August was a great month in many perspectives. Me and my wife have visited a music festival and it was a blast. It was the first time when we left our daughter overnight (actually, two nights) and it went very smoothly. Later in the month our family spent a couple nights in a small house near the lake and it was also great. The summer is over, but it feels that we had enough of it already this year.

With all the fun activities out of the way, let’s see how much passive income our portfolio generated during the last month of the Summer.

Dividend Income

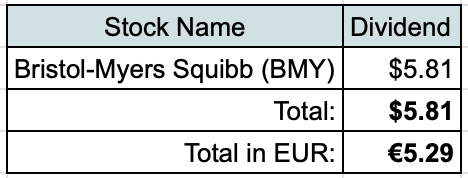

I received the first dividend payment from the latest addition to our portfolio – Bristol-Myers Squibb:

I like to compare received dividends to actual expenses of our family. $5.81 from BMY could cover 3.9% of our expenses on Health during the last 3 months.

P2P Lending

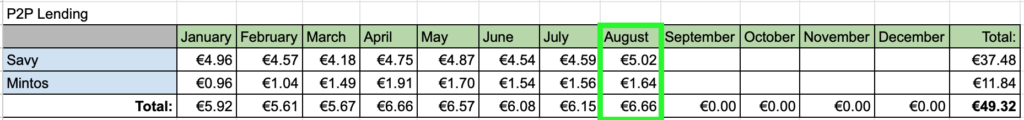

Interest from P2P lending added €6.66 to our passive income during August:

Passive Income Summary

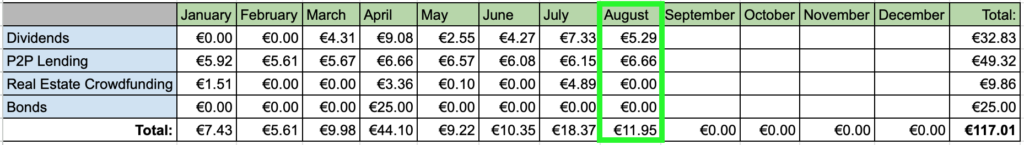

After adding both sources of passive income, August brought €11.95 in total:

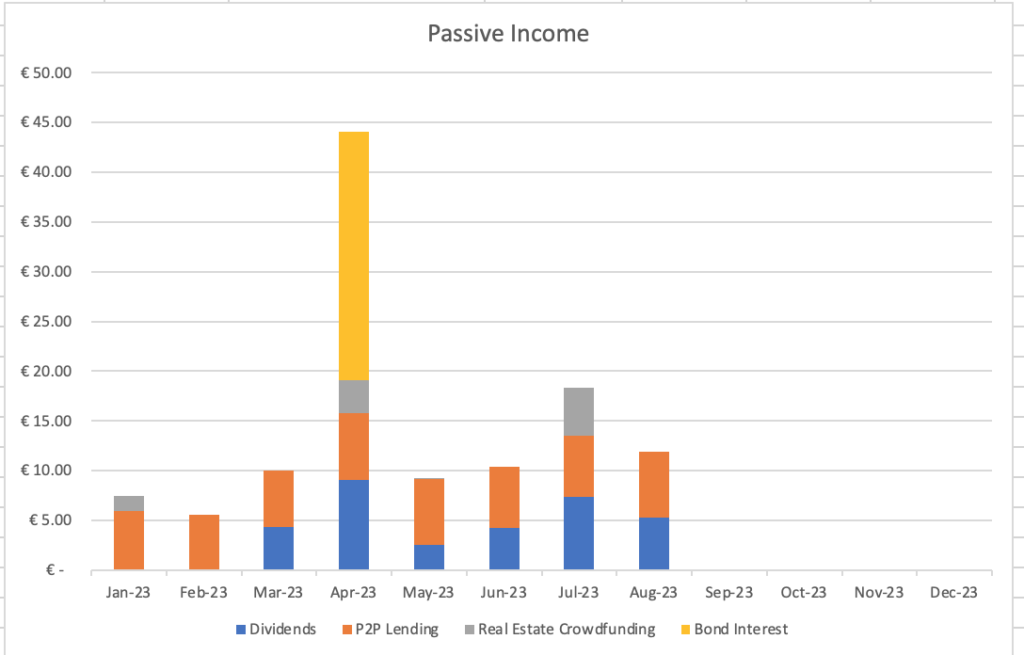

And this is how passive income looks like so far this year:

Investments and Portfolio Contributions

During August, I managed to contribute €550 to our investment accounts.

