I would be lying if I said that the recent turmoil in markets due to coronavirus does not bother me. It definitely does, and seeing your portfolio going down each day for a week is a little bit worrying. There is a lot of uncertainty and I think it is really serious. We don’t know how far it will go, but hopefully the number of lives lost to the virus will not grow hugely.

Regarding our daily life, it is looking pretty good. Our daughter is growing every day and can already say a few words if she really wants to. Her most favourite word for now seems to be “No”, though.

Now to the main topic…

Dividend Income

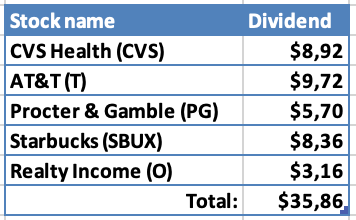

5 companies paid dividends to me during February:

It’s quite similar to what I received previous month. AT&T came as a top payer this month, followed closely by CVS Health & Starbucks.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $8.92 from CVS Health would cover 7.3% of our expenses in Barber category for the last 3 months;

- $9.72 from AT&T would cover 40.7% of our Cellphone bill for the last 3 months;

- $3.16 from Realty Income would cover 0.5% of our monthly Rent;

- $5.70 from Procter & Gamble could pay for 3.2% of our expenses on Cosmetics & Hygiene for the last 3 months;

- Finally, $8.36 from Starbucks would cover 4.4% of our Eating Out expenses for the last 3 months.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

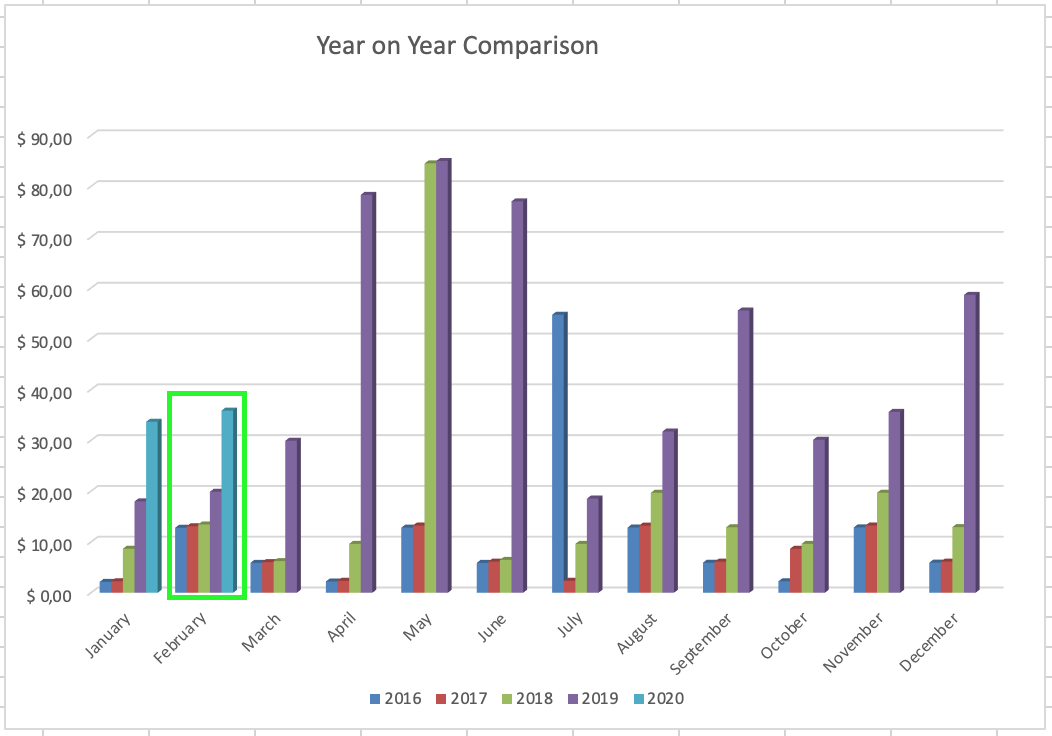

Let’s see how dividend income compares to February of last year:

I didn’t manage to double the dividend income but 80% increase is not too bad.

