It’s time for another edition of monthly passive income review. May is usually my best month in terms of dividends due to some annual payers in my portfolio. This time though, I was worried that I will have the first down month compared to last year since I started this blog. That’s because one of my annual payers cut their dividend. It was neck and neck in the end, as you will see later in this post.

Dividend Income

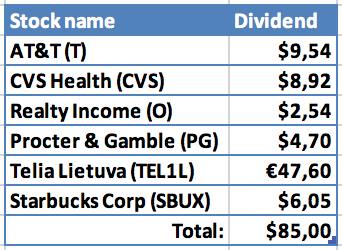

This month 6 companies paid dividend to me! It’s a new record in number of companies that paid in a single month.

This totals to $85 which is a new record!

As always, let’s see what part of expenses, related to the companies, the dividends could cover if I decided to spend them:

- $9.54 from AT&T would cover 35% of what we spent for cellphone bill for the last 3 months. I am using my company’s phone and my wife negotiated a better rate at her provider, so it only costs us €7/month now;

- $8.92 from CVS Health would cover 4.3% of our Barber expenses for the last three months. Since it is my second Healthcare company (after PFE), I decided to assign it to another category of our budget 🙂

- $2.54 from Realty Income would cover 0.4% of our monthly rent;

- €47.60 from Telia Lietuva would cover 56.7% of our TV+Internet expenses for the last 3 months. It feels good to receive dividends from the company which is actually providing our TV & Internet services 🙂

- $6.05 from Starbucks would cover 1.8% of our Eating Out expenses. We spent quite a lot in this category lately, as there was more eating out during our holidays. Hopefully, these expenses will be lower during next months.

It’s getting harder to assign dividends to certain category as I now have several companies from the same sectors. I don’t mind having this problem, though 🙂

Year-on-Year Comparison

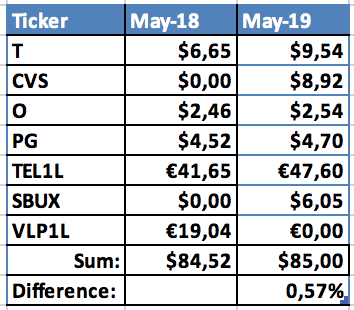

Now the big moment – let’s see if I managed to surpass dividends received during May of last year:

Vilkyskiu Pienine (VLP1L) represented high portion of dividends last year. Their results were not great last year, so the company decided to cut their dividend this year. I was worried that I will experience the first year-on-year decrease since I started this blog. Luckily, dividend increases, new positions and additions to existing ones eliminated the difference and I received slightly more than last year.

