Another month has passed and what a month it has been! Our baby-girl started crawling, I opened my triathlon season with the first race and our little vacation started (it’s still ongoing as I write).

While we were busy living life, our portfolio kept working silently in the background and delivered some passive income. Let’s see what it delivered during April.

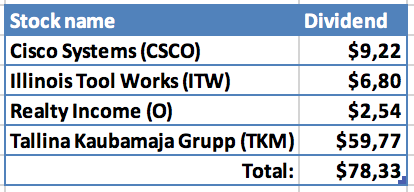

Dividend Income

This month 4 companies paid me dividend. For consistency sake, I converted all dividends to USD, even though TKM paid in EUR:

Finally, my purchase of Tallina Kaubamaja Grupp last September is bearing fruits. They are only paying dividend once a year but it gave a huge boost to my April dividend income.

As always, let’s see what part of expenses, related to the companies, the dividends could cover if I decided to spend them:

- $9.22 from Cisco would cover 9.4% of our TV+Internet expenses for the last 3 months;

- $6.80 from Illinois Tool Works would cover 15% of what we spent in “Home” category during the last 3 months;

- $2.54 from Realty Income would cover 0.4% of our monthly rent;

- €53.57 from Tallina Kaubamaja Grupp would cover 36% of what we spent on “Sweets” (ice cream, cookies, chocolate, sweets etc.) during the first 4 months of this year. On a side note, we should try to decrease expenses in this category.

I keep performing this exercise just for entertainment but it also gives me motivation and shows the value of those dividends. It also reminds me that I can decrease the gap between dividend income and expenses by limiting our consumption, not only by raising the income 🙂

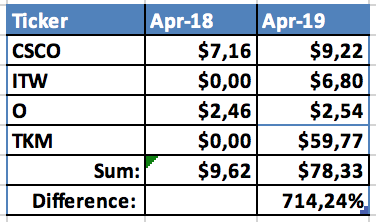

Year-on-year Comparison

Let’s see how dividend income compares to April of last year:

That hefty dividend from TKM really made a difference this April. Of course, additional position of ITW and dividend raises from CSCO & O didn’t hurt. They contributed to the growth as well.

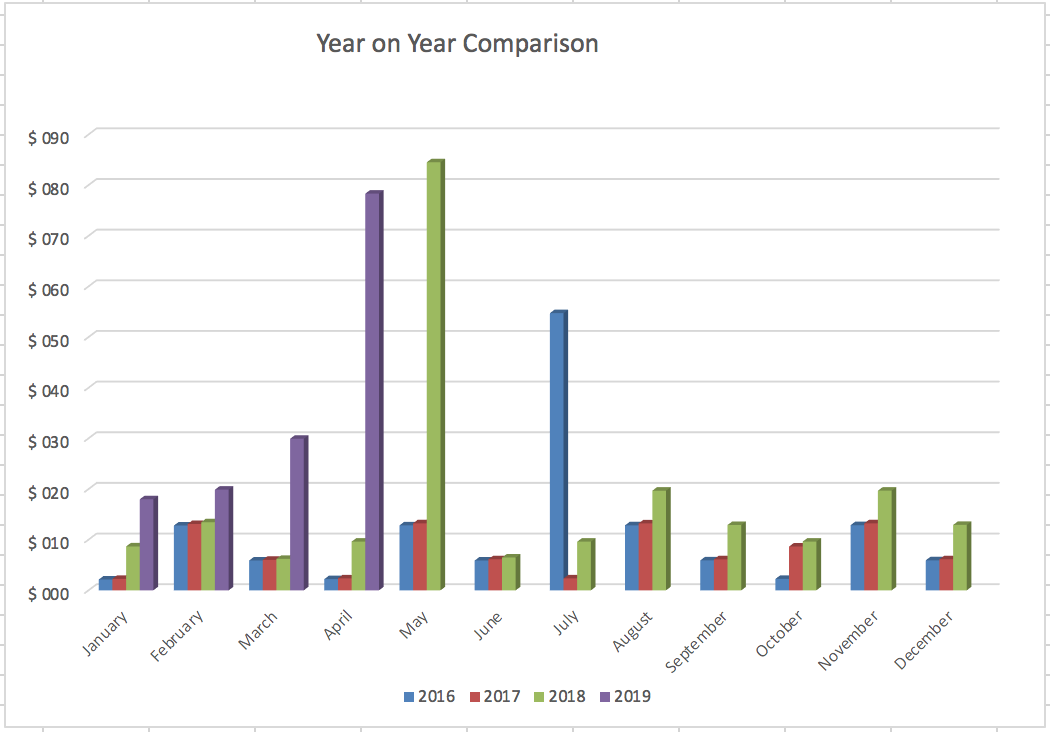

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I put aside €800 to my investment account which is slightly more than usual. I used these funds and leftovers from previous month to initiate a new position in my portfolio. On the 23rd of April, I purchased 100 shares of Uniqa Insurance at €9.51/share for a total of €959 (including commissions). You may read more about this purchase here. This purchase adds €45.05 to my forward annual dividend income (after taxes).

