Back in November 2019 I was celebrating a milestone of €20k my portfolio reached. Well, it seems that I will need to celebrate this occasion one more time, as my portfolio is down below the mark.

The last week of February was the worst so far for my portfolio. It’s actually interesting to experience such downtrends, as you may finally see how psychology works when your real money is on the line. Luckily, I am just at the beginning of my journey and don’t rely on my portfolio appreciation or dividend income, so it’s not so worrisome.

In this post I will review my portfolio for the previous month. It will show biggest moves, top/bottom positions, any portfolio changes and something extra.

Portfolio Overview and Top/Bottom Positions

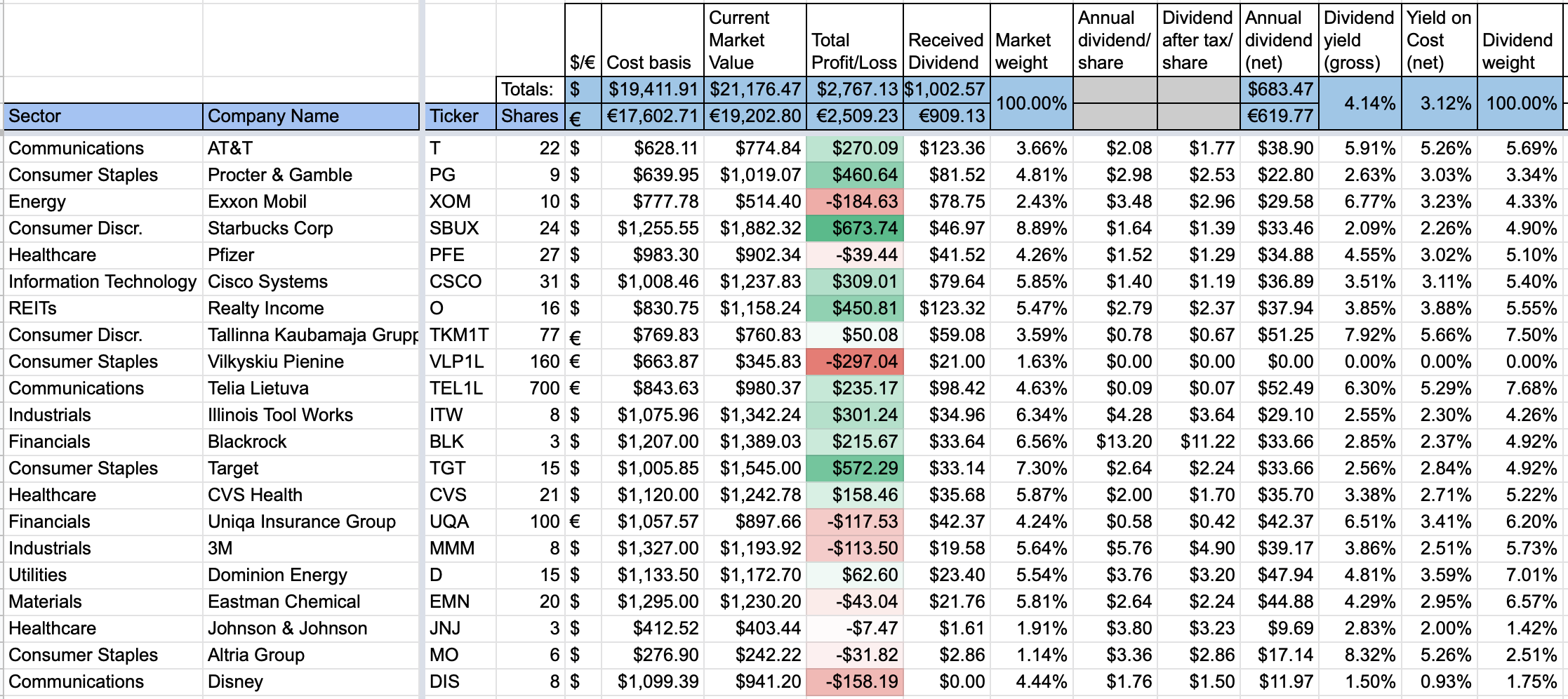

Let’s start with the overview of portfolio, as it stood on the 29th of February:

The biggest change is in the overall value of the portfolio. It went down from €21067 to €19202, which is a decrease of 8.8%.

