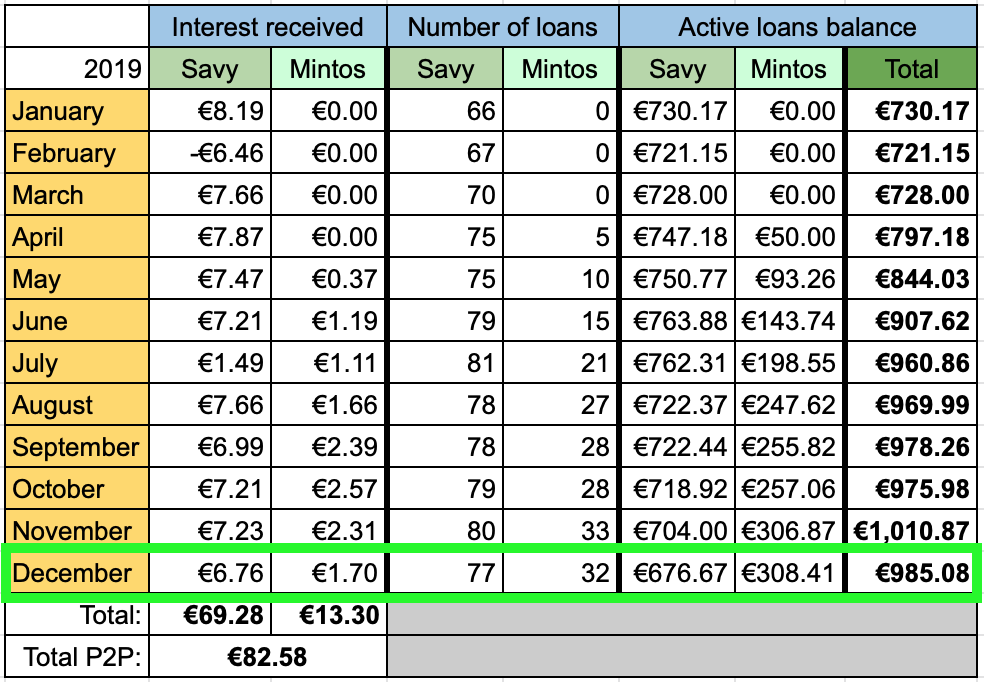

This is how my income from P2P lending looked like in December:

Interest from P2P lending added €8.46 to passive income this month. It’s slightly lower than in previous months. There seems to be a temporary issue with investments overview in Mintos platform, so the numbers may be inaccurate this month.

The amount of active loans also decreased slightly compared to last month due to some cash drag in Savy platform.

My P2P lending portfolio currently stands at 4.6% of my overall portfolio. I would like to keep it at around 5%.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR) I received €61.02 from passive income during December. This brings the total for 2019 to €573.22 which smashes my goal to receive €480. I am really happy with the result and am already thinking what the next year will bring.

How was your December? Did you end the year strong? Are you sharing any dividend payers with me? As always, thanks for reading and don’t hesitate to leave a comment!

Congrats on 570€ dividends. My dividends not made it to 400€ this year but due to latest purchases should increase significantly durring 2020 🙂 Sharing the baby happynes there. Any toughts about 2nd? There is so much joy, why not double it 😉 What about your expenses, did they increased after birth of a child? Ours did.

Thanks P2035! For now there is enough joy with one kid but you never know 🙂

Expenses only increased now when we started hiring a nanny, as my wife is back to work. Before that, I wouldn’t say that expenses increased a lot, this year we were able to save more than the year before.

During the first year there were not much additional expenses, as we had a lot of friends giving used clothes/toys for our baby. We also tend to buy mainly used things, so they don’t cost much. We are eating out less, so we save there as well. This year should be tougher but we’ll see how it goes 🙂

Nice, saving more then year before 🙂 We will try to do that this year. My wife did not returned to job as we used 2y maturity leave and we are aiming for 2nd baby in a row 🙂

By the way how is your sports? My was not as impresive as yours but with baby stoped tottaly. Try to telauch it at 2020 🙂

Good luck, hopefully you will be able to pick up the saving part.

I am going to overview my goals shortly but let’s just say that I didn’t reach any of the fitness goals 😀 I did much less sports but it’s still something (480km running, ~1000km cycling). I think I still improved my overall fitness, as I started doing exercises before lunch at work with a few colleagues. I can do 10 pull-ups now, so that’s definitely an improvement 🙂

Nice 10 pull-ups is something. Just tried muself im at 5 now 🙂 480 running and 1000 km cycling is something especialy with a baby. Lets see how your y2019 goals went.

Nice broke

great yr over yr progress and congrats on smashing that goal. The snowball go’s faster and faster. whats your goal for 2020?

keep it up

cheers

Thanks a lot Rob!

I am still thinking about the passive income goal for 2020, as there will be some headwinds this year. I am thinking about €800-900 for now. I should publish a post about this in about a week, so not sure yet.

An impressive way to cap off 2019, BI. You had monster YoY growth, 5 new dividend payers, and your largest PADI increase of the year due to raises. Plus, you smashed your annual dividend goal. Wow!

Keep up the great work in 2020. You’ve definitely got this DGI ship sailing in the right direction.

Thanks a lot ED! It was really a great year. I wish I could keep the momentum going. I like to say that the main thing is to be in a better situation than I was yesterday 🙂

Hi BI,

Good luck to the New year and congratulations on the successful completion of 2019. I can see that it was successful!

Thanks a lot Druss! Good luck to you too in 2020! 🙂