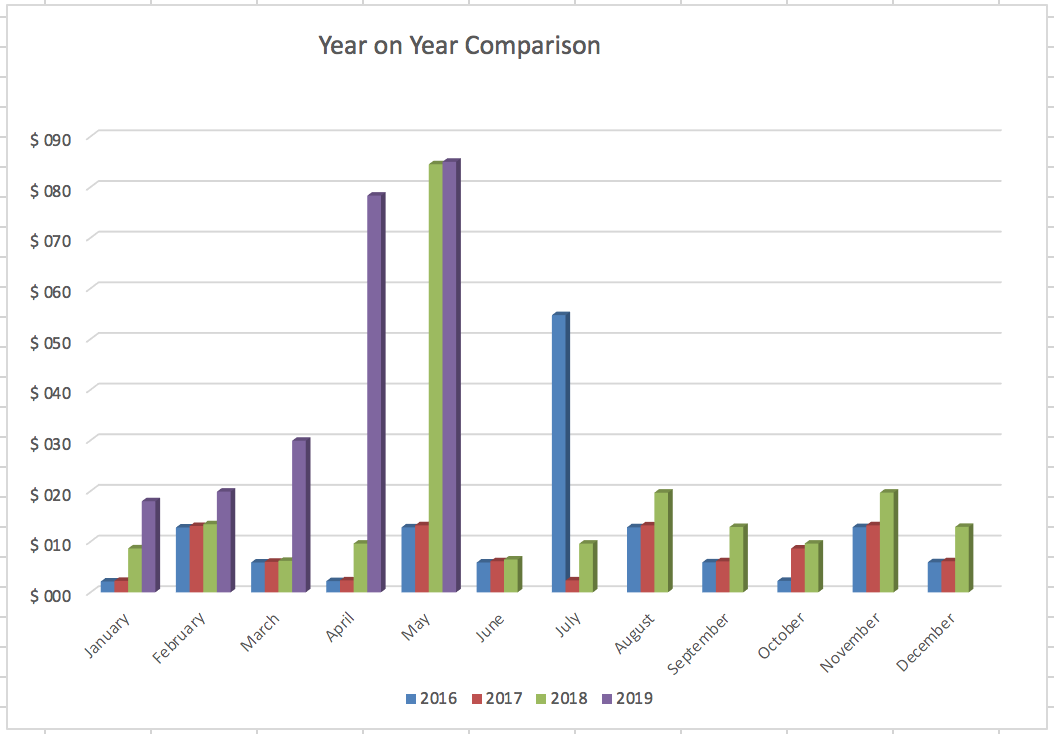

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €800 to my investments account.

I didn’t add any new companies to my portfolio but slightly adjusted it. As I mentioned in my previous posts, I still have some positions at my old broker where I pay 30% tax on dividends, compared to 15% at my new broker. This month, I sold my 7 shares of Exxon Mobil (XOM) at old broker and bought 10 shares at my new broker. This resulted in a $12.06 increase in my projected annual dividend income (after taxes). I managed to do this before XOM’s ex-dividend date, so I should already receive the increased dividend in June.

I also added €50 to Mintos P2P lending account.

Dividend Increases

Unfortunately, the streak of months with dividend increases ended this month. Most of my companies tend to raise their dividend at the beginning of the year, so the latter part of the year will be more silent in this front.

Changes in Projected Annual Dividend Income

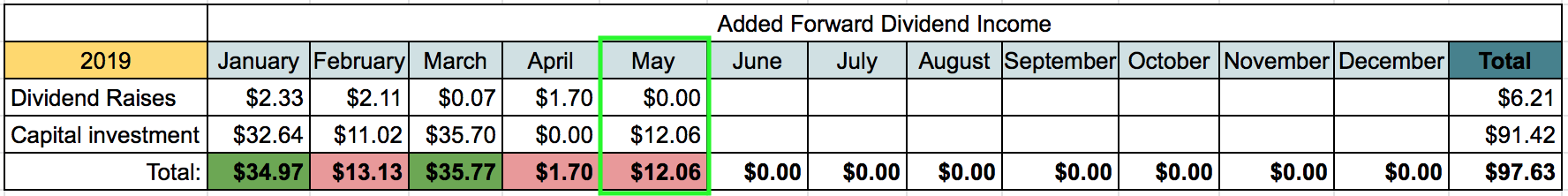

As I mentioned in previous posts, I have a goal to increase my PADI to $450 from US companies this year. At the start of the year it was standing at $236. This means that I should add additional $214 (or $18/month in average) if I want to achieve the target.

To track the progress, I monitor PADI increase/decrease from two sources – dividend increases and capital contribution.

Let’s see how forward dividend income changed during May:

May was another slow month for PADI increases. However, I am still on track to reach the target and June should include a new buy which will push me closer to the goal.

