Markets are really wild lately. The worst days in several decades are followed by the best runs in history. It’s hard to see which direction the market is going to take next. Nevertheless, I think it is important to stay invested and stick to your strategy. That’s why I am looking into some companies that are potential candidates to be added to my portfolio.

This time, I am mainly looking into REITs. They have been hurt lately and I would like to increase my portfolio’s exposure to this sector. As I mentioned in my most recent Portfolio Overview, it was at 5.5% of stocks portfolio when I last checked.

1. STAG Industrial (STAG)

First in the list is an industrial REIT. Shortly about the company from Morningstar:

Stag Industrial Inc is a real estate investment trust primarily involved in the acquisition and operation of single-tenant industrial properties throughout the United States. (…) Stag Industrial derives nearly all of its income in the form of rental income from its portfolio of warehouse and distribution properties. The company generates most of its rental revenue from its facilities located in Midwestern and Eastern U.S. cities. Stag Industrial’s largest customers include air freight and logistics, automotive, and industrial equipment companies in terms of overall revenue.

As most of the market, STAG was hit heavily lately. Its price dropped by ~35% from the highs of February. This is not without a reason, of course. There is risk with the recession looming, and automotive industry, one of the largest customers of Stag, will feel significant impact. That said, Industrial REITs should be less damaged than Retail or health care REITs, concentrating to senior housing etc.

Let’s review the ratios that I am looking to when evaluating REITs:

- Current price – $22.66;

- FFO (Funds From Operations) Payout Ratio (forward) – 92.25%;

- Net Debt/EBITDA – 5.61;

- EBITDA/Net Interest Expenses – 5.46;

- Net Interest Expenses/Net Operating Income – 50.74%;

- Debt/Total Real Estate Assets – 47.5%;

- Dividend Yield – 6.35%;

- Average 4-yr yield – 5.76%.

Of course, most of the calculations are based on historical results. It is hard to predict how FFO or EBITDA will look like going forward, but we can at least see how much margin of safety the company has.

After looking at the numbers, the company seems quite risky in this environment. Hence, the high dividend yield of 6.35% which may be cut in the future if the situation escalates and revenues drop significantly.

2. Prologis (PLD)

Next up is the biggest Industrial REIT in the world. Shortly about the company from Prologis Investor Relations page:

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 964 million square feet* (90 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,500* customers principally across two major categories: business-to-business and retail/online fulfillment.

Company is well diversified. Here is a short overview of company’s assets from its latest Investors FactSheet:

I also like this overview of type of goods in their buildings and main customers:

Let’s run through their numbers at the current stock price:

- Current price – $79.17;

- FFO Payout Ratio (forward) – 68.12%;

- Net Debt/EBITDA – 4.84;

- EBITDA/Net Interest Expenses – 10.81;

- Net Interest Expenses/Net Operating Income – 18.09%;

- Debt/Total Real Estate Assets – 40.74%;

- Dividend Yield – 2.93%;

- Average 4-yr yield – 2.98%.

Based on the ratios above, Prologis is the safest choice from the ones I am considering. Unfortunately, the price already rose a lot since the bottom and the dividend yield is no longer attractive. It was above 3.5% just a week ago, but I was not familiar with the company enough to initiate a position. I would initiate a position if the price went down below $72. I think it is still possible in the nearest future, considering recent swings in the market.

3. Welltower (WELL)

Let’s switch to another kind of REITs. Welltower represents the Healthcare Facilities industry. Shortly about the company from Morningstar:

Welltower owns a diversified healthcare portfolio of over 1,700 in-place properties spread across the senior housing, medical office, and skilled nursing/post-acute care sectors. The portfolio includes over 100 properties in both Canada and the United Kingdom as the company looks for additional investment opportunities in countries with mature healthcare systems that operate similarly to that of the United.

