Another month is gone, so it’s time to review passive income. Let’s see what the month of May brought.

Dividend Income

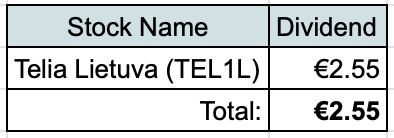

Let’s start with the dividend income. I received dividend from one company during May – Telia Lietuva (TEL1L):

I only own a small amount of Telia shares for now, so the size of dividend is also small.

I am continuing tradition to compare received dividends with actual expenses. €2.55 from Telia would cover 0.8% of our annual expenses on TV+Internet.

It’s a fun exercise to see how the amounts change when the time goes by. Hopefully, one day received dividends would be able to cover more meaningful portions of our expenses.

P2P Lending

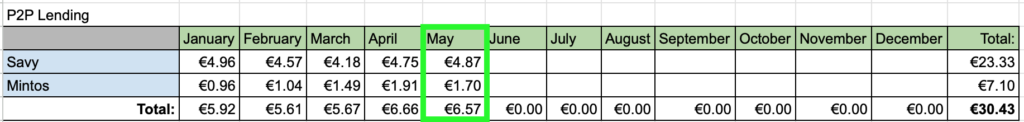

Interest from P2P lending added €6.57 this month, which was the biggest portion of passive income during May.

Real Estate Crowdfunding

Finally, I received a few cents (€0.10) from Real Estate Crowdfunding.

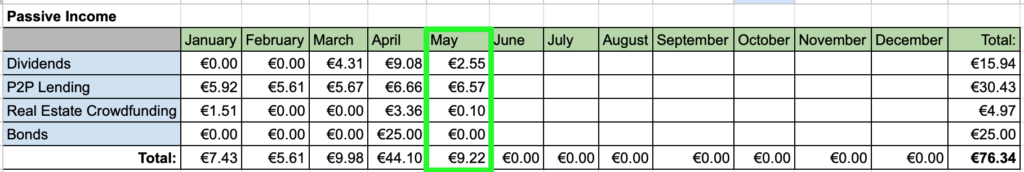

Passive Income Summary

After adding it all up, this is how the final number looks like for May:

In total, I received €9.22 from passive income during the month. Amounts are still small but every little bit counts and it’s fun to track the progress.

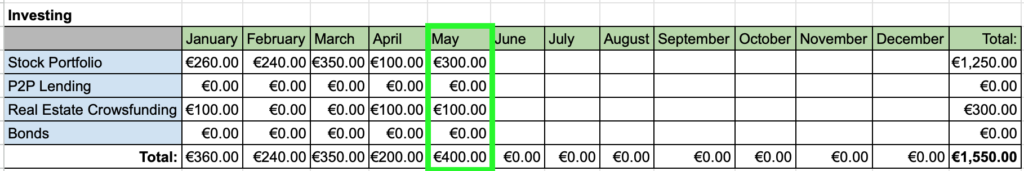

Investments and Portfolio Contributions

During May, I contributed €400 to investments, which is close to my monthly target:

Out of this amount, €100 was invested to a new Real Estate Crowdfunding project. With interest rate of 9%, I am planning to earn €7.03 over a period of 9 months.