P2P Lending Income

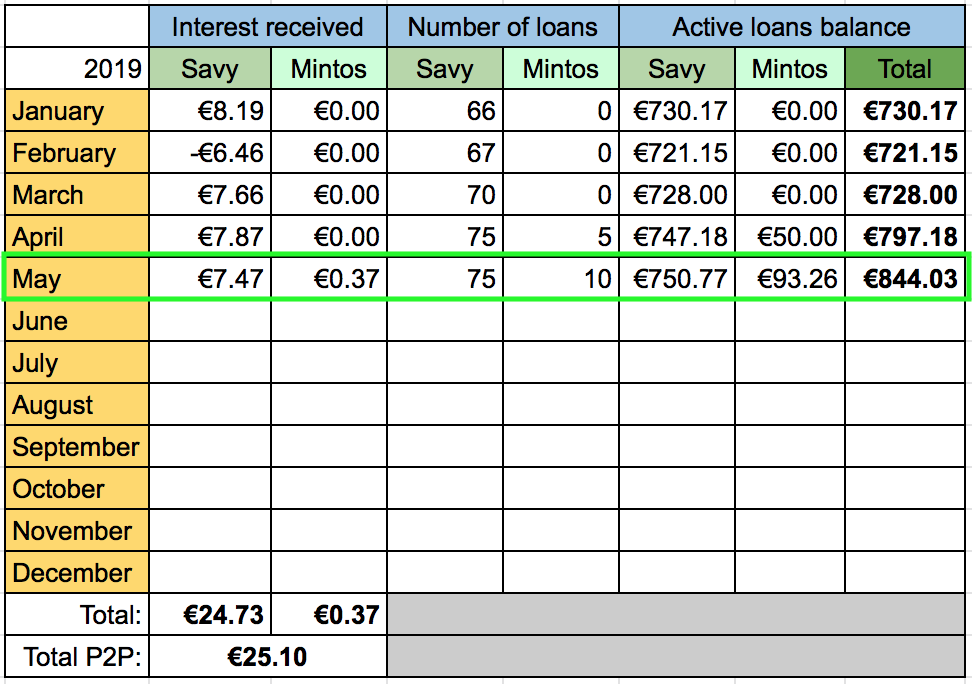

Let’s see how much passive income I received from another source – P2P lending:

This month I received my first interest from Mintos platform. Savy has very limited number of loans, so I am only planning to add some new funds to Mintos going forward.

In total, P2P lending delivered €7.84 this month. Current loans portfolio stands at €844. I am planning to keep it under 10% of my overall portfolio, as I think it’s a riskier type of investment than dividend stocks.

Summary

In total (after converting to EUR) I received €83.28 from passive income. This brings the total for 2019 so far to €240.28 which is 50% of my target to receive €480 from passive income this year. It’s looking good so far because I had a couple of really great months with my annual payers. The dividend payouts will slow down when the year goes on. But I will have some new payers as well so I think I should be able to reach my goal.

How was your month? Do you share any dividend payers with me? Was your portfolio affected by the recent downturn in the market? Please don’t hesitate to leave your comments and thanks for reading!

Sorry to hear about the div decrease. You still squeaked a YoY gain though. Did VLP1L wipe out their dividend completely?

Those are good returns on P2P lending. I’ve not done any P2P lending so I’m not familiar with the savy/mintos, but it looks like your return is almost 3 times higher on savy. You said the loans are limited, but the return appears better. Are you expecting improvement from mintos?

Thanks for sharing!

Thanks for the comment Passive Cash! Yeah, it sucks that VLP1L cut their dividend this year but it was expected after miserable results last year. They are producing milk products and it’s a cyclical business, so I was expecting some swings. It’s one of the worst performing companies in my portfolio but it’s also one of the smallest, so I am keeping them so far.

Regarding Mintos, I made sort of mistake in my auto-investment strategy and I have have of the loans where the interest is paid only once and it will happen after 6 months. The interest in average will also be lower in this platform as I chose to invest only in loans that will be returned in case they are late for 60 days. Of course, if the loan-issuing company does not default 🙂

Hi BI,

we had some similarities last month. For me, May is also the strongest month in terms of dividends (thanks to some annual payers). And like in your case, my PF has set a new record in monthly dividends. So I guess we both love this month:)

On the hand, it sucks to experience dividend cuts. I have never faced a complete cut but there were several dividend reductions in the past (BHP, LB, DAI, f.e.). But having a diversified PF should help to absorb those cuts and reductions. With diversification, it’s the cash flow that I’m trying to protect, not the share price. That’s how I look at diversification.

Btw do you have a specific number (or range) of different companies in mind that you plan to own in your portfolio?

All the best & cheers

-SF

Thanks for the comment SF!

Very good point about diversification. It’s the cash flow that we should try to protect, as we are looking for steady income.

Regarding the number of companies, I haven’t thought about it yet but I guess 30-40 companies should be enough. I still have a few sectors where I don’w own a single company as well. There is a lot of companies that I would like to own at some point 🙂

Nice month BI! Too bad that company cut it’s dividend, but great to see you still have a small year on year gain for the month. What are you gonna do with the company that cut the dividend? Sell it?