I also added €50 to a new P2P lending platform which I will cover a little bit later.

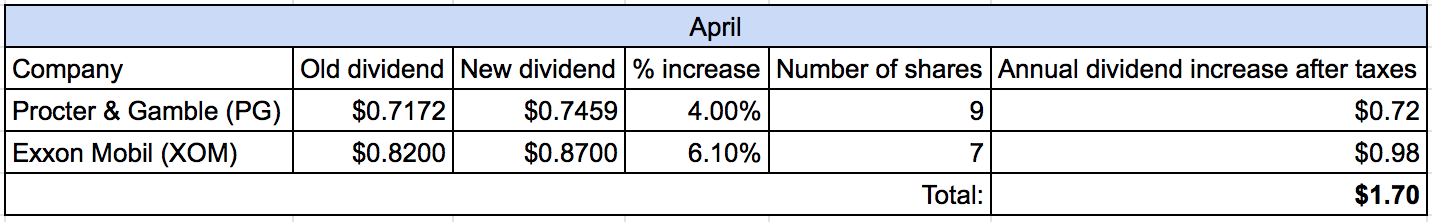

Dividend Increases

I am very pleased to see that the dividend increases streak continues for one more month. I saw two companies announce an increase during April:

The increases are in the expected range for those companies, so no surprises here. Unfortunately, I own both of the companies at my old broker where I pay 30% tax on dividends, compared to 15% on my new broker. If I moved them over, the increase would be slightly bigger after taxes.

Changes in Projected Annual Dividend Income

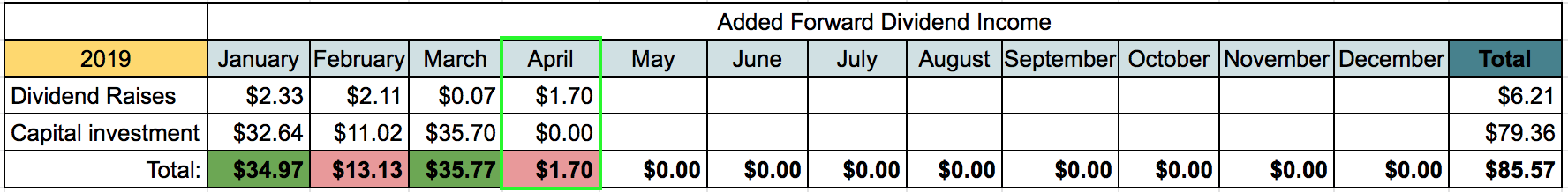

As I mentioned in previous posts, I have a goal to increase my PADI to $450 from US companies this year. This means that I should add additional $18/month in average if I want to achieve the target. To track the progress, I monitor PADI increase/decrease from two sources – dividend increases and capital contribution.

Let’s see how forward dividend income changed during April:

Since I decided to track only added dividend income from US companies, it doesn’t show my purchase of Uniqa Insurance Group which is an Austrian company. I am hesitant of how to best track the progress from European companies in my portfolio but I think it’s not the worst problem to have.