Most of the increase came from the new position of CVS Health. However, payouts from all other holdings were also bigger, due to additional purchases, more favourable tax rate and dividend raises.

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €500 to my investment account.

I didn’t have enough money for a normal size purchase, so I added small amounts to my smallest portfolio positions:

- On the 18th of February, I bought 1 share of Johnson & Johnson for $150.51;

- On the 18th of February, I bought 2 share of Altria Group at $45.09/share for a total of $90.18.

These purchases added $8.94 to my forward annual dividend income. You may read more about the buys here.

I also added €50 to Mintos P2P lending platform.

Dividend Increases

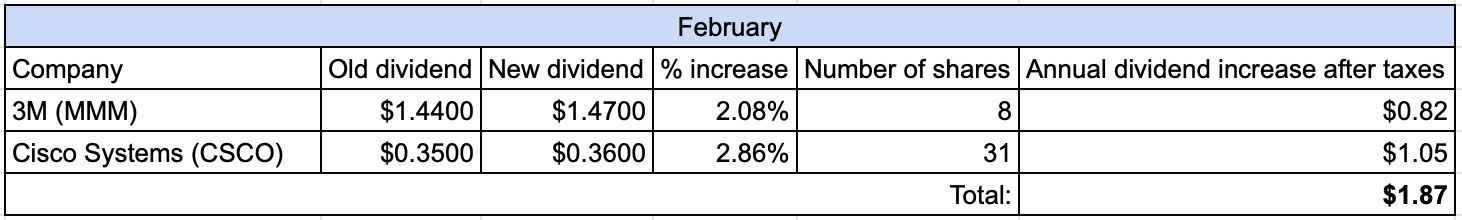

Two companies announced dividend increases during February:

The raises are minimal but every dollar counts, so I am happy for that as well. It all adds up in the long run.

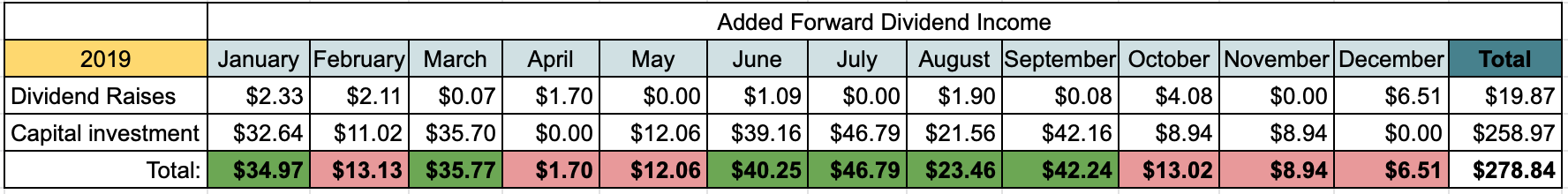

Changes in Projected Annual Dividend Income

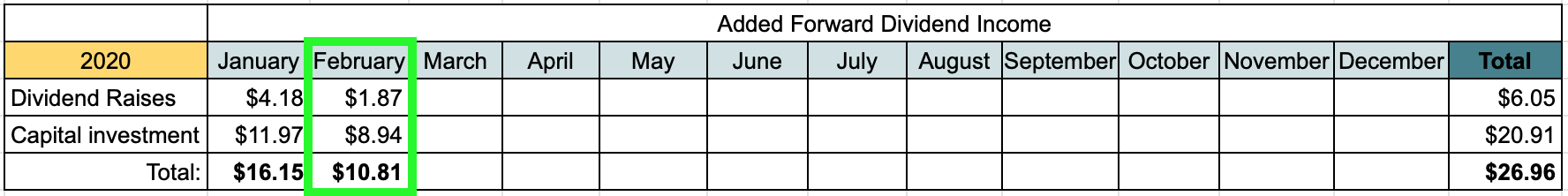

I am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income changed during February:

For comparison, I am also adding the table from previous year:

Unfortunately, added forward dividend income is lower compared to last year for two months in a row. I invested smaller amount this month and dividend raise from Cisco Systems was much bigger last year. Not a good thing to see but hopefully it will look better in upcoming months.

