Can you believe that we’re into the last month of summer? Time is really flying by. July was another great month for our family. Looking back, I think there were only a few days when we didn’t go riding bikes during July. I also managed to participate in a triathlon at the beginning of the month. This time it was only a Sprint distance (750m swim + 20km bike + 5km run) but it was still tough. I only do a few easy runs during the week for my own pleasure, so it’s not a serious training. Bike rides with our daughter are also very calm and easy. However, it still keeps us active, so that’s good.

My portfolio was also doing some activities during the month, even though it’s a smaller month compared to the last few. Let’s see how much income it managed to generate.

Dividend Income

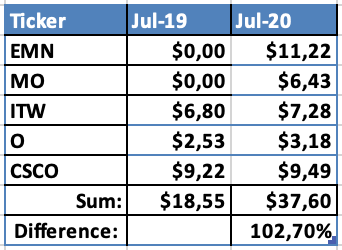

This month, 5 companies paid dividend to me:

First month of the quarter is the weakest for my portfolio, so the amount is not huge. Eastman Chemical was the only company which paid more than $10 this month.

As always, let’s see what part of expenses of different categories in my budget the dividends could cover if I decided to spend them:

- $11.22 from Eastman Chemical would cover 3.1% of our expenses on Clothes for the last 3 months;

- $6.43 from Altria Group could pay for 3.8% of what we spent on Alcohol during the last 3 months;

- $7.28 from Illinois Tool Work would cover 4.6% of our expenses in Home category for the last 3 months;

- $3.18 from Realty Income would cover 0.5% of our monthly Rent;

- Finally, $9.49 from Cisco Systems would cover 15.5% of our TV + Internet subscription for the last 2 months.

There is long way to go for dividends to cover significant amount of our monthly expenses but performing this fun exercise gives me motivation to keep going.

Year-on-Year Comparison

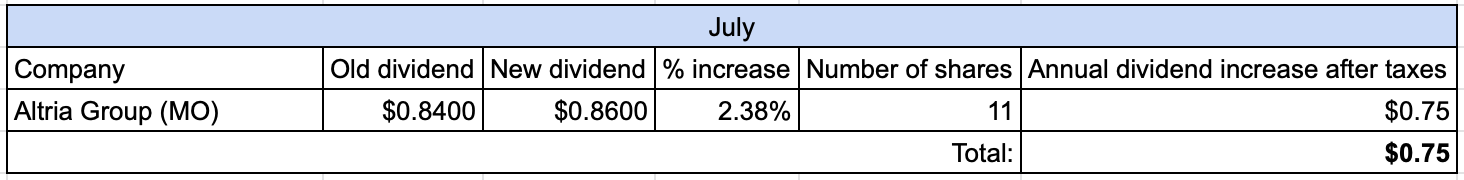

Let’s see how dividend income this July compares to the July a year before:

I love to see that dividend income doubled compared to last year. The biggest reason for that were the new positions of Eastman Chemical (EMN) and Altria Group (MO).

It will be harder to sustain doubling up dividend income as the amounts get bigger but I am sure that it will continue growing each year.

This is how my dividend income progress looks like since the beginning of 2016 when I started tracking it:

Purchases and Portfolio Contributions

This month I added €500 to my investment accounts.

I made one purchase this month. On the 30th of July, I purchased 36 shares of UGI Corp (UGI) at $33.51/share for a total of $1213.36 (including commissions). This purchase adds $40.39 to my net forward annual dividend income. You may read more about the buy here.

Dividend Increases

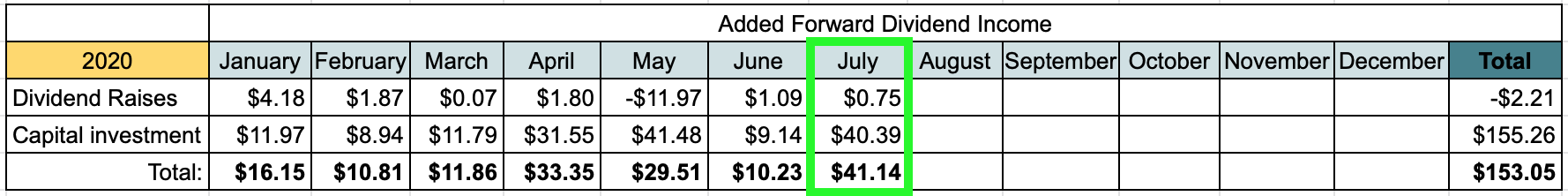

This month, one company announced a dividend increase:

Altria Group raised their dividend by 2.4%. At this environment, I will take any raise and won’t complain.

Changes in Projected Annual Dividend Income

I am continuing the tradition from last year to track changes in Projected Annual Dividend Income. It is coming from two sources – Dividend raises/cuts and new investments.

Let’s see how forward dividend income changed during July:

July marked the biggest increase in PADI this year so far. That’s mainly result of the UGI Corp purchase. I am still in red for the year when calculating dividend raises/cuts, so hopefully I will receive some raises to get me into green in this category as well.