Since Welltower is operating senior houses, it has a risk to be really affected by the ongoing pandemic. They cannot do tours for new residents in senior houses, so it will slow down the business. Also, some seniors may prefer leaving facilities, especially after some cases were reported in other similar institutions. For example, Covid-19 outbreak was reported in Sabra REIT recently.

On the other hand, it’s hard to know the exact impact in long term. Company is offering big dividend yield which is higher than its few years average at the moment, and it may be a nice moment to initiate a position.

Let’s see the ratios of Welltower at its current share price:

- Current price – $49.7;

- FFO Payout Ratio (forward) – 90.59%;

- Net Debt/EBITDA – 6.56;

- EBITDA/Net Interest Expenses – 4.14;

- Net Interest Expenses/Net Operating Income – 44.13%;

- Debt/Total Real Estate Assets – 52.75%;

- Dividend Yield – 7.00%;

- Average 4-yr yield – 5.29%.

Welltower is the most leveraged in terms of debt divided by the most recent EBITDA. It probably will look even worse in the next few quarters at least, so the high debt level is worrying. It is compensated by high dividend yield, though. If you are willing to take the risk, it may turn out rewarding.

4. Realty Income (O)

Finally, I am considering adding to one of my existing positions. It’s the company which calls itself “The Monthly Dividend Company”. There is much to like about Realty Income. It recently became a dividend aristocrat, since they raised their dividend every year for the last 25 straight years.

Shortly about the company from Morningstar:

Realty Income Corp owns roughly 5,000 properties, most of which are freestanding, single-tenant, triple-net-leased retail properties. Its properties are located in 49 states and Puerto Rico and are leased to 250 tenants from 47 industries. Recent acquisitions have added industrial, office, manufacturing, and distribution properties, which make up roughly 18% of revenue.