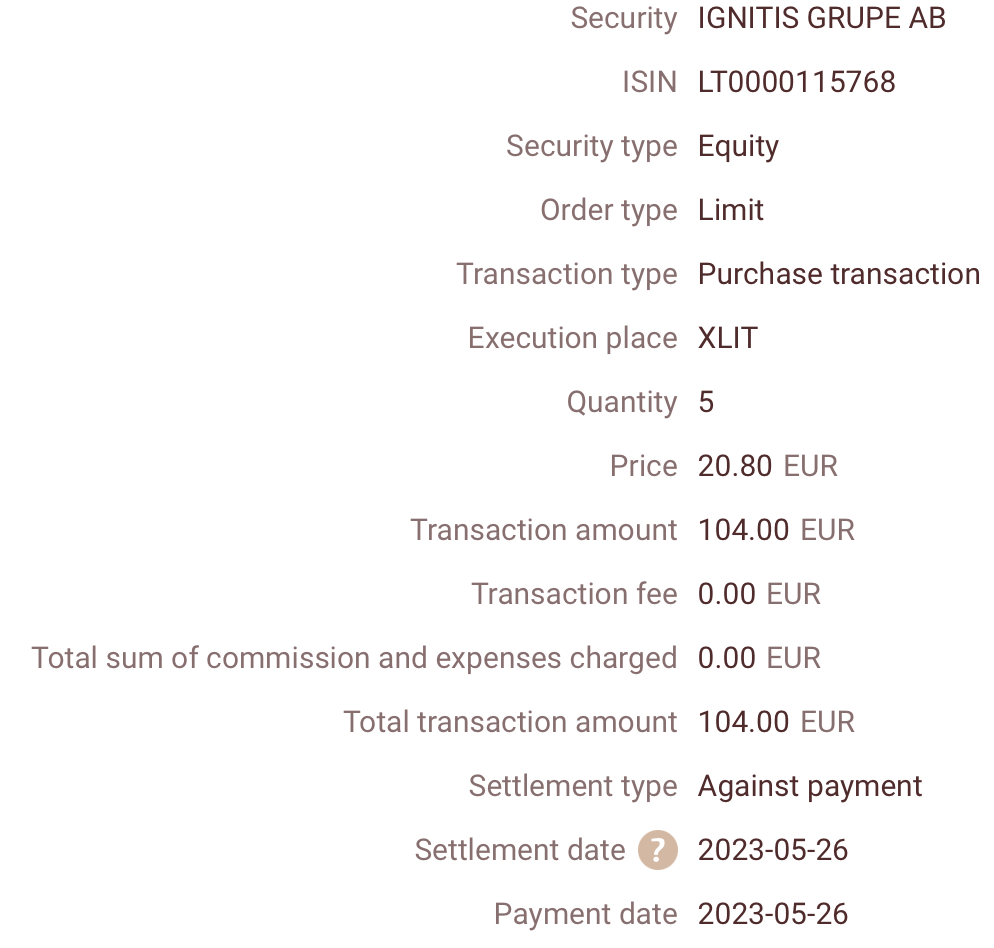

I also invested a small amount to a Utility company I pay my electricity bills to. On the 26th of May, I bought 5 shares of Ignitis Grupe (IGN1L) at €20.80/share for a total of €104:

With their current dividend, this purchase adds €5.30 to my forward annual dividend income.

I am planning to continue buying shares of Ignitis throughout the year. The plan is to buy shares for at least the same amount as we spend on our electricity expenses.

Portfolio Overview

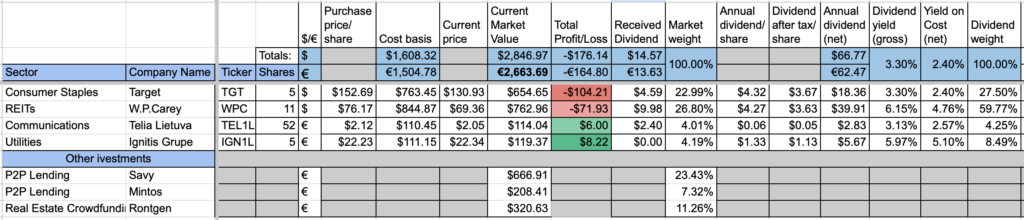

This is how my portfolio looked like at the beginning of June:

Current portfolio value stands close to €2700, which is similar to last month. My companies continue underperforming but it doesn’t bother me, as portfolio is at its beginning stage.

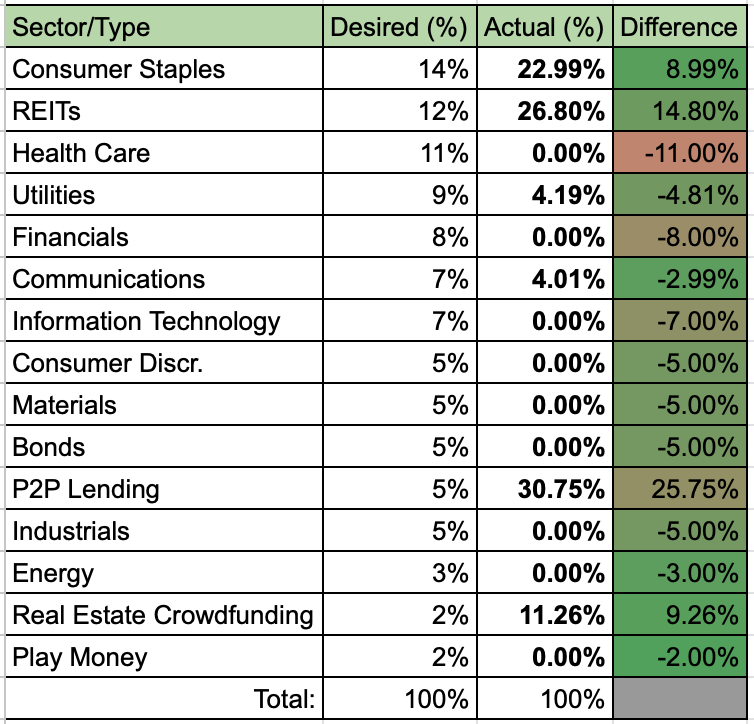

Finally, this is how my current portfolio composition is looking compared to desired allocation in terms of sectors/asset classes:

The biggest candidate to my portfolio is some company from Healthcare sector. I am already looking into those and should be able to purchase something during June.

Summary

During the month, we received €9.22 in passive income from 3 different sources. So far in 2023, we received €76.34 from passive income, which is 41.7% of my goal to receive €183 during the year. This is exactly in line with 41.7% of the year finished. I will fall behind during June but hopefully I’ll be able to catch up with consistent investments throughout the year.

Thanks for reading! 🙂