A couple of weeks ago, my stocks portfolio reached €20k mark for the first time. After some market fluctuation, it went down a bit but then it returned above the threshold again. I decided to celebrate this moment by writing a short post about it.

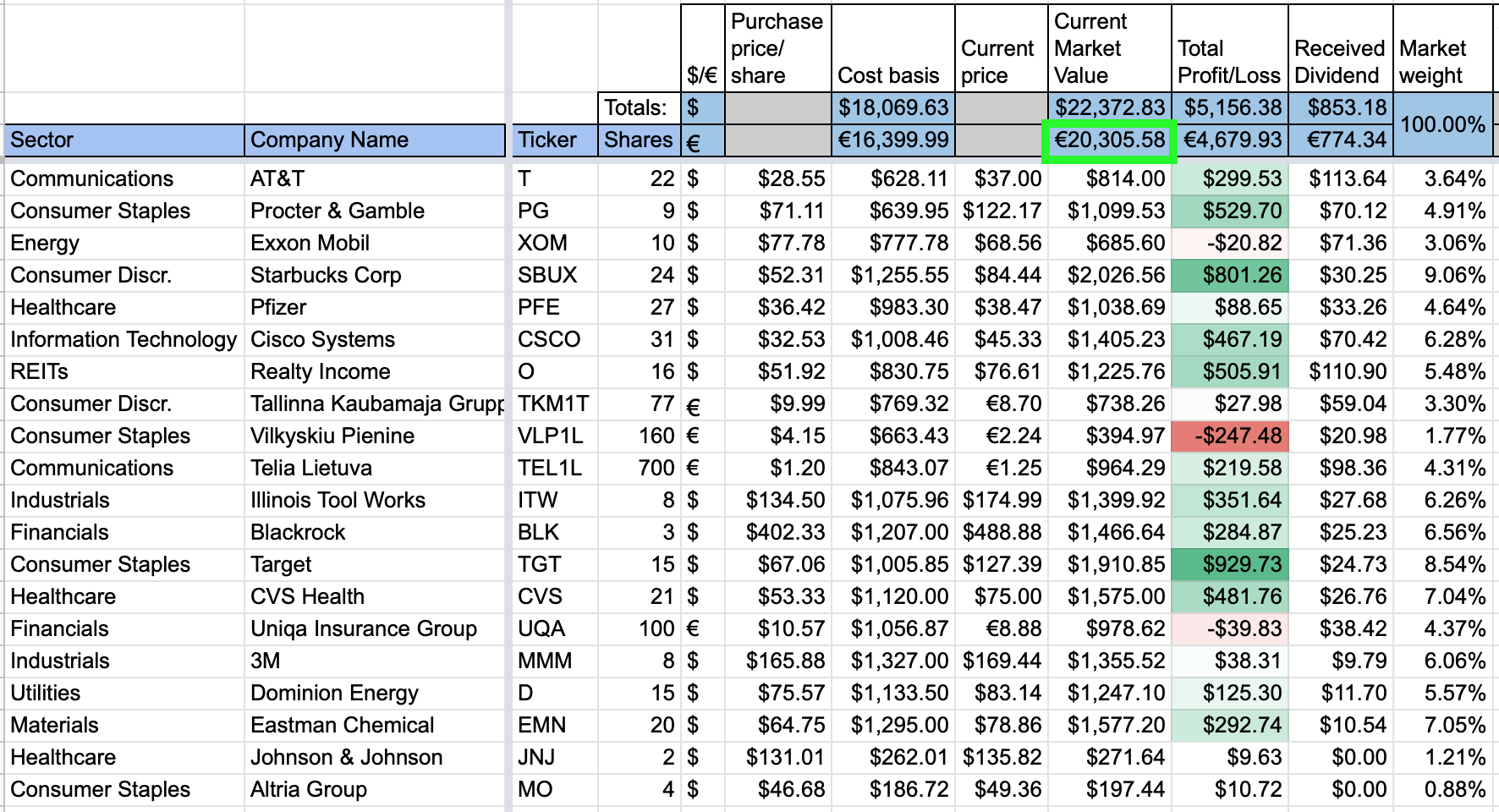

My stocks portfolio stands at ~€20300 as I am writing this:

Of course, it only needs to drop ~1.5% to get below the €20k mark again but I will keep adding to the portfolio to minimize this risk 🙂