Starbucks (SBUX) is still the best performer in terms of capital appreciation while Lithuanian dairy producer Vilkyskiu Pienine (VLP1L) is the biggest laggard.

Price Movement

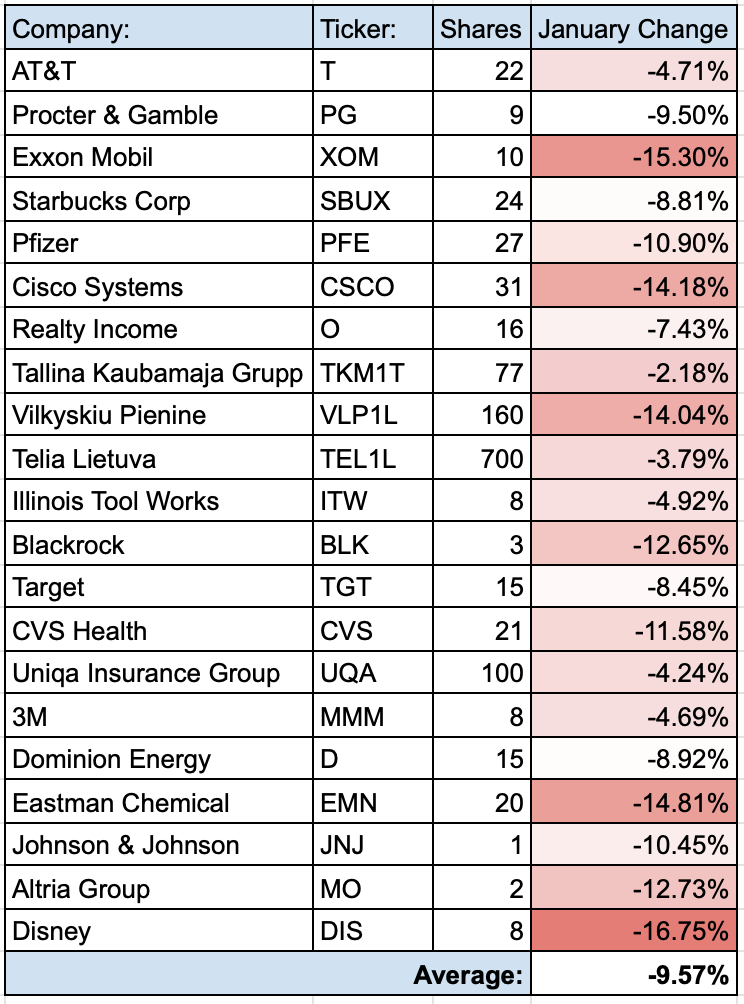

Another first time for my portfolio – all of my positions were in red in February:

Almost half of my portfolio positions (10) reported losses exceeding 10% during the month. Ironically, it was led by one of my latest purchases – Disney (DIS) which fell by 16.75%. Coronavirus hit the company pretty hard, as it is hurting multiple avenues of Disney’s revenues – parks, movies etc. If this was enough, company’s CEO Bob Iger unexpectedly declared a departure on the 25th of February.

Other names that suffered losses of more than 10% include Exxon Mobil (XOM), Eastman Chemical (EMN), Cisco Systems (CSCO), Vilkyskiu Pienine (VLP1L), Altria Group (MO), Blackrock (BLK), CVS Health (CVS), Johnson & Johnson (JNJ) & Pfizer (PFE). I got tired writing down so many names.

Interestingly, the best performing stocks (even though still negative) were some of my European holdings – Tallina Kaubamaja Grupp (TKM1T), Telia Lietuva (TEL1L) & Uniqa Insurance (UQA). It shows that geographic diversification is somewhat limiting the losses.

