May was pretty bad for markets. The prices kept decreasing and my portfolio value shrank by ~€800 (~5%) in a single month. However, it presented some opportunities, as I am still in the early accumulation phase of the portfolio. I took the opportunity and initiated a new position.

This time, it is a dividend king that I decided to add to my portfolio. 3M raised their dividends for 61 years in a row. There are certainly not many companies in the world to achieve that. Shortly about the company:

3M Company (3M), incorporated on June 25, 1929, is a technology company. The Company is a manufacturer and marketer of a range of products and services. The Company operates through five segments: Industrial; Safety and Graphics; Health Care, and Consumer. 3M products are sold through various distribution channels, including directly to users and through a range of wholesalers, retailers, jobbers, distributors and dealers in a range of trades in various countries around the world.

If you haven’t heard about the company, you probably still used some of its products at some point. They are famous for their “scotch tape”, “Post-it” sticky notes etc.

In fact, 3M was one of the earliest companies I heard of when I got interested in dividend growth investing a few years ago. However, this dividend king was looking overvalued most of the time. This year the situation started to change and the price of 3M declined from the highs of $220 to as low as $160 at the start of June. The company missed their earnings and revenue forecasts and cut their EPS expectations for this year. Perhaps the company is not undervalued but I think it’s at least at fair value now. So I decided that it’s a good time to initiate a position if I want to have this dividend king in my portfolio.

Company fundamentals at the purchase price:

- P/E (TTM): 17.5

- Dividend yield: 3.49%

- Payout ratio: 57.30%

- Debt/Equity: 1.69

- Net Debt/EBITDA: 1.7

Purchase Summary

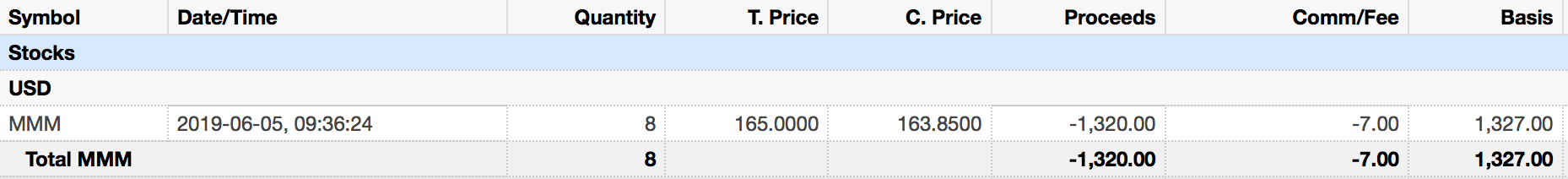

On the 5th of June I purchased 8 shares of MMM at $165/share for a total of $1327 (including commissions):

This adds $39.16 to my forward annual dividend income (after taxes). It puts me one step closer to reach my goal to receive €480 from passive income throughout the year.

Do you like 3M or do you think their glory days are in the past already? Do you have it in your portfolios? I would love to hear your thoughts!

Awesome bij BI. And I’m not saying that only because I did the same 🙂

It’s a quality company who finally got down to normal levels. With the amount of R&D these guys are doing there is no stopping them.

Good call my friend!

Thanks Mr. Robot, hopefully we will both benefit from 3M in the future 🙂

As always, time will tell if it was a good decision.

Sveikinu su geru pirkiniu 😉 siandien baigiau registracija IB, tikiuosi viskas bus gerai ir galesiu pradeti normaliai daryti Dividend portfolio 🙂 visgi baltike mano nuomone neimanoma pasidaryti normalaus dividendinio portfelio, o per lt bankus pirkti JAV akcijas tikra prabanga. Rinkausi tarp Admiral Markets ir Interactive Brokers, tai IB man atrodo labiau profesional, tikiuosi neatsiras kokiu nors pasleptu mokesciu kuriuos praleidau:)

Dėkui ir sveikinu su IB sąskaitos atsidarymu. Tiesiai per juos atsidarei ar per Myriad Capital? Manau, kad apart to $10 mėnesinio minimalaus mokesčio, nėra ten daugiau minusų. Tikiuosi, pasidalinsi, kaip pateisins lūkesčius 🙂

Tiesiai per IB, nes strategija pildyti ne viena akcija per menesi, bet tarkim 10 skirtingu, bet po nedaug. 🙂 tik nerandu del valiutos mokescio kur sakei, kad 4eur uz konvertavima pas juos tinklapi. Ir dar jauciu padariau klaida, kad prie to MiFIR irasiau savo ID, nes po to “other fees” radau, kad uz tai imamas mokestis… Bet to norejau paklausti kiek kainuoja IB saskaitos papildymas?

