Life has been pretty busy lately and it can be seen from my blog writing activity. It’s way too late to report my passive income for April but I guess it’s better late than never. So here’s what happened with my portfolio two months ago.

Dividend Income

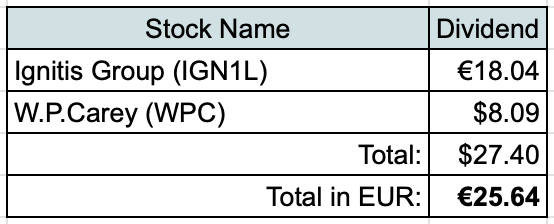

2 companies paid dividend to me during April:

More than €25 in a single month is not too bad for my portfolio. Ignitis pays twice a year, so their dividend amount is bigger compared to my quarterly payers.

As always, let’s see what amount of our monthly expenses in related categories these dividends could cover at the moment:

- €18.04 from Ignitis Group could cover 1.4% of our expenses on Utilities for the last 6 months;

- $8.09 from W.P.Carey would cover 0.2% of our Mortgage payments for the last 3 months.

P2P Lending Income

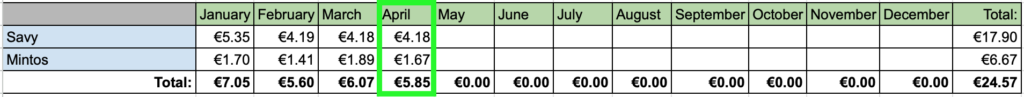

Next, we received some income from P2P lending:

€5.85 interest received is pretty similar to previous months.

Other Passive Income

Finally, I received some passive income from two more categories in my portfolio:

- €5.50 interest from Real Estate Crowdfunding;

- €2.37 interest from a partial Bond I own;

- €3.04 interest from Money Market Funds.

Passive Income Summary

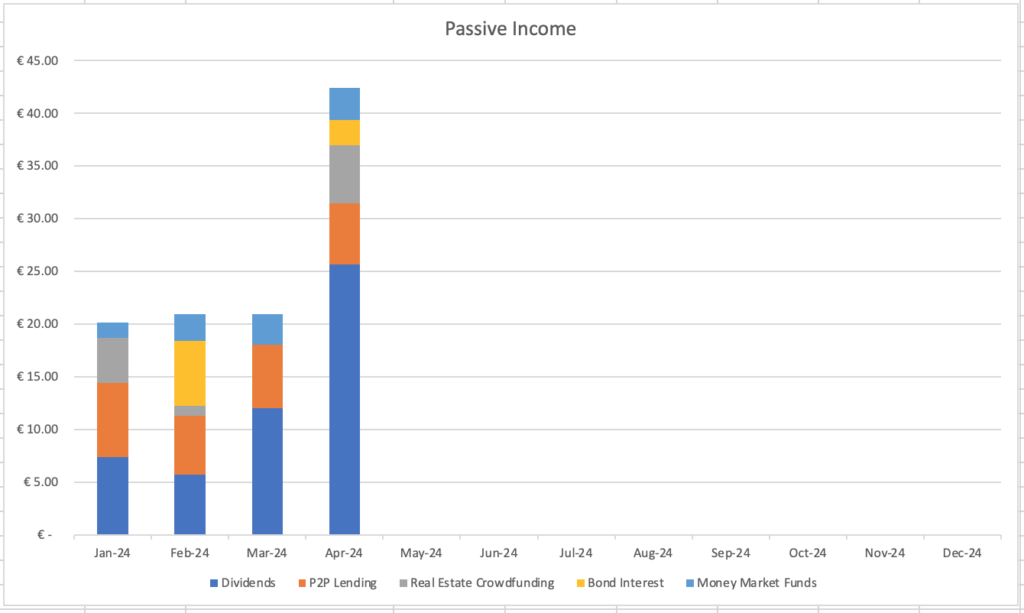

After summing it all up, it adds up to €42.40 for the month of April:

This is the biggest month so far this year but I am hoping to beat it once again before the year ends.