Top/Bottom Portfolio Positions

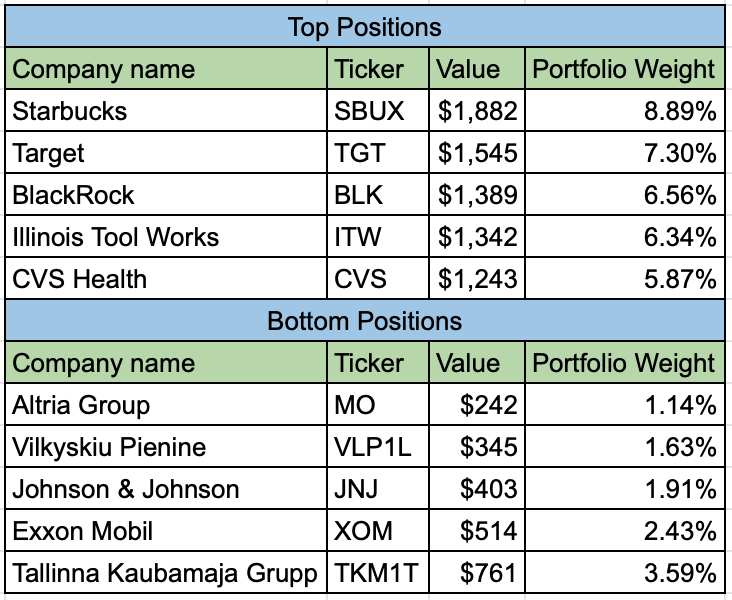

These were my Top and Bottom portfolio holdings in terms of portfolio value at the end of February:

There are some changes compared to last month. While first three companies in the top positions didn’t change, Cisco Systems (CSCO) and Eastman Chemical (EMN) are no longer among the top positions. They were replaced by Illinois Tool Works (ITW) & CVS Health (CVS).

Regarding my smallest positions, the only change from last month is Vilkyskiu Pienine (VLP1L) and Johnson & Johnson (JNJ) switching places.

March should bring a lot of changes, as the volatility in the market is really high, but let’s not jump ahead of us.

Purchases/Sells

I added a little to the smallest positions of my portfolio this month on the 18th of February:

- 1 share of Johnson & Johnson for $150.51;

- 2 shares of Altria Group at $45.09/share for a total of $90.18.

You may read more about the purchases here.