Supratau 🙂 Dėl valiutos keitimo, tai matau, kad pas juos tiesiogiai mažiau kainuoja – $2 minimalus mokestis, Reikia žiūrėti prie Forex komisinių:

https://www.interactivebrokers.com/en/index.php?f=1590&p=fx

Pvz., norint išsikeisti EUR į USD, reikia “parduoti” EUR.USD poziciją, nėra tokio akivaizdaus valiutos konvertavimo 🙂

Dėl MiFIR neįsivaizduoju, nepamenu šito klausimo per savo registraciją.

O dėl IB sąskaitos papildymo, tai bent jau per Myriad Capital nieko nekainuoja. Rašo, kad nekainuoja vieną kartą per mėnesį, bet kažkada dariau porą pavedimų ir nepastebėjau jokių mokesčių. Ten reikia daryti Transfer Funds, pasirinkti sumą ir nurodyti informaciją iš kokio banko ir kokios sąskaitos ateis pinigai. Tuo tarpu padaryti europinį pavedimą iš savo banko į nurodytą vokišką sąskaitą, tai čia irgi gal dar nuo tavo banko sąskaitos priklauso, ar kainuoja pavedimai tarp Europos šalių. Nežinau, ar šitas skiriasi, jei per IB tiesiogiai registruojies (ar į vokišką IB sąskaitą pervedi pinigus).

Aisku, aciu uz info 🙂 o pats naudoji dienos “limit” pirkima akcijoms?

Taip, Limit order darau už nusistatytą kainą 🙂

Turiu dar klausima, kai noriu pervesti pinigus i IB man reikia rasyti adresa Vokietija ar Londonas? Nes ten kur “Wire Funds to” raso vokietija, o kur “bank account title & adress” raso jau london. Tai susipainiojau 🙂

Man adreso nereikia įvesti per SEB, bet šiaip turėtų būti tiesiog copy paste iš jų duodamų rekvizitų. Siūlyčiau jų supportui parašyti, jei neaišku

Issiaiskinau. Idomu tavo nuomone ar likviduosi portfeli pries krize ar laikysi akcijas toliau ir pildysies su nuolaida?

Jei žinočiau, kada bus krizė, tai likviduočiau. Bet kadangi nežinau, tai neplanuoju likviduoti, o tik pildysiuos 🙂

Yra metodikos kaip suprasti kada iseidineti iš biržos pagal tam tikrus indeksus ir kada vėl grįžti ir tai tikrai nesudėtinga ir galima sutaupyti krūvą pinigų. Supranti rusiškai? Jeigu įdomu galiu numesti nebloga video, pats bandysiu pagal tą metodiką daryti. Mūsų atveju kai pas mus dividendinė strategija, tai dar ne taip baisu bet vis tiek galima daug išlošti ant išėjimo ir užėjimo.

Nice buy! I think 3M is a pretty safe bet and the yield is starting to look really attractive. There is just a handful of dividend kings and I am sure they won’t give up that status easily.

Thanks Deluge! I always wanted to have them in my portfolio and thought now may be the best time to enter. Can’t complain about the 3.5% yield, it’s not that common for dividend kings 🙂

Hey BI,

I believe you’ve made a good move by buying MMM. I believe it’s good because MMM is a business of highest quality. In the beginning of the year I came across an intresting article on SA. In that article Dave Van Knapp used 5 widely used quality indicators to come up with a list of the highest-quality dividend stocks. And I’m sure, you already can anticipate it, MMM was one of them. Best grades with VL, Morningstar, S&P and SSD.

When it comes to my next investment, I tend to go with a company from the defensive sector or REIT.

However since MMM is on sale, I strongly consider to add to my MMM position as well.

-SF

Thanks SF!

I agree with you that MMM is a business of highest quality. Of course, any business can come into trouble and the price move of MMM definitely shows that they are facing some issues. I am hoping that this is just a short-term problem and the management will find a way to continue being a great business for investors 🙂

Looking forward to see what you decide to add to your portfolio!