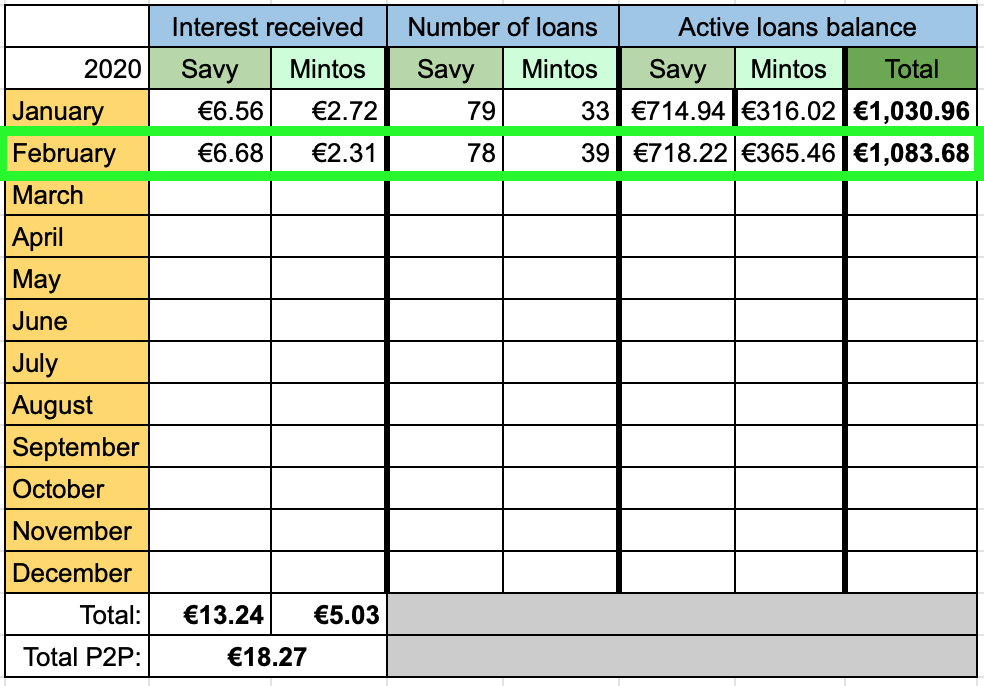

P2P Lending Income

Next up is my income from P2P lending:

Interest from P2P lending added up to €8.99 this month.

After a small contribution this month and a significant decline in value of stocks portfolio, my P2P loans portfolio currently stands at 5.3% of my overall portfolio. I would like to keep it at around 5%.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR), I received €41.07 from passive income this month. This brings the total for 2020 to €81.44. I set a goal to receive €1000 throughout the year, so I am way behind the schedule. With 17% of the year gone, I am only at 8% of the target. Thankfully, the next few months should deliver bigger amounts but it seems that the goal will be too optimistic this year. Of course, I am not giving up, so we’ll see how it goes.

How was your month? Are you sharing any payers with me? Are you worried about the situation in the market? I would love to read your comments!

Very nice month BI! I like the foundation you are building in your portfolio. Between the companies that paid you a dividend this month, and your new purchases, you have quite the set of dividend paying stocks in your account.

Bert

Thanks a lot Bert. The portfolio is still small but I am doing my best to build it over time.

Good progress, BI. 80% growth is outstanding. Keep that growth rate up for as long as possible. The JNJ and MO share additions should keep your momentum going.

I’m with you on those disappointing raises from MMM and CSCO. I wanted to see a little more, too. Let’s hope they can turn things around quickly and provide at least double that or more by next year.

I’m surprised you’ve fallen so far behind last year’s pace with respect to additional forward dividend income, but you can make up ground in short order. It appears it’s due to less capital investment, but it seems like you are investing as normal. Anyway, I’m confident you can catch up.

Thanks a lot for the comment ED!

I am hoping to catch up a little in March, especially with those dividend yields becoming more attractive on many companies. I haven’t decided what I am going to buy next but hopefully it will reverse the trend.