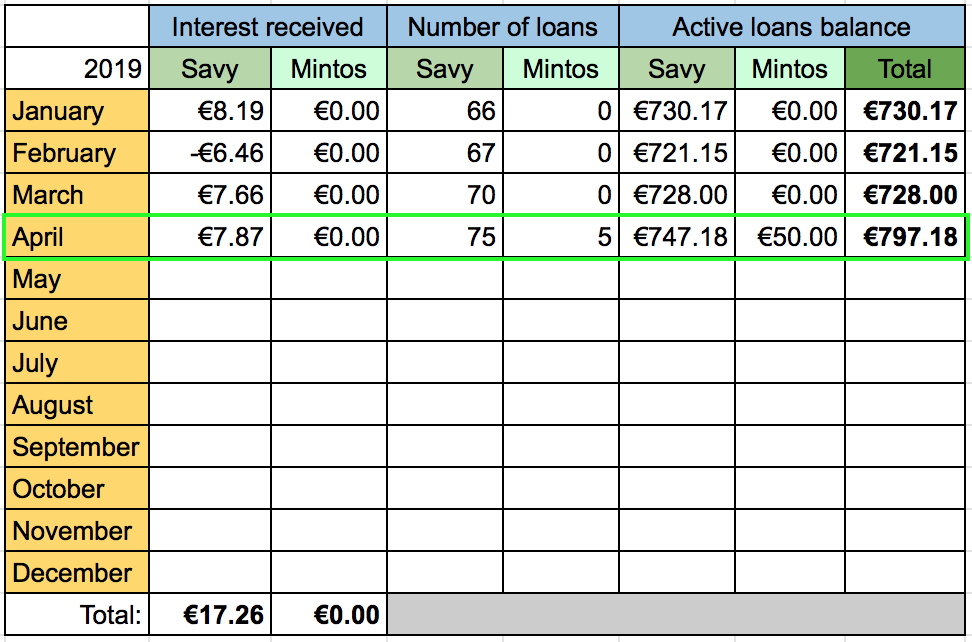

P2P Lending Income

This month I decided to diversify my income from P2P lending. So I opened an account with another P2P platform – Mintos. From now on, I will report my results from P2P lending in a table format. I think this will be more readable and easier to track progress.

I also received my first income from an affiliate link this month. Thanks a lot to somebody who used my referral link to open an account in Savy! I received €10 which I will add to my passive income summary.

Summary

In total (after converting to EUR) I received €87.74 from passive income this month. It’s more than the first three months of the year combined! This brings the total for 2019 so far to €157 which is ~33% of my target to receive €480 from passive income this year. I should have two more months with bigger income from my annual payers and after that it should slow down. At the moment, I am behind my goal. It just means that I will try even harder to invest and come as close to the target as possible.

How was your April? Are you sharing any dividend payers with me? Are you happy with the results? I would love to read your comments, so don’t hesitate to leave one! 🙂

Congrats on your first affiliate income!

I really like Mintos. They’re a stable platform with a steady ROI. It feels much less risky than many other platforms, but interests are a bit lower. I think I’m going to start favouring the less risky platforms over the riskier ones, maybe pick-and-choose some high-yielding projects as a topping.

800€ is definitely a lot. Imagine being able to do that consistently all the time.

Thanks Eelis!

I only started using Mintos and I like it so far. I don’t mind the lower interest rates if it provides less risk.

And yes, being able to put aside €800 feels really good! I guess it would be possible every month if I tried really hard but our family would need to sacrifice too much, so I don’t think it’s worth it 🙂

Good morning BI. Great month for your dividend income!

We share ITW and Savy 🙂

I think it was a very good choice to join Mintos. I currently can’t think of a better platform.

Thanks for the comment Druss!

I really like Mintos so far. It has much more loans than Savy to choose from and there is more criteria to base your investments on 🙂

Galbūt svarstei FinBee Verslui? Trumpalaikės paskolos su 1,4% defaultais ir 15% metine grąža 🙂

Kol kas užtenka dviejų platformų ir nesivaikau aukštų palūkanų. Planas yra laikyti P2P iki 10% savo investicijų, nes mano nuomone tai daug rizikingesnis reikalas, taip pat ir likvidumo trūksta 🙂

Ačiū už komentarą!

Stellar results, BI. Great to see the additional passive income sources.

You were patient waiting for your TKM dividend and it delivered big this month.

You are doing a great job of building your portfolio. I like your progress. Adding 800 Euros for investment will certainly keep the momentum going.

Thanks a lot for the nice words ED!

I will try to keep the momentum going as long as I can 🙂

Well done, 700% isn’t half bad lol

I like your multiple strings of income.

Thanks for sharing

Thanks for visiting Passive Cash!

Fantastic work BI! That TKM dividend is fantastic, but also impressive is that even without that you nearly doubled the monthly result from last year. Nice to see some additional passive income as well. Keep feeding the beast and that chart is going to continue shooting up!

Thanks a lot DivvyDad! The progress is definitely pleasing.

I hope to keep feeding the beast and it will work even harder for me 🙂

Excellent month BI! I haven’t heard of TKM, but that was one juicy dividend that you received. I love how you broke down your dividends by the way!

Bert

Thanks a lot Bert!

Yes, TKM is just a small Estonian company so it would be quite strange if you heard about it 🙂

I guess it will get harder to break down the dividends this way in the future, as I am getting more companies in the same category 😀 But I guess it’s not a bad problem to have 🙂

Pažiūrėjau pas tave portfelį didžioji dalis JAV akcijų, kodėl nesidarai portfelio daugiau iš europinių akcijų? juk europinės akcijos moka didesnius dividendus ir mažiau mokesčių reikia sumokėti VMI.

Labas, reikėtų dar paupdatinti man savo portfelį su naujausiu pirkiniu – austriška kompanija. Bet šiaip man patinka JAV kompanijos, nes jos turi daugiau dividendų mokėjimo istorijos ir tradicijų. Europoje, ypač Baltijos rinkose, jie dažnai būna didesni, bet nepastovūs. Pvz., nedaug kompanijų, kurios keltų dividendus kiekvienus metus 30 metų iš eilės.

