I recently published a watchlist of a few companies that got my attention. It didn’t take long for me to initiate a position in one of them. I decided to go with an insurance company from Austria. It means that I now own a piece of a company from a new country and a new sector in my portfolio. Shortly about Uniqa:

The UNIQA Group is one of the leading insurance groups in its core markets of Austria and Central and Eastern Europe (CEE). We have approximately 40 companies in 18 countries and serve about 9.6 million customers. With UNIQA and Raiffeisen Versicherung, we have the two strongest insurance brands in Austria and are well positioned in the CEE Markets.

This is how their main ratios looked like at my purchase price:

- P/E TTM – 13.72;

- Dividend yield (with proposed dividend of €0.53/share) – 5.6%;

- Payout Ratio – 77%;

- Debt/Equity – 0.56.

Fundamentals are looking pretty good, compared to other big insurance companies in Europe. I also liked what I read in their annual report (on the other hand, those reports always sound good).

One of the reasons I chose to invest to this company now is that I will still receive their dividends this year. Their ex-dividend date is at the end of May and they only pay once a year, so it will boost my dividend income quite nicely.

Purchase Summary

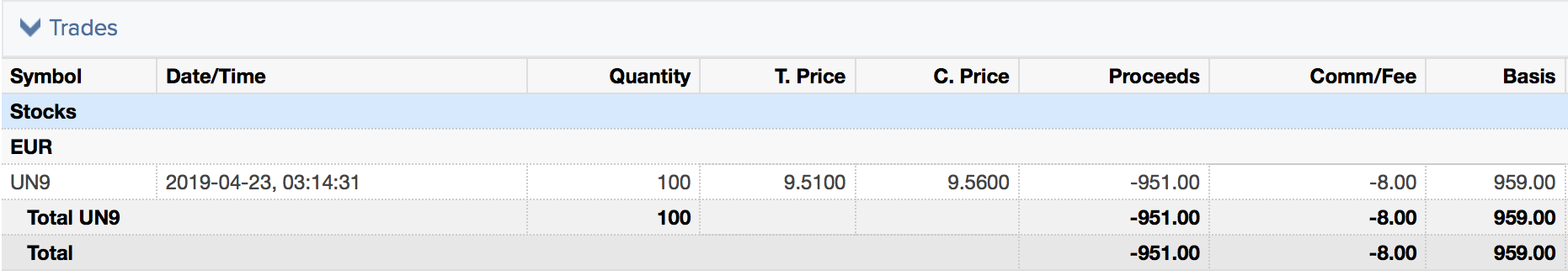

On the 23rd of April, I purchased 100 shares of Uniqa Insurance at €9.51/share for a total of €959 (including commissions):

This purchase will add €45.05 to my forward annual dividend income (after taxes). It puts me one step closer to reach my goal to receive €480 from passive income throughout the year.

What do you think about this purchase? What was your latest buy? Do you own any European companies in your portfolio? I would love to hear your thoughts!

I bought iron mountain yesterday. My first reit. Of european companies i own a lot of norwegian ones like entra (real estate) , Ocean yield (ship leasing), Veidekke (contracter) Selvaag bolig (housing). Also own the danish Danske bank. Otherwise it is al american. But i will add more european and non scandinavian also over time

Hey Norwegian,

Nice buy! I like Iron Mountain, it’s quite popular among dividend growth investors lately. I am no longer able to buy US REITs for the moment, unfortunately. I think that’s due to Mifid regulations, they are treated the same way as ETFs, but I am not sure. I only have one REIT in my portfolio so far – Realty Income.

As for your European companies – I am not familiar with the norwegian ones, only with Danske Bank. Did you buy Danske Bank recently? I am thinking if it’s a good opportunity after the huge price fall due to their Estonian money-laundering scandal.

I bought after the estonian case got out. I am down aprox 8% now, but i got my dividends so basically break even if i sell now. I think they have an attractive price now, but could continue down some more when we know how much they need to pay in fines. In 5 years my guess is they will do great, so i might pick up some more shares in the future if the price keeps going down

I see, thanks for sharing. I would lie if I said that I didn’t think about purchasing some Danske Bank as well. I am monitoring their price for about a year now and it is possible that I will initiate a position. I think now may be a good time to enter but I am still waiting on the sidelines 🙂

Hi BI,

Seems like a solid insurance company. The combined ratio looks good on this one.

I might loop deeper into but I’m already heavily exposed to insurers( I own Ageas, Sampo, Munich Re and Berkshire also has a big insurance branch).

Keep on pushing that snowball.

Cheers,

TLTI