Here’s a better visualization with comparison of different categories of income:

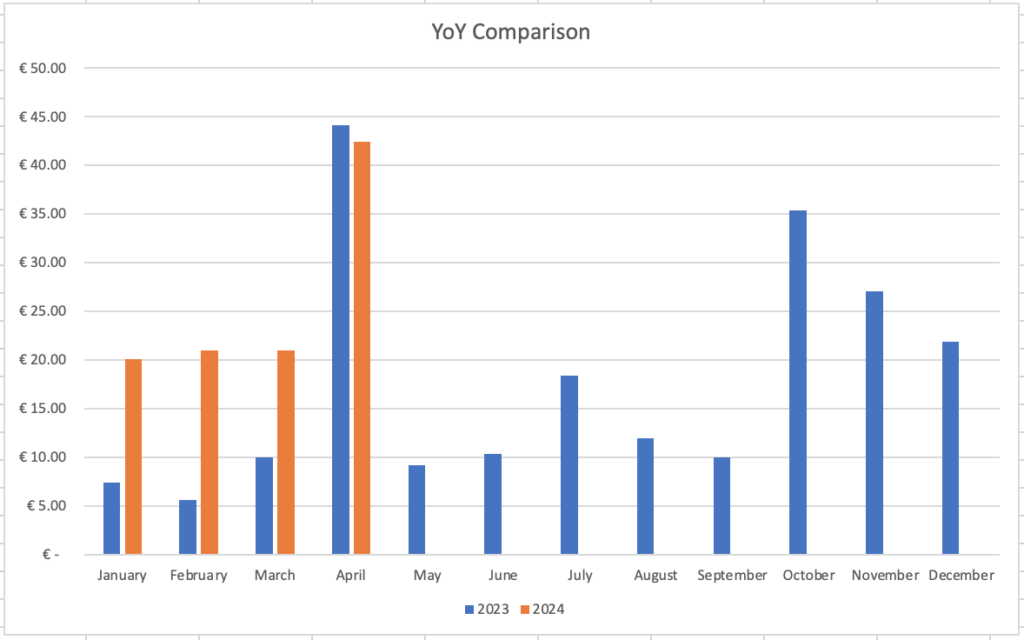

Finally, here’s a comparison to passive income from previous year:

I came pretty close but I didn’t manage to beat passive income from April last year. That’s because last year I received €25 interest from a bond I no longer hold and other investments couldn’t cover the gap.

Investments and Portfolio Contributions

During April, I contributed €500 to passive income portfolio.

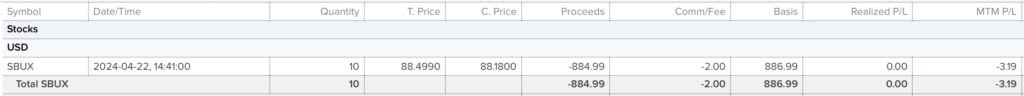

This amount and previous savings went to a new/old company in my portfolio. On the 22nd of April, I bought 10 shares of Starbucks (SBUX) at $88.45 a share (+$2 in commission) for a total of $886.99:

A week after my purchase Starbucks reported their results and they were disappointing, so the share price dropped by more than 10% in a single day. However, I am here for a long haul, so I don’t worry too much. Furthermore, the price is pretty much back to the level at which I bought it.

This purchase adds $19.38 to my forward net annual dividend income.

Summary

During the month of April we received €42.40 in passive income which is the best result so far this year. I also purchased some shares of a company which was in my portfolio before I sold it a few years ago.

So far this year, we received €104.44 in passive income which is 28.61% of my goal to receive €365 during 2024. With April marking the third of the year gone, we are behind our target. We also had some additional expenses during the last couple of months which slowed down the rate of investments, so it is not looking optimistic to achieve the goal this year. However, the main thing is to move forward and we will still be in a better situation than before.

Thanks for reading! 🙂

Better later than never!

I bought some shares of Starbucks too and for long-term.

Thanks for sharing and waiting for other months reports 🙂

Hi Kristina!

Thanks for the comment! Happy to be a fellow shareholder of this great company 🙂

I should post my summary for May in a few days as well.