Recently, I published a post with review of my portfolio from the Sectors perspective. I figured out that there is only one sector (Materials) which is not represented in my portfolio.

Well, at the beginning of last week, I closed the gap and my portfolio now has holdings from each sector. It was quite convenient because Materials sector took a beating lately and I had an eye on a few companies from this field (see my latest Watchlist).

The company I decided to go for is Eastman Chemical (EMN).

Shortly about the company:

Eastman Chemical Company, is an American company primarily involved in the chemical industry. Once a subsidiary of Kodak, it today is an independent global specialty chemical company that produces a broad range of advanced materials, chemicals and fibers for everyday purposes. Founded in 1920 and based in Kingsport, Tennessee, the company now has more than 40 manufacturing sites worldwide and employs approximately 15,000 people.

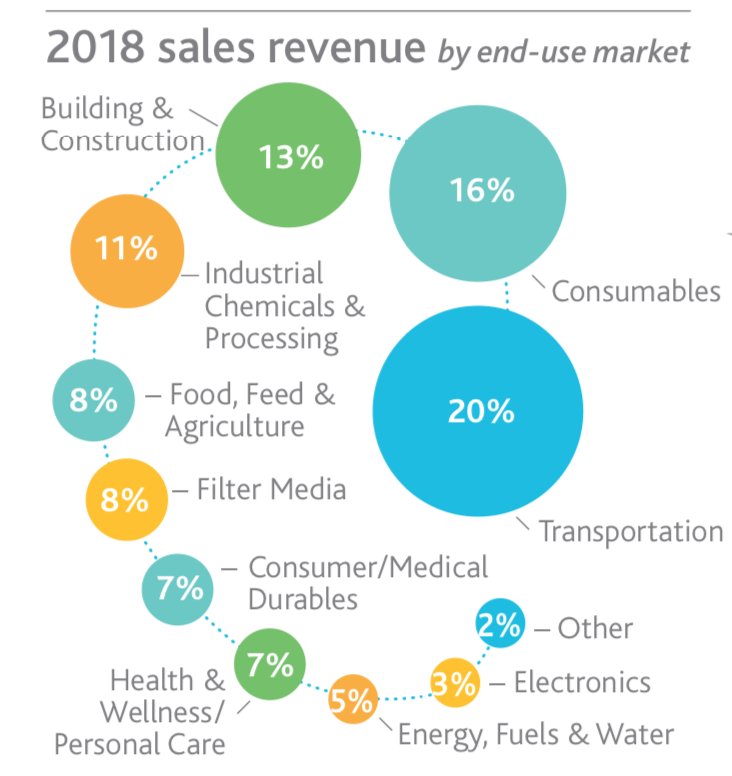

Company is creating a wide range of products that are used in many industries. The main end-use markets are transportation, consumables, building & construction, Industrial chemicals & processing etc:

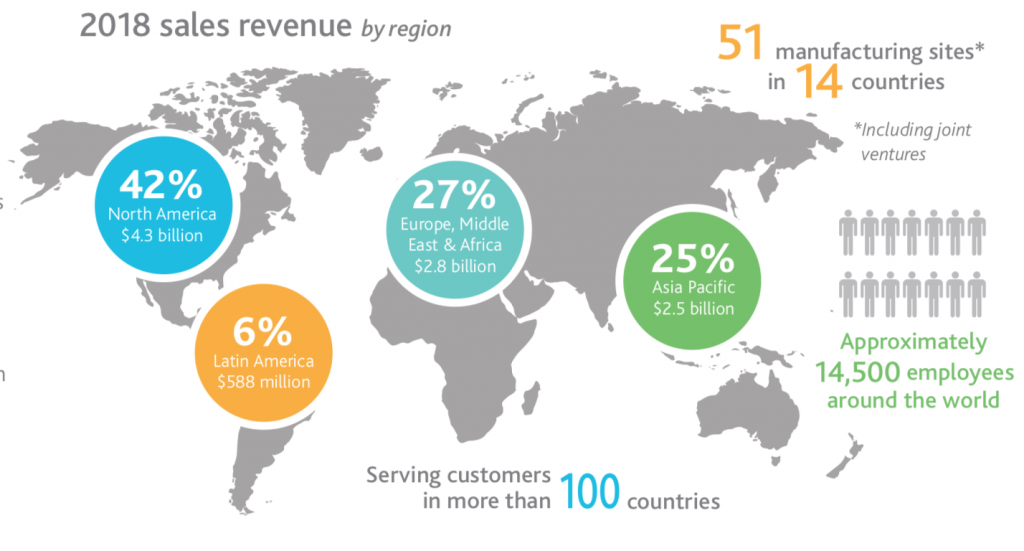

Eastman Chemical is also quite diversified geographically:

Fundamentals at the purchase price:

- P/E (TTM): 9.95

- Forward P/E: 9.20

- Dividend Yield: 3.85%

- Payout Ratio: 38%

- Net Debt/EBITDA: 3.21

- Market Cap: $10.2B

Purchase Summary

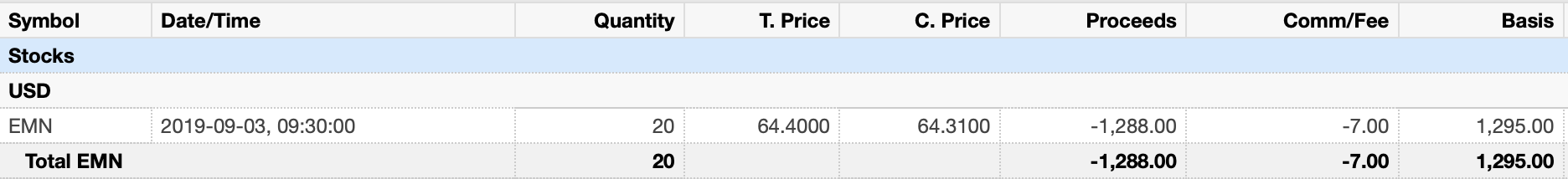

On the 3rd of September, I purchased 20 shares of EMN for $64.4/shares for a total of $1295 (including commissions).

This purchase adds $42.16 to my forward annual dividend income.

My target was to purchase the company if it was trading below $66. Luckily, my purchase coincided with the latest small dip in company’s price and I managed to get it at desired price. Currently, the price is up by ~16% to $74.6, so I am happy I managed to jump to the train. Of course, it may go down again, as it’s quite a volatile stock lately. That’s mainly due to concerns of slowing economies and ongoing trade wars between the U.S. and China.

What do you think about this purchase? What was your latest purchase? I would love to hear from you!

Those are some attractive stats for Eastman Chemical. And it’s well diversified. Hopefully this position works out for you.

Thanks Frugal Fortunes! I hope it will work out 🙂

I’m glad the price stayed below your desired entry price until you could purchase. It appears to be good timing indeed. Nice work… all sectors covered. A nice boost to your forward dividend income, too.

My latest purchase was UNH.

Thanks ED! I first heard about EMN from your blog and then started investigating it! 🙂

Nice move with UNH. I guess it’s overlooked by dividend growth investors, as its dividend yield is quite low. But the dividend growth numbers look amazing. I have to look more into this company as well 🙂

Hey!

Good timing! It would be very interesting to see your updated portfolio as it stands today 🙂

Hey Romas! Thanks for reminding!

I just updated my portfolio with a snapshot from last week (6th September).

P.S. It had a nice run since then and is currently above €19k but I want to keep consistency and use snapshots of the beginning of each month 🙂

Hi BI,

Looks like a good move to me. EMN’s dividend metrics are respectable across the board. I have only one basic material company in my portfolio so far. So it’s always good to spot new potential candidates.

-SF

Thanks SF! We’ll see how it turns out in the future 🙂

EMN looks pretty interesting. The industrial and basic materials sectors were offering up some pretty nice looking values and EMN is no exception. A sub 10 PE, healthy dividend yield and strong payout ratio looks great.

Thanks JC! Future will tell if it was the right choice. The main thing is for them to maintain their dividend history and I hope they will do that 🙂

Well done congrats…filling that void in your portfolio!

Thanks Passive Cash! Now let’s make those positions larger 🙂