2020 is flying by. Already more than half of the year is gone. With each passing month, I keep contributing to my portfolio and July was not an exception.

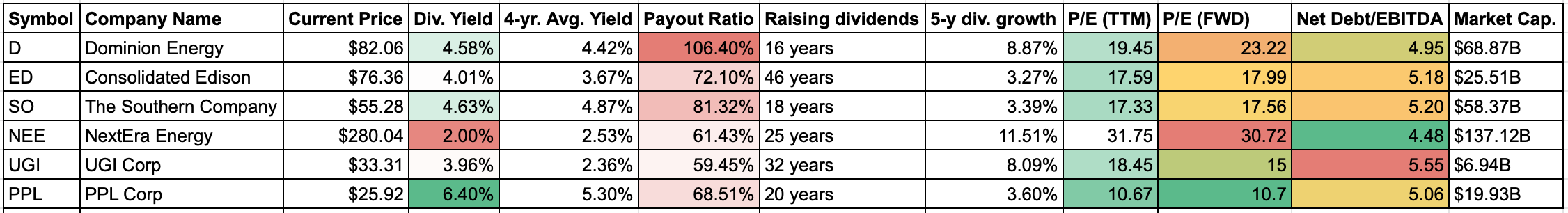

In my most recent Portfolio Overview, I decided to focus on Utilities sector next. Therefore, I compared a few stocks that I had in mind and also included some companies that were mentioned in comments in my previous post. This is what I came up with:

I already own some shares of Dominion, so I mainly focused on the rest 5 of the companies in the list. Out of 5 companies, two stood out to me – NextEra Energy and UGI Corp.

NextEra energy looked attractive because it focuses mainly on energy generation from wind and sun. It’s an attractive sector from the ESG perspective and it will probably strive for years to come, as energy sources need to become greener. However, the company is only offering a dividend yield of 2% at the current price. It’s also below their 4-yr average yield of 2.53%. I would love to have this company in my portfolio but the current price seems a little bit too steep.

That’s why I decided to go with another company which stood out in above list – UGI Corp. Interestingly, it was a company I never heard of before Nicolas included it in his comment in my Portfolio Overview post. Talk about the power of blogging!

UGI Corp (UGI)

Shortly about the company from Morningstar:

UGI Corp is an American holding company that, through its subsidiaries, is involved in the transport and marketing of energy and related services. UGI Corp’s Gas Utility and Midstream & Marketing divisions account for the vast majority of its total revenue. The Gas Utility business engages in the regulated distribution and transmission of natural gas to, primarily, the American states of Pennsylvania and Maryland. UGI Corp’s Midstream & Marketing division encompasses its Energy Services and Electric Generation activities. Within Energy Services, the company sells mainly natural gas to Mid-Atlantic and South Atlantic states through its owns processing, storage, and pipeline facilities. This division also generates and sells electricity through its portfolio of thermal power plants.

So, this company is very different, compared to NextEra Energy. UGI is mainly focusing on Natural Gas as its revenue engine. However, I like quite a few things about the company. First of all, it is offering a dividend yield of ~4% which is higher than their 4-yr. average and average dividend yield of my portfolio. Also, they keep increasing their dividend by ~8% on average for the last 5 years. I guess, it is going to be lower this year, due to the Covid-19 situation, but it still looks promising. I also like that their payout ratio is only 60% at the moment. However, this may change when they report their earnings for the 2nd quarter next week.

One thing that is worrying is their debt level. Net Debt/EBITDA currently stands at 5.55 and it is the highest ratio among the 6 companies I compared. I decided to take the risk nevertheless.

Let’s run through company’s numbers at the purchase price (on the 30th July):

- Price – $33.51;

- P/E (TTM) – 18.45;

- P/E (FWD) – 15.00;

- Dividend Yield – 3.96%;

- Average 4-yr yield – 2.36%;

- Raising dividends – 32 years;

- 5-yr. div. growth – 8.09%;

- Payout Ratio – 59.45%;

- Net Debt/EBITDA – 5.55.

Purchase Summary

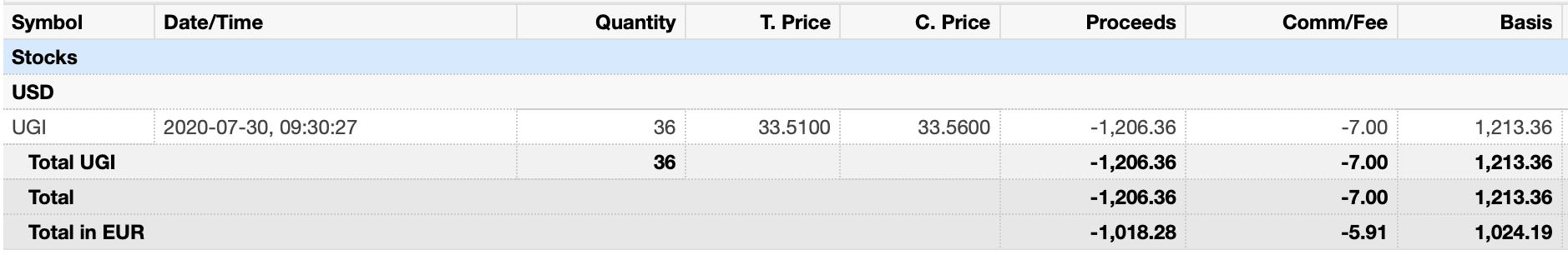

On the 30th of July, I purchased 36 shares of UGI at $33.51/share for a total of $1213.36 (including commissions):

This purchase adds $40.39 to my net forward annual dividend income. As an added bonus, they pay out on the first month of the quarter, which is the weakest month in terms of dividend income.

I now own shares of 2 Utilities companies in my portfolio. My target is to keep ~9% of my portfolio in Utilities sector and this purchase brings it close to the target (currently 8.17%). I would still love to own some company that is focusing more on renewable energy, so maybe I will be able to add some in the future, when valuations look better.

Have you been buying anything recently? What do you think about my purchase? What’s on your watchlist at the moment? Thanks for reading and don’t hesitate to leave a comment!

Hi, interesting choice. UGI is very into gas, which can be replaced in L/T. I would go for more electricity utility like ED, which is on my target actualy 🙂 I own SO and AEP from US also some TVEA from baltics.

Thanks for the comment, P2035. You may be right, but I though that some diversification among my Utility companies won’t hurt.

I am considering adding some more Utility companies to my portfolio in the future, so it will probably be more electricity-oriented company.

Good luck on your choice BI. I only own ED, although I was considering adding SO at one point, but ED won me over. I never looked into UGI

Thanks DP! I would love to have ED in my portfolio as well. Maybe it will find a place in the future 🙂

Good choice 🙂

Just received a note about UGI, I can share with you. Let me your email.

See you

Nicolas

Thanks Nicolas!

My email is inbox@brokeinvestor.net