Dėl mokesčių, tai šitos problemos dabar nebėra, kai perėjau į Interactive Brokers. Ten moku 15% mokesčių, kas yra taip pat kaip ir iš Lietuvos kompanijų ar daugumos Europinių.

Opa sito nezinojau del Interactive Brokers, tai daug ka keicia. O kaip su valiutos konvertavimu? As perku per SEB, tai gan nemazai prarandu kai konvertuoju i USD.

O taip, aš SEB irgi konvertuodamas daug labai prarasdavau dėl jų taikomo spread’o. Per Interactive brokers valiutos pasikeitimas kainuoja $4, tai palyginus su SEB labai susitaupo, ypač jei didesnę sumą konvertuoji

ir dar noriu paklausti koks komisinis pirkti JAV akcijas?

cia raso kad minimum 10EUR lietuva https://www.interactivebrokers.com/en/index.php?f=1590&p=stocks1

ar cia kad lietuvos akcijas pirkti tiek kainuoja ar kad is lietuvos? nelabai suprantu

Bet kiek supratau tu kitus 15proc mokesciu turesi sumoketi vis tiek VMI, taip?

Nereikia papildomai nieko mokėti, Lietuva turi su JAV dvigubo apmokestinimo išvengimo sutartį, tad mokėti reikia tik 15%:

https://www.e-tar.lt/portal/lt/legalAct/TAR.F2E1CDD6F49C

Ten mokestis perkant Lietuvos (ir kitų Baltijos šalių) akcijas (pigiau per SEB).

Tiesa, aš esu pasirašęs sutartį per Myriad Capital (Interactive Brokers atstovai Lietuvoje), o ne tiesiogiai su Interactive Brokers. Per Myriad Capital mokesčiai didesni (pvz. JAV akcijoms $7), bet negalioja mėnesinis $10 minimalus mokestis, kuris galioja tiesiogiai per Interactive Brokers.

Supratau, aciu labai uz atsakymus 🙂

Pas Myriad Capital irgi radau toki mokesti, ar cia pasenusi informacija pas juos?

“Klientai turi per mėnesį sąskaitoje iš prekybos sandorių sugeneruoti 10 USD komisinių. Jei

sugeneruojama mažiau, atitinkamai trūkstamas skirtumas iki 10 USD yra nuskaitomas nuo sąskaitos.

Šis mokestis netaikomas sąskaitoms, kurių grynoji nuosavo turto vertė viršija 100 000 USD.”

Kol kas netaiko jo (aš nuo lapkričio pas juos atsidaręs). Bet nėra garantijos, kad ateity nepradės taikyti, tai nenoriu nieko rekomenduoti 🙂

Kaip supratau, jiems IB tiesiog kol kas netaiko to mokesčio, bet jie negali garantuoti, kad vieną dieną nepradės taikyti, tai apsidraudžiant rašo, kad mokestis yra taikomas

o regitracijos metu cia “Do you qualify for the benefits of a US income tax treaty?” reikia rinktis “YES”? nepyk kad tiek klausineju, bet negalvojau kad bus tokia sudetinga registracija. Ir dar noriu pasitikslinti ten kur MiFIR tai reikia rinktis “no”? ir mokesciu moketojo kodas tai asmens kodas?

Nepamenu šitų klausimų kažkaip, sorry. Dėl Mifid tai reikėjo man tokią anketą užpildyti Myriad Capital, kurią jie teikė Lietuvos bankui. Gali būt, kad kitokia registracijos anketa Myriad Capital klientams, bet nesu tikras 🙁 visus neaiškumus aš su jais aiškinausi

Love your diversification BI! I haven’t dipped my toes in P2P lending but its probably safer then cryptos right! 🙂

Does Mintos also have a referral system?

Thanks for the nice words Mr. Robot!

Yes, I think P2P lending is riskier than dividend stocks but much different to crypto 🙂 Mintos has referral system. Let me know if you are planning to dip your toes, I would appreciate if you used my referral code 🙂 I think I would get €5 and you would get some cash back if you invest a certain amount 🙂

Hi,

good see interesting things going on in your life 🙂

Have you thought of using ETFs rather than stock-picking?

How is the choice of loans at Savy currently? From what I know they rarely offer loans to the investors, that’s why I prefer FinBee.

Hi HonestFire,

Thanks for the comment!

I prefer picking individual companies simply because it’s more interesting 🙂 Maybe it’s a little bit less profitable but I really like investigating individual companies and it’s a hobby for me, it doesn’t feel like work 🙂

Regarding Savy, it’s really not great lately. I am currently waiting for my funds to be invested and it is taking a while. That’s why I started using Mintos and I like it so far.