Sector Breakdown

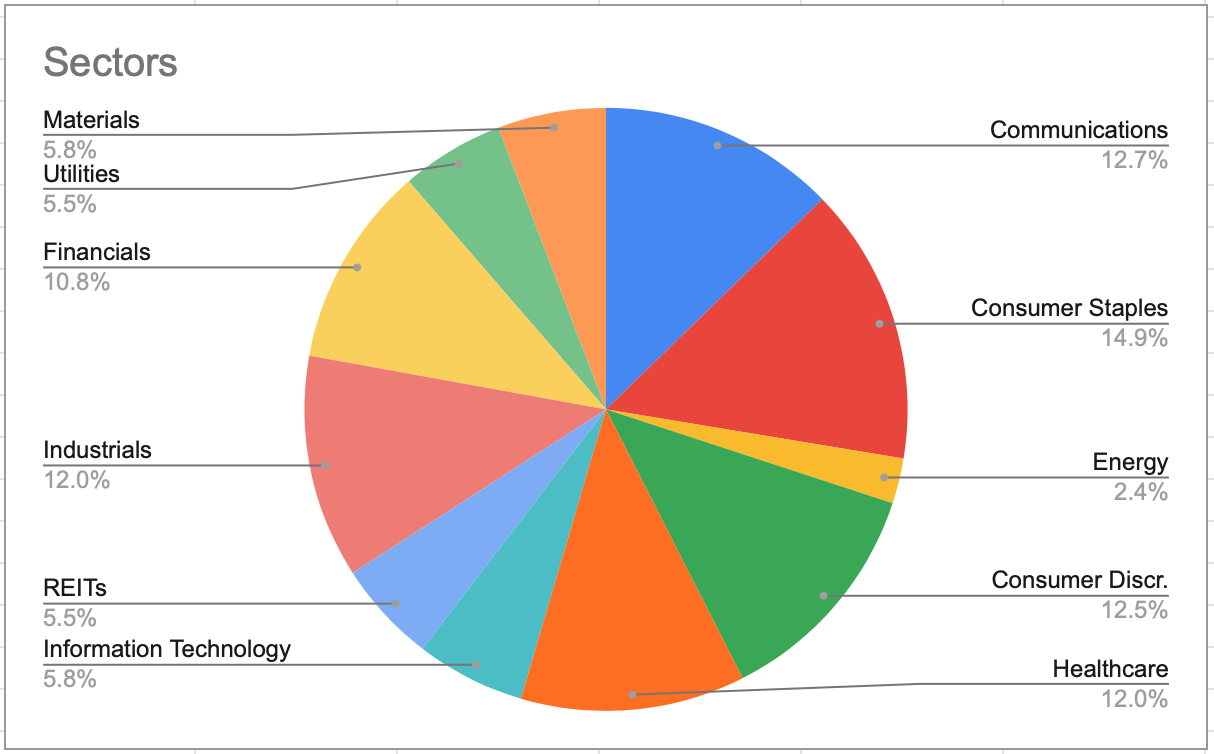

This time, I decided to also review my portfolio based on Sectors. This is how it looks like at the moment.

Consumer Staples is the leading sector in my portfolio with almost 15%. It is closely followed by Consumer Discretionary, Communications, Healthcare and Industrials.

Energy has the smallest part of the pie with 2.4%. REITs, Utilities & Materials are also at the lower end.

Going forward, I would like to keep Consumer Staples and Healtchcare among the leaders. I am thinking to increase my exposure to REITs in the nearest future. Perhaps I should create some framework of how much I want to have in each sector but that’s a plan for the future.

I have a feeling that nowadays it’s hard to assign a company strictly to a single sector. There are a lot of companies that have some IT elements and can earn income from a wide area of fields.

If you would like to read more about sectors, I covered them in this post last year.

Summary

February was probably the worst month in terms of portfolio losses in my short investing history. It looks like March will be even worse but the month isn’t over yet. Anyway, I am not panicking and it’s better to experience such downtrends earlier rather than later. It gives some perspective and gets you thinking if any adjustments to your portfolio should be made in the future.

How is your portfolio doing lately? Are you doing any active steps in this volatile market? As always, thanks for reading and don’t hesitate to leave your comments! 🙂

We’re both handling the market crash in a similar way. It isn’t easy but staying calm and playing the long game is a time-tested approach that tends to work well. Hopefully you’ll be back above €20k soon!

Thanks for the comment Brian! Hopefully, the history will repeat and reward those who don’t panic 🙂 Portfolio will be back above €20k, it’s just a matter of time. The main purpose is still dividends, and if they don’t get cut, I don’t care that much about portfolio value for now.

Hi, try Baltic horizon if your into REITs best one in baltics to my knowlage. Good yield due to bullet structure loan financing, however migh decrease if banks will introduce repayments. Either way good buying opurtunity. Cashed BP for 1/2 of price that I bought earlier 🙂 Nice sector alocation. Im too much into oils and telcos now.

Thanks for the comment P2035! Baltic Horizon is one of the options I have but I haven’t looked into them too much yet. I am going to investigate them for sure, together with some other names, like Welltower, Simon Property Group etc.

Well, if your oil and telecommunications companies don’t cut their dividend, it should be fine. You couldn’t know that this was going to happen. I was thinking about adding to some oil names as well but decided to go with other sectors, so I got lucky to avoid them. It’s still under consideration as well, though.

Well oil companies are down +50% for ex. BP is traded bellow maxico sill low so I have bet on BP and doubled my hilding there. They are so fat on cash compared to XOM and RDSA and this is vital in total lockdown times like today. BP will have no problem surviving 1y with same dividenda. I doubt same will be with XOM and RDSA. Also BP is most into sustainability, renewables ect. Or to put it simple way future of energy sector.

Consider REIT ETF as an option. You can find widely diversified ones. For example: https://www.justetf.com/de-en/etf-profile.html?query=NL0009690239&groupField=index&from=search&isin=NL0009690239

Thanks Aitvaras, that’s a very good suggestion!

I somehow didn’t consider an ETF, since I only own individual stocks in my portfolio but I will consider it.

I can see that your suggested ETF has a few REITs, that I am considering, as top positions in its portfolio.