I used part of this sum to continue building my positions in Lithuanian companies.

On the 16th of August, I bought 5 shares of Ignitis (IGN1L) at €20.2/share for a total of €101. With their current dividend, this purchase adds €5.30 to my forward annual dividend income. After this buy, I now own 18 shares of Ignitis.

At the same time, I purchased 22 shares of Telia Lietuva (TEL1L) at €1.795/share for a total of €39.49. This purchase adds €1.12 to my forward annual dividend income. I now own 95 shares of Telia Lietuva.

The rest of the savings went to my Interactive Brokers account where it’s waiting for a bigger purchase.

Portfolio Overview

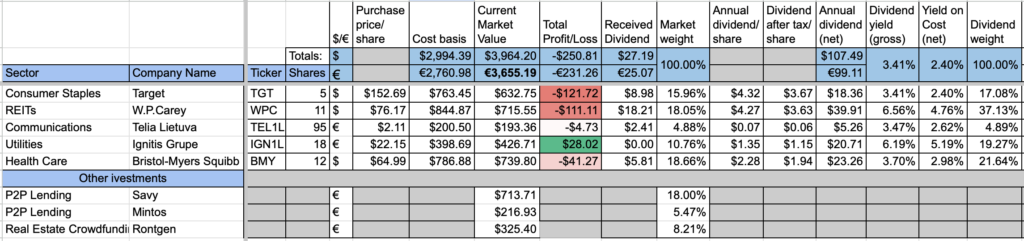

This is how my portfolio looked like on the 1st of September:

Portfolio is up to €3650 (up by €150 since last month) mainly due to the small investments I mentioned earlier.

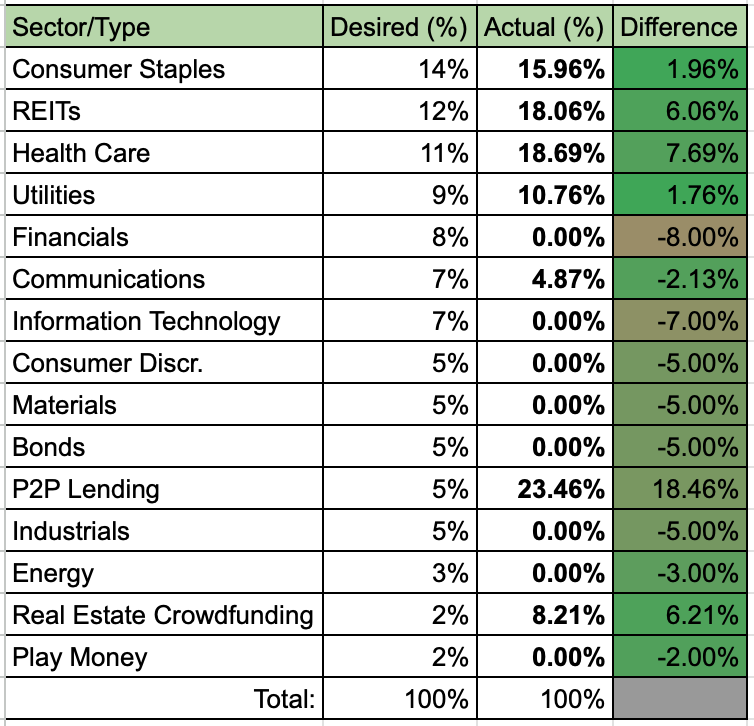

I also updated portfolio composition, based on sectors and investment categories:

Looking at the desired allocations, some company from Financials sector should join my portfolio soon. I am looking into some portfolio candidates already. If I find time, I will post a watchlist of the stocks I am mostly interested in.

Summary

August was another great month and it flew by. Passive income surpassed €10 again and it seems that sub-€10 months could be a thing of the past.

So far in 2023, we received €117.01 from passive income, which is 63.9% of my goal to receive €183 throughout the year. With 67% of the year gone, I am slightly falling behind schedule but I should manage to catch up.

Thanks for reading and happy investing! 🙂