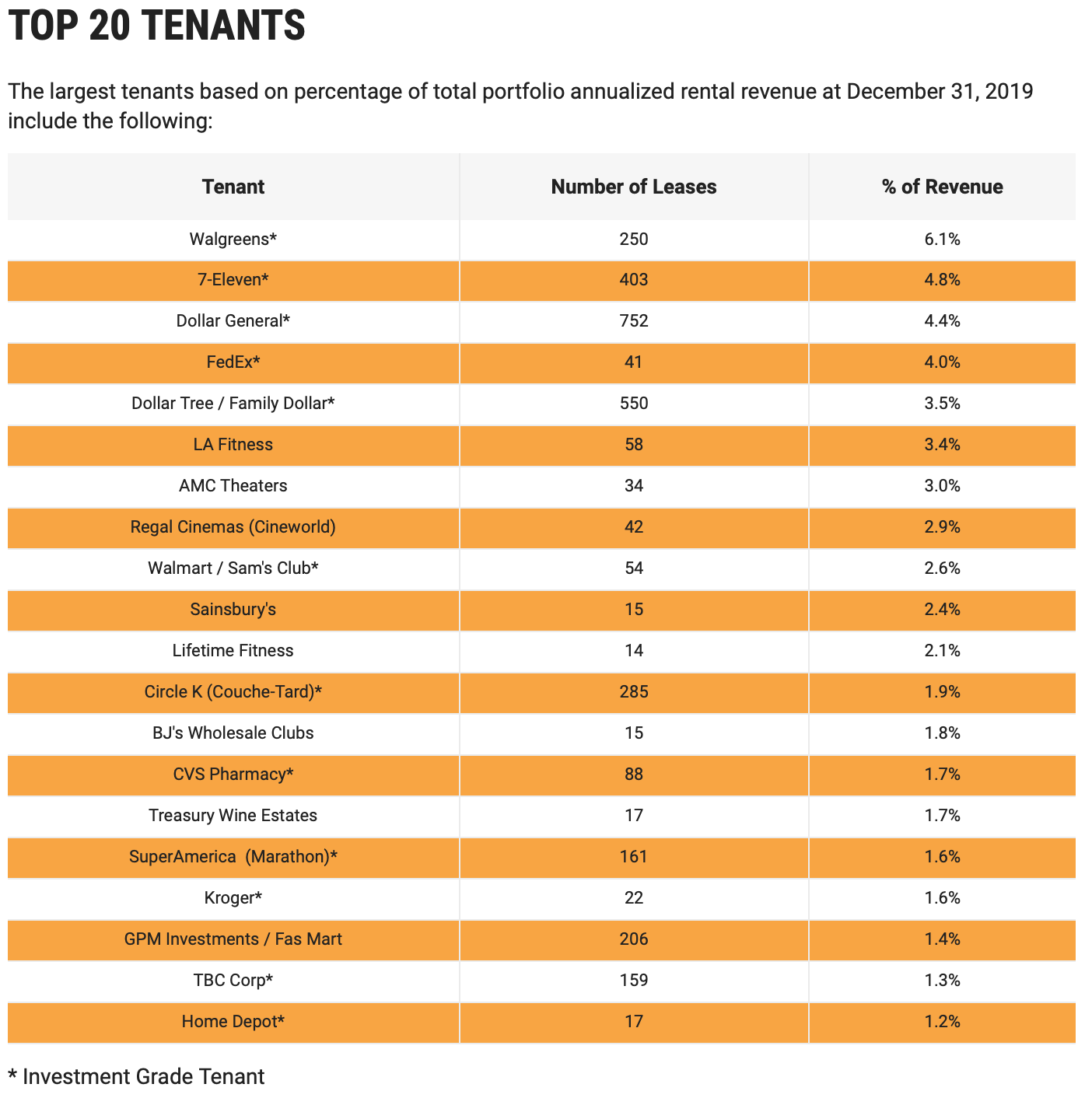

This is how company’s biggest 20 tenants look like:

Let’s review the same data as we did for the previous REITs:

- Current price – $56.90;

- FFO Payout Ratio (forward) – 92.30%;

- Net Debt/EBITDA – 5.90;

- EBITDA/Net Interest Expenses – 4.66;

- Net Interest Expenses/Net Operating Income – 39.19;

- Debt/Total Real Estate Assets – 48.64%;

- Dividend Yield – 4.91%;

- Average 4-yr yield – 4.36%.

I feel that it’s one of the safest choices from Retail REITs, as its biggest tenants include names like Walgreens, FedEx, 7-Eleven, Circle K and alike. It showed that it can survive a recession and even keep raising dividends during the previous one.

However, I already own some shares of O, so it would be nice to diversify my portfolio with some REITs from different industries than Retail.

Summary

This is a table I made to compare the mentioned REITs. All the calculations are mine, based on data from Seeking Alpha, so please do your own diligence.

Stag Industrials and Welltower have the highest dividend yield but are also the riskiest choices. Their debt ratios are worrying and I wouldn’t be surprised if they cut their dividend. On the other hand, the dividend yield should still be high, as REITs are obliged to distribute at least 90% of their Operating Income to avoid Corporate tax.

On the other hand, Prologis and Realty Income should definitely survive but valuations are not that great at the moment.

I started preparing this list a week ago but was pretty busy the whole week, so only finished it today. It took time to investigate how to best value REITs, as they are quite different to regular companies. While I was doing my research slowly, the companies went up in price significantly. On the bright side, I have some entry points now and will be ready if the market takes another swing to the south.

Have you been active lately? What was your most recent purchase? What are you watching at the moment? I would love to read your comments! 🙂

Hi, try looking at Baltic horizon, my largest reit and a baltic one 😉 Personaly bough BP some time ago, betting that they will keep their dividends. I would go for O and I think this will be my purchase.

Thanks for the suggestion P2035. I can see that Baltic Horizon Fund released their annual earnings recently, so I am looking at them now. It may be a candidate for my portfolio 🙂

I really like O and think they are one of the safer choices, even though I remember that its price dropped by ~22% in a single day a couple of weeks ago 🙂