Wishing you the best.

SD

Thanks for the comment SD!

I am keeping the company, as it’s the snallest holding in my portfolio. I don’t think it gan go much lower than now, so hopefully it will get back up 🙂 the management looks good to me, it’s just cyclical sector

Hi, BI,

You have set some fitness goals for 2019 but I haven’t seen any reports about it. How is it going?

Moreover, do you have some target when you would consider yourself FI? Or investing is more of a hobby and you are not sure if you want to retire early?

It is never nice to see your dividends being decreased or cut at all but that is probabbly inevitable while investing in Baltic companies. Had the same issue with Olympic Entertainment last year and Amber Grid this year 🙁

Hi Venkinto,

Thanks for the comment! It’s nice to see a new Lithuanian here (I assume you’re Lithuanian from OEG and AMG) 🙂

Good point about fitness goals. I started writing a post about goals progress in the beginning of May but didn’t find time to finish it. In short, I abandoned the marathon goal for a few reasons. This year it happens on the same weekend as my favorite triathlon destination in Druskininkai. Marathon requires a lot of training and baby-raising takes its toll or I simply became too lazy to do it 😀

Pullups challenge is also lagging behind (I can only make ~6 at the moment and am not making much progress) but I still have time.

I am only focusing on triathlon now but I am also not great at it 🙂 Maybe I should write a short post to cover the fitness goals progress 🙂

Regarding FI, so far I like my job but it would be nice to have some options. When I do some calculations, FI seems very far ahead, so maybe it will just help to maintain the same life quality during retirement. No matter if I reach FI before retirement or not, I will be better off if I continue investing 🙂

And I feel you for the dividend decreases. At least Baltic companies usually offer quite high yield, but it’s never certain if the dividend will be maintained.

How is your portfolio looking? Is it private or do you share it somewhere? Are tou focusing more on growth or steady cash flow from your investments? It would be interesting to know 🙂

Assumption is correct 🙂

How does your preparation for triathlon looks like? Is it daily trainings? Last year I thought that it would be interesting to try at least tri-fun or sprint distance but there are lot of equipment to be bought as I always do the running and bicycling in the gym so debut has been delayed 🙂

I am not sharing my portfolio anywhere as there are already lot of bloggers and I dont see what interesting I could add:) It is still pretty small but hoping to break 10k mark before the end of this year. I am fully focused on cash flow just in the early stage I prefer to take more risks and more than 50% of my portfolio is in p2p/p2b and etc.

Thanks for sharing details about your portfolio. So we are quite at similar stages of portfolios 🙂

Triathlon training should include around 6 days of training/week but I am usually only doing 4-5 training sessions/week this year, as I keep getting ill or lose motivation 🙁 I used to do ~10-12 training sessions/week a few years ago, as it includes swimming, running, bike and strength training, so it’s often training twice a day. It’s not the most important thing in my life at the moment, though, especially with family addition 🙂

You are right about equipment, it’s quite expensive to enter. I am glad that I bought everything ~5 years ago and it’s mostly budget equipment, but you may spend incredible amounts if you want to 🙂 but I would recommend to try the sport if you have means for it. Triathlon is demanding but fulfiling and interesting experience 🙂

It appears you are well on your way to reaching all your annual goals, BI. Keep it going.

Way to squeak out the YoY gain, too… keeping that streak alive!

I shared 4 of your 6 dividend payers in May… who knew we had such overlap.

Here’s also hoping you start another dividend raise streak this month.

Lastly, I’m looking forward to hearing about the June buy… I’ll keep my eyes peeled.

Thanks for stopping by ED!

I should receive some dividend increases this month 🙂

And I am going to share my latest buy in a couple of days 🙂

Dividend decreased suck, no doubt about that. But look at it this way. You set a new PR and you made a strong purchase in XOM. You are increasing the quality of your dividend income stream and that is what is important.

Bert

Thanks for the comment Bert!

Yes, I can’t be too sad, as the portfolio is going to the right direction even with that dividend decrease 🙂

Hi Bi,

Seems like you had a solid month!

Keep up the good work.

Cheers,

TLTI

Thanks TLTI! In my standards, it was pretty solid, hopefully I will have more months like that in the future 🙂