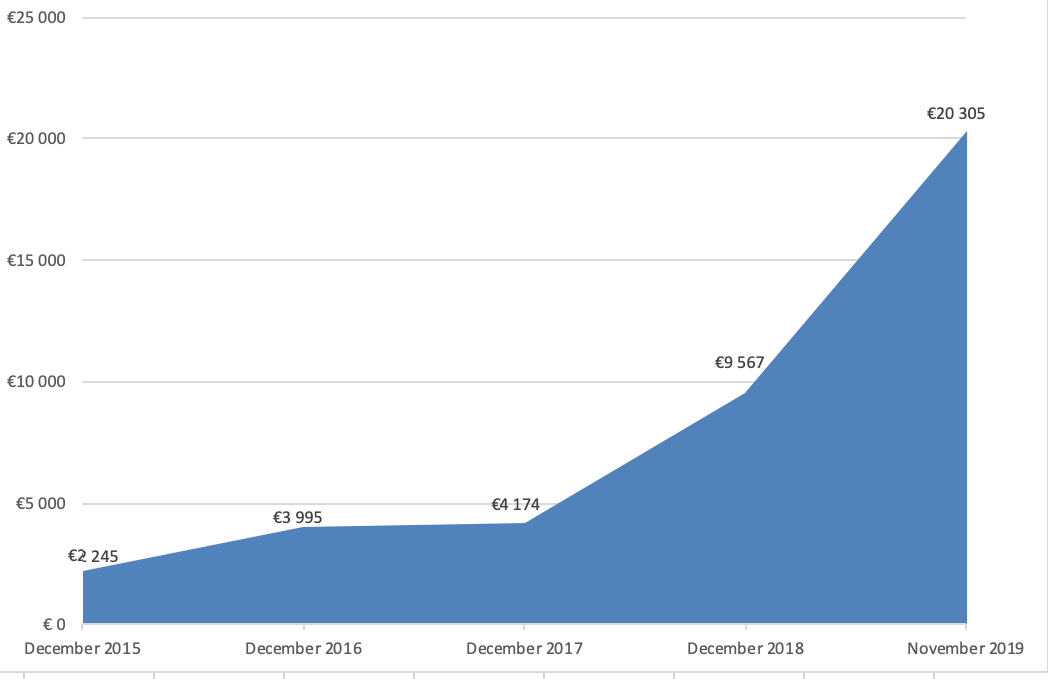

Let’s see how much time it took to get there:

- December 2015 – €2245;

- December 2016 – €3995;

- At the end of 2017 my stock portfolio stood at €4174;

- At the end of 2018 it was up to €9567;

- Currently, it is worth €20305.

It’s great to see that portfolio size doubled in size compared to the end of last year. It’s getting some momentum for sure. What’s even better is that I only added €6300 of new funds this year so far. The rest of the gains was the effect of stock price appreciation and reinvested dividends.

I don’t expect the growth to stay this strong going forward, though. The economy is slowing down and I got lucky with some of my positions that appreciated in price a lot this year. Anyway, capital gains is not the main target of my portfolio. It’s all about dividends and cash flow.

Conclusion

If I compare my portfolio to other investors, €20k does not sound too much but we are all at different situations. It is a significant milestone to me and I am happy to reach it this year already. Next stop – €30k!

Thanks for reading!

Congrats on the milestone 🙂 impresive growth this year, keep it up.

Thanks a lot P2035!

That growth is remarkable, BI. Congrats!

Keep watering this flower and let it bloom.

Cheers

-SF

Thanks a lot SnugFortune! I will do my best to keep the flower alive and growing 🙂

What kind of broker you use. My portfolio is similar in size. I have a Degiro account but since I am a Lithuanian citizen I have to pay 30% of the US divident so I am thinking of moving to IB as soon as I get difference they pay 120 usd

Hi Petras,

I am actually using 3 brokers but the main one is IB via Myriad Capital (their lithuanian partner). The drawback is much higher commissions compared to direct IB account, but I don’t need to pay the $10 minimum monthly fee, so it pays off for now.

I am also using SEB bank for Baltic holdings and recently opened very small positions in Revolut trading to try it out.

I didn’t know that you need to pay 30% on dividends in Degiro. It’s good that I didn’t manage to open an account with them then 🙂 are you also investing to individual dividend companies? Or do you also invest to ETFs or some growth companies that don’t pay dividends?

Thanks for the comment!

I’am have in my portfolio only one ETF IXUS. Most my shares is which pay divident. But have like BB, CTSO which do not pay divident . In future plans to buy ETFs that accumulate dividends or open an IB account and buy only dividend shares.

Congrats on the fast growth and hopefully it continues. The market has been on a hot streak. And I’m of a similar mindset. The capital gains are nice but I’m really in it for building dividend income.

Thanks for the comment Brian! Good to know that we have similar approaches to investing 🙂

Congrats on reaching the new milestone, BI. It’s always good to stop for a moment and acknowledge your accomplishments. Doubling your portfolio value in 1 year is outstanding. You’ve got some good momentum going… keep it going.

Thanks a lot ED!

It seems that I will not be able to continue the growth rate next year but I will try to do my best 🙂