For comparison, I am also adding the table from previous year:

P2P Lending Income

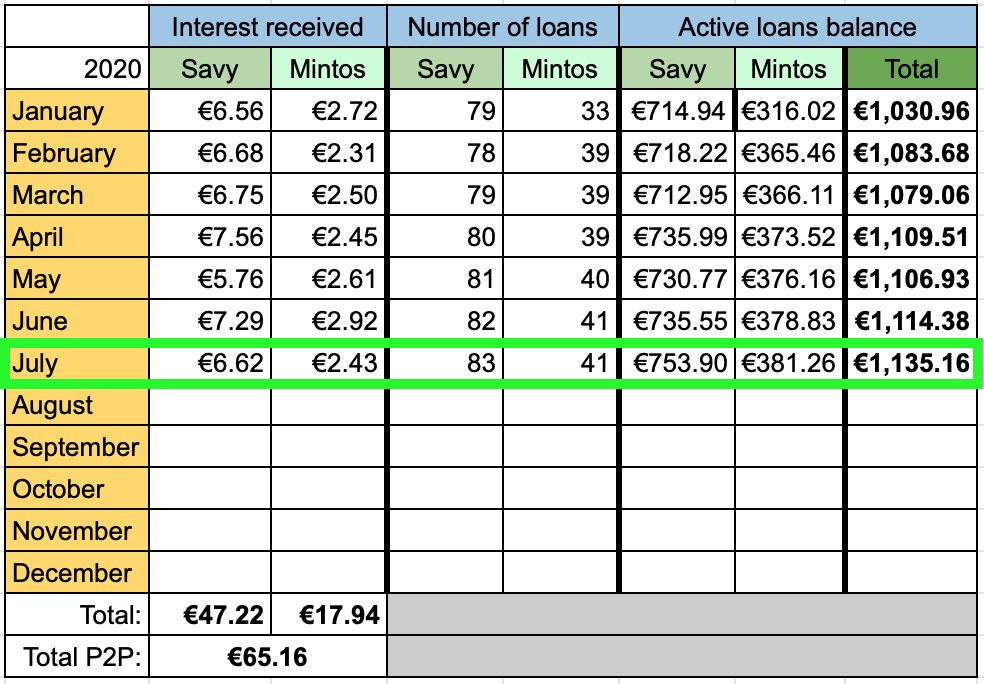

Let’s see how much income was added from interest in P2P lending:

Interest from P2P lending added up to €9.05 this month. It’s below the €10 mark again. I guess some loans were late but I didn’t pay much attention. This part of my portfolio is on auto-pilot now.

P2P loans portfolio takes 4.42% of my overall portfolio. It’s close to my target of 5%, so I just keep it as it is for now. Loans portfolio is slowly growing just from the interest received.

If you would like to sign up with Mintos and receive some cashback, feel free to use my referral link (I would also get a small commission).

Summary

In total (after converting to EUR), I received €40.75 from passive income during June. This brings the total for 2020 so far to €462.66 which is 46% of my goal to receive €1000 from passive income this year. The goal seems to be too optimistic but I will keep pushing.

The first month of the quarter is smaller for my portfolio, especially after the previous few months when I had some annual payers. I am still happy to receive a growing passive income I no longer need to work for.

How was your month? Are you sharing any dividend payers with me? How is the summer going for you? Thanks for reading and I would love to hear from you! 🙂

Hi

First of all congrats for your triathlon. Very hard effort !

Very impressive to see growth vs last year. Bravo

What will be your next investment ?

Thanks for the comment and encouragement Nicolas!

I am not sure about my next investment yet. Perhaps it will be in the tech sector but I haven’t decided yet. I will look into it more when I review my portfolio monthly.

What about you? Do you have any targets?

Hello

This week, I will invest in Colgate Palmolive. Great dividend safety score and part of the King’s list 🙂

Nice choice Nicolas! I was considering it at some point but decided to go with something else. It’s still a company I would like to have a part of in the future 🙂

That’s a tremendous YoY growth number, BI. There’s nothing like doubling your income… expect maybe tripling it. 🙂 That’s probably too much to ask though.

It was a clean sweep for me… I own all 5 of your dividend payers from July. I was glad to see that ITW delivered a nice raise for us last week. Those raises seem hard to come by these days.

Congrats on your biggest boost to forward dividend income for the year. Unfortunately, I went negative in this category for July because of that WFC dividend cut.

Nice effort on completing the triathlon. I would have keeled over, despite it being the Sprint version. Sounds like you and the family are getting plenty of time outdoors with the bike rides. That’s probably good… winter will be there before you know it. Take care.

Thanks a lot ED!

Haha, I am happy with doubling the dividends but of course I wouldn’t complain about tripling it up. But it will be harder when the numbes get higher.

Happy to hear about the raise from ITW, I haven’t noticed it yet.

Having a small kid definitely helps to spend more time outside, and that’s definitely a good thing. Let’s enjoy it while we can.

Take care!

Vargsti dar žiūrių su tais dividendais. Nuoširdžiai linkiu, kad kuo greičiau prabustum ir pereitum į investavimą į augimo kompanijas. Nes kitaip bijau, kad nelabai pasieksi FIRE. Sekmės.

Ačiū už rūpestį, kažkaip išgyvensiu 🙂

That seems like some awesome uality time with your family and congrats on the triathlon. I usually do 1 obstacle run (or sometimes 2) per year and those are 10KM with about 25 obstacles. Just like playing in a playground 🙂

Doubling your income is no small feat, great stuff BI!

Thanks a lot Mr Robot!

I was also considering an obstacle run but had a stag party of a friend that day. Obstacle run will have to wait for next year but it definitely sounds like fun 🙂

Take care!